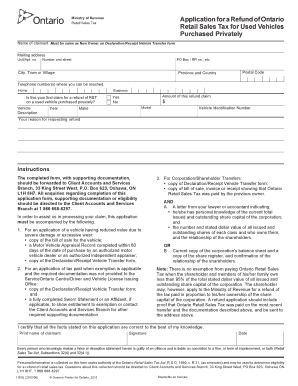

Application for a Refund of Ontario Retail Sales Tax for Used Vehicles Purchased Privately Form

What is the application for a refund of provincial sales tax paid on a motor vehicle in Ontario?

The application for a refund of provincial sales tax paid on a motor vehicle in Ontario is a formal request submitted by individuals seeking reimbursement for sales tax they have paid when purchasing a vehicle. This tax is typically charged on the purchase price of the vehicle, and certain conditions may allow for a refund. Understanding the criteria and process for this application is essential for ensuring that eligible individuals can reclaim the tax they have overpaid.

Steps to complete the application for a refund of provincial sales tax paid on a motor vehicle in Ontario

Completing the application for a refund involves several key steps. First, gather all necessary documentation, including proof of purchase and any receipts related to the sales tax paid. Next, fill out the application form accurately, ensuring that all required fields are completed. It is important to double-check the information for accuracy to avoid delays. Once the form is completed, submit it along with the supporting documents to the appropriate provincial authority. Keeping a copy of the submitted application for your records is also advisable.

Required documents for the application for a refund of provincial sales tax paid on a motor vehicle in Ontario

When applying for a refund, specific documents are required to support your claim. These typically include:

- Proof of purchase, such as a bill of sale or invoice.

- Receipts showing the amount of provincial sales tax paid.

- Any additional documentation that may be relevant, such as identification or proof of residency.

Having these documents ready will facilitate a smoother application process and help ensure that your refund is processed efficiently.

Eligibility criteria for the application for a refund of provincial sales tax paid on a motor vehicle in Ontario

To be eligible for a refund of provincial sales tax paid on a motor vehicle in Ontario, applicants must meet certain criteria. Generally, the vehicle must have been purchased from a private seller, and the sales tax must have been paid at the time of purchase. Additionally, the applicant must be the registered owner of the vehicle and must not have previously claimed a refund for the same transaction. Understanding these eligibility requirements is crucial for a successful application.

Application process and approval time for the refund of provincial sales tax paid on a motor vehicle in Ontario

The application process for a refund of provincial sales tax involves submitting the completed form along with the required documentation to the relevant provincial authority. Once submitted, the processing time can vary. Typically, applicants can expect a response within a few weeks, although this may differ based on the volume of applications being processed. Staying informed about the status of your application can help manage expectations regarding the approval timeline.

Legal use of the application for a refund of provincial sales tax paid on a motor vehicle in Ontario

The legal use of the application for a refund of provincial sales tax is governed by specific regulations set forth by provincial authorities. It is essential that applicants adhere to these regulations to ensure their claims are valid. Submitting false information or failing to provide necessary documentation can result in denial of the refund request. Understanding the legal framework surrounding this application helps protect the rights of applicants and ensures compliance with provincial laws.

Quick guide on how to complete application for a refund of ontario retail sales tax for used vehicles purchased privately

Prepare Application For A Refund Of Ontario Retail Sales Tax For Used Vehicles Purchased Privately effortlessly on any device

Online document management has gained popularity among companies and individuals alike. It offers a superior eco-friendly alternative to traditional printed and signed documents, enabling you to find the appropriate form and securely store it online. airSlate SignNow equips you with all the necessary tools to create, modify, and electronically sign your documents swiftly and without complications. Manage Application For A Refund Of Ontario Retail Sales Tax For Used Vehicles Purchased Privately on any platform with airSlate SignNow Android or iOS applications and enhance any document-based task today.

How to modify and eSign Application For A Refund Of Ontario Retail Sales Tax For Used Vehicles Purchased Privately with ease

- Locate Application For A Refund Of Ontario Retail Sales Tax For Used Vehicles Purchased Privately and click Get Form to begin.

- Use the tools we offer to complete your document.

- Emphasize important segments of your documents or redact sensitive information with features that airSlate SignNow provides specifically for that purpose.

- Generate your eSignature with the Sign tool, which takes mere seconds and carries the same legal validity as a conventional ink signature.

- Review the information and click the Done button to store your changes.

- Choose how you wish to send your form, via email, SMS, or invite link, or download it to your computer.

Eliminate the hassle of lost or misplaced documents, tedious form searching, or errors that necessitate the printing of new document copies. airSlate SignNow meets all your document management needs with just a few clicks from any device. Edit and eSign Application For A Refund Of Ontario Retail Sales Tax For Used Vehicles Purchased Privately and ensure exceptional communication at every phase of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the application for a refund of ontario retail sales tax for used vehicles purchased privately

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is the application for refund of provincial sales tax paid on a motor vehicle in Ontario?

The application for refund of provincial sales tax paid on a motor vehicle in Ontario is a formal process that allows individuals to claim back tax paid on eligible vehicles under specific circumstances, such as a resale, donation, or total loss of the vehicle. This process typically involves completing specific forms and providing documentation to support your claim.

-

How do I complete the application for refund of provincial sales tax paid on a motor vehicle in Ontario?

To complete the application for refund of provincial sales tax paid on a motor vehicle in Ontario, you need to gather the required documentation, including proof of tax payment and details of the vehicle transaction. Once you've compiled everything, fill out the appropriate application form and submit it to the Ontario Ministry of Finance for processing.

-

What documents are required for the application for refund of provincial sales tax paid on a motor vehicle in Ontario?

The documents required for the application for refund of provincial sales tax paid on a motor vehicle in Ontario usually include the original bill of sale, proof of payment of the provincial sales tax, and any other relevant receipts or supporting information. Make sure all documentation is clear and complete to avoid processing delays.

-

How long does it take to process my application for refund of provincial sales tax paid on a motor vehicle in Ontario?

Typically, it can take anywhere from four to six weeks for the application for refund of provincial sales tax paid on a motor vehicle in Ontario to be processed. However, processing times can vary based on the volume of applications and the completeness of your submission. For the most accurate updates, keep an eye on communications from the Ministry of Finance.

-

Is there a fee to submit the application for refund of provincial sales tax paid on a motor vehicle in Ontario?

No, there is no fee associated with submitting the application for refund of provincial sales tax paid on a motor vehicle in Ontario. It's a straightforward process designed to help individuals reclaim tax without incurring additional costs.

-

Can I track the status of my application for refund of provincial sales tax paid on a motor vehicle in Ontario?

Yes, you can track the status of your application for refund of provincial sales tax paid on a motor vehicle in Ontario by contacting the Ministry of Finance directly. They provide information and updates regarding your application status upon request.

-

What if my application for refund of provincial sales tax paid on a motor vehicle in Ontario is denied?

If your application for refund of provincial sales tax paid on a motor vehicle in Ontario is denied, you will receive a notification detailing the reasons for denial. You can appeal this decision by providing additional information or rectifying any issues pointed out in the denial notice.

Get more for Application For A Refund Of Ontario Retail Sales Tax For Used Vehicles Purchased Privately

- Letter from tenant to landlord containing notice to landlord to withdraw improper rent increase due to violation of rent 497308495 form

- Letter tenant rent sample 497308496 form

- Louisiana letter lease form

- Letter landlord rental 497308498 form

- Letter from landlord to tenant as notice to tenant to repair damage caused by tenant louisiana form

- Louisiana letter notice form

- Letter from tenant to landlord containing notice to landlord to cease retaliatory decrease in services louisiana form

- Letter from tenant to landlord containing notice to landlord to cease retaliatory threats to evict or retaliatory eviction 497308502 form

Find out other Application For A Refund Of Ontario Retail Sales Tax For Used Vehicles Purchased Privately

- How Do I Sign Arkansas Legal Document

- How Can I Sign Connecticut Legal Document

- How Can I Sign Indiana Legal Form

- Can I Sign Iowa Legal Document

- How Can I Sign Nebraska Legal Document

- How To Sign Nevada Legal Document

- Can I Sign Nevada Legal Form

- How Do I Sign New Jersey Legal Word

- Help Me With Sign New York Legal Document

- How Do I Sign Texas Insurance Document

- How Do I Sign Oregon Legal PDF

- How To Sign Pennsylvania Legal Word

- How Do I Sign Wisconsin Legal Form

- Help Me With Sign Massachusetts Life Sciences Presentation

- How To Sign Georgia Non-Profit Presentation

- Can I Sign Nevada Life Sciences PPT

- Help Me With Sign New Hampshire Non-Profit Presentation

- How To Sign Alaska Orthodontists Presentation

- Can I Sign South Dakota Non-Profit Word

- Can I Sign South Dakota Non-Profit Form