Form LLC 12 CA Gov

What is the Form LLC 12 CA gov

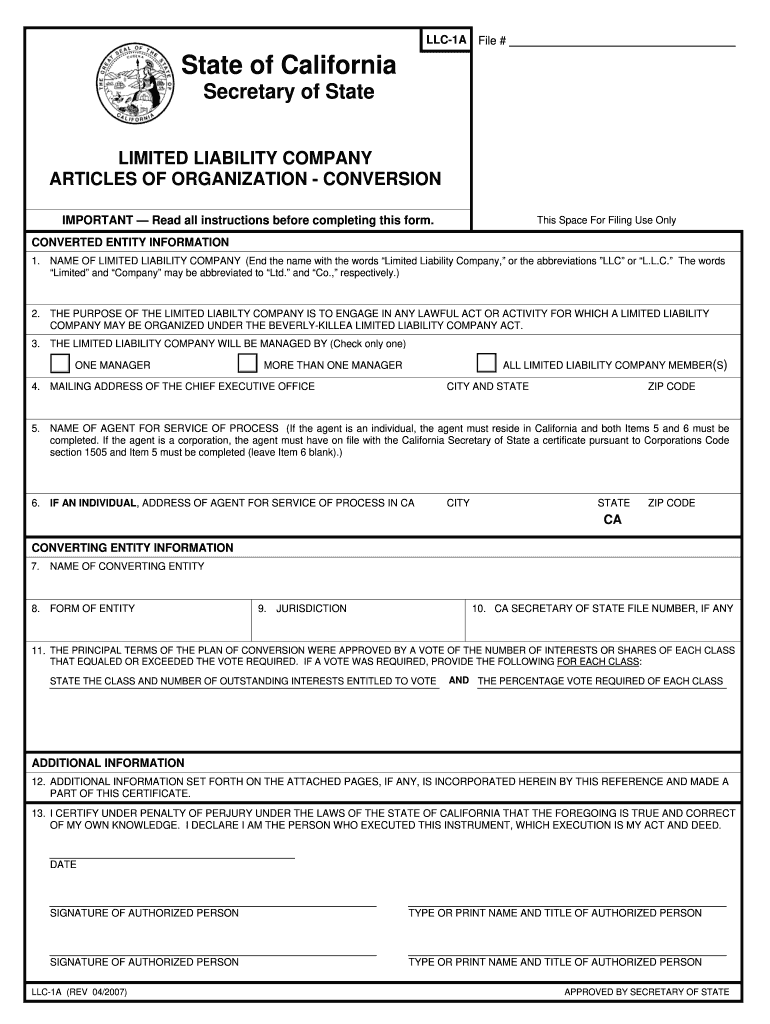

The Form LLC 12, officially known as the California LLC Statement of Information, is a crucial document for limited liability companies (LLCs) operating in California. This form serves to provide the state with updated information about the LLC, including its address, management structure, and the names of its members or managers. Filing the LLC 12 is essential for maintaining compliance with California state laws and ensuring that the business remains in good standing.

How to use the Form LLC 12 CA gov

Using the Form LLC 12 involves several steps to ensure accurate and timely submission. First, gather the necessary information about your LLC, including its official name, business address, and details about its management. Next, download the form from the California Secretary of State's website or use an electronic signature platform for a digital version. After filling out the form, review it for accuracy before submitting it through the appropriate channels, whether online, by mail, or in person.

Steps to complete the Form LLC 12 CA gov

Completing the Form LLC 12 requires careful attention to detail. Follow these steps:

- Obtain the latest version of the form from the California Secretary of State's website.

- Provide the LLC's name and Secretary of State file number.

- Fill in the principal office address and mailing address if different.

- List the names and addresses of the LLC's members or managers.

- Sign and date the form, ensuring that the signer is authorized to do so.

- Submit the completed form according to the chosen submission method.

Legal use of the Form LLC 12 CA gov

The legal use of the Form LLC 12 is vital for maintaining the LLC's status and compliance with California law. Filing this form ensures that the state has up-to-date information about the business, which is essential for legal notifications and communications. Failure to file the LLC 12 can lead to penalties, including the potential loss of good standing and administrative dissolution of the LLC. Therefore, it is important to file this form within the required timeframes.

Filing Deadlines / Important Dates

Timely filing of the Form LLC 12 is crucial for compliance. The form must be filed within 90 days of the initial registration of the LLC and every two years thereafter. Additionally, if there are any changes in the LLC's management or address, an updated form should be submitted promptly. Keeping track of these deadlines helps avoid late fees and ensures that the LLC remains in good standing with the state.

Who Issues the Form

The Form LLC 12 is issued by the California Secretary of State's office. This state agency is responsible for overseeing business registrations and maintaining official records for all LLCs operating within California. The Secretary of State's office provides resources and guidance on how to complete and submit the form, ensuring that businesses comply with state regulations.

Quick guide on how to complete form llc 12 ca gov

Complete Form LLC 12 CA gov effortlessly on any device

Online document administration has become increasingly favored by companies and individuals alike. It serves as an ideal eco-friendly substitute for conventional printed and signed documents, allowing you to obtain the necessary form and securely store it online. airSlate SignNow equips you with all the tools needed to create, modify, and electronically sign your documents swiftly without delays. Manage Form LLC 12 CA gov on any device with the airSlate SignNow Android or iOS applications and enhance any document-based operation today.

The easiest way to modify and electronically sign Form LLC 12 CA gov with ease

- Obtain Form LLC 12 CA gov and click Get Form to begin.

- Utilize the tools we provide to complete your document.

- Emphasize relevant sections of the documents or obscure sensitive information with tools specifically designed for that purpose by airSlate SignNow.

- Create your signature using the Sign tool, which takes seconds and holds the same legal validity as a traditional wet ink signature.

- Verify all the details and click on the Done button to save your changes.

- Choose how you'd like to send your form, either by email, SMS, an invite link, or download it to your computer.

Eliminate concerns about lost or misplaced documents, tedious form searches, or errors that necessitate printing new copies. airSlate SignNow fulfills your document management requirements in just a few clicks from any device you prefer. Modify and electronically sign Form LLC 12 CA gov and ensure effective communication at every stage of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the form llc 12 ca gov

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is the purpose of the form llc12?

The form llc12 is specifically designed for Limited Liability Companies (LLCs) in the U.S. to report their annual updates. Completing the form llc12 ensures compliance with state regulations and maintains good standing for your LLC.

-

How can airSlate SignNow assist with filing form llc12?

airSlate SignNow simplifies the process of filing your form llc12 by allowing you to electronically sign and send documents securely. This not only saves time but also ensures that your form is submitted efficiently and professionally.

-

What features does airSlate SignNow offer for managing form llc12?

With airSlate SignNow, you can utilize features like templates, document tracking, and team collaboration specifically for managing your form llc12. These features streamline the preparation and submission process, making it more organized.

-

Is there a cost associated with using airSlate SignNow for form llc12?

Yes, there is a cost associated with using airSlate SignNow, but it is designed to be cost-effective for businesses of all sizes. You can choose a plan that best fits your needs while ensuring a seamless experience for filing your form llc12.

-

Can airSlate SignNow integrate with other tools for form llc12 submissions?

Absolutely! airSlate SignNow offers integrations with various applications, making it easy to incorporate your form llc12 into your existing workflow. This allows for a more cohesive approach to document management and submission.

-

What are the benefits of using airSlate SignNow for form llc12?

The benefits of using airSlate SignNow for form llc12 include enhanced security, improved efficiency, and the ability to track document status. These advantages lead to a smoother submission process, minimizing stress and errors.

-

What types of documents can I manage with airSlate SignNow besides form llc12?

In addition to form llc12, airSlate SignNow allows you to manage a variety of documents, including contracts, agreements, and invoices. This versatility ensures that you can handle all your document needs in one convenient platform.

Get more for Form LLC 12 CA gov

- Essential legal life documents for military personnel kansas form

- Essential legal life documents for new parents kansas form

- General power of attorney for care and custody of child or children kansas form

- Small business accounting package kansas form

- Kansas procedures form

- Kansas revocation 497307650 form

- Newly divorced individuals package kansas form

- Contractors forms package kansas

Find out other Form LLC 12 CA gov

- Can I Sign North Carolina Orthodontists Presentation

- How Do I Sign Rhode Island Real Estate Form

- Can I Sign Vermont Real Estate Document

- How To Sign Wyoming Orthodontists Document

- Help Me With Sign Alabama Courts Form

- Help Me With Sign Virginia Police PPT

- How To Sign Colorado Courts Document

- Can I eSign Alabama Banking PPT

- How Can I eSign California Banking PDF

- How To eSign Hawaii Banking PDF

- How Can I eSign Hawaii Banking Document

- How Do I eSign Hawaii Banking Document

- How Do I eSign Hawaii Banking Document

- Help Me With eSign Hawaii Banking Document

- How To eSign Hawaii Banking Document

- Can I eSign Hawaii Banking Presentation

- Can I Sign Iowa Courts Form

- Help Me With eSign Montana Banking Form

- Can I Sign Kentucky Courts Document

- How To eSign New York Banking Word