Scholarship Exemption Declaration Form

What is the scholarship exemption declaration form?

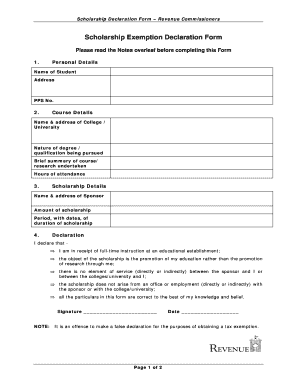

The scholarship exemption declaration form is a crucial document used by students to declare their eligibility for specific scholarships. This form typically requires the applicant to provide personal information, such as their name, address, and educational background. It may also ask for details about the scholarship for which they are applying, including its purpose and any associated criteria. Understanding this form is essential for students seeking financial assistance for their education, as it ensures that they meet the necessary requirements set by scholarship providers.

How to complete the scholarship exemption declaration form

Filling out the scholarship exemption declaration form involves several key steps. First, gather all necessary personal and educational information. Next, carefully read the instructions provided with the form to ensure compliance with the scholarship's requirements. Fill in the required fields accurately, paying close attention to details such as dates and financial information. Once completed, review the form for any errors or omissions before submitting it. Utilizing a digital platform like signNow can streamline this process, allowing for easy editing and secure submission.

Legal use of the scholarship exemption declaration form

The legal validity of the scholarship exemption declaration form hinges on several factors. To be considered legally binding, the form must comply with relevant laws, such as the ESIGN Act and UETA, which govern electronic signatures and documents. This means that the form should include a method for verifying the identity of the signer, such as a digital certificate. Additionally, the form must be completed in accordance with the scholarship provider's guidelines to ensure that it meets all legal requirements for acceptance.

Key elements of the scholarship exemption declaration form

Several essential components make up the scholarship exemption declaration form. These typically include:

- Personal Information: Name, address, contact details, and educational institution.

- Scholarship Details: Name of the scholarship, its purpose, and eligibility criteria.

- Financial Information: Income details, if required, to assess financial need.

- Signature: A declaration of truthfulness and consent to the terms outlined in the scholarship application.

Each of these elements plays a vital role in ensuring that the form is comprehensive and meets the requirements set by scholarship providers.

Steps to obtain the scholarship exemption declaration form

Obtaining the scholarship exemption declaration form can vary depending on the scholarship provider. Generally, the process involves the following steps:

- Identify the Scholarship: Determine which scholarship you are applying for and its specific requirements.

- Visit the Provider's Website: Most scholarship providers will have the form available for download or online completion on their official website.

- Contact the Provider: If the form is not readily available, reach out to the scholarship provider directly for assistance.

By following these steps, students can easily access the necessary documentation to support their scholarship applications.

Form submission methods

Submitting the scholarship exemption declaration form can typically be done through various methods, depending on the scholarship provider's preferences. Common submission options include:

- Online Submission: Many providers allow applicants to submit the form electronically through their website.

- Mail: Some may require a physical copy to be mailed to their office.

- In-Person: Certain institutions may offer the option to submit the form in person at designated locations.

It is important for applicants to follow the specific submission guidelines provided by the scholarship program to ensure timely processing of their application.

Quick guide on how to complete scholarship exemption declaration form

Complete Scholarship Exemption Declaration Form with ease on any device

Managing documents online has gained tremendous popularity among businesses and individuals alike. It offers an excellent environmentally friendly alternative to traditional printed and signed papers, as you can access the appropriate form and securely store it online. airSlate SignNow provides all the tools you need to create, edit, and eSign your documents promptly without any hold-ups. Handle Scholarship Exemption Declaration Form on any device using airSlate SignNow's Android or iOS applications and enhance any document-oriented process today.

The simplest method to modify and eSign Scholarship Exemption Declaration Form effortlessly

- Obtain Scholarship Exemption Declaration Form and click on Get Form to begin.

- Utilize the tools we provide to complete your document.

- Emphasize important sections of your documents or conceal sensitive information with the tools that airSlate SignNow has specifically designed for this purpose.

- Create your signature using the Sign tool, which takes only seconds and carries the same legal validity as a traditional handwritten signature.

- Review all the details and click on the Done button to save your modifications.

- Select how you wish to send your form, via email, SMS, or invitation link, or download it to your computer.

Say goodbye to lost or misplaced files, tiresome document searches, or mistakes that require printing new copies. airSlate SignNow addresses all your document management needs in just a few clicks from your preferred device. Edit and eSign Scholarship Exemption Declaration Form and ensure excellent communication at every step of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the scholarship exemption declaration form

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is a declaration form for scholarship?

A declaration form for scholarship is a document that students must complete to affirm their eligibility for various scholarships. This form typically includes personal information, academic details, and any other relevant declarations needed to assess the applicant's claims. airSlate SignNow provides an efficient platform to create, send, and eSign these sensitive documents securely.

-

How can airSlate SignNow help with the declaration form for scholarship?

airSlate SignNow streamlines the process of creating and managing your declaration form for scholarship. Our platform allows you to easily customize the form to meet the specific requirements of different scholarships, ensuring that all necessary information is captured accurately. Plus, with electronic signing, your documents can be processed faster than traditional methods.

-

What are the costs associated with using airSlate SignNow for scholarship forms?

airSlate SignNow offers flexible pricing plans to accommodate different needs, which include creating and managing declaration forms for scholarship. These plans typically provide access to essential features, and you can choose a subscription that best fits your budget. Our cost-effective solutions make it easier for students and organizations to manage important documents.

-

Is it easy to integrate airSlate SignNow with other tools for scholarship management?

Yes, airSlate SignNow seamlessly integrates with a variety of third-party applications, enhancing your ability to manage your declaration form for scholarship alongside other tools. Whether you're using CRM software, cloud storage, or education management systems, integrating SignNow can simplify your workflow and keep all your documents organized.

-

What features does airSlate SignNow offer for managing scholarship declaration forms?

airSlate SignNow includes a range of features ideal for managing declaration forms for scholarship, such as customizable templates, automatic reminders, and a secure signing process. You can easily track the status of your forms and receive notifications when they are signed. These features help ensure that the application process runs smoothly from start to finish.

-

Can I store my completed declaration forms for scholarship on airSlate SignNow?

Absolutely! airSlate SignNow allows you to securely store all completed declaration forms for scholarship in a centralized cloud storage system. This means you can easily access, share, and manage your documents whenever you need to. Our secure storage ensures that all sensitive information is protected.

-

What benefits do I gain by using airSlate SignNow over traditional methods for scholarship applications?

Using airSlate SignNow for your declaration form for scholarship offers numerous benefits over traditional paper methods. You’ll save time with electronic processing, reduce the risk of errors with streamlined data entry, and enjoy quicker turnaround times with instant notifications. Moreover, the enhanced security features protect your personal information better than standard paper methods.

Get more for Scholarship Exemption Declaration Form

- Quitclaim deed from individual to corporation kentucky form

- Warranty deed from individual to corporation kentucky form

- Quitclaim deed from individual to llc kentucky form

- Warranty deed from individual to llc kentucky form

- Deed husband wife 497307913 form

- Warranty deed from husband and wife to corporation kentucky form

- Kentucky case form

- Quitclaim deed from husband and wife to llc kentucky form

Find out other Scholarship Exemption Declaration Form

- How To eSign Illinois Rental application

- How To eSignature Maryland Affidavit of Identity

- eSignature New York Affidavit of Service Easy

- How To eSignature Idaho Affidavit of Title

- eSign Wisconsin Real estate forms Secure

- How To eSign California Real estate investment proposal template

- eSignature Oregon Affidavit of Title Free

- eSign Colorado Real estate investment proposal template Simple

- eSign Louisiana Real estate investment proposal template Fast

- eSign Wyoming Real estate investment proposal template Free

- How Can I eSign New York Residential lease

- eSignature Colorado Cease and Desist Letter Later

- How Do I eSignature Maine Cease and Desist Letter

- How Can I eSignature Maine Cease and Desist Letter

- eSignature Nevada Cease and Desist Letter Later

- Help Me With eSign Hawaii Event Vendor Contract

- How To eSignature Louisiana End User License Agreement (EULA)

- How To eSign Hawaii Franchise Contract

- eSignature Missouri End User License Agreement (EULA) Free

- eSign Delaware Consulting Agreement Template Now