Same Day Taxpayer Worksheet Form

What is the Same Day Taxpayer Worksheet

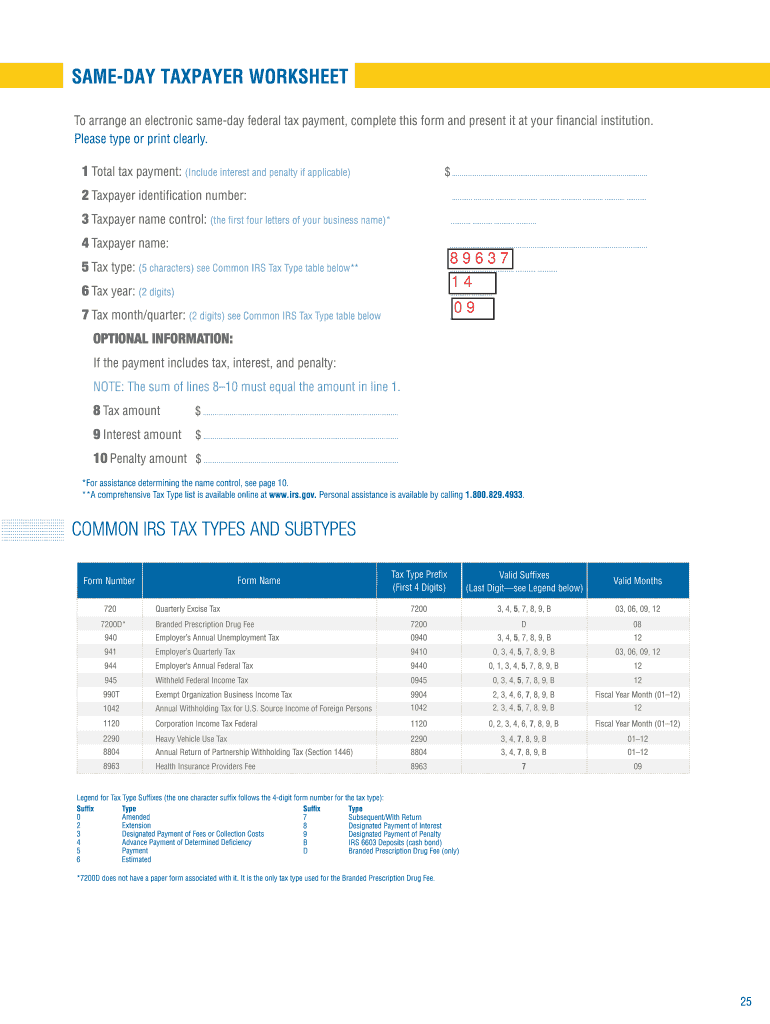

The Same Day Taxpayer Worksheet is a crucial document for individuals who need to make immediate tax payments to the IRS. This worksheet allows taxpayers to report their payment details accurately and ensures that their payments are processed on the same day. It is particularly useful for those who may have missed regular payment deadlines and need to fulfill their tax obligations promptly. The worksheet includes fields for essential information, such as taxpayer identification numbers, payment amounts, and methods of payment.

How to use the Same Day Taxpayer Worksheet

Using the Same Day Taxpayer Worksheet involves a straightforward process. First, obtain the form from the IRS website or through authorized providers. Fill in the required fields with accurate information, including your name, address, and taxpayer identification number. Specify the payment amount and the method you intend to use, whether it be electronic funds transfer or another method. Once completed, review the form for accuracy before submitting it to ensure your payment is processed without delays.

Steps to complete the Same Day Taxpayer Worksheet

Completing the Same Day Taxpayer Worksheet requires careful attention to detail. Follow these steps for accurate submission:

- Download the worksheet from the IRS website or obtain a physical copy.

- Enter your personal information, including your full name and taxpayer identification number.

- Indicate the payment amount you wish to submit.

- Select your payment method, ensuring it aligns with IRS requirements.

- Double-check all entries for accuracy.

- Submit the worksheet according to IRS guidelines, either electronically or via mail.

IRS Guidelines

The IRS provides specific guidelines for using the Same Day Taxpayer Worksheet. It is essential to adhere to these guidelines to ensure compliance and avoid penalties. Taxpayers should ensure that they are using the most current version of the worksheet and that all information is filled out completely and accurately. The IRS also emphasizes the importance of submitting payments on the same day to avoid interest and penalties associated with late payments.

Filing Deadlines / Important Dates

Filing deadlines for the Same Day Taxpayer Worksheet are critical for taxpayers. Generally, payments must be submitted by the end of the business day to be considered same-day transactions. It is advisable to check the IRS calendar for specific deadlines related to tax payments and any changes that may occur annually. Being aware of these dates can help taxpayers avoid unnecessary penalties and interest charges.

Required Documents

To complete the Same Day Taxpayer Worksheet, certain documents may be required. Taxpayers should have their taxpayer identification number, any relevant tax forms, and documentation related to their payment method. Having these documents ready can streamline the process and ensure that all necessary information is included on the worksheet.

Quick guide on how to complete same day taxpayer worksheet common irs tax types irs

Complete Same Day Taxpayer Worksheet seamlessly on any device

Managing documents online has gained popularity among organizations and individuals. It offers an ideal eco-friendly alternative to traditional printed and signed documents, allowing you to access the correct format and securely store it online. airSlate SignNow provides you with all the tools necessary to create, modify, and electronically sign your documents swiftly without delays. Handle Same Day Taxpayer Worksheet on any device using airSlate SignNow's Android or iOS applications and enhance any document-focused operation today.

The easiest way to alter and electronically sign Same Day Taxpayer Worksheet effortlessly

- Find Same Day Taxpayer Worksheet and click Get Form to begin.

- Utilize the tools we provide to fill out your form.

- Emphasize pertinent sections of your documents or obscure sensitive information with tools that airSlate SignNow specifically offers for those tasks.

- Create your signature with the Sign feature, which takes mere seconds and holds the same legal validity as a conventional wet ink signature.

- Review all the details and then click the Done button to save your changes.

- Choose how you would like to send your form, via email, SMS, or invite link, or download it to your computer.

Eliminate the worry of missing or misplaced documents, tedious form searching, or errors that require printing new document copies. airSlate SignNow meets your document management needs in just a few clicks from any device you prefer. Edit and electronically sign Same Day Taxpayer Worksheet and ensure excellent communication at every stage of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

FAQs

-

For taxes, does one have to fill out a federal IRS form and a state IRS form?

No, taxes are handled separately between state and federal governments in the United States.The IRS (Internal Revenue Service) is a federal, not state agency.You will be required to fill out the the necessary tax documentation for your federal income annually and submit them to the IRS by April 15th of that year. You can receive extensions for this; but you have to apply for those extensions.As far as state taxes go, 41 states require you to fill out an income tax return annually. They can either mail you those forms or they be downloaded from online. They are also available for free at various locations around the state.Nine states have no tax on personal income, so there is no need to fill out a state tax return unless you are a business owner.Reference:www.irs.gov

-

How many tax forms does a small startup usually have to fill for the IRS?

It depends. Have you set up a separate legal entity, such as a C corporation or an LLC? Are you operating as a sole proprietor? Are you referring specifically to income tax returns? Depending on what kind of business you have, you may include additional schedules, election statements, informational forms to supplement your income tax returns.

-

How can I deduct on my Federal income taxes massage therapy for my chronic migraines? Is there some form to fill out to the IRS for permission?

As long as your doctor prescribed this, it is tax deductible under the category for medical expenses. There is no IRS form for permission.

-

Why does the IRS not allow accountants to help business owners fill out tax forms? When the IRS isn't available to answer clarification questions, why can't I ask my accountant for clarification instead? What's the reasoning behind this IRS rule?

What! The IRS doesn’t allow CPAs to fill in tax returns for their clients? Where have I been? The IRS allows CPAs to help their clients in any respect necessary. The only thing is , if they materially contribute to the preparation of the return, the IRS wants the CPA to sign the return as a preparer. I get that, it makes sense. If I help you do a tax return, essentially I am a “shadow preparer” and the IRS wants me to sign on the return, to be sure I gave you proper and lawful advice.What I think you are relating is a common issue. A client comes in and asks a bunch of questions about how to complete a return. The CPA gives them all sorts of advice, but the client wants to do it themselves. Now the CPA is in an ethical quandary. The IRS demands that the CPA sign on the return, because they have materially participated in the preparation. The client is going to prepare the return, and so the CPA has lost control of what’s actually in the return, yet is going to have to sign it. Most CPAs simply won’t do that. They are going to demand to prepare the return, because their name ( and their professional status) is on the line. That’s what I do. If a client wants to ask me theoretical questions, fine, but if they are asking a bunch of questions about the preparation of their specific return, then I basically say that the IRS demands I sign the return, and there are so many moving parts in a tax return that I really have to prepare it, or charge them for reviewing it, which will probably cost as much or more.You can ( and should) ask your accountant for clarification on tax issues, that’s what we’re here for. But really, why are you so insistent on preparing your own return? It’s kind of like doing your own appendectomy. You probably could, but isn’t it better to have a professional fiddle with those things? I mean, is this really a special interest of yours, a hobby?In my experience, most clients who are convinced they should do their own returns are deluded by the myth that they can understand the tax law without spending hundreds of hours studying it, or they are afraid of paying for expert assistance. In either case, they are penny wise and pound foolish. If your time is only worth the minimum wage, if you are to keep up to date with the tax law, you have already spent time that’s way in excess of what a return professionally prepared will cost. Additionally, you’ve missed out having the return reviewed by someone who sees hundreds of returns, and knows when things stick out like sore audit flags. And, very importantly, you are flying solo without someone to back up and support the work they did.

-

How can the public be sure that the tax forms released by a candidate are the same as the tax forms submitted to the IRS?

Unless the forms were released directly by the IRS, there is no way to prove that anyone's returns are the returns that were actually filed.That is why, when applying for a loan, the bank asks you to sign a form allowing them to request copies of your returns from the IRS in addition to the copies they ask you to provide them.The copies the bank gets from the IRS are not actual copies of the forms, but rather are reports showing the what the numbers reported on the actual forms were.

Create this form in 5 minutes!

How to create an eSignature for the same day taxpayer worksheet common irs tax types irs

How to create an electronic signature for the Same Day Taxpayer Worksheet Common Irs Tax Types Irs in the online mode

How to make an electronic signature for the Same Day Taxpayer Worksheet Common Irs Tax Types Irs in Google Chrome

How to create an electronic signature for putting it on the Same Day Taxpayer Worksheet Common Irs Tax Types Irs in Gmail

How to create an electronic signature for the Same Day Taxpayer Worksheet Common Irs Tax Types Irs from your smartphone

How to generate an eSignature for the Same Day Taxpayer Worksheet Common Irs Tax Types Irs on iOS devices

How to make an eSignature for the Same Day Taxpayer Worksheet Common Irs Tax Types Irs on Android

People also ask

-

What is the same day taxpayer worksheet offered by airSlate SignNow?

The same day taxpayer worksheet is a streamlined document that helps taxpayers organize and complete their tax filings efficiently. With airSlate SignNow, you can fill out and eSign your same day taxpayer worksheet quickly, allowing for faster processing of your tax documents.

-

How does airSlate SignNow ensure the security of my same day taxpayer worksheet?

Security is a top priority at airSlate SignNow. We utilize advanced encryption technologies and secure servers to protect your same day taxpayer worksheet, ensuring that your personal information remains confidential while you eSign your documents.

-

What features are included with the same day taxpayer worksheet in airSlate SignNow?

The same day taxpayer worksheet in airSlate SignNow comes with features like customizable templates, easy eSigning options, and document tracking. These features make it simple to manage your tax documents and ensure that everything is completed on time.

-

Is there a cost associated with using the same day taxpayer worksheet on airSlate SignNow?

Yes, there is a cost associated with using the same day taxpayer worksheet on airSlate SignNow, but we offer competitive pricing to suit your needs. Subscribe to our plans to enjoy unlimited access to all features, including the same day taxpayer worksheet, while keeping your expenses low.

-

Can I integrate airSlate SignNow with other applications for my same day taxpayer worksheet?

Absolutely! airSlate SignNow integrates seamlessly with several popular applications, allowing you to streamline your workflow. Whether it's your accounting software or document management tools, you can easily link them to manage your same day taxpayer worksheet more effectively.

-

What benefits can I expect when using the same day taxpayer worksheet through airSlate SignNow?

Using the same day taxpayer worksheet through airSlate SignNow provides several benefits, including time savings and increased accuracy. By eSigning and completing your worksheet digitally, you reduce the risk of errors and ensure your documents are processed without unnecessary delays.

-

How easy is it to use the same day taxpayer worksheet on airSlate SignNow?

The same day taxpayer worksheet on airSlate SignNow is designed for ease of use. With an intuitive interface, users can navigate through the document quickly, fill in required fields, and eSign in just a few clicks, making tax preparation efficient and stress-free.

Get more for Same Day Taxpayer Worksheet

- 93 579 chris coons form

- St jude trike a thon sponsor form st jude trike a thon sponsor form

- Expense forms printable

- Ny cle update form pdf

- Algebraic proportions worksheet form

- Nysed career plan form

- Form 2350 sp application for extension of time to file u s income tax return spanish version

- Form 8919 uncollected social security and medicare tax

Find out other Same Day Taxpayer Worksheet

- eSignature Colorado Demand for Payment Letter Mobile

- eSignature Colorado Demand for Payment Letter Secure

- eSign Delaware Shareholder Agreement Template Now

- eSign Wyoming Shareholder Agreement Template Safe

- eSign Kentucky Strategic Alliance Agreement Secure

- Can I eSign Alaska Equipment Rental Agreement Template

- eSign Michigan Equipment Rental Agreement Template Later

- Help Me With eSignature Washington IOU

- eSign Indiana Home Improvement Contract Myself

- eSign North Dakota Architectural Proposal Template Online

- How To eSignature Alabama Mechanic's Lien

- Can I eSign Alabama Car Insurance Quotation Form

- eSign Florida Car Insurance Quotation Form Mobile

- eSign Louisiana Car Insurance Quotation Form Online

- Can I eSign Massachusetts Car Insurance Quotation Form

- eSign Michigan Car Insurance Quotation Form Online

- eSign Michigan Car Insurance Quotation Form Mobile

- eSignature Massachusetts Mechanic's Lien Online

- eSignature Massachusetts Mechanic's Lien Free

- eSign Ohio Car Insurance Quotation Form Mobile