Verification of Deposit Form

What is the Verification of Deposit Form

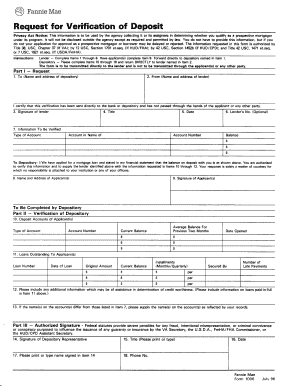

The verification of deposit form is a crucial document used primarily by financial institutions to confirm a customer's account balance and transaction history. It serves as an official statement that verifies the funds available in a bank account, providing essential information for various financial transactions such as loan applications or rental agreements. This form is often requested by lenders, landlords, or other entities requiring proof of financial stability.

Steps to Complete the Verification of Deposit Form

Completing the verification of deposit form involves several key steps to ensure accuracy and compliance. Here’s a straightforward process to follow:

- Gather necessary information, including your bank account number, the bank's contact details, and the specific purpose for the verification.

- Fill out the form with accurate details, ensuring that all required fields are completed.

- Sign the form to authorize the bank to release your information.

- Submit the completed form to your bank, either online or in-person, depending on their submission guidelines.

- Follow up with your bank to confirm that the verification has been processed and sent to the requesting party.

Legal Use of the Verification of Deposit Form

The verification of deposit form is legally recognized as a valid document when completed correctly. It must adhere to specific legal standards, ensuring that the information provided is accurate and truthful. This form is often used in legal contexts, such as loan agreements or rental contracts, where proof of financial capability is necessary. Misrepresentation or falsification of information on this form can lead to legal consequences, including penalties or denial of financial services.

Key Elements of the Verification of Deposit Form

Understanding the key elements of the verification of deposit form is essential for accurate completion. The main components typically include:

- Account Holder Information: Name, address, and contact details of the individual or entity requesting the verification.

- Account Details: The type of account, account number, and the date the account was opened.

- Balance Information: The current balance, average balance, and any recent transactions that may be relevant.

- Bank Information: The name and address of the bank, along with contact details for verification purposes.

- Signature: The account holder's signature authorizing the release of information.

How to Obtain the Verification of Deposit Form

Obtaining the verification of deposit form is a straightforward process. Most banks provide this form directly to their customers. You can typically access it in the following ways:

- Visit your bank's website and navigate to the forms section, where you may find a downloadable version.

- Request the form in-person at your bank branch, where a representative can assist you.

- Contact your bank's customer service for guidance on how to obtain the form, including any specific requirements they may have.

Examples of Using the Verification of Deposit Form

The verification of deposit form is utilized in various scenarios, showcasing its importance in financial transactions. Common examples include:

- Applying for a mortgage, where lenders require proof of funds to assess your ability to repay the loan.

- Renting an apartment, where landlords may ask for verification to ensure tenants have sufficient income to cover rent.

- Securing a loan for a business, where financial institutions need to verify the business's financial health.

Quick guide on how to complete verification of deposit form 447962301

Complete Verification Of Deposit Form effortlessly on any device

Managing documents online has become increasingly favored by organizations and individuals. It offers an ideal eco-friendly substitute to conventional printed and signed documents, allowing you to locate the appropriate form and securely store it online. airSlate SignNow provides you with all the tools required to create, modify, and eSign your documents quickly without delays. Handle Verification Of Deposit Form on any device using airSlate SignNow’s Android or iOS applications and enhance any document-centric operation today.

The easiest way to modify and eSign Verification Of Deposit Form without effort

- Find Verification Of Deposit Form and click Get Form to begin.

- Use the tools we offer to complete your form.

- Highlight pertinent sections of your documents or obscure sensitive information with tools that airSlate SignNow supplies specifically for that purpose.

- Create your signature with the Sign tool, which takes seconds and holds the same legal validity as a traditional wet ink signature.

- Review all the information and click the Done button to save your changes.

- Choose how you wish to deliver your form, via email, SMS, or invitation link, or download it to your computer.

Say goodbye to lost or misplaced files, tedious form searches, or errors that require printing new document copies. airSlate SignNow addresses your document management needs in just a few clicks from your device of choice. Alter and eSign Verification Of Deposit Form and ensure seamless communication at every step of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the verification of deposit form 447962301

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is verification of deposit and how does it work with airSlate SignNow?

Verification of deposit is the process used to confirm a customer's bank balance and transaction history. With airSlate SignNow, you can easily create and send documents that require verification of deposit, streamlining the process for both parties involved and ensuring that your transactions are secure.

-

How does airSlate SignNow ensure the security of my verification of deposit documents?

AirSlate SignNow employs top-notch security measures, including encryption and secure servers, to protect all verification of deposit documents. Our platform complies with industry standards to safeguard your sensitive information, offering peace of mind to businesses and their clients.

-

Is there a cost associated with using airSlate SignNow for verification of deposit?

Yes, airSlate SignNow offers various pricing plans that cater to different business needs. Whether you require basic features or advanced functionalities for verification of deposit, our cost-effective solutions ensure you get the best value for your investment.

-

Can I integrate airSlate SignNow with other applications for verification of deposit?

Absolutely! airSlate SignNow integrates seamlessly with popular applications, allowing you to automate your workflows. This integration ensures that your verification of deposit documents are processed efficiently, saving you time and enhancing productivity.

-

What are the benefits of using airSlate SignNow for verification of deposit?

Using airSlate SignNow for verification of deposit offers numerous benefits, including reduced processing times and higher accuracy in document management. Additionally, our eSignature functionality allows for quick approvals, making it easier and more efficient to handle verification tasks.

-

How user-friendly is the airSlate SignNow platform for verification of deposit?

The airSlate SignNow platform is designed with user experience in mind, making it simple to create and manage verification of deposit documents. Even users with no technical background can effortlessly navigate our intuitive interface.

-

What types of businesses benefit from using airSlate SignNow's verification of deposit features?

AirSlate SignNow’s verification of deposit features are ideal for various industries, including banking, real estate, and finance. Any business that requires secure and efficient verification processes can signNowly benefit from our platform's capabilities.

Get more for Verification Of Deposit Form

- Sample transmittal letter 497309984 form

- Ma annulment form

- New resident guide massachusetts form

- Satisfaction release or cancellation of mortgage by corporation massachusetts form

- Satisfaction release or cancellation of mortgage by individual massachusetts form

- Partial release of property from mortgage for corporation massachusetts form

- Partial release of property from mortgage by individual holder massachusetts form

- Warranty deed for husband and wife converting property from tenants in common to joint tenancy massachusetts form

Find out other Verification Of Deposit Form

- eSign Oregon Limited Power of Attorney Secure

- How Can I eSign Arizona Assignment of Shares

- How To eSign Hawaii Unlimited Power of Attorney

- How To eSign Louisiana Unlimited Power of Attorney

- eSign Oklahoma Unlimited Power of Attorney Now

- How To eSign Oregon Unlimited Power of Attorney

- eSign Hawaii Retainer for Attorney Easy

- How To eSign Texas Retainer for Attorney

- eSign Hawaii Standstill Agreement Computer

- How Can I eSign Texas Standstill Agreement

- How To eSign Hawaii Lease Renewal

- How Can I eSign Florida Lease Amendment

- eSign Georgia Lease Amendment Free

- eSign Arizona Notice of Intent to Vacate Easy

- eSign Louisiana Notice of Rent Increase Mobile

- eSign Washington Notice of Rent Increase Computer

- How To eSign Florida Notice to Quit

- How To eSign Hawaii Notice to Quit

- eSign Montana Pet Addendum to Lease Agreement Online

- How To eSign Florida Tenant Removal