Wells Fargo Listing Addendum Form

What is the Wells Fargo Listing Addendum

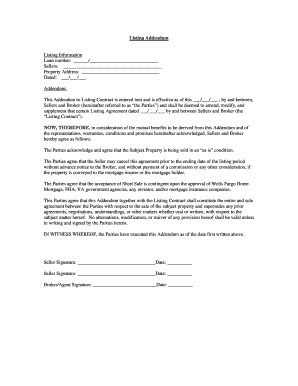

The Wells Fargo Listing Addendum is a supplementary document used in real estate transactions. It provides additional terms and conditions related to the listing of a property. This addendum is typically attached to a listing agreement and serves to clarify specific details that may not be included in the main contract. It is essential for both sellers and real estate agents to understand the implications of this document, as it can affect the sale process and the obligations of each party involved.

How to use the Wells Fargo Listing Addendum

Using the Wells Fargo Listing Addendum involves several key steps. First, ensure that you have the correct version of the addendum, which can be obtained from Wells Fargo or your real estate agent. Next, review the main listing agreement to identify areas where additional terms may be needed. Fill out the addendum with precise information, including any special conditions or contingencies that apply to the property. Both the seller and the agent must sign the addendum for it to be valid. Keep a copy for your records and provide one to all parties involved in the transaction.

Steps to complete the Wells Fargo Listing Addendum

Completing the Wells Fargo Listing Addendum requires careful attention to detail. Begin by downloading the form from a reliable source. Fill in the property details, including the address, listing price, and any relevant dates. Specify any additional terms, such as commission rates or buyer contingencies. After filling out the form, both the seller and the listing agent should review the addendum to ensure all information is accurate. Finally, obtain signatures from both parties to finalize the document. This process ensures that all parties are in agreement and legally bound by the terms outlined in the addendum.

Legal use of the Wells Fargo Listing Addendum

The legal use of the Wells Fargo Listing Addendum hinges on its compliance with state laws and regulations governing real estate transactions. It is crucial that the addendum is signed by all relevant parties to be enforceable. Additionally, the terms outlined in the addendum must not contradict the main listing agreement. Understanding the legal implications of each clause is essential to avoid disputes. Consulting with a legal professional or a real estate expert can provide clarity on the enforceability of the addendum in specific situations.

Key elements of the Wells Fargo Listing Addendum

Key elements of the Wells Fargo Listing Addendum include the property address, listing price, and specific terms related to the sale. Important clauses may cover commission rates, marketing strategies, and any contingencies that must be met for the sale to proceed. Additionally, the addendum may outline responsibilities for both the seller and the agent, ensuring clarity in the transaction process. Each element must be clearly defined to prevent misunderstandings and ensure a smooth transaction.

Examples of using the Wells Fargo Listing Addendum

Examples of using the Wells Fargo Listing Addendum can vary based on the specifics of the property and the agreement between the seller and the agent. For instance, if a seller wishes to specify that only certain appliances are included in the sale, this can be noted in the addendum. Another example might involve setting a specific timeline for open houses or showings, which helps manage expectations for both parties. These examples illustrate how the addendum can be tailored to meet the unique needs of each real estate transaction.

Quick guide on how to complete wells fargo listing addendum

Complete Wells Fargo Listing Addendum effortlessly on any device

Digital document management has become increasingly popular among businesses and individuals. It serves as an excellent eco-friendly alternative to conventional printed and signed documents, allowing you to locate the appropriate form and securely store it online. airSlate SignNow provides you with all the necessary tools to generate, alter, and eSign your papers swiftly without any delays. Manage Wells Fargo Listing Addendum on any device using airSlate SignNow's Android or iOS applications and enhance any document-centric operation today.

The easiest way to alter and eSign Wells Fargo Listing Addendum without hassle

- Locate Wells Fargo Listing Addendum and click Get Form to begin.

- Utilize the tools available to submit your document.

- Highlight pertinent sections of the documents or obscure sensitive information with specialized tools provided by airSlate SignNow.

- Create your signature using the Sign tool, which takes seconds and carries the same legal validity as a conventional wet ink signature.

- Review the information and click the Done button to save your changes.

- Select your preferred method to share your form, whether by email, text message (SMS), invite link, or download it to your computer.

Eliminate concerns about lost or misplaced documents, tedious form searching, or errors that necessitate printing new document copies. airSlate SignNow addresses all your document management needs in just a few clicks from any device you prefer. Edit and eSign Wells Fargo Listing Addendum and ensure excellent communication throughout your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the wells fargo listing addendum

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is the Wells Fargo listing addendum?

The Wells Fargo listing addendum is a legal document used in real estate transactions to provide additional information or conditions related to a property listing. It is essential for ensuring that all parties involved in the transaction are aware of specific terms, which can help avoid potential disputes. airSlate SignNow allows you to easily create and eSign the Wells Fargo listing addendum with an intuitive interface.

-

How can airSlate SignNow assist with the Wells Fargo listing addendum?

With airSlate SignNow, you can efficiently create, send, and eSign your Wells Fargo listing addendum. Our platform simplifies the document management process, allowing you to collaborate in real-time and ensure all signatures are collected promptly. This not only speeds up transactions but also ensures compliance with regulatory standards.

-

Is there a cost associated with using airSlate SignNow for the Wells Fargo listing addendum?

airSlate SignNow offers competitive pricing plans suited for various business needs, including those requiring the Wells Fargo listing addendum. You can choose from different subscription models, ranging from monthly to annual plans, ensuring cost-effectiveness based on your usage. Additionally, we provide a free trial, allowing you to explore our features before committing to a plan.

-

What features does airSlate SignNow offer for handling the Wells Fargo listing addendum?

airSlate SignNow provides features such as template creation, document tracking, and automated reminders for the Wells Fargo listing addendum. Users can customize templates based on their specific needs, ensuring seamless integration with their existing workflows. Additionally, the platform enhances security with advanced encryption to protect your documents.

-

Can airSlate SignNow integrate with other tools for the Wells Fargo listing addendum?

Yes, airSlate SignNow integrates with a variety of tools and applications to enhance your workflow when managing the Wells Fargo listing addendum. Integration options include CRM systems, project management tools, and cloud storage solutions, allowing for easier document sharing and collaboration. This interoperability streamlines your business processes and improves efficiency.

-

What are the benefits of using airSlate SignNow for my Wells Fargo listing addendum?

Using airSlate SignNow for your Wells Fargo listing addendum provides several benefits, including increased efficiency, streamlined workflows, and enhanced security. The platform's user-friendly design makes it easy to manage documents, reducing turnaround times for eSigning. This ultimately leads to faster transactions and improved client satisfaction.

-

Is airSlate SignNow secure for signing the Wells Fargo listing addendum?

Absolutely! airSlate SignNow employs advanced security measures, including encryption and multi-factor authentication, to ensure the integrity of your Wells Fargo listing addendum. Our commitment to data protection means you can trust that your documents are safe from unauthorized access or tampering, giving you peace of mind during transactions.

Get more for Wells Fargo Listing Addendum

Find out other Wells Fargo Listing Addendum

- How Do I eSign Alaska Car Dealer Form

- How To eSign California Car Dealer Form

- Can I eSign Colorado Car Dealer Document

- How Can I eSign Colorado Car Dealer Document

- Can I eSign Hawaii Car Dealer Word

- How To eSign Hawaii Car Dealer PPT

- How To eSign Hawaii Car Dealer PPT

- How Do I eSign Hawaii Car Dealer PPT

- Help Me With eSign Hawaii Car Dealer PPT

- How Can I eSign Hawaii Car Dealer Presentation

- How Do I eSign Hawaii Business Operations PDF

- How Can I eSign Hawaii Business Operations PDF

- How To eSign Hawaii Business Operations Form

- How Do I eSign Hawaii Business Operations Form

- Help Me With eSign Hawaii Business Operations Presentation

- How Do I eSign Idaho Car Dealer Document

- How Do I eSign Indiana Car Dealer Document

- How To eSign Michigan Car Dealer Document

- Can I eSign Michigan Car Dealer PPT

- How Can I eSign Michigan Car Dealer Form