Rev 1220 Form

What is the Rev 1220

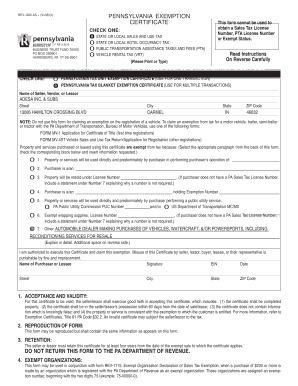

The Rev 1220 is a Pennsylvania exemption certificate used primarily for sales tax purposes. This form allows eligible purchasers to claim exemption from sales tax on certain purchases. It is essential for businesses and individuals who qualify for tax-exempt status under specific circumstances, such as non-profit organizations or government entities. Understanding the Rev 1220 is crucial for ensuring compliance with Pennsylvania tax laws and for avoiding unnecessary tax liabilities.

Steps to complete the Rev 1220

Completing the Rev 1220 involves several clear steps to ensure accuracy and compliance. First, gather necessary information, including your name, address, and the reason for the exemption. Next, accurately fill in the details of the seller and the specific items being purchased. It is important to include a valid exemption reason, as this justifies the claim for tax exemption. Finally, sign and date the form to validate it. Ensure that all information is correct before submitting the form to avoid delays or issues.

Legal use of the Rev 1220

The legal use of the Rev 1220 requires that the purchaser meets the criteria for tax exemption as outlined by Pennsylvania law. It is important to use the form only for eligible purchases and to maintain proper documentation to support the exemption claim. Misuse of the Rev 1220 can lead to penalties, including fines and back taxes. Therefore, understanding the legal implications and ensuring compliance with the relevant tax regulations is essential for all users of this form.

Examples of using the Rev 1220

Examples of using the Rev 1220 include purchases made by non-profit organizations for materials needed for charitable activities or items bought by government entities for official use. For instance, a local charity purchasing office supplies for its operations can utilize the Rev 1220 to avoid paying sales tax. Similarly, a state agency acquiring equipment for public service can also claim exemption using this form. These examples illustrate the practical applications of the Rev 1220 in various contexts.

Eligibility Criteria

Eligibility for using the Rev 1220 is determined by specific criteria set forth by Pennsylvania tax regulations. Generally, organizations such as non-profits, government agencies, and certain educational institutions qualify for tax exemption. To be eligible, the purchaser must provide valid documentation proving their exempt status. Additionally, the items purchased must be directly related to the exempt purpose. Understanding these criteria is vital for ensuring that the Rev 1220 is used correctly and effectively.

Form Submission Methods

The Rev 1220 can be submitted in various ways, depending on the seller's preferences and the nature of the transaction. Common methods include providing a physical copy of the completed form at the point of sale or sending it via mail to the seller. Some businesses may also accept digital submissions, allowing for a more streamlined process. It is important to confirm with the seller regarding their preferred submission method to ensure compliance and acceptance of the exemption claim.

Quick guide on how to complete rev 1220 385416300

Effortlessly Prepare Rev 1220 on Any Device

Digital document management has become increasingly popular among businesses and individuals. It offers an ideal eco-friendly substitute for traditional printed and signed documents, as you can easily find the necessary form and securely store it online. airSlate SignNow equips you with all the tools needed to create, modify, and electronically sign your documents swiftly without delays. Manage Rev 1220 on any device with the airSlate SignNow Android or iOS applications and enhance any document-driven process today.

How to Modify and Electronically Sign Rev 1220 with Ease

- Find Rev 1220 and click Get Form to begin.

- Make use of the tools we provide to complete your document.

- Highlight important sections of your documents or obscure sensitive information with tools that airSlate SignNow provides specifically for that purpose.

- Generate your signature using the Sign feature, which takes mere seconds and carries the same legal validity as a conventional wet ink signature.

- Review the information and click the Done button to save your changes.

- Choose how you wish to send your form, via email, text message (SMS), or invite link, or download it to your computer.

Say goodbye to lost or misplaced documents, tedious form searching, or errors that require new document prints. airSlate SignNow meets your document management needs in just a few clicks from any device of your choosing. Edit and electronically sign Rev 1220 and ensure excellent communication at every stage of your form preparation with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the rev 1220 385416300

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is the best way to learn how to fill out rev 1220 using airSlate SignNow?

The best way to learn how to fill out rev 1220 is to use our intuitive platform, which provides step-by-step guidance. Additionally, airSlate SignNow offers tutorials and support resources to help users navigate the process easily. By leveraging these tools, you can efficiently complete the form without confusion.

-

Are there any costs associated with using airSlate SignNow to fill out rev 1220?

Yes, airSlate SignNow offers a range of pricing plans suitable for different business needs. While there are costs involved, the platform is designed to be cost-effective, ensuring you get great value for eSigning and filling out forms such as rev 1220. A free trial is also available to help you explore the features before committing.

-

Can I save my progress while filling out rev 1220 on airSlate SignNow?

Absolutely! airSlate SignNow allows users to save their progress when filling out rev 1220. This feature ensures you can come back and complete the document at your convenience without losing any information. Just sign in to your account, and your data will be securely stored.

-

What features does airSlate SignNow offer that help with filling out rev 1220?

airSlate SignNow provides a variety of features tailored for filling out forms like rev 1220, including customizable templates and easy drag-and-drop functionality. Users can also utilize electronic signatures and document sharing capabilities, streamlining the entire process from start to finish. These features reduce errors and enhance efficiency.

-

Is airSlate SignNow suitable for businesses of all sizes when filling out rev 1220?

Yes, airSlate SignNow is designed to cater to businesses of all sizes, making it a flexible solution for filling out rev 1220. Whether you are a small startup or a large corporation, our platform adapts to your unique workflow needs. This scalability ensures that you can manage documents effectively regardless of your business size.

-

How does airSlate SignNow ensure the security of documents when filling out rev 1220?

Security is a top priority at airSlate SignNow, especially when users are filling out sensitive documents like rev 1220. We implement robust encryption methods and secure cloud storage to protect your data. Additionally, our compliance with industry standards offers peace of mind that your information is safeguarded.

-

Can I integrate airSlate SignNow with other applications while filling out rev 1220?

Yes, airSlate SignNow seamlessly integrates with various applications, allowing you to fill out rev 1220 alongside your preferred tools. Whether it's CRM software or cloud storage services, our integrations enhance your workflow by connecting all your essential applications. This can streamline document management processes signNowly.

Get more for Rev 1220

Find out other Rev 1220

- How To Sign Alabama Legal LLC Operating Agreement

- Sign Alabama Legal Cease And Desist Letter Now

- Sign Alabama Legal Cease And Desist Letter Later

- Sign California Legal Living Will Online

- How Do I Sign Colorado Legal LLC Operating Agreement

- How Can I Sign California Legal Promissory Note Template

- How Do I Sign North Dakota Insurance Quitclaim Deed

- How To Sign Connecticut Legal Quitclaim Deed

- How Do I Sign Delaware Legal Warranty Deed

- Sign Delaware Legal LLC Operating Agreement Mobile

- Sign Florida Legal Job Offer Now

- Sign Insurance Word Ohio Safe

- How Do I Sign Hawaii Legal Business Letter Template

- How To Sign Georgia Legal Cease And Desist Letter

- Sign Georgia Legal Residential Lease Agreement Now

- Sign Idaho Legal Living Will Online

- Sign Oklahoma Insurance Limited Power Of Attorney Now

- Sign Idaho Legal Separation Agreement Online

- Sign Illinois Legal IOU Later

- Sign Illinois Legal Cease And Desist Letter Fast