Form 982

What is the Form 982

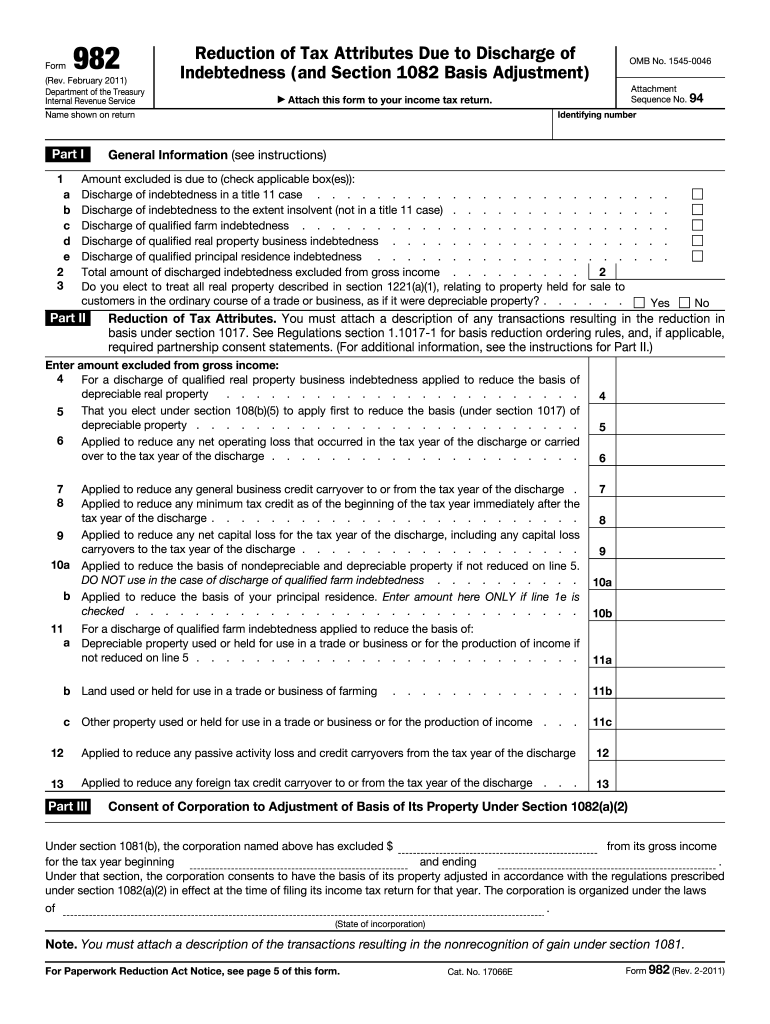

The IRS Form 982 is a tax form used by individuals and businesses to request the discharge of indebtedness income. This form is particularly relevant for taxpayers who have had debt forgiven or canceled, as it allows them to exclude that income from their taxable income under specific circumstances. Understanding the purpose of Form 982 is crucial for ensuring compliance with tax regulations and managing financial obligations effectively.

How to use the Form 982

Using the IRS Form 982 involves a few key steps. First, taxpayers must determine their eligibility for debt discharge under the relevant tax laws. Next, they should gather necessary documentation, such as cancellation of debt notices and financial statements. Once the information is compiled, taxpayers can fill out the form accurately, ensuring all required fields are completed. Finally, the completed form must be submitted to the IRS along with the appropriate tax return, either electronically or by mail.

Steps to complete the Form 982

Completing the IRS Form 982 requires careful attention to detail. Here are the essential steps:

- Gather all relevant financial documents related to the debt cancellation.

- Review the instructions for Form 982 to understand the requirements.

- Fill out the form, ensuring to include your personal information and details about the canceled debt.

- Indicate the reason for the discharge of indebtedness income on the form.

- Double-check all entries for accuracy before submission.

Legal use of the Form 982

The legal use of Form 982 is governed by IRS regulations. Taxpayers must ensure that they qualify for the exclusions provided under the Internal Revenue Code. This form is legally binding when filled out correctly and submitted in accordance with IRS guidelines. Misuse or incorrect filing can lead to penalties or audits, emphasizing the importance of understanding the legal implications of using Form 982.

Key elements of the Form 982

Key elements of the IRS Form 982 include:

- Taxpayer Information: Personal details such as name, address, and Social Security number.

- Debt Information: Details regarding the canceled debt, including the amount and the creditor.

- Exclusion Clauses: Specific sections that allow taxpayers to indicate the type of exclusion they are claiming.

- Signature: The taxpayer's signature certifying the accuracy of the information provided.

Filing Deadlines / Important Dates

Filing deadlines for Form 982 align with the general tax filing deadlines set by the IRS. Typically, individual taxpayers must file their tax returns by April 15 of each year. If you are claiming a discharge of indebtedness income, it is crucial to include Form 982 with your return by this deadline to avoid penalties. Extensions may be available, but it is essential to check the IRS guidelines for specific dates and requirements.

Quick guide on how to complete form 982 1156845

Complete Form 982 easily on any device

Digital document management has gained signNow traction among businesses and individuals. It serves as an ideal eco-friendly alternative to traditional printed and signed documents, allowing you to obtain the correct form and securely store it online. airSlate SignNow provides all the resources you need to create, modify, and eSign your files quickly without any hassle. Manage Form 982 on any device using airSlate SignNow's Android or iOS applications and enhance any document-centric procedure today.

How to modify and eSign Form 982 effortlessly

- Locate Form 982 and click Get Form to begin.

- Use the tools we provide to complete your form.

- Highlight important sections of the documents or redact sensitive information using tools specifically designed for that purpose by airSlate SignNow.

- Create your eSignature with the Sign tool, which takes mere seconds and holds the same legal validity as a conventional wet ink signature.

- Review the details and click the Done button to save your changes.

- Select your preferred delivery method for the form: via email, text message (SMS), or invitation link, or download it to your computer.

Say goodbye to lost or misplaced papers, tedious form searches, or mistakes that necessitate printing new document copies. airSlate SignNow meets your document management needs in just a few clicks from any device you choose. Adjust and eSign Form 982 and guarantee effective communication at every stage of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the form 982 1156845

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is the 982 form and how is it used?

The 982 form is a document used for specific tax purposes, particularly for reporting adjustments related to the cancellation of debt. Understanding how to fill out the 982 form correctly is crucial for ensuring compliance with IRS regulations, especially for businesses dealing with debt forgiveness.

-

How can airSlate SignNow simplify the process of completing a 982 form?

airSlate SignNow streamlines the process of completing a 982 form by allowing users to fill out, sign, and send documents electronically. This saves time and reduces the likelihood of errors, making the form completion more efficient and accurate.

-

Is there a cost associated with using airSlate SignNow for the 982 form?

Yes, airSlate SignNow offers various pricing plans that cater to different business needs. By choosing the right plan, you can utilize a range of features while managing your costs effectively, whether you need to handle a few or many 982 forms.

-

What features does airSlate SignNow provide for managing 982 forms?

airSlate SignNow offers a variety of features for managing 982 forms, including electronic signatures, document templates, and secure cloud storage. These tools facilitate seamless collaboration and ensure that all documentation is easily accessible and organized.

-

Can I integrate airSlate SignNow with other applications for my 982 form processing?

Absolutely! airSlate SignNow supports integrations with various applications such as CRMs, cloud storage solutions, and accounting software. This allows for a more streamlined workflow when processing 982 forms and enhances productivity across your business.

-

What benefits does electronic signing of the 982 form provide?

Electronic signing of the 982 form provides multiple benefits, including faster turnaround times and improved security. With airSlate SignNow, you can ensure that your documents are signed and returned promptly, reducing administrative delays and enhancing overall efficiency.

-

Is airSlate SignNow compliant with regulations for handling 982 forms?

Yes, airSlate SignNow is compliant with various regulations regarding electronic signatures and document handling. This compliance ensures that your 982 form and related documents are legally valid and secure, providing peace of mind for businesses.

Get more for Form 982

- Power of attorney forms package michigan

- Michigan anatomical form

- Michigan process form

- Michigan anatomical 497311668 form

- Michigan anatomical 497311669 form

- Employment or job termination package michigan form

- Newly widowed individuals package michigan form

- Employment interview package michigan form

Find out other Form 982

- Electronic signature Wisconsin Codicil to Will Later

- Electronic signature Idaho Guaranty Agreement Free

- Electronic signature North Carolina Guaranty Agreement Online

- eSignature Connecticut Outsourcing Services Contract Computer

- eSignature New Hampshire Outsourcing Services Contract Computer

- eSignature New York Outsourcing Services Contract Simple

- Electronic signature Hawaii Revocation of Power of Attorney Computer

- How Do I Electronic signature Utah Gift Affidavit

- Electronic signature Kentucky Mechanic's Lien Free

- Electronic signature Maine Mechanic's Lien Fast

- Can I Electronic signature North Carolina Mechanic's Lien

- How To Electronic signature Oklahoma Mechanic's Lien

- Electronic signature Oregon Mechanic's Lien Computer

- Electronic signature Vermont Mechanic's Lien Simple

- How Can I Electronic signature Virginia Mechanic's Lien

- Electronic signature Washington Mechanic's Lien Myself

- Electronic signature Louisiana Demand for Extension of Payment Date Simple

- Can I Electronic signature Louisiana Notice of Rescission

- Electronic signature Oregon Demand for Extension of Payment Date Online

- Can I Electronic signature Ohio Consumer Credit Application