Eritrean Embassy Tax Form

What is the Eritrean Embassy Tax Form

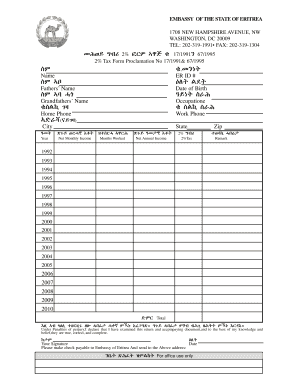

The Eritrean Embassy Tax Form is a crucial document for individuals engaging with the Eritrean Embassy in Washington, D.C. This form is typically required for various tax-related matters, including declarations and compliance with Eritrean tax laws. It serves as an official means to report income, assets, and other financial information relevant to Eritrean nationals or residents living abroad. Understanding the purpose and requirements of this form is essential for ensuring compliance with both Eritrean and U.S. tax regulations.

How to Obtain the Eritrean Embassy Tax Form

Obtaining the Eritrean Embassy Tax Form can be done through several straightforward methods. Individuals can visit the official website of the Eritrean Embassy in Washington, D.C., where downloadable versions of the form may be available. Alternatively, individuals can contact the embassy directly via phone or email to request a physical copy of the form. It is important to ensure that you are using the most current version of the form to avoid any issues during submission.

Steps to Complete the Eritrean Embassy Tax Form

Completing the Eritrean Embassy Tax Form involves several key steps to ensure accuracy and compliance. Begin by gathering all necessary documentation, including identification, proof of income, and any relevant financial statements. Next, carefully fill out each section of the form, ensuring that all information is accurate and complete. Double-check for any errors or omissions before signing the form. Once completed, the form can be submitted according to the guidelines provided by the embassy.

Legal Use of the Eritrean Embassy Tax Form

The Eritrean Embassy Tax Form holds legal significance, as it is used to fulfill tax obligations under Eritrean law. When completed correctly, it serves as a formal declaration of financial information, which may be used by the Eritrean government for tax assessment purposes. It is essential to ensure that the form is filled out honestly and accurately to avoid potential legal repercussions, including penalties for non-compliance.

Required Documents for the Eritrean Embassy Tax Form

When preparing to complete the Eritrean Embassy Tax Form, certain documents are typically required. These may include:

- Valid identification, such as a passport or national ID.

- Proof of income, including pay stubs or tax returns.

- Bank statements or financial records that reflect assets.

- Any previous tax forms filed with the Eritrean government.

Having these documents ready will facilitate a smoother completion process and ensure that all necessary information is accurately reported.

Form Submission Methods

The Eritrean Embassy Tax Form can be submitted through various methods, depending on the embassy's guidelines. Common submission methods include:

- Online Submission: If available, this method allows for a quick and efficient submission process.

- Mail: The completed form can be mailed to the Eritrean Embassy, ensuring it is sent to the correct address.

- In-Person: Individuals may also choose to deliver the form directly to the embassy during business hours.

It is advisable to confirm the preferred submission method with the embassy to ensure compliance with their requirements.

Quick guide on how to complete eritrean embassy tax form 5710714

Effortlessly Prepare Eritrean Embassy Tax Form on Any Device

Managing documents online has gained traction among businesses and individuals. It serves as an excellent eco-friendly alternative to traditional printed and signed papers, as you can easily locate the right form and securely store it online. airSlate SignNow equips you with all the tools necessary to create, edit, and eSign your documents swiftly and without delays. Handle Eritrean Embassy Tax Form on any device with the airSlate SignNow Android or iOS applications and streamline your document-centric processes today.

The Easiest Way to Edit and eSign Eritrean Embassy Tax Form With Ease

- Locate Eritrean Embassy Tax Form and click Get Form to begin.

- Utilize the tools we provide to complete your form.

- Emphasize relevant sections of the documents or redact sensitive information with tools specifically designed for that purpose by airSlate SignNow.

- Generate your eSignature using the Sign feature, which takes mere seconds and holds the same legal validity as a conventional wet ink signature.

- Review the information and click the Done button to save your changes.

- Select your preferred method for sharing your form, whether by email, SMS, invitation link, or download to your PC.

Eliminate the hassle of lost or mislaid documents, tedious form searches, or mistakes requiring the printing of new copies. airSlate SignNow addresses all your document management needs with just a few clicks from your preferred device. Edit and eSign Eritrean Embassy Tax Form and guarantee effective communication at every stage of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the eritrean embassy tax form 5710714

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is the purpose of the Eritrean embassy tax form?

The Eritrean embassy tax form is used to report income and ensure compliance with Eritrean tax regulations. This form is essential for Eritrean citizens or residents living abroad who need to file their taxes accurately. By using the airSlate SignNow platform, you can seamlessly manage and eSign this form.

-

How do I fill out the Eritrean embassy tax form using airSlate SignNow?

Filling out the Eritrean embassy tax form with airSlate SignNow is simple. You can upload the form, enter the necessary information, and use our user-friendly tools to complete it. Additionally, our platform allows you to save your progress, making it easy to return and finish at your convenience.

-

What features does airSlate SignNow offer for handling the Eritrean embassy tax form?

airSlate SignNow includes features such as eSignature capabilities, document management, and real-time collaboration, specifically designed for handling forms like the Eritrean embassy tax form. These features enhance productivity and ensure that your documents are signed and sent securely without delays.

-

Are there any costs associated with using airSlate SignNow for the Eritrean embassy tax form?

Yes, there are subscription plans for using airSlate SignNow that allow you to manage the Eritrean embassy tax form efficiently. Our plans are cost-effective and designed to cater to different business needs, giving you the flexibility to choose what works best for you while ensuring compliance.

-

Can I track the status of my Eritrean embassy tax form submission?

Absolutely! airSlate SignNow allows you to track the status of your Eritrean embassy tax form submission in real time. You will receive notifications when the form is viewed and signed, ensuring you stay informed throughout the process and manage your documents effortlessly.

-

Is airSlate SignNow compliant with Eritrean tax regulations?

Yes, airSlate SignNow is designed to assist users in complying with various tax regulations, including those related to the Eritrean embassy tax form. Our platform ensures that all documents are created and managed following legal requirements, giving you peace of mind when filing your taxes.

-

Can I integrate airSlate SignNow with other tools for the Eritrean embassy tax form?

Yes, airSlate SignNow offers integrations with a variety of third-party apps and software solutions, simplifying the workflow for managing your Eritrean embassy tax form. You can connect with tools like CRMs and accounting software to streamline document management and enhance your efficiency.

Get more for Eritrean Embassy Tax Form

Find out other Eritrean Embassy Tax Form

- Can I Electronic signature Nevada Plumbing Agreement

- Electronic signature Illinois Real Estate Affidavit Of Heirship Easy

- How To Electronic signature Indiana Real Estate Quitclaim Deed

- Electronic signature North Carolina Plumbing Business Letter Template Easy

- Electronic signature Kansas Real Estate Residential Lease Agreement Simple

- How Can I Electronic signature North Carolina Plumbing Promissory Note Template

- Electronic signature North Dakota Plumbing Emergency Contact Form Mobile

- Electronic signature North Dakota Plumbing Emergency Contact Form Easy

- Electronic signature Rhode Island Plumbing Business Plan Template Later

- Electronic signature Louisiana Real Estate Quitclaim Deed Now

- Electronic signature Louisiana Real Estate Quitclaim Deed Secure

- How Can I Electronic signature South Dakota Plumbing Emergency Contact Form

- Electronic signature South Dakota Plumbing Emergency Contact Form Myself

- Electronic signature Maryland Real Estate LLC Operating Agreement Free

- Electronic signature Texas Plumbing Quitclaim Deed Secure

- Electronic signature Utah Plumbing Last Will And Testament Free

- Electronic signature Washington Plumbing Business Plan Template Safe

- Can I Electronic signature Vermont Plumbing Affidavit Of Heirship

- Electronic signature Michigan Real Estate LLC Operating Agreement Easy

- Electronic signature West Virginia Plumbing Memorandum Of Understanding Simple