Printable Mileage Log Form

What is the Printable Mileage Log

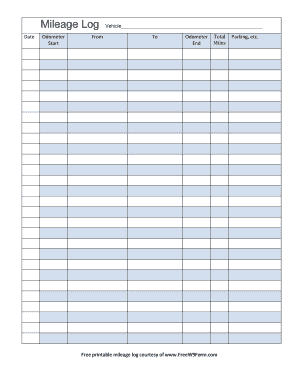

A printable mileage log is a structured document used to record the distance traveled for business purposes. This log is essential for individuals and businesses seeking to claim mileage reimbursement or deductions on their taxes. The vehicle mileage log template typically includes fields for the date of travel, starting and ending odometer readings, the purpose of the trip, and the total miles driven. By maintaining accurate records, users can ensure compliance with IRS guidelines and maximize their potential deductions.

How to use the Printable Mileage Log

Using a printable mileage log involves several straightforward steps. First, download the vehicle mileage log template in a suitable format, such as PDF. Next, fill in the required details for each trip, including the date, starting and ending odometer readings, and the purpose of the travel. It is important to keep this log updated regularly to ensure accuracy. At the end of the tax year, the completed mileage log can be used to substantiate any claims for mileage reimbursement or tax deductions.

Steps to complete the Printable Mileage Log

Completing a printable mileage log requires attention to detail to ensure all necessary information is recorded accurately. Follow these steps:

- Download the vehicle mileage log template and open it in a PDF viewer.

- Enter the date of each trip in the designated field.

- Record the starting odometer reading before beginning your trip.

- Document the ending odometer reading after completing your trip.

- Note the purpose of the trip, such as business meetings or client visits.

- Calculate the total miles driven by subtracting the starting reading from the ending reading.

- Repeat this process for each trip throughout the year.

Legal use of the Printable Mileage Log

The legal use of a printable mileage log is crucial for ensuring that the recorded information is accepted by the IRS and other authorities. To be considered valid, the log must be accurate and maintained regularly. It is advisable to include all relevant details, such as the date, purpose, and mileage, to support any claims made on tax returns. Using a reliable digital platform for signing and storing these logs can enhance their legal standing, as it provides a secure way to manage sensitive information.

IRS Guidelines

The IRS has specific guidelines regarding the use of mileage logs for tax purposes. According to IRS regulations, taxpayers must keep detailed records of their business mileage to claim deductions. This includes maintaining a log that documents the date, destination, purpose of the trip, and mileage driven. The IRS recommends that taxpayers use a consistent method for tracking their mileage, whether through a printable mileage log or a digital tracking system. Failure to comply with these guidelines may result in denied deductions during tax audits.

Examples of using the Printable Mileage Log

There are various scenarios in which a printable mileage log can be beneficial. For instance, self-employed individuals often use the log to track business-related travel expenses, allowing them to deduct these costs on their tax returns. Similarly, employees who use their personal vehicles for work-related tasks may submit their mileage logs to their employers for reimbursement. Additionally, businesses can utilize these logs to monitor vehicle usage and ensure compliance with internal policies regarding travel expenses.

Quick guide on how to complete printable mileage log 44885982

Easily Prepare Printable Mileage Log on Any Device

Managing documents online has gained popularity among businesses and individuals. It offers an ideal eco-friendly substitute for conventional printed and signed documents, allowing you to locate the correct form and securely store it online. airSlate SignNow equips you with all the necessary tools to create, edit, and electronically sign your documents promptly and without setbacks. Handle Printable Mileage Log on any device using airSlate SignNow's Android or iOS applications and enhance any document-centric workflow today.

The Easiest Way to Edit and Electronically Sign Printable Mileage Log

- Find Printable Mileage Log and click Get Form to initiate the process.

- Use the tools provided to fill out your form.

- Select important sections of your documents or redact sensitive information with specialized tools from airSlate SignNow.

- Create your eSignature with the Sign feature, which takes seconds and carries the same legal validity as a conventional handwritten signature.

- Review all the details and click the Done button to save your modifications.

- Decide how you wish to send your form, whether by email, SMS, or invitation link, or download it to your computer.

Eliminate worries about lost or misplaced documents, cumbersome form navigation, or errors that require printing new document copies. airSlate SignNow meets all your document management needs within a few clicks from your preferred device. Edit and electronically sign Printable Mileage Log to ensure outstanding communication at every step of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the printable mileage log 44885982

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is a vehicle mileage log template?

A vehicle mileage log template is a structured document designed to help users track and record their driving time and distance for business or personal use. Utilizing an efficient template allows for accurate documentation, making it easier to manage expenses and reimbursements.

-

How can airSlate SignNow assist with a vehicle mileage log template?

airSlate SignNow offers a user-friendly platform to create, customize, and manage your vehicle mileage log template efficiently. With electronic signature capabilities, you can easily authenticate and share mileage logs, streamlining your documentation process.

-

Is there a cost associated with using airSlate SignNow for the vehicle mileage log template?

airSlate SignNow provides various pricing plans to cater to different business needs, ensuring that you find a cost-effective solution for using a vehicle mileage log template. These plans are designed to help you reduce administrative overhead while enhancing productivity.

-

What features are included in the vehicle mileage log template from airSlate SignNow?

The vehicle mileage log template from airSlate SignNow includes features such as customizable fields for date, distance, purpose of the trip, and automatic calculations for expenses. This makes it easier to maintain accurate records consolidated in one place.

-

What are the benefits of using a vehicle mileage log template?

Using a vehicle mileage log template simplifies tracking your mileage, aids in tax preparation, and ensures compliance with IRS guidelines. It allows for accurate expense reporting, saving time and effort on administrative tasks.

-

Can I integrate my vehicle mileage log template with other software?

Yes, airSlate SignNow integrates seamlessly with various platforms, allowing users to connect their vehicle mileage log template with accounting tools and CRMs for enhanced efficiency. This integration can streamline your workflow and improve data management.

-

Is the vehicle mileage log template suitable for both personal and business use?

Absolutely! The vehicle mileage log template is versatile enough for both personal and business applications, making it ideal for freelancers, business owners, and everyday users. It helps maintain organized records regardless of the purpose.

Get more for Printable Mileage Log

Find out other Printable Mileage Log

- eSign Oklahoma Doctors Arbitration Agreement Online

- eSign Oklahoma Doctors Forbearance Agreement Online

- eSign Oregon Doctors LLC Operating Agreement Mobile

- eSign Hawaii Education Claim Myself

- eSign Hawaii Education Claim Simple

- eSign Hawaii Education Contract Simple

- eSign Hawaii Education NDA Later

- How To eSign Hawaii Education NDA

- How Do I eSign Hawaii Education NDA

- eSign Hawaii Education Arbitration Agreement Fast

- eSign Minnesota Construction Purchase Order Template Safe

- Can I eSign South Dakota Doctors Contract

- eSign Mississippi Construction Rental Application Mobile

- How To eSign Missouri Construction Contract

- eSign Missouri Construction Rental Lease Agreement Easy

- How To eSign Washington Doctors Confidentiality Agreement

- Help Me With eSign Kansas Education LLC Operating Agreement

- Help Me With eSign West Virginia Doctors Lease Agreement Template

- eSign Wyoming Doctors Living Will Mobile

- eSign Wyoming Doctors Quitclaim Deed Free