K Cns 101 2014-2026

What is the K Cns 101

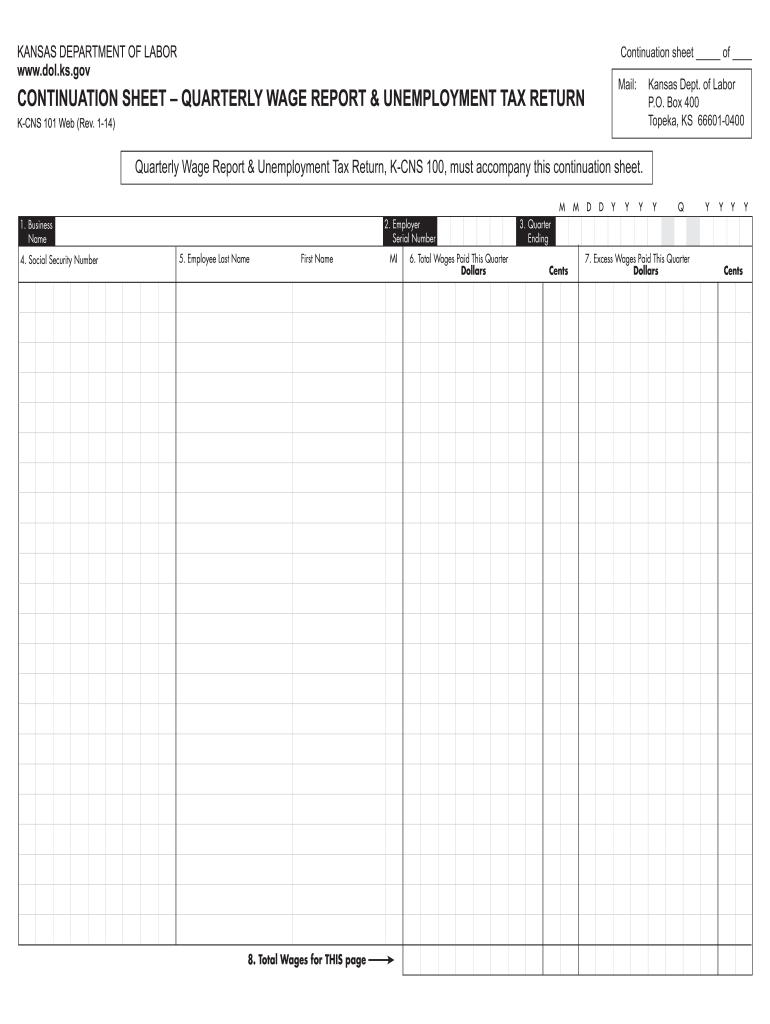

The K Cns 101 is a crucial form used in the state of Kansas for reporting wages paid to employees. This form is essential for employers to accurately report their payroll information to the Kansas Department of Labor. It helps ensure that all wage data is collected for tax purposes, unemployment insurance, and other state benefits. The K Cns 101 is a part of the state's efforts to maintain accurate employment records and facilitate the proper administration of unemployment insurance programs.

How to Use the K Cns 101

Using the K Cns 101 involves several steps to ensure that all information is reported correctly. Employers must gather necessary payroll data, including employee names, Social Security numbers, and total wages paid during the reporting period. Once the data is collected, it should be entered into the K Cns 101 form accurately. Employers should also verify that all calculations are correct to avoid discrepancies. After completing the form, it must be submitted to the appropriate state agency by the specified deadline.

Steps to Complete the K Cns 101

Completing the K Cns 101 requires a systematic approach to ensure accuracy and compliance. Follow these steps:

- Gather all employee payroll records for the reporting period.

- Fill in the employee details, including names and Social Security numbers.

- Calculate the total wages paid to each employee during the reporting period.

- Double-check all entries for accuracy.

- Submit the completed K Cns 101 form to the Kansas Department of Labor by the due date.

Legal Use of the K Cns 101

The K Cns 101 must be used in accordance with Kansas state laws and regulations. Employers are legally obligated to report accurate wage information to avoid penalties. Failure to submit the form or providing incorrect information can lead to fines or legal repercussions. It is essential for employers to understand their responsibilities regarding this form to remain compliant with state employment laws.

Filing Deadlines / Important Dates

Employers must be aware of the filing deadlines for the K Cns 101 to avoid late penalties. Typically, the form must be submitted quarterly, with specific due dates set by the Kansas Department of Labor. It is advisable for employers to mark these dates on their calendars and prepare the necessary documentation in advance to ensure timely submission.

Form Submission Methods

The K Cns 101 can be submitted through various methods, providing flexibility for employers. Options include:

- Online submission through the Kansas Department of Labor's website.

- Mailing a paper copy of the completed form to the appropriate office.

- In-person submission at designated state offices.

Employers should choose the method that best fits their operational needs while ensuring that they meet all deadlines.

Quick guide on how to complete continuation sheet quarterly wage report dol ks

Simplify Your HR Processes with K Cns 101 Template

Every HR specialist recognizes the importance of maintaining employees’ documents orderly and systematic. With airSlate SignNow, you gain entry to a comprehensive collection of state-specific labor documents that greatly enhance the organization, management, and storage of all work-related paperwork in a single location. airSlate SignNow enables you to manage K Cns 101 from beginning to end, with a wide range of editing and eSignature capabilities available whenever you need them. Increase your accuracy, document safety, and minimize minor manual errors in just a few clicks.

Steps to Edit and eSign K Cns 101:

- Select the appropriate state and search for the form you require.

- Access the form page and click Get Form to start working with it.

- Allow K Cns 101 to upload in the editor and follow the prompts indicating mandatory fields.

- Input your information or add additional fillable fields to the document.

- Utilize our tools and features to adjust your form as necessary: annotate, obscure sensitive information, and create an eSignature.

- Review your document for any mistakes prior to proceeding with its submission.

- Select Done to save your changes and download your form.

- Alternatively, distribute your documents directly to your recipients and collect signatures and information.

- Safely store completed forms in your airSlate SignNow account and access them whenever you wish.

Employing a flexible eSignature solution is essential when handling K Cns 101. Make even the most intricate workflow as straightforward as possible with airSlate SignNow. Start your free trial today to explore what you can accomplish with your department.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the continuation sheet quarterly wage report dol ks

How to generate an eSignature for the Continuation Sheet Quarterly Wage Report Dol Ks online

How to create an eSignature for your Continuation Sheet Quarterly Wage Report Dol Ks in Google Chrome

How to create an electronic signature for signing the Continuation Sheet Quarterly Wage Report Dol Ks in Gmail

How to create an electronic signature for the Continuation Sheet Quarterly Wage Report Dol Ks from your smartphone

How to make an eSignature for the Continuation Sheet Quarterly Wage Report Dol Ks on iOS devices

How to create an eSignature for the Continuation Sheet Quarterly Wage Report Dol Ks on Android OS

People also ask

-

What is the Kansas quarterly wage report 2019?

The Kansas quarterly wage report 2019 is a document that businesses in Kansas must file to report employee wages and contributions. This report is essential for complying with state taxation and unemployment insurance requirements, ensuring that businesses remain in good standing with state authorities.

-

How can airSlate SignNow help with submitting the Kansas quarterly wage report 2019?

airSlate SignNow streamlines the process of submitting the Kansas quarterly wage report 2019 by allowing users to digitally sign and send documents securely. Our user-friendly platform reduces paperwork and provides quick access to electronic copies, making compliance hassle-free.

-

What features does airSlate SignNow offer for managing the Kansas quarterly wage report 2019?

airSlate SignNow offers features such as customizable templates, eSignature capabilities, and document storage. These tools simplify the preparation and submission of the Kansas quarterly wage report 2019, ensuring accuracy and efficiency, ultimately saving businesses time.

-

Is airSlate SignNow cost-effective for submitting the Kansas quarterly wage report 2019?

Yes, airSlate SignNow provides a cost-effective solution for submitting the Kansas quarterly wage report 2019. With various pricing plans, businesses can choose the option that best fits their needs, allowing for effective document management without straining their budget.

-

Can I track the status of my Kansas quarterly wage report 2019 with airSlate SignNow?

Absolutely! airSlate SignNow offers tracking features that allow you to monitor the status of your Kansas quarterly wage report 2019. You will receive notifications when the document is viewed and signed, ensuring you stay informed throughout the process.

-

Does airSlate SignNow integrate with other accounting software for the Kansas quarterly wage report 2019?

Yes, airSlate SignNow integrates seamlessly with various accounting and payroll software. This integration simplifies the process of generating and submitting the Kansas quarterly wage report 2019 by allowing data to flow easily between platforms.

-

What are the benefits of using airSlate SignNow for the Kansas quarterly wage report 2019?

Using airSlate SignNow for the Kansas quarterly wage report 2019 offers numerous benefits, including increased efficiency, reduced paperwork, and improved compliance. Our secure platform ensures that your sensitive information is protected while facilitating faster processing times.

Get more for K Cns 101

- Ownerguard gap cancellation form

- Kissimmee little league form

- Tsca template form

- School refusal assessment scale printable form

- Althafer senior placement and referral services althafer assisted form

- Temple university letterhead form

- Form pa dl 180 fill online printable fillable

- Buying or selling a vehicle in illinois form

Find out other K Cns 101

- Help Me With eSignature Kentucky Charity Form

- How Do I eSignature Michigan Charity Presentation

- How Do I eSignature Pennsylvania Car Dealer Document

- How To eSignature Pennsylvania Charity Presentation

- Can I eSignature Utah Charity Document

- How Do I eSignature Utah Car Dealer Presentation

- Help Me With eSignature Wyoming Charity Presentation

- How To eSignature Wyoming Car Dealer PPT

- How To eSignature Colorado Construction PPT

- How To eSignature New Jersey Construction PDF

- How To eSignature New York Construction Presentation

- How To eSignature Wisconsin Construction Document

- Help Me With eSignature Arkansas Education Form

- Can I eSignature Louisiana Education Document

- Can I eSignature Massachusetts Education Document

- Help Me With eSignature Montana Education Word

- How To eSignature Maryland Doctors Word

- Help Me With eSignature South Dakota Education Form

- How Can I eSignature Virginia Education PDF

- How To eSignature Massachusetts Government Form