Partner Basis Worksheet Template Excel Form

What is the Partner Basis Worksheet Template Excel

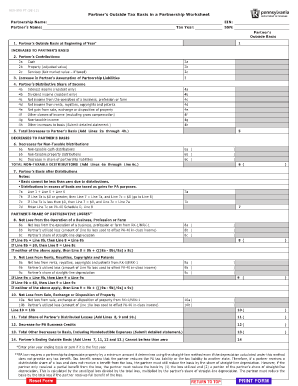

The Partner Basis Worksheet Template Excel is a structured document designed to help partners in a partnership accurately calculate their individual basis in the partnership. This basis is crucial for determining the tax implications of distributions, contributions, and the sale of partnership interests. The worksheet typically includes sections for recording initial contributions, additional investments, distributions received, and adjustments for income or losses. By using this template, partners can ensure they maintain accurate records that comply with IRS guidelines.

Steps to Complete the Partner Basis Worksheet Template Excel

Completing the Partner Basis Worksheet Template Excel involves several key steps to ensure accuracy and compliance:

- Gather Required Information: Collect all relevant financial documents, including partnership agreements, prior tax returns, and records of contributions and distributions.

- Input Initial Basis: Enter the initial cash and property contributions made to the partnership. This forms the starting point for your basis calculation.

- Adjust for Additional Contributions: Record any additional investments made during the partnership’s operation, including cash and property contributions.

- Account for Distributions: Document any distributions received from the partnership, which will reduce your basis.

- Include Income and Loss Adjustments: Adjust your basis for your share of partnership income and losses, which can affect your overall tax liability.

- Review for Accuracy: Double-check all entries for accuracy before finalizing the worksheet.

Legal Use of the Partner Basis Worksheet Template Excel

The legal use of the Partner Basis Worksheet Template Excel is essential for ensuring compliance with IRS regulations. The worksheet serves as a record of each partner's basis, which is critical when reporting taxable income or losses. It is important to retain this document for your records, as it may be required during audits or when filing tax returns. Properly completed worksheets help establish the legitimacy of your tax positions and can protect against potential disputes with the IRS.

IRS Guidelines

The IRS provides specific guidelines regarding the calculation and reporting of partnership basis. According to IRS regulations, partners must accurately report their basis on Form 1065, the U.S. Return of Partnership Income. The Partner Basis Worksheet Template Excel assists in ensuring that all necessary adjustments are considered, including contributions, distributions, and share of income or losses. Adhering to these guidelines is crucial for maintaining compliance and avoiding penalties during tax assessments.

Examples of Using the Partner Basis Worksheet Template Excel

Utilizing the Partner Basis Worksheet Template Excel can be illustrated through various scenarios:

- New Partner Contributions: A new partner joins the partnership and contributes cash and property. The worksheet helps calculate their initial basis accurately.

- Distributions Received: A partner receives a distribution from the partnership. The worksheet allows them to adjust their basis accordingly, ensuring accurate tax reporting.

- Partnership Losses: In a year where the partnership incurs losses, partners can use the worksheet to adjust their basis downward, reflecting their share of the losses.

Quick guide on how to complete partner basis worksheet template excel

Effortlessly Prepare Partner Basis Worksheet Template Excel on Any Device

The management of documents online has gained signNow traction among businesses and individuals alike. It offers an ideal environmentally friendly substitute for traditional printed and signed documents, allowing you to locate the necessary form and securely store it online. airSlate SignNow equips you with all the tools necessary to create, modify, and electronically sign your documents quickly and without hold-ups. Manage Partner Basis Worksheet Template Excel on any device using airSlate SignNow's Android or iOS applications and enhance any document-related process today.

How to Modify and Electronically Sign Partner Basis Worksheet Template Excel Seamlessly

- Locate Partner Basis Worksheet Template Excel and click on Get Form to begin.

- Utilize the tools we offer to fill out your form.

- Emphasize pertinent sections of your documents or redact sensitive information with tools provided by airSlate SignNow specifically for that purpose.

- Create your signature using the Sign tool, which takes mere seconds and holds the same legal validity as a traditional handwritten signature.

- Review the information and click on the Done button to save your changes.

- Select your preferred method for sharing your form, whether by email, SMS, or an invitation link, or download it to your computer.

Forget about lost or misplaced documents, tedious searches for forms, or mistakes that necessitate printing new document copies. airSlate SignNow meets your document management needs in just a few clicks from a device of your choice. Modify and electronically sign Partner Basis Worksheet Template Excel to ensure outstanding communication throughout your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the partner basis worksheet template excel

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is a partnership basis worksheet?

A partnership basis worksheet is a financial document that helps partners track their capital contributions, distributions, and share of profits. It assists in determining each partner's basis for tax reporting and compliance. This worksheet is essential for accurate record-keeping in partnerships.

-

How can I create a partnership basis worksheet using airSlate SignNow?

To create a partnership basis worksheet with airSlate SignNow, you can easily use our customizable templates to input your partnership's financial details. The platform allows you to collaborate with partners in real-time, making document preparation seamless. You can then eSign the worksheet for official use.

-

Is there a cost associated with using airSlate SignNow for my partnership basis worksheet?

Yes, airSlate SignNow offers a variety of pricing plans to suit different business needs. Each plan includes access to customizable templates like the partnership basis worksheet and features such as eSigning and secure document storage. We advise reviewing our pricing page for the best option that fits your requirements.

-

What features does airSlate SignNow offer for managing partnership basis worksheets?

airSlate SignNow provides features such as customizable templates, real-time collaboration, electronic signatures, and cloud storage for partnership basis worksheets. These tools ensure that you can manage your documents efficiently while maintaining compliance with legal standards. Additionally, the platform's user-friendly interface makes document management straightforward.

-

Can I integrate airSlate SignNow with other software for my partnership basis worksheet?

Yes, airSlate SignNow offers various integrations with popular software applications like Salesforce, Dropbox, and Google Drive. This enables you to streamline your workflow when managing your partnership basis worksheet, making it easier to pull in necessary information or store completed documents. Check our integrations page for more details.

-

What are the benefits of using a partnership basis worksheet?

Using a partnership basis worksheet simplifies tracking each partner's investment and share in the business, aiding in tax calculations and compliance. It allows partners to clearly see their financial standing and distributions over time. This clarity is crucial for making informed business decisions and maintaining transparency among partners.

-

Is technical support available for airSlate SignNow users working on partnership basis worksheets?

Yes, airSlate SignNow offers robust technical support for all users. Whether you have questions about creating a partnership basis worksheet or require assistance with features, our support team is available through multiple channels, including chat, email, and phone support. We ensure that you receive prompt help whenever needed.

Get more for Partner Basis Worksheet Template Excel

Find out other Partner Basis Worksheet Template Excel

- eSignature North Dakota Government Quitclaim Deed Free

- eSignature Kansas Finance & Tax Accounting Business Letter Template Free

- eSignature Washington Government Arbitration Agreement Simple

- Can I eSignature Massachusetts Finance & Tax Accounting Business Plan Template

- Help Me With eSignature Massachusetts Finance & Tax Accounting Work Order

- eSignature Delaware Healthcare / Medical NDA Secure

- eSignature Florida Healthcare / Medical Rental Lease Agreement Safe

- eSignature Nebraska Finance & Tax Accounting Business Letter Template Online

- Help Me With eSignature Indiana Healthcare / Medical Notice To Quit

- eSignature New Jersey Healthcare / Medical Credit Memo Myself

- eSignature North Dakota Healthcare / Medical Medical History Simple

- Help Me With eSignature Arkansas High Tech Arbitration Agreement

- eSignature Ohio Healthcare / Medical Operating Agreement Simple

- eSignature Oregon Healthcare / Medical Limited Power Of Attorney Computer

- eSignature Pennsylvania Healthcare / Medical Warranty Deed Computer

- eSignature Texas Healthcare / Medical Bill Of Lading Simple

- eSignature Virginia Healthcare / Medical Living Will Computer

- eSignature West Virginia Healthcare / Medical Claim Free

- How To eSignature Kansas High Tech Business Plan Template

- eSignature Kansas High Tech Lease Agreement Template Online