Form 4868 Application for Automatic Extension of Time to File U S Individual Income Tax Return

What is the Form 4868 Application For Automatic Extension Of Time To File U S Individual Income Tax Return

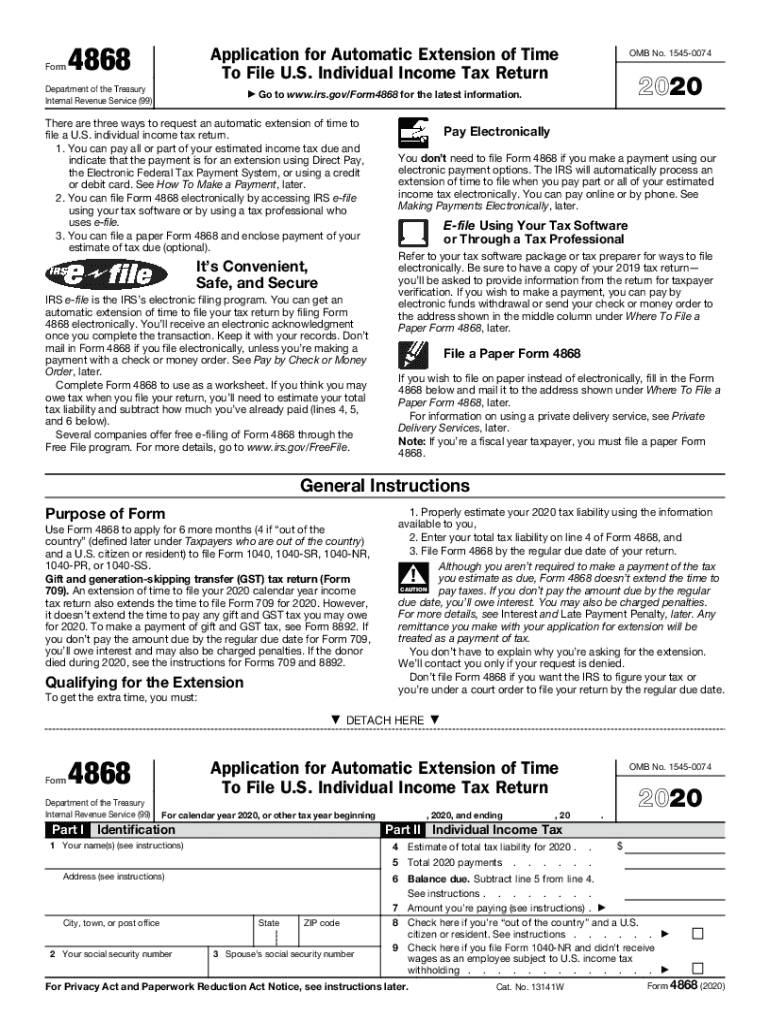

The Form 4868 is an official document used by U.S. taxpayers to request an automatic extension of time to file their individual income tax return. This form allows taxpayers an additional six months to submit their tax returns without incurring late filing penalties. It is important to note that while the form provides an extension for filing, it does not extend the time to pay any taxes owed. Taxpayers must estimate their tax liability and pay any balance due by the original filing deadline to avoid interest and penalties.

Steps to Complete the Form 4868 Application For Automatic Extension Of Time To File U S Individual Income Tax Return

Completing Form 4868 involves a few straightforward steps:

- Begin by providing your name, address, and Social Security number at the top of the form.

- Estimate your total tax liability for the year, which includes any expected credits and payments.

- Calculate the amount you have already paid towards your taxes, including withholding and estimated payments.

- Determine if you owe any additional tax by subtracting your payments from your estimated liability.

- Sign and date the form to certify that the information provided is accurate.

Once completed, the form can be submitted electronically or via mail, depending on your preference.

IRS Guidelines

The IRS provides specific guidelines for using Form 4868. Taxpayers must file the form by the original due date of their tax return, typically April fifteenth. If the deadline falls on a weekend or holiday, the due date is extended to the next business day. The IRS recommends filing electronically to ensure timely processing and to receive confirmation of submission. Additionally, taxpayers should keep a copy of the submitted form for their records.

Filing Deadlines / Important Dates

The deadline for submitting Form 4868 aligns with the due date for the individual income tax return. For most taxpayers, this is April fifteenth. If an extension is granted, the new deadline for filing the return is October fifteenth. It is crucial to remember that this extension applies only to the filing of the return and not to the payment of any taxes owed. Any taxes due should be paid by the original deadline to avoid penalties and interest.

Eligibility Criteria

Most individual taxpayers are eligible to file Form 4868. This includes those who file Form 1040, Form 1040A, or Form 1040EZ. However, certain criteria must be met, such as being a U.S. citizen or resident alien and not being subject to any special rules that may disqualify you from obtaining an extension. Taxpayers living abroad may have different considerations and should consult IRS guidelines specific to overseas filers.

Form Submission Methods (Online / Mail / In-Person)

Form 4868 can be submitted in several ways:

- Online: Taxpayers can file electronically using tax preparation software or through the IRS e-file system.

- By Mail: The completed form can be printed and mailed to the appropriate IRS address based on the taxpayer's location.

- In-Person: While not common, some taxpayers may choose to deliver the form directly to their local IRS office.

Regardless of the submission method, it is essential to ensure that the form is filed by the original due date to avoid penalties.

Quick guide on how to complete form 4868 application for automatic extension of time to file u s individual income tax return

Manage Form 4868 Application For Automatic Extension Of Time To File U S Individual Income Tax Return effortlessly on any device

Digital document management has become increasingly favored by companies and individuals alike. It presents an ideal eco-friendly solution to traditional printed and signed documents, allowing you to find the necessary form and securely keep it online. airSlate SignNow provides you with all the tools needed to create, edit, and electronically sign your documents swiftly without delays. Handle Form 4868 Application For Automatic Extension Of Time To File U S Individual Income Tax Return on any platform using airSlate SignNow’s Android or iOS apps and enhance any document-centric process today.

How to modify and electronically sign Form 4868 Application For Automatic Extension Of Time To File U S Individual Income Tax Return with ease

- Find Form 4868 Application For Automatic Extension Of Time To File U S Individual Income Tax Return and then click Get Form to begin.

- Utilize the tools we provide to complete your form.

- Emphasize important sections of the documents or redact sensitive information with the tools that airSlate SignNow offers specifically for that purpose.

- Generate your signature using the Sign feature, which takes only seconds and holds the same legal significance as a traditional ink signature.

- Review the information and click on the Done button to save your modifications.

- Select how you would like to send your form, whether by email, SMS, invite link, or download it to your computer.

Forget about lost or misplaced documents, cumbersome form searching, or errors that necessitate printing new copies. airSlate SignNow fulfills your document management needs in just a few clicks from any device of your choice. Alter and electronically sign Form 4868 Application For Automatic Extension Of Time To File U S Individual Income Tax Return while ensuring outstanding communication throughout your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the form 4868 application for automatic extension of time to file u s individual income tax return

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is the role of airSlate SignNow in managing IRS file documents?

airSlate SignNow simplifies the management of IRS files by allowing users to send, sign, and store documents electronically. This streamlined process ensures you meet IRS requirements quickly and efficiently, reducing the hassle of paper-based workflows.

-

How does airSlate SignNow enhance the security of my IRS files?

With airSlate SignNow, your IRS files are protected through industry-leading security measures, including data encryption and secure servers. The platform also offers features like two-factor authentication, ensuring that your sensitive information remains confidential and compliant.

-

Can I integrate airSlate SignNow with other software for managing IRS files?

Yes, airSlate SignNow offers seamless integrations with various software tools, including accounting and tax preparation applications. This allows you to easily import and export IRS files, enhancing your workflow and ensuring a smoother document management experience.

-

Is airSlate SignNow a cost-effective solution for managing IRS files?

Absolutely! airSlate SignNow provides a cost-effective solution for managing your IRS files, with flexible pricing plans to suit different business sizes. You gain access to advanced document management features without breaking the bank.

-

What features does airSlate SignNow offer for IRS file handling?

airSlate SignNow includes features specifically designed for IRS file handling, such as electronic signatures, document templates, and automated workflows. These functionalities streamline the process, making it easier to prepare and manage IRS-related documents.

-

How does airSlate SignNow improve the efficiency of managing IRS files?

By automating document workflows and enabling electronic signatures, airSlate SignNow signNowly increases the efficiency of managing IRS files. You can reduce turnaround times and minimize errors, allowing your team to focus on more critical tasks.

-

Is training available for using airSlate SignNow with IRS files?

Yes, airSlate SignNow provides comprehensive training and support resources to help users effectively manage their IRS files. With tutorials, webinars, and customer support, you’ll be up to speed in no time, making the transition seamless.

Get more for Form 4868 Application For Automatic Extension Of Time To File U S Individual Income Tax Return

- Quitclaim deed individual to a corporation mississippi form

- Warranty deed from husband and wife to two individuals mississippi form

- Petition to modify divorce decree by terminating child support child emancipated mississippi form

- Quitclaim deed individual to a trust mississippi form

- Heirship affidavit descent mississippi form

- Quitclaim deed from a trust to an individual mississippi form

- Mississippi trust form

- Contract for transfer of real property from bank to individual mississippi form

Find out other Form 4868 Application For Automatic Extension Of Time To File U S Individual Income Tax Return

- eSign Connecticut Real Estate LLC Operating Agreement Later

- eSign Connecticut Real Estate LLC Operating Agreement Free

- eSign Real Estate Document Florida Online

- eSign Delaware Real Estate Quitclaim Deed Easy

- eSign Hawaii Real Estate Agreement Online

- Help Me With eSign Hawaii Real Estate Letter Of Intent

- eSign Florida Real Estate Residential Lease Agreement Simple

- eSign Florida Real Estate Limited Power Of Attorney Online

- eSign Hawaii Sports RFP Safe

- eSign Hawaii Sports Warranty Deed Myself

- eSign Louisiana Real Estate Last Will And Testament Easy

- eSign Louisiana Real Estate Work Order Now

- eSign Maine Real Estate LLC Operating Agreement Simple

- eSign Maine Real Estate Memorandum Of Understanding Mobile

- How To eSign Michigan Real Estate Business Plan Template

- eSign Minnesota Real Estate Living Will Free

- eSign Massachusetts Real Estate Quitclaim Deed Myself

- eSign Missouri Real Estate Affidavit Of Heirship Simple

- eSign New Jersey Real Estate Limited Power Of Attorney Later

- eSign Alabama Police LLC Operating Agreement Fast