Vat Challan Form

What is the Vat Challan Form

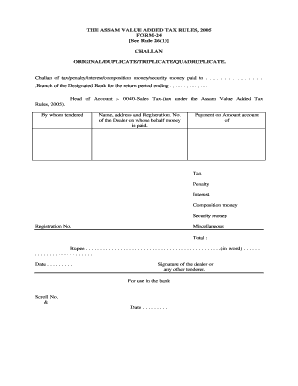

The VAT Challan Form is a crucial document used for the payment of Value Added Tax (VAT) in various jurisdictions. This form serves as a receipt for the tax paid and is essential for both businesses and individuals who are obligated to remit VAT. It typically includes details such as the taxpayer's information, the amount of VAT due, and the payment method. Understanding the purpose and structure of this form is vital for compliance with tax regulations.

How to use the Vat Challan Form

Using the VAT Challan Form involves several steps to ensure accurate completion and submission. First, gather all necessary information, including your tax identification number and the specific VAT amount owed. Next, fill out the form with the required details, ensuring accuracy to avoid penalties. Once completed, the form can be submitted either electronically or physically, depending on the regulations in your state. Retaining a copy for your records is also advisable for future reference.

Steps to complete the Vat Challan Form

Completing the VAT Challan Form requires careful attention to detail. Follow these steps for a smooth process:

- Collect all relevant financial documents, including invoices and previous VAT returns.

- Access the VAT Challan Form in PDF format, ensuring it is the correct version for your jurisdiction.

- Fill in your personal and business information accurately.

- Calculate the total VAT due based on your sales and purchases.

- Review the completed form for any errors before submission.

By following these steps, you can ensure that your VAT Challan Form is filled out correctly and submitted on time.

Legal use of the Vat Challan Form

The VAT Challan Form is legally binding when completed and submitted according to the regulations set forth by tax authorities. It serves as proof of tax payment, which can be crucial in the event of an audit. Ensuring compliance with local laws regarding the use of this form is essential for avoiding penalties and maintaining good standing with tax authorities. Always check for the latest legal requirements in your state to ensure your submission is valid.

Key elements of the Vat Challan Form

Understanding the key elements of the VAT Challan Form can facilitate accurate completion. Important components include:

- Taxpayer Information: Name, address, and tax identification number.

- Payment Details: Amount of VAT due and payment method.

- Transaction Information: Dates and descriptions of taxable transactions.

- Signature: Required to validate the form upon submission.

Familiarity with these elements helps ensure that the form is completed correctly and meets all necessary requirements.

Form Submission Methods (Online / Mail / In-Person)

The VAT Challan Form can typically be submitted through various methods, depending on state regulations. Common submission options include:

- Online Submission: Many states allow electronic filing through their tax authority websites.

- Mail Submission: Forms can be printed and sent via postal service to the appropriate tax office.

- In-Person Submission: Taxpayers may also choose to deliver the form directly to their local tax office.

Choosing the appropriate submission method can streamline the process and ensure timely payment of VAT.

Quick guide on how to complete vat challan form 14898456

Complete Vat Challan Form effortlessly on any device

Managing documents online has gained signNow traction among businesses and individuals. It offers an excellent eco-friendly substitute for traditional printed and signed documents, as you can easily find the necessary form and securely keep it online. airSlate SignNow equips you with all the tools required to create, edit, and electronically sign your documents promptly without delays. Handle Vat Challan Form on any device with airSlate SignNow Android or iOS applications and streamline any document-related task today.

The easiest way to edit and electronically sign Vat Challan Form without effort

- Obtain Vat Challan Form and click Get Form to begin.

- Use the tools we offer to fill out your document.

- Emphasize important sections of your documents or redact sensitive information with tools that airSlate SignNow provides specifically for that purpose.

- Create your electronic signature using the Sign feature, which takes mere seconds and holds the same legal validity as a conventional wet ink signature.

- Review the details and click the Done button to save your changes.

- Select how you would like to send your form: via email, text message (SMS), invitation link, or download it to your computer.

Say goodbye to lost or misplaced files, time-consuming document searches, or errors that necessitate printing new copies. airSlate SignNow meets all your document management needs in just a few clicks from any device you prefer. Modify and eSign Vat Challan Form and ensure exceptional communication at every stage of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the vat challan form 14898456

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is the process for এ চালান ফরম ডাউনলোড?

To initiate the এ চালান ফরম ডাউনলোড, simply visit our website, navigate to the specific form section, and follow the prompts for downloading your desired form. The process is user-friendly and takes only a few moments.

-

Is there a cost associated with এ চালান ফরম ডাউনলোড?

No, downloading the এ চালান ফরম is completely free. We believe in providing accessible resources to help businesses streamline their operations without incurring additional costs.

-

What features does airSlate SignNow offer for document signing?

airSlate SignNow offers a wide range of features for document signing, including secure eSignature capabilities, customizable templates, and intuitive workflow automation. These features enhance efficiency when you download the এ চালান ফরম and manage document signing.

-

How can I integrate airSlate SignNow with my existing software?

Integrating airSlate SignNow with your existing software is easy, as we offer a variety of APIs and third-party integrations. Whether you’re using CRM systems, cloud storage, or other platforms, you can seamlessly integrate to access the features for এ চালান ফরম ডাউনলোড.

-

What are the benefits of using airSlate SignNow for document management?

Using airSlate SignNow for document management allows businesses to save time and reduce paperwork. With features like the ability to eSign and download the এ চালান ফরম, it streamlines processes and enhances collaboration among teams.

-

Can I customize my documents after downloading the এ চালান ফরম?

Yes, after downloading the এ চালান ফরম, you have the option to customize it according to your needs. airSlate SignNow provides tools that allow you to edit the document and add your specific requirements before sending it out for signatures.

-

What types of businesses can benefit from using airSlate SignNow?

AirSlate SignNow is beneficial for businesses of all sizes across various industries. Whether you are a small business or a large enterprise, the features available, including the ability to download the এ চালান ফরম, can enhance your operational efficiency.

Get more for Vat Challan Form

Find out other Vat Challan Form

- How Do I eSignature Arizona Charity Rental Application

- How To eSignature Minnesota Car Dealer Bill Of Lading

- eSignature Delaware Charity Quitclaim Deed Computer

- eSignature Colorado Charity LLC Operating Agreement Now

- eSignature Missouri Car Dealer Purchase Order Template Easy

- eSignature Indiana Charity Residential Lease Agreement Simple

- How Can I eSignature Maine Charity Quitclaim Deed

- How Do I eSignature Michigan Charity LLC Operating Agreement

- eSignature North Carolina Car Dealer NDA Now

- eSignature Missouri Charity Living Will Mobile

- eSignature New Jersey Business Operations Memorandum Of Understanding Computer

- eSignature North Dakota Car Dealer Lease Agreement Safe

- eSignature Oklahoma Car Dealer Warranty Deed Easy

- eSignature Oregon Car Dealer Rental Lease Agreement Safe

- eSignature South Carolina Charity Confidentiality Agreement Easy

- Can I eSignature Tennessee Car Dealer Limited Power Of Attorney

- eSignature Utah Car Dealer Cease And Desist Letter Secure

- eSignature Virginia Car Dealer Cease And Desist Letter Online

- eSignature Virginia Car Dealer Lease Termination Letter Easy

- eSignature Alabama Construction NDA Easy