PR Check Stub Form

What is the PR Check Stub

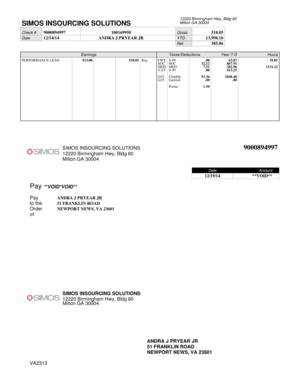

The PR Check Stub is a document that provides a detailed breakdown of an employee's earnings and deductions for a specific pay period. It serves as a record of the wages paid and the taxes withheld, which is essential for both the employee and the employer. This stub typically includes information such as gross pay, net pay, tax deductions, and other withholdings like health insurance or retirement contributions. Understanding this document is crucial for employees to track their earnings and for employers to maintain accurate payroll records.

How to use the PR Check Stub

Using the PR Check Stub involves reviewing the details to ensure accuracy and understanding your financial situation. Employees should regularly check their stubs to verify that the amounts reported match their expectations based on hours worked and agreed-upon pay rates. It is also important for tax preparation, as the information on the stub will be needed when filing income tax returns. Employers can use the PR Check Stub to maintain compliance with labor laws and ensure that all deductions are correctly applied.

Steps to complete the PR Check Stub

Completing the PR Check Stub involves several straightforward steps:

- Gather necessary information, including employee details, pay period dates, and hours worked.

- Calculate gross pay based on hourly rates or salaries.

- Determine applicable deductions, including federal and state taxes, Social Security, and Medicare.

- Subtract the total deductions from the gross pay to arrive at the net pay.

- Ensure all calculations are accurate before finalizing the stub.

Legal use of the PR Check Stub

The PR Check Stub is legally recognized as a valid document for payroll records. It must comply with federal and state regulations regarding employee compensation and reporting. Employers are required to provide accurate and timely pay stubs to their employees as part of their legal obligations. This document can also serve as evidence in disputes regarding wages or employment status, making it essential for both parties to maintain accurate records.

Key elements of the PR Check Stub

Several key elements should be included in every PR Check Stub to ensure its completeness and accuracy:

- Employee Information: Name, address, and identification number.

- Employer Information: Company name and address.

- Pay Period: Start and end dates of the pay period.

- Gross Pay: Total earnings before deductions.

- Deductions: Itemized list of taxes and other withholdings.

- Net Pay: Amount received after deductions.

Examples of using the PR Check Stub

Employees can use the PR Check Stub in various scenarios, such as:

- Verifying income when applying for loans or mortgages.

- Tracking earnings over time for personal budgeting.

- Ensuring that tax withholdings are appropriate for their financial situation.

Employers may reference the PR Check Stub for compliance audits or to resolve payroll discrepancies.

Quick guide on how to complete pr check stub

Prepare PR Check Stub effortlessly on any device

Digital document management has gained increased popularity among both enterprises and individuals. It serves as an ideal eco-friendly substitute for traditionally printed and signed documents, as you can locate the necessary form and securely store it online. airSlate SignNow equips you with all the tools required to draft, modify, and eSign your documents promptly without interruptions. Manage PR Check Stub on any platform with airSlate SignNow Android or iOS applications and enhance any document-driven process today.

How to alter and eSign PR Check Stub with ease

- Locate PR Check Stub and click on Get Form to begin.

- Utilize the tools we offer to fill out your document.

- Emphasize pertinent parts of the documents or obscure sensitive information using tools that airSlate SignNow provides specifically for such purposes.

- Generate your signature using the Sign tool, which takes seconds and carries the same legal validity as a conventional wet ink signature.

- Review the details and click on the Done button to save your changes.

- Select your preferred method to send your form, whether by email, SMS, or invite link, or download it to your computer.

Eliminate the worry of lost or misplaced documents, tedious form searching, or errors requiring new document prints. airSlate SignNow meets all your document management needs in just a few clicks from any device of your choice. Modify and eSign PR Check Stub to ensure outstanding communication at any stage of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the pr check stub

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is a PR Check Stub?

A PR Check Stub is a detailed record provided by employers outlining the breakdown of an employee's earnings, deductions, and net pay. It serves as an essential document for tracking income and ensuring accuracy in payroll. With airSlate SignNow, you can efficiently sign and store PR Check Stubs securely.

-

How can airSlate SignNow help me with PR Check Stubs?

airSlate SignNow allows businesses to create, send, and eSign PR Check Stubs seamlessly. Our platform simplifies the process, ensuring that you can generate legally compliant documents quickly. Moreover, with electronic signatures, you can enhance your payroll process efficiency signNowly.

-

What features does airSlate SignNow offer for managing PR Check Stubs?

Our platform provides features such as document templates, eSignature capabilities, and automated workflows specifically designed for handling PR Check Stubs. You can customize these templates to suit your business needs and ensure that all necessary information is included for your employees.

-

Is there a cost associated with using airSlate SignNow for PR Check Stubs?

Yes, airSlate SignNow offers various pricing plans to cater to different business needs, including options for managing PR Check Stubs. Our plans are designed to be cost-effective, allowing businesses of all sizes to access premium features without breaking the bank.

-

Can I integrate airSlate SignNow with other software to manage PR Check Stubs?

Absolutely! airSlate SignNow supports integrations with numerous accounting and payroll software solutions, making it easy to manage your PR Check Stubs alongside other business functions. These integrations help streamline your workflow, reducing manual entry and saving time.

-

What are the benefits of using airSlate SignNow for PR Check Stubs?

Using airSlate SignNow for PR Check Stubs enhances accuracy, speeds up the document processing time, and improves organization. It ensures compliance with legal requirements while providing a user-friendly experience for both employers and employees, making payroll management more efficient.

-

How secure is my data when using airSlate SignNow for PR Check Stubs?

airSlate SignNow takes data security very seriously. When you use our platform for PR Check Stubs, your documents are protected with industry-standard encryption and secure cloud storage. We adhere to best practices to ensure that sensitive information remains safe from unauthorized access.

Get more for PR Check Stub

Find out other PR Check Stub

- eSign Maine Doctors Promissory Note Template Easy

- eSign Kentucky Construction Claim Online

- How Can I eSign Maine Construction Quitclaim Deed

- eSign Colorado Education Promissory Note Template Easy

- eSign North Dakota Doctors Affidavit Of Heirship Now

- eSign Oklahoma Doctors Arbitration Agreement Online

- eSign Oklahoma Doctors Forbearance Agreement Online

- eSign Oregon Doctors LLC Operating Agreement Mobile

- eSign Hawaii Education Claim Myself

- eSign Hawaii Education Claim Simple

- eSign Hawaii Education Contract Simple

- eSign Hawaii Education NDA Later

- How To eSign Hawaii Education NDA

- How Do I eSign Hawaii Education NDA

- eSign Hawaii Education Arbitration Agreement Fast

- eSign Minnesota Construction Purchase Order Template Safe

- Can I eSign South Dakota Doctors Contract

- eSign Mississippi Construction Rental Application Mobile

- How To eSign Missouri Construction Contract

- eSign Missouri Construction Rental Lease Agreement Easy