Sc 2821 2005-2026

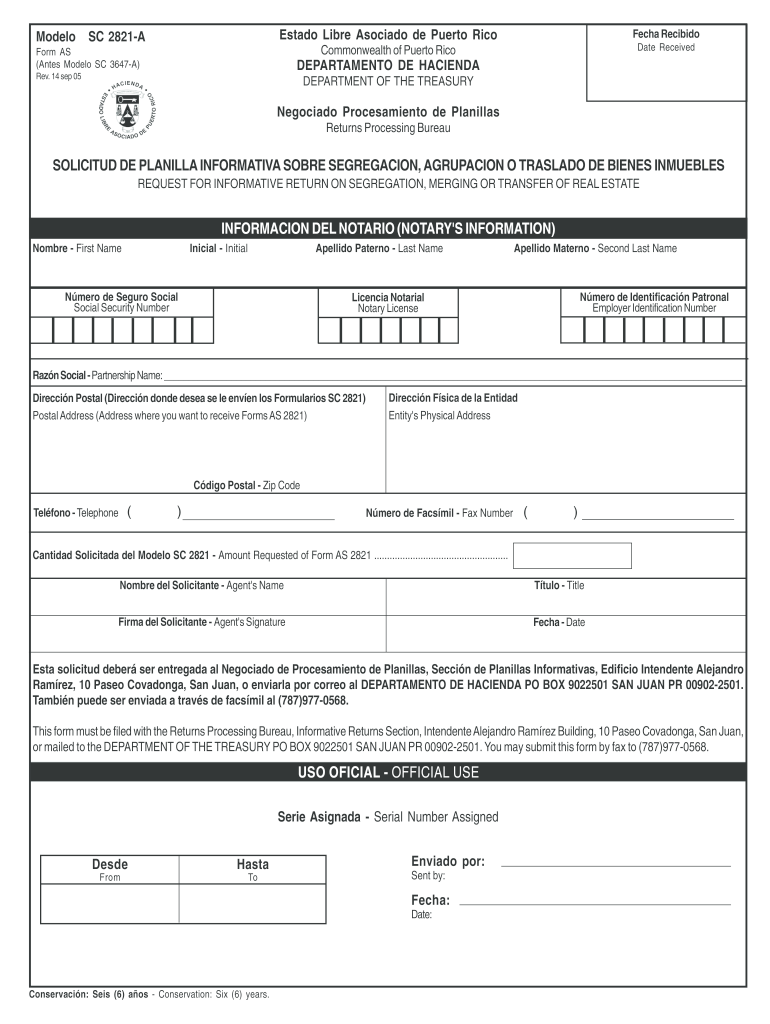

What is the SC 2821?

The SC 2821, commonly referred to as the planilla informativa, is a tax form used in Puerto Rico to report information regarding the transfer of real estate assets. This form is essential for individuals and businesses involved in real estate transactions, ensuring compliance with local tax regulations. It captures vital details such as the parties involved in the transaction, property descriptions, and the nature of the transfer.

How to use the SC 2821

Using the SC 2821 involves several steps to ensure accurate reporting. First, gather all necessary information about the property and the parties involved. Next, access the form online or obtain a physical copy. Fill out the form carefully, ensuring that all required fields are completed. Once the form is filled, it must be signed and submitted to the appropriate tax authority. Using an electronic signature can simplify this process, making it quicker and more efficient.

Steps to complete the SC 2821

Completing the SC 2821 requires careful attention to detail. Follow these steps:

- Gather all relevant information about the property and transaction.

- Access the SC 2821 form online or through local tax offices.

- Fill in the required fields, including property details and parties' information.

- Review the completed form for accuracy.

- Sign the form, ensuring all signatures are valid.

- Submit the form electronically or by mail to the designated tax office.

Legal use of the SC 2821

The SC 2821 must be used in accordance with Puerto Rican tax laws. It serves as a legal document that provides the tax authorities with necessary information about real estate transactions. Ensuring compliance with the legal requirements helps avoid penalties and ensures that the transfer of property is recognized by the government.

Filing Deadlines / Important Dates

Filing deadlines for the SC 2821 are crucial for compliance. Typically, the form must be submitted within a specified period following the completion of the real estate transaction. It is important to stay informed about these deadlines to avoid late fees or penalties. Check with local tax authorities for the most current deadlines and any changes that may occur annually.

Required Documents

To complete the SC 2821 accurately, certain documents are required. These may include:

- Deed of transfer or sale agreement.

- Identification of the parties involved.

- Property tax records.

- Previous tax returns related to the property, if applicable.

Form Submission Methods

The SC 2821 can be submitted through various methods. Options typically include:

- Online submission through the official tax authority portal.

- Mailing a physical copy to the designated tax office.

- In-person submission at local tax offices.

Quick guide on how to complete planilla informativa sc 2821

Your assistance manual on how to prepare your Sc 2821

If you’re wondering how to generate and submit your Sc 2821, here are a few brief guidelines on how to simplify tax declaration.

To start, you just need to register your airSlate SignNow account to transform how you manage documents online. airSlate SignNow is an exceptionally user-friendly and robust document solution that enables you to modify, create, and finalize your tax forms with ease. With its editor, you can alternate between text, check boxes, and eSignatures, and return to update information as necessary. Enhance your tax oversight with sophisticated PDF editing, eSigning, and seamless sharing.

Follow the steps below to complete your Sc 2821 in just minutes:

- Set up your account and begin working on PDFs in a flash.

- Utilize our catalog to locate any IRS tax form; browse through versions and schedules.

- Click Get form to access your Sc 2821 in our editor.

- Complete the mandatory fillable fields with your information (text, numbers, check marks).

- Employ the Sign Tool to add your legally-binding eSignature (if necessary).

- Examine your document and correct any discrepancies.

- Save changes, print your copy, forward it to your recipient, and download it to your device.

Refer to this manual to file your taxes electronically using airSlate SignNow. Be aware that submitting on paper can lead to return errors and delay refunds. Of course, before e-filing your taxes, review the IRS website for filing regulations in your jurisdiction.

Create this form in 5 minutes or less

FAQs

-

Why don't schools teach children about taxes and bills and things that they will definitely need to know as adults to get by in life?

Departments of education and school districts always have to make decisions about what to include in their curriculum. There are a lot of life skills that people need that aren't taught in school. The question is should those skills be taught in schools?I teach high school, so I'll talk about that. The typical high school curriculum is supposed to give students a broad-based education that prepares them to be citizens in a democracy and to be able to think critically. For a democracy to work, we need educated, discerning citizens with the ability to make good decisions based on evidence and objective thought. In theory, people who are well informed about history, culture, science, mathematics, etc., and are capable of critical, unbiased thinking, will have the tools to participate in a democracy and make good decisions for themselves and for society at large. In addition to that, they should be learning how to be learners, how to do effective, basic research, and collaborate with other people. If that happens, figuring out how to do procedural tasks in real life should not provide much of a challenge. We can't possibly teach every necessary life skill people need, but we can help students become better at knowing how to acquire the skills they need. Should we teach them how to change a tire when they can easily consult a book or search the internet to find step by step instructions for that? Should we teach them how to balance a check book or teach them how to think mathematically and make sense of problems so that the simple task of balancing a check book (which requires simple arithmetic and the ability to enter numbers and words in columns and rows in obvious ways) is easy for them to figure out. If we teach them to be good at critical thinking and have some problem solving skills they will be able to apply those overarching skills to all sorts of every day tasks that shouldn't be difficult for someone with decent cognitive ability to figure out. It's analogous to asking why a culinary school didn't teach its students the steps and ingredients to a specific recipe. The school taught them about more general food preparation and food science skills so that they can figure out how to make a lot of specific recipes without much trouble. They're also able to create their own recipes.So, do we want citizens with very specific skill sets that they need to get through day to day life or do we want citizens with critical thinking, problem solving, and other overarching cognitive skills that will allow them to easily acquire ANY simple, procedural skill they may come to need at any point in their lives?

-

How does one get invited to the Quora Partner Program? What criteria do they use, or is it completely random?

I live in Germany. I got an invite to the Quora partner program the day I landed in USA for a business trip. So from what I understand, irrespective of the number of views on your answers, there is some additional eligibility criteria for you to even get an email invite.If you read the terms of service, point 1 states:Eligibility. You must be located in the United States to participate in this Program. If you are a Quora employee, you are eligible to participate and earn up to a maximum of $200 USD a month. You also agree to be bound by the Platform Terms (https://www.quora.com/about/tos) as a condition of participation.Again, if you check the FAQ section:How can other people I know .participate?The program is invite-only at this time, but we intend to open it up to more people as time goes on.So my guess is that Quora is currently targeting people based out of USA, who are active on Quora, may or may not be answering questions frequently ( I have not answered questions frequently in the past year or so) and have a certain number of consistent answer views.Edit 1: Thanks to @Anita Scotch, I got to know that the Quora partner program is now available for other countries too. Copying Anuta’s comment here:If you reside in one of the Countries, The Quora Partner Program is active in, you are eligible to participate in the program.” ( I read more will be added, at some point, but here are the countries, currently eligible at this writing,) U.S., Japan, Germany, Spain, France, United Kingdom, Italy and Australia.11/14/2018Edit 2 : Here is the latest list of countries with 3 new additions eligible for the Quora Partner program:U.S., Japan, Germany, Spain, France, United Kingdom, Italy, Canada, Australia, Indonesia, India and Brazil.Thanks to Monoswita Rez for informing me about this update.

-

How can I get more people to fill out my survey?

Make it compellingQuickly and clearly make these points:Who you are and why you are doing thisHow long it takesWhats in it for me -- why should someone help you by completing the surveyExample: "Please spend 3 minutes helping me make it easier to learn Mathematics. Answer 8 short questions for my eternal gratitude and (optional) credit on my research findings. Thank you SO MUCH for helping."Make it convenientKeep it shortShow up at the right place and time -- when people have the time and inclination to help. For example, when students are planning their schedules. Reward participationOffer gift cards, eBooks, study tips, or some other incentive for helping.Test and refineTest out different offers and even different question wording and ordering to learn which has the best response rate, then send more invitations to the offer with the highest response rate.Reward referralsIf offering a reward, increase it for referrals. Include a custom invite link that tracks referrals.

-

How do film producers put out a casting call for "ugly" people? If they need a truly hideous, obese, acne scarred, buck toothed, no chin character to fill, do actors say, "Oh, that's me!"?

Yes. Acting is no place for ego, and that's readily apparent to anyone standing in front of an agent or casting director.Truth be told, that isn't the worst thing you'll hear from an agent. Here are some highlights of my short career:"You're not really black or white. You just look like a dirty white girl""The standard female wardrobe size is a three for this production. They can't use you""I love seeing people who haven't seen the play try the character!" "Wow, you really messed up the character!"Playing a character who is being bullied and having people call me fat, ugly, a loser, and a waste of a human life for 5 days that we rehearsed that scene and 30 minutes altogether throughout the production, in front of an audience of hundreds of people.Re-watch some movies and you'll see what actors go through in their roles. Mean Girls for example is a very popular movie and not many people consider the fact that everyone in the entire cast, other than two girls, was repeatedly called ugly.Acting is an art form. It's about shedding light on the real world. You have to know yourself well and be comfortable with your stereotypes. And it's worth it.If they can't find an actual "ugly person" for the role, they're just going to slap some makeup on Charlize Theron or something. Yes, she's an amazing actress who did a fantastic job in monster, but also yes, I would rather have seen someone who looked like an actual poverty-stricken addict in that role.The most important thing about playing a role can be truly understanding the character. It can be very liberating for someone who has been called "ugly" to play an "ugly" role….especially since movies calling for a "nerdy" "ugly" "plain Jane" character are usually the ones where that person gets a win for once.

Create this form in 5 minutes!

How to create an eSignature for the planilla informativa sc 2821

How to create an eSignature for the Planilla Informativa Sc 2821 in the online mode

How to generate an electronic signature for your Planilla Informativa Sc 2821 in Google Chrome

How to create an electronic signature for signing the Planilla Informativa Sc 2821 in Gmail

How to make an electronic signature for the Planilla Informativa Sc 2821 right from your smartphone

How to make an eSignature for the Planilla Informativa Sc 2821 on iOS devices

How to make an eSignature for the Planilla Informativa Sc 2821 on Android devices

People also ask

-

What is a planilla informativa and how can airSlate SignNow help?

A planilla informativa is a document used for reporting financial and operational information. airSlate SignNow provides a user-friendly platform for creating, sending, and eSigning planilla informativa documents efficiently, ensuring compliance and ease of use for businesses.

-

How much does airSlate SignNow’s service cost for managing planilla informativa?

airSlate SignNow offers competitive pricing plans tailored for businesses of all sizes. Our pricing is designed to provide cost-effective solutions for managing planilla informativa, ensuring you only pay for the features you need.

-

What features does airSlate SignNow offer for handling planilla informativa?

airSlate SignNow includes features like document templates, bulk sending, and real-time tracking, which simplify the process of handling planilla informativa. These tools enhance productivity and ensure that all documents are managed securely.

-

Can I integrate airSlate SignNow with other software for planilla informativa management?

Yes, airSlate SignNow supports various integrations with popular software such as CRM systems and project management tools, making it easy to manage planilla informativa alongside your other business operations. This enhances workflow efficiency and data accuracy.

-

Is it easy to create and customize a planilla informativa with airSlate SignNow?

Absolutely, airSlate SignNow offers intuitive document customization tools that allow you to easily create a planilla informativa. You can add your branding, modify fields, and utilize pre-built templates to streamline the process.

-

What are the security features for protecting my planilla informativa in airSlate SignNow?

airSlate SignNow prioritizes security, providing features like encryption, two-factor authentication, and audit trails to protect your planilla informativa. These measures ensure that your sensitive data remains secure during the signing process.

-

How can airSlate SignNow benefit teams that frequently manage planilla informativa?

Using airSlate SignNow can signNowly enhance team collaboration by allowing multiple users to access and manage planilla informativa documents simultaneously. This fosters a more efficient workflow and reduces turnaround time for important document processing.

Get more for Sc 2821

- Michigan sales tax form 5080

- Sum 200a additional parties attachment attachment to summons judicial council forms courts ca

- Odm07216 application for health coverage amp help paying costs form

- Form 424 general information certificate of amendment texas sos texas

- Pa schedule fg 2014 form

- Lic 9092 california department of social services dss cahwnet form

- Form grade sheet

- 2015 instructions for form 940 instructions for form 940 employers annual federal unemployment futa tax return irs

Find out other Sc 2821

- eSignature Wyoming Plumbing Quitclaim Deed Myself

- eSignature Colorado Sports Living Will Mobile

- eSignature Iowa Real Estate Moving Checklist Simple

- eSignature Iowa Real Estate Quitclaim Deed Easy

- eSignature Real Estate Form Louisiana Simple

- eSignature Louisiana Real Estate LLC Operating Agreement Myself

- Can I eSignature Louisiana Real Estate Quitclaim Deed

- eSignature Hawaii Sports Living Will Safe

- eSignature Hawaii Sports LLC Operating Agreement Myself

- eSignature Maryland Real Estate Quitclaim Deed Secure

- eSignature Idaho Sports Rental Application Secure

- Help Me With eSignature Massachusetts Real Estate Quitclaim Deed

- eSignature Police Document Florida Easy

- eSignature Police Document Florida Safe

- How Can I eSignature Delaware Police Living Will

- eSignature Michigan Real Estate LLC Operating Agreement Mobile

- eSignature Georgia Police Last Will And Testament Simple

- How To eSignature Hawaii Police RFP

- Can I eSignature Minnesota Real Estate Warranty Deed

- How Do I eSignature Indiana Police Lease Agreement Form