Ohio Beer and Malt Beverage Tax Return for Qualified a 1C BPermitb Bb Tax Ohio Form

What is the Ohio Beer And Malt Beverage Tax Return For Qualified A 1C BPermitb Bb Tax Ohio

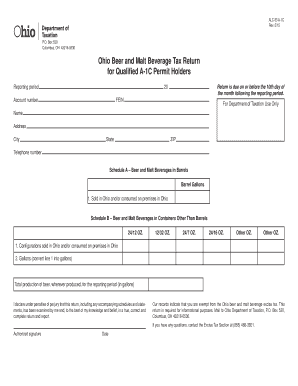

The Ohio Beer And Malt Beverage Tax Return For Qualified A 1C BPermitb Bb Tax Ohio is a specific tax form used by businesses that produce or distribute beer and malt beverages within the state of Ohio. This form is essential for reporting the production, importation, and distribution of these beverages, ensuring compliance with state tax regulations. It is designed for entities that hold a specific type of permit, known as the A 1C BPermitb Bb, which allows them to operate legally in the beverage industry.

Steps to complete the Ohio Beer And Malt Beverage Tax Return For Qualified A 1C BPermitb Bb Tax Ohio

Completing the Ohio Beer And Malt Beverage Tax Return involves several key steps to ensure accuracy and compliance. First, gather all relevant financial data, including production volumes and sales figures for the reporting period. Next, fill out the required sections of the form, which typically include details about the business, the type of beverages produced, and the corresponding tax calculations. After completing the form, review it for any errors or omissions before submitting it to the appropriate state authority.

How to obtain the Ohio Beer And Malt Beverage Tax Return For Qualified A 1C BPermitb Bb Tax Ohio

To obtain the Ohio Beer And Malt Beverage Tax Return, businesses can access the form through the Ohio Department of Taxation's official website or contact their local tax office. The form may also be available in physical locations where permits are issued. Ensure that you have the correct version of the form that corresponds to your specific permit type, as there may be variations based on the nature of the business.

Legal use of the Ohio Beer And Malt Beverage Tax Return For Qualified A 1C BPermitb Bb Tax Ohio

The legal use of the Ohio Beer And Malt Beverage Tax Return is crucial for maintaining compliance with state tax laws. This form must be completed accurately and submitted by the designated deadlines to avoid penalties. Businesses are required to keep detailed records of their production and sales, as these will support the information provided on the tax return. Failure to comply with these legal requirements can result in fines or other legal repercussions.

Filing Deadlines / Important Dates

Filing deadlines for the Ohio Beer And Malt Beverage Tax Return are typically set by the Ohio Department of Taxation. It is important for businesses to stay informed about these dates to ensure timely submission. Generally, returns may be due on a monthly or quarterly basis, depending on the volume of beer and malt beverages produced. Marking these deadlines on a calendar can help businesses avoid late fees and maintain good standing with state authorities.

Penalties for Non-Compliance

Non-compliance with the Ohio Beer And Malt Beverage Tax Return requirements can lead to significant penalties. These may include monetary fines, interest on unpaid taxes, and potential legal action against the business. It is essential for businesses to understand their obligations and to file the return accurately and on time to mitigate these risks. Regular audits and reviews of tax submissions can help ensure compliance and identify any areas of concern.

Quick guide on how to complete ohio beer and malt beverage tax return for qualified a 1c bpermitb bb tax ohio

Complete Ohio Beer And Malt Beverage Tax Return For Qualified A 1C BPermitb Bb Tax Ohio effortlessly on any device

Online document management has become favored by businesses and individuals. It offers a perfect eco-friendly substitute for conventional printed and signed documents, as you can access the correct version and securely store it online. airSlate SignNow equips you with all the resources you need to create, modify, and electronically sign your documents rapidly without delays. Handle Ohio Beer And Malt Beverage Tax Return For Qualified A 1C BPermitb Bb Tax Ohio on any device with airSlate SignNow's Android or iOS applications and enhance any document-based process today.

How to modify and electronically sign Ohio Beer And Malt Beverage Tax Return For Qualified A 1C BPermitb Bb Tax Ohio with ease

- Locate Ohio Beer And Malt Beverage Tax Return For Qualified A 1C BPermitb Bb Tax Ohio and click Get Form to begin.

- Utilize the tools we provide to fill out your document.

- Highlight important sections of the documents or conceal sensitive information with tools that airSlate SignNow offers specifically for that purpose.

- Create your signature using the Sign tool, which takes mere seconds and carries the same legal significance as a traditional wet ink signature.

- Review the information and click on the Done button to save your modifications.

- Choose how you wish to send your form, whether by email, text message (SMS), or invitation link, or download it to your computer.

Say goodbye to lost or misplaced files, tedious form searching, or errors that require printing new document copies. airSlate SignNow meets all your document management needs in just a few clicks from any device of your choice. Modify and eSign Ohio Beer And Malt Beverage Tax Return For Qualified A 1C BPermitb Bb Tax Ohio and ensure excellent communication at every stage of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the ohio beer and malt beverage tax return for qualified a 1c bpermitb bb tax ohio

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is the Ohio Beer And Malt Beverage Tax Return For Qualified A 1C BPermitb Bb Tax Ohio?

The Ohio Beer And Malt Beverage Tax Return For Qualified A 1C BPermitb Bb Tax Ohio is a specific tax form that businesses must file if they produce or sell beer and malt beverages within Ohio. This return ensures compliance with state tax obligations and helps businesses maintain their good standing with regulatory authorities.

-

How can airSlate SignNow help with the Ohio Beer And Malt Beverage Tax Return For Qualified A 1C BPermitb Bb Tax Ohio?

airSlate SignNow streamlines the process of preparing and submitting your Ohio Beer And Malt Beverage Tax Return For Qualified A 1C BPermitb Bb Tax Ohio. Our platform allows for easy document management, ensuring that your tax return is filled out correctly and securely signed, minimizing the risk of errors.

-

What features are included in airSlate SignNow for managing tax returns?

With airSlate SignNow, you gain access to customizable templates, secure eSigning capabilities, and real-time collaboration features. These tools are especially useful when working on the Ohio Beer And Malt Beverage Tax Return For Qualified A 1C BPermitb Bb Tax Ohio, allowing multiple stakeholders to review and sign documents efficiently.

-

Is there a free trial available for airSlate SignNow for tax filing?

Yes, airSlate SignNow offers a free trial that allows you to explore its features, including those for handling your Ohio Beer And Malt Beverage Tax Return For Qualified A 1C BPermitb Bb Tax Ohio. This trial provides an opportunity to see how the platform can simplify your tax processes without any financial commitment.

-

How does airSlate SignNow ensure the security of my tax documents?

Security is a top priority at airSlate SignNow. When working on documents like the Ohio Beer And Malt Beverage Tax Return For Qualified A 1C BPermitb Bb Tax Ohio, you can trust that they are protected by advanced encryption, multi-factor authentication, and secure cloud storage to safeguard your sensitive data.

-

Can I integrate airSlate SignNow with other accounting software?

Absolutely! airSlate SignNow offers various integrations with popular accounting software, making it easy to manage your finances and tax returns including the Ohio Beer And Malt Beverage Tax Return For Qualified A 1C BPermitb Bb Tax Ohio. This integration helps streamline your workflow and improves overall efficiency.

-

What are the benefits of using airSlate SignNow for tax returns?

Using airSlate SignNow for your Ohio Beer And Malt Beverage Tax Return For Qualified A 1C BPermitb Bb Tax Ohio saves you time and reduces frustration. Our user-friendly interface, along with features like automated reminders and document tracking, ensures that you never miss a deadline and everything is organized in one place.

Get more for Ohio Beer And Malt Beverage Tax Return For Qualified A 1C BPermitb Bb Tax Ohio

- Letter from tenant to landlord about fair housing reduction or denial of services to family with children nevada form

- Letter from tenant to landlord containing notice of termination for landlords noncompliance with possibility to cure nevada form

- Letter from tenant to landlord responding to notice to terminate for noncompliance noncompliant condition caused by landlords 497320660 form

- Letter from tenant to landlord for failure of landlord to return all prepaid and unearned rent and security recoverable by 497320661 form

- Nevada codes form

- Letter from landlord to tenant where tenant complaint was caused by the deliberate or negligent act of tenant or tenants guest 497320663 form

- Letter from landlord to tenant for failure to keep premises as clean and safe as condition of premises permits remedy or lease 497320664 form

- Nevada landlord in form

Find out other Ohio Beer And Malt Beverage Tax Return For Qualified A 1C BPermitb Bb Tax Ohio

- How Can I eSignature Kentucky Co-Branding Agreement

- How Can I Electronic signature Alabama Declaration of Trust Template

- How Do I Electronic signature Illinois Declaration of Trust Template

- Electronic signature Maryland Declaration of Trust Template Later

- How Can I Electronic signature Oklahoma Declaration of Trust Template

- Electronic signature Nevada Shareholder Agreement Template Easy

- Electronic signature Texas Shareholder Agreement Template Free

- Electronic signature Mississippi Redemption Agreement Online

- eSignature West Virginia Distribution Agreement Safe

- Electronic signature Nevada Equipment Rental Agreement Template Myself

- Can I Electronic signature Louisiana Construction Contract Template

- Can I eSignature Washington Engineering Proposal Template

- eSignature California Proforma Invoice Template Simple

- eSignature Georgia Proforma Invoice Template Myself

- eSignature Mississippi Proforma Invoice Template Safe

- eSignature Missouri Proforma Invoice Template Free

- Can I eSignature Mississippi Proforma Invoice Template

- eSignature Missouri Proforma Invoice Template Simple

- eSignature Missouri Proforma Invoice Template Safe

- eSignature New Hampshire Proforma Invoice Template Mobile