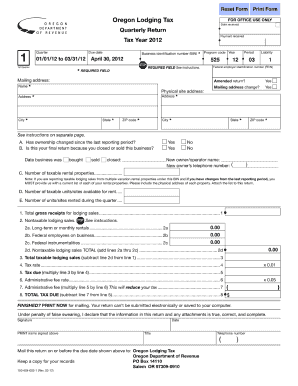

Oregon Lodging Tax Quarterly Return Form

What is the Nyna Konishi Form?

The Nyna Konishi form is a specific document used for various administrative and legal purposes within certain jurisdictions. It is essential for individuals and businesses to understand the exact requirements and implications of this form. The form typically includes sections for personal or business information, details related to the specific transaction or application, and areas designated for signatures. Ensuring accuracy in filling out this form is crucial for compliance and to avoid potential legal issues.

How to Use the Nyna Konishi Form

Using the Nyna Konishi form involves several straightforward steps. First, gather all necessary information, including identification details and any relevant documentation that supports your application or request. Next, carefully fill out each section of the form, ensuring that all information is accurate and complete. Once completed, review the form for any errors before submitting it to the appropriate authority. Depending on the requirements, you may need to submit the form online, by mail, or in person.

Steps to Complete the Nyna Konishi Form

Completing the Nyna Konishi form can be broken down into specific steps for clarity:

- Read the instructions carefully to understand the requirements.

- Gather all necessary documentation and information needed to fill out the form.

- Complete each section of the form accurately, ensuring all required fields are filled.

- Double-check your entries for any mistakes or missing information.

- Sign and date the form where required.

- Submit the form according to the specified submission method.

Legal Use of the Nyna Konishi Form

The Nyna Konishi form must be used in accordance with applicable laws and regulations. It is essential to ensure that the information provided is truthful and accurate, as providing false information can lead to legal repercussions. Additionally, the form may require specific types of signatures or certifications to be considered valid. Understanding the legal framework surrounding this form can help users avoid pitfalls and ensure compliance with local laws.

Filing Deadlines / Important Dates

Filing deadlines for the Nyna Konishi form can vary based on the specific purpose of the form and the jurisdiction in which it is being submitted. It is important to be aware of these deadlines to avoid penalties or complications. Users should consult the relevant authority or legal guidelines to determine the exact dates and ensure timely submission.

Who Issues the Nyna Konishi Form

The Nyna Konishi form is typically issued by a government agency or relevant authority responsible for overseeing the specific process related to the form's use. This could include local, state, or federal agencies depending on the nature of the application. Understanding which authority issues the form is crucial for ensuring that it is filled out correctly and submitted to the right place.

Quick guide on how to complete oregon lodging tax quarterly return form 5359496

Complete Oregon Lodging Tax Quarterly Return Form effortlessly on any device

Online document management has gained popularity among businesses and individuals. It serves as an ideal eco-friendly alternative to conventional printed and signed paperwork, as you can locate the appropriate form and securely store it online. airSlate SignNow provides you with all the necessary tools to create, modify, and electronically sign your documents swiftly without delays. Handle Oregon Lodging Tax Quarterly Return Form on any device using the airSlate SignNow Android or iOS applications and enhance any document-centric operation today.

How to modify and eSign Oregon Lodging Tax Quarterly Return Form with ease

- Find Oregon Lodging Tax Quarterly Return Form and click on Get Form to begin.

- Utilize the tools we provide to complete your form.

- Highlight important sections of the documents or obscure sensitive information with tools that airSlate SignNow offers specifically for that purpose.

- Generate your signature using the Sign feature, which takes seconds and carries the same legal validity as a conventional wet ink signature.

- Review the information and then click on the Done button to save your changes.

- Select how you wish to deliver your form—via email, text message (SMS), invite link, or download it to your computer.

Forget about lost or misplaced documents, tedious form searching, or mistakes that necessitate printing new copies. airSlate SignNow meets your document management needs in just a few clicks from any device you prefer. Alter and eSign Oregon Lodging Tax Quarterly Return Form and ensure exceptional communication at every stage of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the oregon lodging tax quarterly return form 5359496

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is nyna konishi and how does it relate to airSlate SignNow?

Nyna Konishi is known for advocating innovative document management solutions like airSlate SignNow. This platform simplifies the process of sending and eSigning documents, making it easier for businesses to streamline their workflow and enhance productivity.

-

What pricing plans does airSlate SignNow offer?

airSlate SignNow offers a variety of pricing plans, catering to different business needs. Whether you are an individual or a large organization, the plans are designed to be cost-effective while providing the essential features highlighted by Nyna Konishi.

-

What key features are included in airSlate SignNow?

airSlate SignNow includes features such as document templates, real-time collaboration, and advanced security measures. These functionalities align with Nyna Konishi's vision of providing efficient and secure document management solutions for businesses.

-

How can airSlate SignNow benefit my business?

By utilizing airSlate SignNow, your business can signNowly reduce document turnaround times and eliminate paper clutter. This aligns with Nyna Konishi's emphasis on efficiency, allowing companies to focus more on core operations and less on administrative tasks.

-

Can I integrate airSlate SignNow with other software?

Yes, airSlate SignNow offers seamless integrations with various productivity tools and software applications. This integration capability reflects Nyna Konishi's commitment to creating a comprehensive document management ecosystem that enhances business processes.

-

Is airSlate SignNow secure for sensitive documents?

Absolutely, airSlate SignNow prioritizes security with robust encryption and compliance with industry regulations. Nyna Konishi’s advocacy for secure solutions ensures that your sensitive documents remain protected throughout the eSigning process.

-

How easy is it to use airSlate SignNow?

airSlate SignNow is designed to be user-friendly, allowing even those with minimal technical expertise to navigate the platform effortlessly. This simplicity resonates with Nyna Konishi’s approach of empowering users to adopt technology easily.

Get more for Oregon Lodging Tax Quarterly Return Form

- Ok limited form

- Limited power of attorney where you specify powers with sample powers included oklahoma form

- Limited power of attorney for stock transactions and corporate powers oklahoma form

- Special durable power of attorney for bank account matters oklahoma form

- Ok small 497323411 form

- Oklahoma property management package oklahoma form

- Application completion form

- Annual minutes for an oklahoma professional corporation oklahoma form

Find out other Oregon Lodging Tax Quarterly Return Form

- How To Electronic signature New York Non-disclosure agreement PDF

- Electronic signature South Carolina Partnership agreements Online

- How Can I Electronic signature Florida Rental house lease agreement

- How Can I Electronic signature Texas Rental house lease agreement

- eSignature Alabama Trademark License Agreement Secure

- Electronic signature Maryland Rental agreement lease Myself

- How To Electronic signature Kentucky Rental lease agreement

- Can I Electronic signature New Hampshire Rental lease agreement forms

- Can I Electronic signature New Mexico Rental lease agreement forms

- How Can I Electronic signature Minnesota Rental lease agreement

- Electronic signature Arkansas Rental lease agreement template Computer

- Can I Electronic signature Mississippi Rental lease agreement

- Can I Electronic signature Missouri Rental lease contract

- Electronic signature New Jersey Rental lease agreement template Free

- Electronic signature New Jersey Rental lease agreement template Secure

- Electronic signature Vermont Rental lease agreement Mobile

- Electronic signature Maine Residential lease agreement Online

- Electronic signature Minnesota Residential lease agreement Easy

- Electronic signature Wyoming Rental lease agreement template Simple

- Electronic signature Rhode Island Residential lease agreement Online