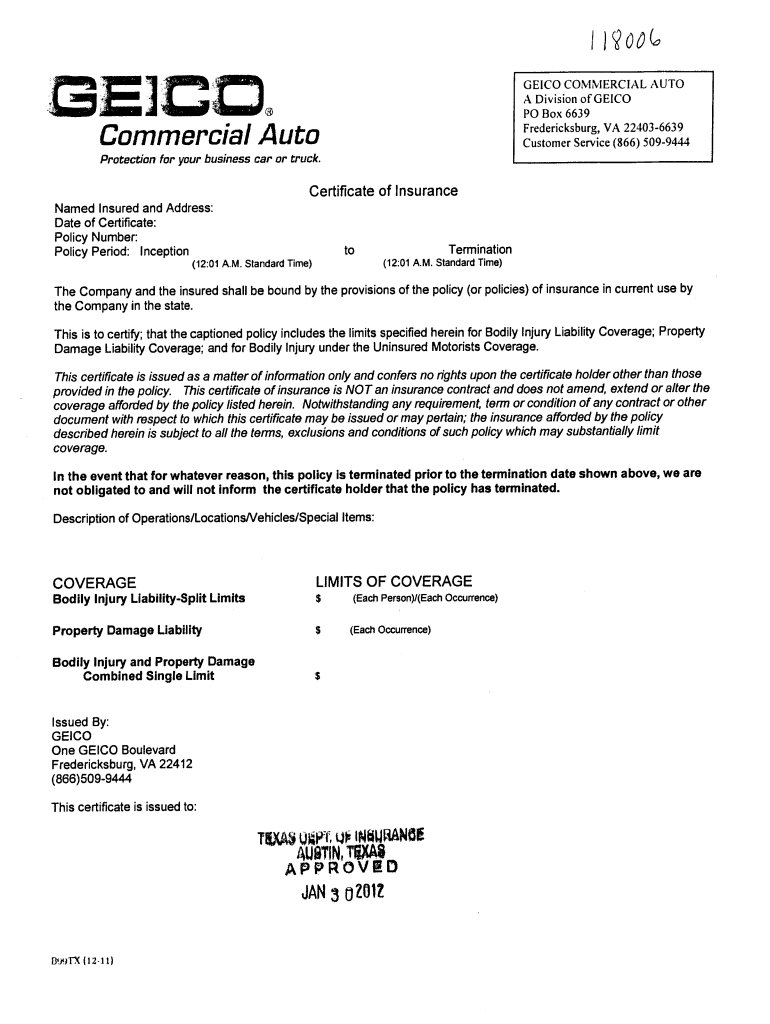

Geico Commercial Auto Insurance Form

Understanding the Geico Declaration Page

The Geico declaration page serves as a summary of your auto insurance policy. It outlines key details such as the insured vehicles, coverage limits, deductibles, and the policyholder's information. This document is essential for understanding your insurance coverage and serves as proof of insurance. It is often required when registering a vehicle or filing a claim.

Key Elements of the Geico Declaration Page

Several critical components are included in the Geico declaration page:

- Policy Number: A unique identifier for your insurance policy.

- Insured Vehicles: Details about each vehicle covered under the policy, including make, model, and VIN.

- Coverage Types: Information about the types of coverage included, such as liability, collision, and comprehensive.

- Premium Amount: The total cost of the insurance policy, typically broken down by payment schedule.

- Effective Dates: The start and end dates of the coverage period.

How to Obtain the Geico Declaration Page

To obtain your Geico declaration page, you can follow these steps:

- Log in to your Geico account on their official website.

- Navigate to the "Policies" section where your active policies are listed.

- Select the specific policy for which you need the declaration page.

- Download or print the declaration page directly from your account.

Legal Use of the Geico Declaration Page

The Geico declaration page is legally recognized as proof of insurance. It is essential for various legal and administrative purposes, such as:

- Registering your vehicle with the Department of Motor Vehicles (DMV).

- Providing evidence of insurance during traffic stops or accidents.

- Submitting claims for damages or losses covered under your policy.

Steps to Complete the Geico Declaration Page

Completing the Geico declaration page involves ensuring that all information is accurate and up to date. Here are the steps to follow:

- Review the personal information, including your name and address.

- Check the details of each insured vehicle for accuracy.

- Verify the coverage types and limits to ensure they meet your needs.

- Confirm the premium amount and payment schedule.

Examples of Using the Geico Declaration Page

There are several scenarios where the Geico declaration page is useful:

- When applying for a loan or financing for a vehicle, lenders often require proof of insurance.

- During a claim process, having the declaration page helps expedite the review and approval of your claim.

- When switching insurance providers, you may need to present your declaration page to ensure continuous coverage.

Quick guide on how to complete geico certificate of insurance texas department of insurance tdi texas

Complete Geico Commercial Auto Insurance effortlessly on any device

Online document management has gained popularity among businesses and individuals. It offers an ideal eco-friendly substitute for conventional printed and signed papers, as you can locate the appropriate form and securely store it online. airSlate SignNow provides all the tools necessary to create, edit, and eSign your documents swiftly without delays. Manage Geico Commercial Auto Insurance on any platform using the airSlate SignNow Android or iOS applications and enhance any document-based workflow today.

The easiest method to alter and eSign Geico Commercial Auto Insurance without any hassle

- Locate Geico Commercial Auto Insurance and then click Get Form to begin.

- Utilize the tools we offer to submit your document.

- Highlight important sections of the documents or obscure sensitive information with tools specifically provided by airSlate SignNow for that purpose.

- Generate your eSignature using the Sign tool, which only takes seconds and has the same legal validity as a traditional wet ink signature.

- Review the information and then click on the Done button to save your modifications.

- Choose how you wish to send your form, via email, text message (SMS), or invitation link, or download it to your computer.

Eliminate concerns about lost or misplaced files, laborious form searching, or errors that necessitate printing new document copies. airSlate SignNow meets your needs in document management in just a few clicks from any device you prefer. Modify and eSign Geico Commercial Auto Insurance and ensure effective communication at every stage of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

FAQs

-

How long would you need to be insured before a flood to be covered? Couldn't the people of Texas buy insurance a few days before?

All flood insurance policies (written through the National Flood Insurance Program) have a 30-day waiting period.Why?Flood insurance is plagued with the problem of adverse selection. Allowing people to secure coverage as the storm approaches would only exacerbate a systemic problem.Wikipedia aptly captures this dilemma:Nationwide, only 20% of American homes at risk for floods are covered by flood insurance.[2]Most private insurers do not insure against the peril of flood due to the prevalence of adverse selection, which is the purchase of insurance by persons most affected by the specific peril of flood. In traditional insurance, insurers use the economic law of large numbers to charge a relatively small fee to large numbers of people in order to pay the claims of the small numbers of claimants who have suffered a loss.Unfortunately, in flood insurance, the numbers of claimants is larger than the available number of persons interested in protecting their property from the peril, which means that most private insurers view the probability of generating a profit from providing flood insurance as being remoteThere are exceptions to the flood insurance 30-day waiting period. those include:When the purchase of flood insurance is in connection with making, increasing, extension or renewal of a loan.This is most common when a person is purchasing a new home and financing it through a national lending institution.A refinance of an existing home can also remove the 30–day waiting period.When the purchase of flood insurance is following a [map] revision or updating of floodplain areas of flood zones, within a 1 year period.The function of any type of insurance is compromised whenever adverse selection is allowed to thrive (think health insurance). Flood insurance is no exception. In fact, financial and sustainability problems hound the National Flood Insurance Program (NFIP) specifically because it is fraught with compromises to the concept.Our fellow Americans in Texas are facing an unfathomable event and are going to need some help.Hurricane Harvey : Charity Navigator

-

How does health insurance work when someone is rear-ended by a third party? GEICO tells me to update them when I go to the doc, but I’m not sure whether I would have to pay out of pocket?

It depends on the laws of your particular state; here in the commonwealth if you have private insurance, Geico is obligated to pay on the first 2,000.00 of the bill. Once that has been paid, your private insurance will have to take care of the rest.Your doctor may not accept Geico’s guarantee that she will be paid because Geico can stop payment for various reasons including noncooperation on your part.You might edit the question and request an answer that pertains to your state.

-

How much time and money does it take for a new startup (<50 employees) to fill out the paperwork to become a group for the purpose of negotiating for health insurance for their founders and employees?

I'm not sure if this is a purely exploratory question or if you're inferring that you're planning on navigating the group health insurance market without the assistance of a broker. If the latter, I'd caution against it for several reasons (which I'll omit for now for the sake of brevity).To get a group quote, generally all that's needed is an employee census. Some states apply a modifier to the rate depending on the overall health of the group members (for a very accurate quote, employees may need to fill out general health statements).Obtaining rates themselves can take a few minutes (for states like CA which don't have a signNow health modifier) to several days.I suspect your cor question is the time/effort required once you've determined the most appropriate plan design for your company. This is variable depending on how cohesive your employee base is.Best case scenario - if all employees are in one location and available at the same time, I could bring an enrollment team and get all the paperwork done in the course of 1-3 hours depending on the size of your group. In the vast majority of cases, the employer's paperwork is typically around 6 pages of information, and the employee applications about 4-8 pages. Individually none of them take more than several minutes to complete.Feel free to contact me directly if you have specific questions or concerns.

Create this form in 5 minutes!

How to create an eSignature for the geico certificate of insurance texas department of insurance tdi texas

How to make an electronic signature for the Geico Certificate Of Insurance Texas Department Of Insurance Tdi Texas in the online mode

How to create an electronic signature for the Geico Certificate Of Insurance Texas Department Of Insurance Tdi Texas in Chrome

How to create an electronic signature for putting it on the Geico Certificate Of Insurance Texas Department Of Insurance Tdi Texas in Gmail

How to create an electronic signature for the Geico Certificate Of Insurance Texas Department Of Insurance Tdi Texas straight from your smart phone

How to create an electronic signature for the Geico Certificate Of Insurance Texas Department Of Insurance Tdi Texas on iOS

How to make an electronic signature for the Geico Certificate Of Insurance Texas Department Of Insurance Tdi Texas on Android devices

People also ask

-

What is a declaration page for car insurance?

A declaration page for car insurance is a summary document provided by your insurer that outlines the key details of your insurance policy. It includes information such as your coverage limits, the type of vehicle insured, and the policyholder's name. Understanding what a declaration page for car insurance entails is essential for reviewing your coverage and ensuring you have adequate protection.

-

Why do I need a declaration page for car insurance?

You need a declaration page for car insurance because it serves as proof of your coverage and outlines the specifics of your policy. This document is important for verifying your insurance when required by law or when making a claim. Keeping your declaration page handy helps you understand your coverage and helps facilitate communication with your insurer.

-

How do I obtain a declaration page for car insurance?

To obtain a declaration page for car insurance, you can request it directly from your insurance provider, either through their website or by contacting customer service. In many cases, insurers provide this document electronically via email or through an online account. Understanding how to access your declaration page can streamline your insurance management.

-

Can I use airSlate SignNow to sign a declaration page for car insurance?

Yes, you can use airSlate SignNow to eSign your declaration page for car insurance securely and efficiently. The platform allows you to upload the document, add eSignatures, and send it out for signatures, making the process seamless. This functionality ensures you can manage your insurance paperwork without hassle.

-

What information is typically included in a declaration page for car insurance?

A declaration page for car insurance typically includes the policy number, coverage type, limits, premium costs, and details about the insured vehicle. Additionally, it lists any discounts applied and the coverage period. Familiarizing yourself with what is included can help you make informed decisions about your policy.

-

Is there a cost associated with getting a declaration page for car insurance?

Generally, there is no cost to request a declaration page for car insurance, as it is a standard part of your insurance policy documentation. However, if you require duplicate copies or expedited service, some insurers may charge a fee. Always check with your provider for their specific policies regarding document access.

-

How does a declaration page for car insurance differ from an insurance policy?

A declaration page for car insurance is a concise summary of your policy, highlighting crucial details, while the insurance policy is a comprehensive document outlining all terms, conditions, and coverage provisions. The declaration page acts as a quick reference, whereas the policy provides in-depth legal information. Knowing the difference can help you better manage your insurance documents.

Get more for Geico Commercial Auto Insurance

- Dna replication practice worksheet 46602773 form

- Sf 424a form fillable usda 21249639

- Carebridge eap form

- Isdnpstn internet access form

- Lehman college readmission form

- San carlos education department form

- Bariatric surgery predetermination request form bluecross

- Bariatric surgery patient medical history form

Find out other Geico Commercial Auto Insurance

- eSignature Hawaii Memorandum of Agreement Template Online

- eSignature Hawaii Memorandum of Agreement Template Mobile

- eSignature New Jersey Memorandum of Agreement Template Safe

- eSignature Georgia Shareholder Agreement Template Mobile

- Help Me With eSignature Arkansas Cooperative Agreement Template

- eSignature Maryland Cooperative Agreement Template Simple

- eSignature Massachusetts Redemption Agreement Simple

- eSignature North Carolina Redemption Agreement Mobile

- eSignature Utah Equipment Rental Agreement Template Now

- Help Me With eSignature Texas Construction Contract Template

- eSignature Illinois Architectural Proposal Template Simple

- Can I eSignature Indiana Home Improvement Contract

- How Do I eSignature Maryland Home Improvement Contract

- eSignature Missouri Business Insurance Quotation Form Mobile

- eSignature Iowa Car Insurance Quotation Form Online

- eSignature Missouri Car Insurance Quotation Form Online

- eSignature New Jersey Car Insurance Quotation Form Now

- eSignature Hawaii Life-Insurance Quote Form Easy

- How To eSignature Delaware Certeficate of Insurance Request

- eSignature New York Fundraising Registration Form Simple