Form 8606

What is the Form 8606

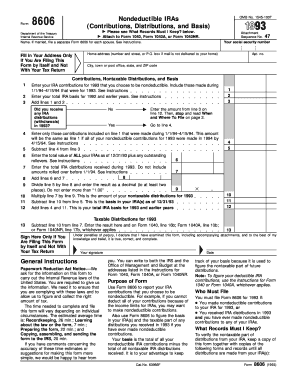

The Form 8606 is a tax form used by U.S. taxpayers to report nondeductible contributions to traditional Individual Retirement Accounts (IRAs) and to track the basis in these accounts. This form is essential for individuals who have made nondeductible contributions, as it helps prevent double taxation on distributions from these accounts. It is also utilized to report conversions from traditional IRAs to Roth IRAs, ensuring that the tax implications of these transactions are properly documented. Understanding the purpose of Form 8606 is crucial for maintaining accurate tax records and ensuring compliance with IRS regulations.

How to use the Form 8606

Using the Form 8606 involves several key steps. First, determine if you need to file this form based on your IRA contributions and distributions. If you made nondeductible contributions or converted funds to a Roth IRA, you will need to complete this form. Next, gather your financial documents, including records of your IRA contributions and any prior Form 8606 submissions. Fill out the form accurately, ensuring that you report all required information, such as the amount of nondeductible contributions and any conversions. Finally, submit the completed form along with your tax return to the IRS to ensure proper processing.

Steps to complete the Form 8606

Completing the Form 8606 requires careful attention to detail. Follow these steps:

- Begin with your personal information, including your name and Social Security number.

- Indicate the tax year for which you are filing the form.

- Report any nondeductible contributions made to traditional IRAs in Part I of the form.

- In Part II, provide details about any conversions from traditional IRAs to Roth IRAs.

- Ensure that you accurately calculate your total basis in traditional IRAs, which will be essential for future tax reporting.

- Review the completed form for accuracy before submitting it with your tax return.

Legal use of the Form 8606

The legal use of Form 8606 is critical for ensuring compliance with IRS regulations. This form serves as a record of nondeductible contributions and conversions, which helps taxpayers avoid double taxation on distributions. Filing this form is not only a requirement but also a safeguard against potential penalties for incorrect reporting. Properly completing and submitting Form 8606 ensures that taxpayers maintain accurate records of their IRA activities, which is essential for future tax filings and audits.

Filing Deadlines / Important Dates

Filing deadlines for Form 8606 align with the overall tax return deadlines. Typically, the form must be submitted by the tax return due date, which is usually April 15 of the following year. If you file for an extension, you must still submit Form 8606 by the extended deadline. It is important to keep track of these dates to avoid late filing penalties and ensure that all tax obligations are met in a timely manner.

Penalties for Non-Compliance

Failure to file Form 8606 when required can result in significant penalties. The IRS imposes a penalty of $50 for each failure to file the form, which can add up quickly if multiple years are involved. Additionally, not reporting nondeductible contributions can lead to double taxation on distributions, resulting in further financial implications. Therefore, it is essential to understand the filing requirements and ensure compliance to avoid these penalties.

Quick guide on how to complete form 8606 1672007

Prepare Form 8606 effortlessly on any device

Digital document management has become increasingly prevalent among businesses and individuals. It offers an ideal environmentally friendly substitute for traditional printed and signed documents since you can obtain the correct form and securely keep it online. airSlate SignNow provides you with all the necessary tools to create, modify, and electronically sign your documents quickly and without delays. Manage Form 8606 on any device with airSlate SignNow's Android or iOS applications and enhance any document-related workflow today.

The simplest way to modify and electronically sign Form 8606 without hassle

- Find Form 8606 and then click Get Form to commence.

- Utilize the features we offer to complete your document.

- Emphasize important sections of your documents or redact sensitive information with tools that airSlate SignNow provides specifically for that purpose.

- Create your signature using the Sign tool, which takes mere seconds and carries the same legal validity as a traditional wet ink signature.

- Review all details and then click on the Done button to save your changes.

- Choose how you wish to submit your form, via email, text message (SMS), or invite link, or download it to your computer.

Forget about lost or misplaced files, tedious form searching, or errors that require printing new document copies. airSlate SignNow addresses all your document management needs in just a few clicks from any device of your choosing. Modify and electronically sign Form 8606 and ensure seamless communication at every stage of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the form 8606 1672007

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is Form 8606 and when do I need to file it?

Form 8606 is used to report nondeductible contributions to traditional IRAs and Roth IRAs. You need to file it if you made contributions to these accounts and are not eligible for a full deduction, or if you converted amounts from a traditional IRA to a Roth IRA. Completing Form 8606 accurately is essential to avoid penalties from the IRS.

-

How can airSlate SignNow assist with signing Form 8606?

airSlate SignNow offers a user-friendly platform to eSign Form 8606 quickly and securely. With our document management features, you can upload, fill out, and sign your Form 8606 digitally, streamlining your filing process. This enhances efficiency and ensures that your tax documents are handled with the utmost security.

-

Are there any costs associated with using airSlate SignNow for Form 8606?

airSlate SignNow provides a cost-effective solution for managing documents like Form 8606. Our pricing plans cater to various needs, including individual and business users, ensuring you only pay for the features you use. There are also free trials available to explore our capabilities before committing.

-

What features does airSlate SignNow offer for handling tax forms like Form 8606?

airSlate SignNow integrates essential features such as customizable templates, document sharing, collaboration tools, and secure eSigning for forms like Form 8606. These capabilities simplify the process, allowing multiple users to contribute efficiently and ensuring compliance with tax regulations. Additionally, our platform supports a seamless document workflow.

-

Can I integrate airSlate SignNow with other applications for managing Form 8606?

Yes, airSlate SignNow offers integrations with various applications that can enhance how you manage Form 8606. Whether you're using accounting software or document management systems, our integrations facilitate a smooth workflow, allowing for easier document handling and signing processes. This means you can streamline your overall operations while maintaining compliance.

-

What are the benefits of eSigning Form 8606 with airSlate SignNow?

eSigning Form 8606 with airSlate SignNow offers several advantages, such as faster processing times and reduced paper clutter. You can complete your tax documents from anywhere, at any time, which enhances convenience. Moreover, our platform ensures that all signed documents are securely stored and easily accessible whenever you need them.

-

Is airSlate SignNow secure for signing sensitive documents like Form 8606?

Absolutely, airSlate SignNow prioritizes security, employing industry-standard encryption and authentication measures to protect sensitive documents like Form 8606. Our secure platform ensures that your personal information and financial data remain confidential throughout the signing process. Trust us to manage your sensitive tax documents with the highest level of security.

Get more for Form 8606

Find out other Form 8606

- How Can I eSignature Louisiana Non-Profit PDF

- Can I eSignature Alaska Orthodontists PDF

- How Do I eSignature New York Non-Profit Form

- How To eSignature Iowa Orthodontists Presentation

- Can I eSignature South Dakota Lawers Document

- Can I eSignature Oklahoma Orthodontists Document

- Can I eSignature Oklahoma Orthodontists Word

- How Can I eSignature Wisconsin Orthodontists Word

- How Do I eSignature Arizona Real Estate PDF

- How To eSignature Arkansas Real Estate Document

- How Do I eSignature Oregon Plumbing PPT

- How Do I eSignature Connecticut Real Estate Presentation

- Can I eSignature Arizona Sports PPT

- How Can I eSignature Wisconsin Plumbing Document

- Can I eSignature Massachusetts Real Estate PDF

- How Can I eSignature New Jersey Police Document

- How Can I eSignature New Jersey Real Estate Word

- Can I eSignature Tennessee Police Form

- How Can I eSignature Vermont Police Presentation

- How Do I eSignature Pennsylvania Real Estate Document