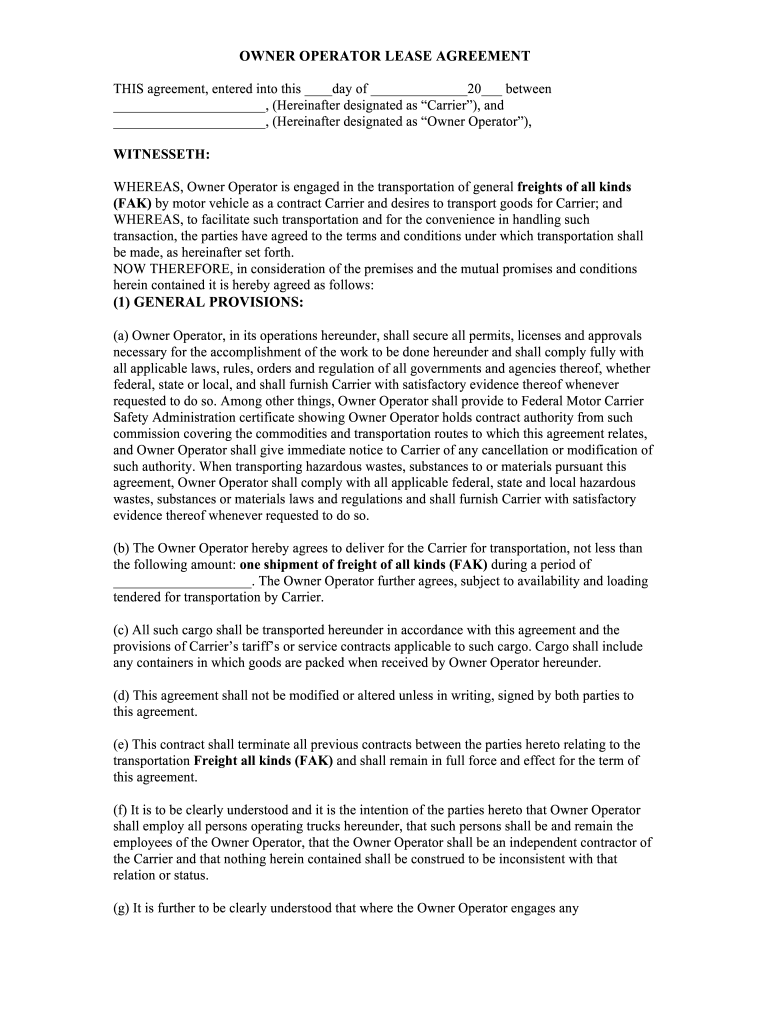

Owner Operator Lease Agreement Form

What is the trucking authority lease agreement?

The trucking authority lease agreement is a legal document that outlines the terms and conditions between a trucking company and an owner-operator. This agreement allows the owner-operator to operate under the trucking company's authority while detailing the responsibilities of both parties. It typically includes provisions regarding compensation, maintenance of the vehicle, insurance requirements, and compliance with federal regulations. This type of agreement is essential for ensuring that both the trucking company and the owner-operator understand their rights and obligations in the business relationship.

Key elements of the trucking authority lease agreement

A well-structured trucking authority lease agreement contains several critical components:

- Parties involved: Clearly identifies the trucking company and the owner-operator.

- Vehicle details: Specifies the make, model, and identification number of the truck being leased.

- Compensation structure: Outlines how and when the owner-operator will be paid, including any deductions for expenses.

- Duration of the lease: States the length of the agreement and conditions for renewal or termination.

- Insurance requirements: Details the types of insurance coverage required for the operation of the vehicle.

- Compliance obligations: Ensures that both parties adhere to federal and state regulations, including those set by the Federal Motor Carrier Safety Administration (FMCSA).

Steps to complete the trucking authority lease agreement

Completing a trucking authority lease agreement involves several important steps:

- Gather necessary information: Collect all relevant details about the trucking company, the owner-operator, and the vehicle.

- Draft the agreement: Use a standard template or create a custom document that includes all key elements.

- Review the terms: Both parties should carefully read the agreement to ensure clarity and mutual understanding.

- Sign the document: Utilize a reliable electronic signature tool to sign the agreement, ensuring compliance with eSignature laws.

- Distribute copies: Provide each party with a signed copy of the agreement for their records.

Legal use of the trucking authority lease agreement

The trucking authority lease agreement is legally binding when executed correctly. To ensure its validity, both parties must meet specific legal requirements, including:

- Compliance with federal regulations: The agreement must adhere to FMCSA guidelines and other applicable laws.

- Proper signatures: Both parties should sign the document, either physically or electronically, using a compliant eSignature platform.

- Retention of records: Both parties should keep copies of the signed agreement for future reference and legal protection.

How to obtain the trucking authority lease agreement

Obtaining a trucking authority lease agreement can be done through various methods:

- Online templates: Many websites offer free or paid templates that can be customized to suit specific needs.

- Legal professionals: Consulting with a lawyer specializing in transportation law can help create a tailored agreement that meets all legal requirements.

- Industry associations: Some trucking associations provide resources and templates for their members.

Examples of using the trucking authority lease agreement

The trucking authority lease agreement is commonly used in various scenarios, including:

- Owner-operators: Individuals who own their trucks and lease them to a larger trucking company.

- Fleet management: Companies that manage a fleet of trucks may use these agreements to formalize relationships with independent drivers.

- Contract agreements: Businesses that require specific transportation services may establish leases with owner-operators for dedicated routes.

Quick guide on how to complete owner operator lease agreementdoc

Complete Owner Operator Lease Agreement effortlessly on any device

Managing documents online has gained in popularity among businesses and individuals. It offers an ideal eco-friendly substitute for conventional printed and signed papers, as you can locate the appropriate form and securely store it online. airSlate SignNow provides you with all the tools necessary to create, modify, and eSign your documents swiftly without any hassle. Handle Owner Operator Lease Agreement on any device using airSlate SignNow's Android or iOS applications and enhance any document-centric operation today.

How to modify and eSign Owner Operator Lease Agreement with ease

- Obtain Owner Operator Lease Agreement and then click Get Form to initiate the process.

- Use the tools we offer to finalize your document.

- Highlight important sections of your documents or obscure sensitive details with tools specifically provided by airSlate SignNow for that purpose.

- Generate your eSignature with the Sign tool, which takes mere seconds and holds the same legal validity as a conventional wet ink signature.

- Review all the details and then click on the Done button to preserve your changes.

- Choose how you wish to send your form, via email, text message (SMS), or invitation link, or download it to your computer.

Wave goodbye to missing or lost documents, tiring form searches, or errors that necessitate printing new copies. airSlate SignNow caters to all your document management requirements in just a few clicks from a device of your choosing. Modify and eSign Owner Operator Lease Agreement and guarantee excellent communication at every stage of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

FAQs

-

What forms do I need to fill out as a first-year LLC owner? It's a partnership LLC.

A Limited Liability Company (LLC) is business structure that provides the limited liability protection features of a corporation and the tax efficiencies and operational flexibility of a partnership.Unlike shareholders in a corporation, LLCs are not taxed as a separate business entity. Instead, all profits and losses are "passed through" the business to each member of the LLC. LLC members report profits and losses on their personal federal tax returns, just like the owners of a partnership would.The owners of an LLC have no personal liability for the obligations of the LLC. An LLC is the entity of choice for a businesses seeking to flow through losses to its investors because an LLC offers complete liability protection to all its members. The basic requirement for forming an Limited Liability Company are:Search your business name - before you form an LLC, you should check that your proposed business name is not too similar to another LLC registered with your state's Secretary of StateFile Articles of Organization - the first formal paper you will need file with your state's Secretary of State to form an LLC. This is a necessary document for setting up an LLC in many states. Create an Operating Agreement - an agreement among LLC members governing the LLC's business, and member's financial and managerial rights and duties. Think of this as a contract that governs the rules for the people who own the LLC. Get an Employer Identification Number (EIN) - a number assigned by the IRS and used to identify taxpayers that are required to file various business tax returns. You can easily file for an EIN online if you have a social security number. If you do not have a social security number or if you live outsides of United States, ask a business lawyer to help you get one.File Statement of Information - includes fairly basic information about the LLC that you need to file with your state’s Secretary of State every 2 years. Think of it as a company census you must complete every 2 years.Search and Apply for Business Licenses and Permits - once your business is registered, you should look and apply for necessary licenses and permits you will need from the county and city where you will do business. Every business has their own business licenses and permits so either do a Google search of your business along with the words "permits and licenses" or talk to a business lawyer to guide you with this.If you have any other questions, talk to a business lawyer who will clarify and help you with all 6 above steps or answer any other question you may have about starting your business.I am answering from the perspective of a business lawyer who represents businesspersons and entrepreneurs with their new and existing businesses. Feel free to contact me sam@mollaeilaw.com if you need to form your LLC.In my course, How To Incorporate Your Business on Your Own: Quick & Easy, you will learn how to form your own Limited Liability Company (LLC) or Corporation without a lawyer, choose a business name, file a fictitious business name, file Articles of Organization or Articles of Incorporation, create Operating Agreement or Bylaws, apply for an EIN, file Statement of Information, and how to get business licenses and permits.

-

How a Non-US residence company owner (has EIN) should fill the W-7 ITIN form out? Which option is needed to be chosen in the first part?

Depends on the nature of your business and how it is structured.If you own an LLC taxed as a passthrough entity, then you probably will check option b and submit the W7 along with your US non-resident tax return. If your LLC’s income is not subject to US tax, then you will check option a.If the business is a C Corp, then you probably don’t need an ITIN, unless you are receiving taxable compensation from the corporation and then we are back to option b.

-

How can you get your family doctor to fill out a disability form?

Definitely ask for a psychologist referral! You want someone on your side who can understand your issues and be willing and eager to advocate for you with the beancounters because disability can be rather hard to get some places, like just south of the border in America.Having a psychologist means you have a more qualified specialist filling out your papers (which is a positive for you and for the government), and it means you can be seeing someone who can get to know your issues in greater depth and expertise for further government and non-profit organization provided aid.If seeing a psychologist on a regular basis is still too difficult for you, start with your initial appointment and then perhaps build up a rapport with a good therapist through distanced appointments (like via telephone, if that is easier) until you can be going into a physical office. It would probably look good on the form if your psychologist can truthfully state that you are currently seeking regular treatment for your disorders because of how serious and debilitating they are.I don't know how disability in Canada works, but I have gone through the process in the US, and specifically for anxiety and depression, like you. Don't settle for a reluctant or wishywashy doctor or psychologist, especially when it comes to obtaining the resources for basic survival. I also advise doing some internet searches on how to persuasively file for disability in Canada. Be prepared to fight for your case through an appeal, if it should come to that, and understand the requirements and processes involved in applying for disability by reading government literature and reviewing success stories on discussion websites.

-

How do I fill out a Form 10BA if I lived in two rented homes during the previous year as per the rent agreement? Which address and landlord should I mention in the form?

you should fill out the FORM 10BA, with detail of the rented house, for which you are paying more rent than other.To claim Section 80GG deduction, the following conditions must be fulfilled by the taxpayer:HRA Not Received from Employer:- The taxpayer must not have received any house rent allowance (HRA) from the employer.Not a Home Owner:- The taxpayer or spouse or minor child must not own a house property. In case of a Hindu Undivided Family (HUF), the HUF must not own a house property where the taxpayer resides.Form 10BA Declaration:- The taxpayer must file a declaration in Form 10BA that he/she has taken a residence on rent in the previous year and that he/she has no other residence.format of form-10BA:-https://www.webtel.in/Image/Form...Amount of Deduction under Section 80GG:-Maximum deduction under Section 80GG is capped at Rs.60,000. Normally, the deduction under Section 80GG is the lower of the following three amounts :-25% of Adjusted Total IncomeRent Paid minus 10% of Adjusted Total IncomeRs.5000 per Month

Create this form in 5 minutes!

How to create an eSignature for the owner operator lease agreementdoc

How to make an electronic signature for the Owner Operator Lease Agreementdoc in the online mode

How to create an electronic signature for the Owner Operator Lease Agreementdoc in Google Chrome

How to make an eSignature for putting it on the Owner Operator Lease Agreementdoc in Gmail

How to generate an electronic signature for the Owner Operator Lease Agreementdoc from your mobile device

How to make an electronic signature for the Owner Operator Lease Agreementdoc on iOS

How to create an electronic signature for the Owner Operator Lease Agreementdoc on Android devices

People also ask

-

What is an owner operator lease agreement?

An owner operator lease agreement is a legal contract between a truck owner and a motor carrier. This agreement outlines the terms of leasing the truck for transportation services, including responsibilities, payment rates, and duration. Understanding the details of an owner operator lease agreement is essential for both parties to ensure clarity and compliance.

-

How does airSlate SignNow support owner operator lease agreements?

airSlate SignNow simplifies the process of managing your owner operator lease agreement by enabling electronic signatures and document storage. Users can easily prepare, send, and sign agreements from any device, accelerating the onboarding process. This digital solution also enhances organization and access to important documents.

-

What are the pricing options for using airSlate SignNow for my owner operator lease agreement?

airSlate SignNow offers several pricing plans to accommodate different needs, ranging from basic to advanced features. Each plan allows users to manage their owner operator lease agreements effectively, with options for increased functionality and integrations. You can choose a plan that best fits your budget and usage requirements.

-

What features should I look for in an owner operator lease agreement template?

When choosing an owner operator lease agreement template, look for essential features such as clear terms and conditions, payment schedules, and compliance with industry regulations. Additionally, a good template should allow customization to suit your specific needs, making it easier to create a personalized owner operator lease agreement.

-

Can I integrate airSlate SignNow with other tools for my owner operator lease agreement?

Yes, airSlate SignNow offers various integrations with popular business tools, allowing you to streamline the management of your owner operator lease agreement. Integrating with applications like CRM systems, cloud storage, and finance tools enhances your workflow and ensures all aspects of your business are synchronized. Check the integration options available to maximize efficiency.

-

What are the benefits of electronic signing for owner operator lease agreements?

Electronic signing offers numerous benefits for owner operator lease agreements, including faster turnaround times and reduced paperwork. With airSlate SignNow, you can sign documents from anywhere, at any time, which simplifies the process and increases productivity. Additionally, electronic signatures are legally binding, ensuring the validity of your owner operator lease agreement.

-

How secure is my data when using airSlate SignNow for owner operator lease agreements?

Security is a top priority for airSlate SignNow, which employs advanced encryption and secure storage solutions to protect your data. When managing your owner operator lease agreements, you can trust that your information is safeguarded against unauthorized access and data bsignNowes. Regular audits and compliance with industry standards further enhance the platform’s security.

Get more for Owner Operator Lease Agreement

Find out other Owner Operator Lease Agreement

- How To eSign West Virginia Real Estate Quitclaim Deed

- eSign Hawaii Police Permission Slip Online

- eSign New Hampshire Sports IOU Safe

- eSign Delaware Courts Operating Agreement Easy

- eSign Georgia Courts Bill Of Lading Online

- eSign Hawaii Courts Contract Mobile

- eSign Hawaii Courts RFP Online

- How To eSign Hawaii Courts RFP

- eSign Hawaii Courts Letter Of Intent Later

- eSign Hawaii Courts IOU Myself

- eSign Hawaii Courts IOU Safe

- Help Me With eSign Hawaii Courts Cease And Desist Letter

- How To eSign Massachusetts Police Letter Of Intent

- eSign Police Document Michigan Secure

- eSign Iowa Courts Emergency Contact Form Online

- eSign Kentucky Courts Quitclaim Deed Easy

- How To eSign Maryland Courts Medical History

- eSign Michigan Courts Lease Agreement Template Online

- eSign Minnesota Courts Cease And Desist Letter Free

- Can I eSign Montana Courts NDA