Wi Z Tax Form

What is the Wi Z Tax Form

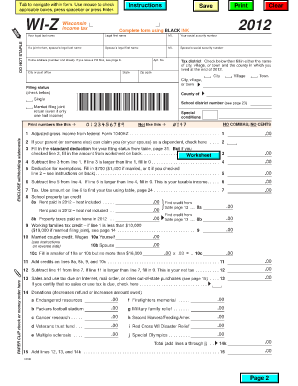

The Wi Z Tax Form is a specific tax document used in the United States for various tax-related purposes. It is essential for individuals and businesses to accurately report income, deductions, and credits to the Internal Revenue Service (IRS). Understanding the purpose and requirements of this form is crucial for compliance with federal tax laws.

How to use the Wi Z Tax Form

Using the Wi Z Tax Form involves several steps to ensure accurate completion. First, gather all necessary financial documents, such as income statements and previous tax returns. Next, fill out the form with the required information, ensuring that all entries are accurate and complete. After completing the form, review it for any errors before submitting it to the appropriate tax authority.

Steps to complete the Wi Z Tax Form

Completing the Wi Z Tax Form can be streamlined by following these steps:

- Gather necessary documents, including income statements and previous tax returns.

- Fill in personal information, such as name, address, and Social Security number.

- Report income from all sources, ensuring accuracy in amounts.

- Claim deductions and credits applicable to your situation.

- Review the completed form for accuracy and completeness.

- Sign and date the form before submission.

Legal use of the Wi Z Tax Form

The Wi Z Tax Form is legally binding when completed and submitted according to IRS guidelines. It is important to ensure that all information provided is truthful and accurate, as any discrepancies may lead to penalties or audits. Utilizing a reliable electronic signature solution can enhance the legal validity of the form, ensuring compliance with eSignature laws.

Filing Deadlines / Important Dates

Filing deadlines for the Wi Z Tax Form vary depending on the specific tax year and the taxpayer's situation. Generally, individual tax returns are due by April 15 of each year. It is essential to be aware of any extensions or changes to deadlines, especially for businesses or special circumstances, to avoid penalties.

Required Documents

To complete the Wi Z Tax Form, several documents are typically required. These include:

- W-2 forms from employers

- 1099 forms for additional income sources

- Receipts for deductible expenses

- Previous year’s tax return for reference

Having these documents ready will facilitate a smoother filing process.

Form Submission Methods (Online / Mail / In-Person)

The Wi Z Tax Form can be submitted through various methods, depending on the taxpayer's preference. Options include:

- Online submission through the IRS e-file system or authorized software

- Mailing a paper form to the designated IRS address

- In-person submission at local IRS offices, if applicable

Choosing the right submission method can impact processing times and convenience.

Quick guide on how to complete wi z tax form

Effortlessly Prepare Wi Z Tax Form on Any Device

Managing documents online has become increasingly popular among businesses and individuals alike. It offers an excellent eco-friendly alternative to conventional printed and signed paperwork, as you can obtain the correct version and store it securely online. airSlate SignNow supplies you with all the tools necessary to create, edit, and electronically sign your documents quickly without delays. Handle Wi Z Tax Form on any platform with the airSlate SignNow apps for Android or iOS and enhance any document-centric procedure today.

How to Edit and eSign Wi Z Tax Form with Ease

- Locate Wi Z Tax Form and click Get Form to begin.

- Utilize the tools we provide to complete your document.

- Highlight pertinent sections of your documents or obscure sensitive information using the tools airSlate SignNow has specifically designed for that purpose.

- Create your eSignature with the Sign tool, which takes just a few seconds and carries the same legal validity as a traditional ink signature.

- Review the information and then click on the Done button to save your changes.

- Select how you would like to send your form, via email, SMS, or an invitation link, or download it to your computer.

Eliminate concerns about lost or misplaced files, tedious form navigation, or mistakes that require reprinting document copies. airSlate SignNow meets all your document management needs in just a few clicks from any device you prefer. Edit and eSign Wi Z Tax Form to ensure outstanding communication at every stage of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the wi z tax form

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is the Wi Z Tax Form and how does it work?

The Wi Z Tax Form is a tax document used in Wisconsin for various tax reporting purposes. By utilizing airSlate SignNow, you can easily send, sign, and manage your Wi Z Tax Form electronically, streamlining your workflow and ensuring compliance with tax regulations.

-

How can I eSign the Wi Z Tax Form using airSlate SignNow?

With airSlate SignNow, eSigning your Wi Z Tax Form is simple and efficient. You can upload the form, add signers, and send it for electronic signatures. The platform provides a secure and legally binding method, making it convenient for both individuals and businesses.

-

What are the pricing options for using airSlate SignNow for the Wi Z Tax Form?

airSlate SignNow offers flexible pricing plans to accommodate different business needs. Depending on your usage and required features for managing documents like the Wi Z Tax Form, you can choose a plan that suits you best, ensuring you only pay for what you need.

-

Are there any integrations available for managing the Wi Z Tax Form?

Yes, airSlate SignNow integrates seamlessly with a variety of applications, enhancing your ability to manage the Wi Z Tax Form. You can connect it with tools like CRM systems, accounting software, and more, enabling a smooth workflow for document management across platforms.

-

What are the benefits of using airSlate SignNow for the Wi Z Tax Form?

Using airSlate SignNow for the Wi Z Tax Form comes with numerous benefits, including increased efficiency in signing and processing documents. It helps reduce paper usage, saves time, and ensures that you remain compliant with tax deadlines and requirements, all while being cost-effective.

-

Is the Wi Z Tax Form secure when using airSlate SignNow?

Absolutely! airSlate SignNow prioritizes the security of your documents, including the Wi Z Tax Form. The platform uses advanced encryption and security protocols to protect your information, ensuring that your tax submissions are safe and confidential.

-

Can I track the status of my Wi Z Tax Form with airSlate SignNow?

Yes, airSlate SignNow offers comprehensive tracking features for your Wi Z Tax Form. You can monitor the progress of the document, see when it has been viewed and signed, and receive notifications, allowing you to stay informed throughout the entire process.

Get more for Wi Z Tax Form

- First bank account opening form

- Lake worth beach building department form

- Leap q form

- Landlords inspection checklist tentant move out form

- Petition for grandparent visitation parent deceased handwritten www2 co fresno ca form

- Preparing for surgery at uva main hospital form

- Www thebalancecareers comletter of introductionletter of introduction examples and writing tips form

- Ach enrollment form

Find out other Wi Z Tax Form

- eSign Alabama Non-Profit Business Plan Template Easy

- eSign Mississippi Legal Last Will And Testament Secure

- eSign California Non-Profit Month To Month Lease Myself

- eSign Colorado Non-Profit POA Mobile

- How Can I eSign Missouri Legal RFP

- eSign Missouri Legal Living Will Computer

- eSign Connecticut Non-Profit Job Description Template Now

- eSign Montana Legal Bill Of Lading Free

- How Can I eSign Hawaii Non-Profit Cease And Desist Letter

- Can I eSign Florida Non-Profit Residential Lease Agreement

- eSign Idaho Non-Profit Business Plan Template Free

- eSign Indiana Non-Profit Business Plan Template Fast

- How To eSign Kansas Non-Profit Business Plan Template

- eSign Indiana Non-Profit Cease And Desist Letter Free

- eSign Louisiana Non-Profit Quitclaim Deed Safe

- How Can I eSign Maryland Non-Profit Credit Memo

- eSign Maryland Non-Profit Separation Agreement Computer

- eSign Legal PDF New Jersey Free

- eSign Non-Profit Document Michigan Safe

- eSign New Mexico Legal Living Will Now