Tax Form Wi Z

What is the Tax Form Wi Z

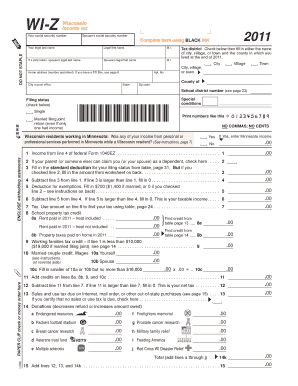

The Tax Form Wi Z is an essential document used by individuals and businesses to report income, expenses, and other financial information to the Internal Revenue Service (IRS). This form is particularly relevant for taxpayers who need to provide accurate financial data for tax assessment purposes. The information submitted on this form helps determine tax liabilities and eligibility for various credits or deductions. Understanding the purpose and requirements of the Tax Form Wi Z is crucial for ensuring compliance with federal tax laws.

How to use the Tax Form Wi Z

Using the Tax Form Wi Z involves several steps to ensure accurate completion and submission. First, gather all necessary financial documents, such as W-2s, 1099s, and any relevant receipts. Next, fill out the form with precise information, ensuring that all entries are correct and complete. After completing the form, review it thoroughly to avoid errors that could lead to delays or penalties. Once verified, the form can be submitted electronically or via mail, depending on your preference and the IRS guidelines.

Steps to complete the Tax Form Wi Z

Completing the Tax Form Wi Z requires a systematic approach to ensure accuracy. Follow these steps:

- Gather all necessary documentation, including income statements and deductions.

- Fill out the form starting with personal information, such as your name and Social Security number.

- Report all sources of income, ensuring to include any additional income that may apply.

- Detail deductions and credits that you are eligible for, referencing IRS guidelines for accuracy.

- Review the completed form for any errors or omissions.

- Submit the form electronically through a secure platform or mail it to the appropriate IRS address.

Legal use of the Tax Form Wi Z

The legal use of the Tax Form Wi Z is governed by IRS regulations, ensuring that the information provided is accurate and truthful. Submitting this form under false pretenses can result in penalties, including fines or legal action. It is essential to maintain compliance with all applicable tax laws and regulations when using this form. Utilizing secure electronic signing solutions, such as signNow, can enhance the legitimacy and security of the submission process, ensuring that all signatures and documents are legally binding.

Filing Deadlines / Important Dates

Filing deadlines for the Tax Form Wi Z are critical to avoid penalties and interest on unpaid taxes. Typically, the IRS requires that this form be submitted by April fifteenth of each year for individual taxpayers. However, extensions may be available under certain circumstances. It is important to stay informed about any changes to tax deadlines, as these can vary based on legislative updates or specific taxpayer situations. Mark important dates on your calendar to ensure timely filing.

Form Submission Methods (Online / Mail / In-Person)

The Tax Form Wi Z can be submitted through various methods to accommodate different preferences and situations. Taxpayers can choose to file online using secure e-filing services, which often provide immediate confirmation of receipt. Alternatively, the form can be mailed directly to the IRS, ensuring that it is sent to the correct address based on the taxpayer's location. In-person submissions are generally not recommended but may be possible in specific circumstances. Regardless of the method chosen, ensuring that the form is submitted on time is essential for compliance.

Quick guide on how to complete tax form wi z

Complete Tax Form Wi Z effortlessly on any device

Online document management has gained popularity among businesses and individuals. It offers an ideal eco-friendly substitute for traditional printed and signed papers, allowing you to access the correct form and securely store it online. airSlate SignNow provides you with all the tools required to create, edit, and electronically sign your documents quickly without delays. Manage Tax Form Wi Z on any device using airSlate SignNow’s Android or iOS applications and streamline any document-related task today.

The simplest way to edit and electronically sign Tax Form Wi Z effortlessly

- Obtain Tax Form Wi Z and click Get Form to begin.

- Utilize the tools we provide to complete your document.

- Mark important sections of the documents or redact sensitive data using tools specifically provided by airSlate SignNow for that purpose.

- Create your electronic signature with the Sign tool, which takes moments and carries the same legal validity as a traditional ink signature.

- Review all the details and then click the Done button to save your changes.

- Select your preferred delivery method for your form, via email, SMS, invitation link, or download it to your computer.

Forget about lost or misfiled documents, tedious form searching, or errors requiring reprinting new document copies. airSlate SignNow meets your document management needs in just a few clicks from any device you choose. Edit and electronically sign Tax Form Wi Z to ensure outstanding communication at every step of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the tax form wi z

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is the Tax Form Wi Z and how does it work with airSlate SignNow?

The Tax Form Wi Z is a crucial document for Wisconsin taxpayers, and airSlate SignNow simplifies its signing and sharing process. With our platform, you can easily create, send, and eSign the Tax Form Wi Z securely and efficiently, ensuring compliance and accuracy in your submissions.

-

How much does it cost to use airSlate SignNow for the Tax Form Wi Z?

airSlate SignNow offers competitive pricing plans that accommodate various business needs when it comes to handling the Tax Form Wi Z. You can choose from our flexible monthly or annual subscriptions, which include features specifically designed for tax document management without breaking the bank.

-

What features does airSlate SignNow offer for managing the Tax Form Wi Z?

Our platform provides features like customizable templates, automated workflows, and reminders to help you manage the Tax Form Wi Z efficiently. Additionally, airSlate SignNow ensures document security with encryption, making it easier to handle sensitive tax information.

-

Are there any benefits to using airSlate SignNow for the Tax Form Wi Z?

Using airSlate SignNow for the Tax Form Wi Z allows for faster processing times and improved accuracy, reducing the risk of errors. You'll also benefit from a user-friendly platform that streamlines the eSignature process, allowing you to focus more on your business and less on paperwork.

-

Can I integrate airSlate SignNow with other software for Tax Form Wi Z management?

Yes, airSlate SignNow seamlessly integrates with various software solutions, making it easy to manage your Tax Form Wi Z alongside your existing applications. This integration can enhance your overall workflow and ensure that all your important documents are connected.

-

Is airSlate SignNow secure for handling sensitive Tax Form Wi Z information?

Absolutely! airSlate SignNow is designed with robust security measures to protect sensitive information related to the Tax Form Wi Z. With features like SSL encryption and audit trails, you can confidently manage your tax documents in a secure environment.

-

Can I access airSlate SignNow for the Tax Form Wi Z on mobile devices?

Yes, airSlate SignNow is accessible on mobile devices, allowing you to complete and eSign the Tax Form Wi Z anytime, anywhere. Our mobile app provides full functionality, ensuring that you can manage your documents on the go.

Get more for Tax Form Wi Z

- Hawaii income expense statement form

- Asset statement form 497304480

- Hawaii divorce decree 497304481 form

- Affidavit of plaintiff for uncontested divorce hawaii form

- Commercial sublease hawaii form

- Hi child support form

- Residential lease renewal agreement hawaii form

- Supplemental affidavit regarding direct payment child support hawaii form

Find out other Tax Form Wi Z

- How To eSign Hawaii Construction Word

- How Can I eSign Hawaii Construction Word

- How Can I eSign Hawaii Construction Word

- How Do I eSign Hawaii Construction Form

- How Can I eSign Hawaii Construction Form

- How To eSign Hawaii Construction Document

- Can I eSign Hawaii Construction Document

- How Do I eSign Hawaii Construction Form

- How To eSign Hawaii Construction Form

- How Do I eSign Hawaii Construction Form

- How To eSign Florida Doctors Form

- Help Me With eSign Hawaii Doctors Word

- How Can I eSign Hawaii Doctors Word

- Help Me With eSign New York Doctors PPT

- Can I eSign Hawaii Education PDF

- How To eSign Hawaii Education Document

- Can I eSign Hawaii Education Document

- How Can I eSign South Carolina Doctors PPT

- How Can I eSign Kansas Education Word

- How To eSign Kansas Education Document