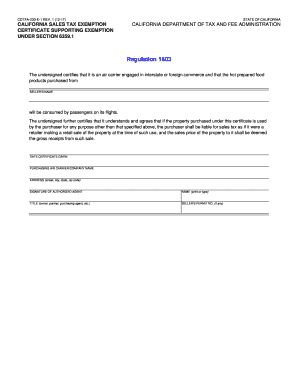

California Tax Exemption Certificate Form

What is the California Tax Exemption Certificate

The California Tax Exemption Certificate is a crucial document that allows qualifying organizations to purchase goods and services without paying sales tax. This certificate is primarily used by non-profit organizations, government entities, and certain educational institutions that meet specific criteria set by the California Department of Tax and Fee Administration (CDTFA). By presenting this certificate, eligible entities can demonstrate their tax-exempt status to vendors, ensuring they are not charged sales tax on qualifying purchases.

How to Obtain the California Tax Exemption Certificate

To obtain a California Tax Exemption Certificate, organizations must first ensure they meet the eligibility requirements. This typically involves being recognized as a non-profit or government entity. Once eligibility is confirmed, the organization must complete the appropriate application form, which can be found on the CDTFA website. After submitting the application, the organization will receive a confirmation of their tax-exempt status, which they can then use to request the certificate from the CDTFA.

Steps to Complete the California Tax Exemption Certificate

Completing the California Tax Exemption Certificate involves several key steps:

- Gather necessary information, including the organization's name, address, and tax identification number.

- Ensure that the organization qualifies for tax exemption under California law.

- Fill out the California Tax Exemption Certificate form accurately, ensuring all required fields are completed.

- Provide any supporting documentation, such as proof of non-profit status or government affiliation.

- Submit the completed certificate to the vendor or seller from whom goods or services are being purchased.

Legal Use of the California Tax Exemption Certificate

The California Tax Exemption Certificate must be used in compliance with state laws and regulations. Organizations should only use the certificate for purchases that are directly related to their exempt activities. Misuse of the certificate, such as using it for personal purchases or for items not qualifying for tax exemption, can lead to penalties and loss of tax-exempt status. It is essential for organizations to keep accurate records of all transactions made using the certificate to ensure compliance with legal requirements.

Key Elements of the California Tax Exemption Certificate

Understanding the key elements of the California Tax Exemption Certificate is vital for proper use. The certificate typically includes:

- The name and address of the purchaser.

- The seller's name and address.

- The type of exemption being claimed (e.g., non-profit, government).

- The tax identification number of the purchaser.

- A declaration that the purchase is exempt from sales tax.

Eligibility Criteria

Eligibility for the California Tax Exemption Certificate is determined by specific criteria set forth by the state. Generally, organizations must be recognized as non-profit entities, government agencies, or educational institutions. Additionally, they must engage in activities that qualify for tax exemption under California law. Organizations should review the CDTFA guidelines to ensure they meet all necessary criteria before applying for the certificate.

Quick guide on how to complete california tax exemption certificate

Complete California Tax Exemption Certificate effortlessly on any device

Digital document management has surged in popularity among businesses and individuals alike. It offers an excellent eco-friendly alternative to traditional printed and signed documents, allowing you to locate the necessary form and securely archive it online. airSlate SignNow equips you with all the resources required to create, modify, and electronically sign your documents swiftly without any hurdles. Administer California Tax Exemption Certificate on any device using airSlate SignNow's Android or iOS applications and enhance any document-oriented task today.

The simplest method to modify and eSign California Tax Exemption Certificate without any hassle

- Obtain California Tax Exemption Certificate and click Get Form to begin.

- Employ the tools we offer to fill out your form.

- Highlight pertinent sections of the documents or obscure sensitive information with tools specifically provided by airSlate SignNow for these tasks.

- Generate your signature using the Sign feature, which takes mere seconds and carries the same legal validity as a conventional wet ink signature.

- Review the details and click on the Done button to save your modifications.

- Choose how you wish to submit your form, via email, SMS, invite link, or download it to your computer.

Purge the worry of lost or misplaced documents, laborious form searches, or mistakes that necessitate reprinting new document copies. airSlate SignNow addresses your document management needs in just a few clicks from your preferred device. Modify and eSign California Tax Exemption Certificate and guarantee excellent communication throughout any phase of your form preparation procedure with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the california tax exemption certificate

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is a tax exempt form?

A tax exempt form is a document used by organizations to claim exemption from sales tax or income tax under specific conditions. By submitting a tax exempt form, eligible businesses can avoid paying taxes on certain purchases. Understanding how to fill out and submit this form can help organizations maximize savings.

-

How can airSlate SignNow help with tax exempt forms?

airSlate SignNow simplifies the process of filling out and signing tax exempt forms electronically. With our platform, users can easily create, send, and eSign these forms securely and efficiently. This saves time and reduces the risk of errors in submissions.

-

Are there any costs associated with using airSlate SignNow for tax exempt forms?

Yes, airSlate SignNow offers various pricing plans that cater to different business needs. While there is a nominal fee to access our platform, the investment pays off through improved efficiency and the ability to handle tax exempt forms seamlessly. We also provide a free trial for new users to explore our features.

-

What features support the management of tax exempt forms?

airSlate SignNow includes features such as customizable templates, automated workflows, and secure eSigning, all of which are valuable for managing tax exempt forms. These features streamline the document process, allowing users to fill out and send forms quickly. Additionally, our platform supports document tracking, ensuring you know when a tax exempt form has been signed.

-

Can I integrate airSlate SignNow with other applications for tax exempt forms?

Absolutely! airSlate SignNow offers integrations with popular applications like Google Drive, Salesforce, and more. This enables users to streamline their workflow and manage tax exempt forms within their existing systems. Integration enhances productivity by reducing the need for manual uploads and data entry.

-

How secure is airSlate SignNow when handling tax exempt forms?

Security is a top priority at airSlate SignNow. Our platform utilizes advanced encryption methods to protect your tax exempt forms and sensitive information. We are also compliant with industry standards to ensure that your documents remain confidential and secure.

-

Can I track the status of my tax exempt forms in airSlate SignNow?

Yes, airSlate SignNow provides real-time tracking of your tax exempt forms. Users can check the status of their documents—whether they are sent, viewed, or signed—directly from the dashboard. This feature keeps you updated and helps manage your workflow effectively.

Get more for California Tax Exemption Certificate

Find out other California Tax Exemption Certificate

- How To Integrate Sign in Banking

- How To Use Sign in Banking

- Help Me With Use Sign in Banking

- Can I Use Sign in Banking

- How Do I Install Sign in Banking

- How To Add Sign in Banking

- How Do I Add Sign in Banking

- How Can I Add Sign in Banking

- Can I Add Sign in Banking

- Help Me With Set Up Sign in Government

- How To Integrate eSign in Banking

- How To Use eSign in Banking

- How To Install eSign in Banking

- How To Add eSign in Banking

- How To Set Up eSign in Banking

- How To Save eSign in Banking

- How To Implement eSign in Banking

- How To Set Up eSign in Construction

- How To Integrate eSign in Doctors

- How To Use eSign in Doctors