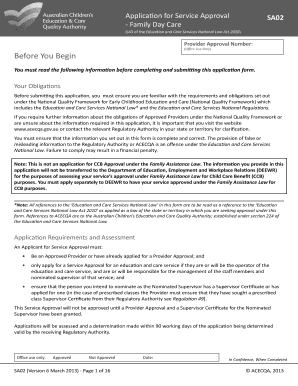

Sa02 Form

What is the SA02 Form

The SA02 form is a specific document used primarily in the context of tax reporting and compliance within the United States. It serves as a declaration for various financial activities and is essential for individuals and businesses to accurately report their income and expenses. Understanding the purpose of the SA02 form helps taxpayers ensure they meet their obligations and avoid potential penalties.

How to Use the SA02 Form

Using the SA02 form involves several key steps to ensure accurate completion and submission. First, gather all necessary financial documents, such as income statements and receipts. Next, fill out the form with precise information regarding your financial activities. It is crucial to double-check all entries for accuracy before submission. Finally, submit the form according to the specified guidelines, whether electronically or via mail.

Steps to Complete the SA02 Form

Completing the SA02 form requires careful attention to detail. Follow these steps for successful completion:

- Review the form instructions thoroughly to understand the required information.

- Gather all relevant financial documents, including income records and expense receipts.

- Fill out the form accurately, ensuring all fields are completed as per the guidelines.

- Check for any errors or omissions before finalizing the form.

- Submit the completed form by the designated deadline to avoid penalties.

Legal Use of the SA02 Form

The SA02 form holds legal significance, as it is used to report financial information to the IRS. Proper use of the form ensures compliance with federal regulations, helping to avoid legal repercussions. It is essential to understand the legal implications of the information provided on the form, as inaccuracies can lead to audits or penalties.

Filing Deadlines / Important Dates

Filing deadlines for the SA02 form vary depending on the taxpayer's situation. Generally, individuals must submit the form by April 15 of the following tax year. However, extensions may be available under certain circumstances. It is important to stay informed about these deadlines to ensure timely submission and compliance with tax laws.

Key Elements of the SA02 Form

The SA02 form contains several key elements that are vital for accurate reporting. These include:

- Taxpayer identification information, such as Social Security Number or Employer Identification Number.

- Details regarding income sources and amounts.

- Information on deductible expenses and credits.

- Signature and date to validate the form.

Examples of Using the SA02 Form

Examples of using the SA02 form can help clarify its application in real-world scenarios. For instance, a self-employed individual might use the form to report income from freelance work, detailing both earnings and expenses. Similarly, a small business owner may utilize the SA02 form to declare revenue and applicable deductions, ensuring compliance with tax regulations.

Quick guide on how to complete sa02 form

Complete Sa02 Form effortlessly on any gadget

Online document management has become increasingly favored by businesses and individuals. It serves as an ideal eco-friendly alternative to conventional printed and signed paperwork, allowing you to locate the correct form and safely store it online. airSlate SignNow equips you with all the tools necessary to create, edit, and eSign your documents swiftly without delays. Manage Sa02 Form on any gadget with airSlate SignNow Android or iOS applications and enhance any document-focused process today.

The simplest method to modify and eSign Sa02 Form effortlessly

- Find Sa02 Form and click Get Form to begin.

- Utilize the tools we offer to complete your document.

- Highlight pertinent sections of the documents or obscure sensitive information with tools that airSlate SignNow provides specifically for that purpose.

- Create your signature using the Sign tool, which takes moments and holds the same legal validity as a conventional wet ink signature.

- Verify the details and click on the Done button to save your changes.

- Select how you would like to send your form, by email, text message (SMS), or invite link, or download it to your computer.

Forget about lost or misplaced documents, tedious form searching, or errors that require printing new document copies. airSlate SignNow meets all your document management needs in just a few clicks from any device you prefer. Modify and eSign Sa02 Form and ensure outstanding communication at every stage of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the sa02 form

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is the SA02 form used for?

The SA02 form is utilized for various document management needs, allowing businesses to streamline their workflow. This form simplifies the process of eSigning documents, ensuring that all parties can sign securely and efficiently. With airSlate SignNow, you can manage SA02 forms effortlessly, enhancing collaboration.

-

How does airSlate SignNow handle the SA02 form?

AirSlate SignNow provides a user-friendly platform to create, send, and manage SA02 forms. You can easily upload your SA02 form, send it to recipients for eSignature, and track the document's status in real time. This ensures that your document management process runs smoothly.

-

Is there a cost associated with using the SA02 form in airSlate SignNow?

Using airSlate SignNow to handle your SA02 form comes with affordable pricing plans tailored to fit various business needs. Our competitive pricing structure allows you to choose a plan that offers the features necessary for your organization. With a range of options, you can find the right value for managing your SA02 forms.

-

What features does airSlate SignNow offer for the SA02 form?

AirSlate SignNow offers a suite of features for the SA02 form, including templates, bulk sending, and customized workflows. Additionally, users can integrate with other applications to streamline their document management processes. These features help ensure that your SA02 form requirements are met efficiently.

-

Can the SA02 form be integrated with other software?

Yes, the SA02 form can seamlessly integrate with various software applications through airSlate SignNow's API and pre-built connectors. This allows you to synchronize your data across multiple platforms while managing your SA02 forms effectively. Integrations enhance productivity by reducing manual data entry.

-

What are the benefits of using airSlate SignNow for the SA02 form?

Using airSlate SignNow for the SA02 form delivers numerous benefits, including improved efficiency, enhanced security, and compliance with legal requirements. The platform simplifies the eSigning process, allowing for quicker turnaround times and better collaboration among team members. Ultimately, it helps businesses save time and improve customer satisfaction.

-

Is it easy to eSign an SA02 form with airSlate SignNow?

Absolutely! AirSlate SignNow makes it incredibly easy to eSign an SA02 form. Users can simply open the document, follow the prompts to add their signatures, and complete the process within minutes. The intuitive interface ensures that anyone can eSign without hassle.

Get more for Sa02 Form

- Reliance lifes declaration of goof health form

- Radiation machine registration form new registrants rh 2261n cdph ca

- Synapse ris pdf form

- Bd 81 1 v 05 claim by owner of property form

- Larrabee fund association inc form

- Bampo tax form town of harpers ferry harpersferrywv

- Chalan 377235201 form

- Cib 01e form

Find out other Sa02 Form

- Electronic signature Indiana Legal Contract Fast

- Electronic signature Indiana Legal Rental Application Online

- Electronic signature Delaware Non-Profit Stock Certificate Free

- Electronic signature Iowa Legal LLC Operating Agreement Fast

- Electronic signature Legal PDF Kansas Online

- Electronic signature Legal Document Kansas Online

- Can I Electronic signature Kansas Legal Warranty Deed

- Can I Electronic signature Kansas Legal Last Will And Testament

- Electronic signature Kentucky Non-Profit Stock Certificate Online

- Electronic signature Legal PDF Louisiana Online

- Electronic signature Maine Legal Agreement Online

- Electronic signature Maine Legal Quitclaim Deed Online

- Electronic signature Missouri Non-Profit Affidavit Of Heirship Online

- Electronic signature New Jersey Non-Profit Business Plan Template Online

- Electronic signature Massachusetts Legal Resignation Letter Now

- Electronic signature Massachusetts Legal Quitclaim Deed Easy

- Electronic signature Minnesota Legal LLC Operating Agreement Free

- Electronic signature Minnesota Legal LLC Operating Agreement Secure

- Electronic signature Louisiana Life Sciences LLC Operating Agreement Now

- Electronic signature Oregon Non-Profit POA Free