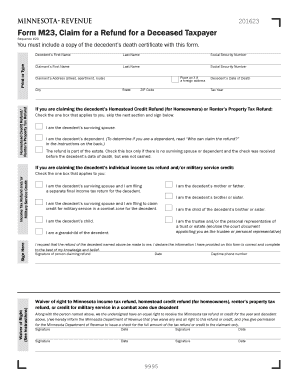

Minnesota Form M23

What is the Minnesota Form M23

The Minnesota Form M23 is an official document used primarily for tax purposes in the state of Minnesota. This form is designed to facilitate the reporting of specific financial information, which may include income, deductions, and credits. It is essential for individuals and businesses to accurately complete this form to ensure compliance with state tax regulations. The form serves as a key tool for the Minnesota Department of Revenue to assess tax obligations and determine eligibility for various tax benefits.

Steps to complete the Minnesota Form M23

Completing the Minnesota Form M23 involves several important steps to ensure accuracy and compliance. Begin by gathering all necessary financial documents, including income statements and previous tax returns. Follow these steps:

- Review the instructions provided with the form to understand the requirements.

- Fill in your personal information, including your name, address, and Social Security number.

- Report your income sources accurately, ensuring all figures are correct.

- Calculate any deductions or credits you may qualify for, as these can significantly impact your tax liability.

- Double-check all entries for accuracy before submitting the form.

Once completed, the form can be submitted electronically or via mail, depending on your preference and the guidelines provided by the Minnesota Department of Revenue.

Legal use of the Minnesota Form M23

The Minnesota Form M23 is legally binding when completed and submitted in accordance with state regulations. To ensure its legal standing, it is crucial to provide accurate information and adhere to all filing deadlines. The form must be signed, and any electronic submissions should comply with eSignature laws, which validate the authenticity of the signatures. Failure to comply with these legal requirements may result in penalties or delays in processing.

How to obtain the Minnesota Form M23

The Minnesota Form M23 can be obtained through several convenient methods. It is available for download directly from the Minnesota Department of Revenue's official website. Additionally, physical copies may be requested from local tax offices or through designated state agencies. Ensure that you are using the most current version of the form to avoid any issues with your submission.

Form Submission Methods (Online / Mail / In-Person)

Submitting the Minnesota Form M23 can be done through multiple channels, providing flexibility for taxpayers. The options include:

- Online Submission: Many taxpayers prefer to submit their forms electronically through the Minnesota Department of Revenue’s online portal, which is secure and efficient.

- Mail: Completed forms can be mailed to the designated address provided in the form instructions. Ensure that you allow adequate time for postal delivery.

- In-Person: For those who prefer face-to-face interaction, forms can be submitted in person at local tax offices, where staff can assist with any questions.

Key elements of the Minnesota Form M23

The Minnesota Form M23 includes several key elements that must be accurately completed for proper processing. Important sections typically include:

- Personal Information: Name, address, and Social Security number.

- Income Details: Comprehensive reporting of all income sources.

- Deductions and Credits: Information on applicable deductions and tax credits.

- Signature: A signed declaration confirming the accuracy of the information provided.

Each of these elements plays a crucial role in determining your tax liability and ensuring compliance with state tax laws.

Quick guide on how to complete minnesota form m23

Effortlessly Prepare Minnesota Form M23 on Any Device

Digital document management has become increasingly favored by businesses and individuals alike. It offers an excellent eco-friendly alternative to traditional printed and signed documents, as you can access the necessary form and securely save it online. airSlate SignNow provides you with all the resources needed to create, modify, and electronically sign your documents swiftly, without any hold-ups. Manage Minnesota Form M23 on any device with the airSlate SignNow Android or iOS applications and streamline any paperwork process today.

Edit and eSign Minnesota Form M23 with Ease

- Find Minnesota Form M23 and click on Get Form to begin.

- Utilize the tools we provide to complete your form.

- Select important sections of the documents or redact sensitive details using the tools that airSlate SignNow specifically offers for this purpose.

- Create your signature with the Sign tool, which takes only seconds and holds the same legal validity as a traditional handwritten signature.

- Review the information and click on the Done button to save your modifications.

- Decide how you wish to send your form via email, text message (SMS), or invitation link, or download it directly to your computer.

Eliminate the worry of lost or misplaced files, tedious form searching, or mistakes that necessitate reprinting new document copies. airSlate SignNow meets all your document management needs in just a few clicks from any device you choose. Modify and eSign Minnesota Form M23 and guarantee exceptional communication at every stage of the document preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the minnesota form m23

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is the mn form m23 and how is it used?

The mn form m23 is a document specifically used in Minnesota for certain legal and administrative purposes. It allows users to gather essential information and submit it effectively. With airSlate SignNow, completing and signing the mn form m23 can be done quickly and securely online.

-

How does airSlate SignNow simplify the mn form m23 process?

airSlate SignNow streamlines the mn form m23 process by providing an intuitive platform where users can fill out, sign, and send the form electronically. This eliminates the need for printing and mailing, saving time and reducing errors. Our solution ensures that your mn form m23 is completed efficiently and accurately.

-

What are the pricing options for using airSlate SignNow with the mn form m23?

airSlate SignNow offers various pricing plans to suit different business needs when handling the mn form m23. Our plans are designed to be cost-effective, allowing businesses to choose a plan that aligns with their document signing frequency and volume. Each plan includes features that help manage the mn form m23 effectively.

-

Can I integrate airSlate SignNow with other software for the mn form m23?

Absolutely! airSlate SignNow supports integration with a variety of applications to enhance your workflow for the mn form m23. Whether you use CRM systems, cloud storage, or other business tools, our platform can seamlessly integrate to ensure you manage your documents efficiently.

-

What are the benefits of using airSlate SignNow for the mn form m23?

Using airSlate SignNow for the mn form m23 offers numerous benefits, including increased efficiency and reduced turnaround time for document signing. Our platform provides robust security features to protect sensitive information, ensuring compliance with legal standards. Additionally, users can track the status of their mn form m23 in real time.

-

Is it easy to edit the mn form m23 in airSlate SignNow?

Yes, editing the mn form m23 in airSlate SignNow is straightforward. Users can easily make necessary changes to the document before sending it for signatures. This flexibility ensures that your mn form m23 is always up-to-date with the latest information.

-

What types of documents can I manage besides the mn form m23?

In addition to the mn form m23, airSlate SignNow allows you to manage a wide range of documents including contracts, agreements, and various forms across different industries. Our platform is versatile, making it an ideal solution for businesses needing to handle multiple types of documents securely and efficiently.

Get more for Minnesota Form M23

- Illinois small form

- Illinois property management package illinois form

- Illinois annual corporation form

- Sample bylaws for an illinois professional corporation illinois form

- Annual minutes for an illinois professional corporation illinois form

- Illinois a corporation form

- Sample transmittal letter for articles of incorporation illinois form

- Sample operating agreement for professional limited liability company pllc illinois form

Find out other Minnesota Form M23

- How Do I Sign New Mexico Sports Limited Power Of Attorney

- Sign Ohio Sports LLC Operating Agreement Easy

- Sign New Jersey Real Estate Limited Power Of Attorney Computer

- Sign New Mexico Real Estate Contract Safe

- How To Sign South Carolina Sports Lease Termination Letter

- How Can I Sign New York Real Estate Memorandum Of Understanding

- Sign Texas Sports Promissory Note Template Online

- Sign Oregon Orthodontists Last Will And Testament Free

- Sign Washington Sports Last Will And Testament Free

- How Can I Sign Ohio Real Estate LLC Operating Agreement

- Sign Ohio Real Estate Quitclaim Deed Later

- How Do I Sign Wisconsin Sports Forbearance Agreement

- How To Sign Oregon Real Estate Resignation Letter

- Can I Sign Oregon Real Estate Forbearance Agreement

- Sign Pennsylvania Real Estate Quitclaim Deed Computer

- How Do I Sign Pennsylvania Real Estate Quitclaim Deed

- How Can I Sign South Dakota Orthodontists Agreement

- Sign Police PPT Alaska Online

- How To Sign Rhode Island Real Estate LLC Operating Agreement

- How Do I Sign Arizona Police Resignation Letter