Ca Form 100 Instructions

What is the Ca Form 100 Instructions

The Ca Form 100 instructions provide guidance for corporations in California to report their income and calculate their tax obligations. This form is essential for entities operating within the state, ensuring compliance with California tax laws. The instructions detail the necessary steps to complete the form accurately, including the types of income that must be reported and the deductions that may be claimed. Understanding these instructions is crucial for maintaining good standing with the California Franchise Tax Board.

Steps to complete the Ca Form 100 Instructions

Completing the Ca Form 100 requires careful attention to detail. Here are the essential steps:

- Gather necessary financial documents, including income statements and expense reports.

- Review the specific sections of the form that apply to your business type.

- Fill out the identification section, including your corporation's name, address, and federal employer identification number (EIN).

- Report total income, including gross receipts and other income sources.

- Claim allowable deductions, ensuring you have documentation for each.

- Calculate the tax owed based on the corporation's taxable income.

- Review the completed form for accuracy before submission.

Legal use of the Ca Form 100 Instructions

The legal use of the Ca Form 100 instructions is vital for corporations to fulfill their tax obligations correctly. Compliance with these instructions ensures that the information submitted is accurate and adheres to California tax regulations. Failure to follow the instructions can lead to penalties or audits from the California Franchise Tax Board. It is important to understand that the form must be submitted by the designated deadlines to avoid late fees.

Required Documents

To complete the Ca Form 100, certain documents are required to support the information provided. These include:

- Financial statements, including balance sheets and income statements.

- Records of all income sources, such as sales and service revenue.

- Documentation for all claimed deductions, such as receipts and invoices.

- Previous tax returns, if applicable, to ensure consistency in reporting.

Form Submission Methods (Online / Mail / In-Person)

Corporations can submit the Ca Form 100 through various methods, providing flexibility to meet compliance requirements. The available submission methods include:

- Online submission via the California Franchise Tax Board's website, which is often faster and more efficient.

- Mailing a paper version of the completed form to the appropriate address specified in the instructions.

- In-person submission at designated Franchise Tax Board offices, which may be necessary for specific circumstances.

Filing Deadlines / Important Dates

Staying informed about filing deadlines is crucial for corporations to avoid penalties. The Ca Form 100 must typically be filed by the 15th day of the third month following the close of the corporation's fiscal year. For corporations operating on a calendar year, this means the due date is March 15. Extensions may be available, but they require filing specific forms and adhering to additional deadlines.

Quick guide on how to complete ca form 100 instructions

Complete Ca Form 100 Instructions effortlessly on any device

Online document management has become widely accepted by enterprises and individuals alike. It offers an ideal eco-friendly substitute for conventional printed and signed documents, as you can locate the right form and securely keep it online. airSlate SignNow equips you with all the tools necessary to create, modify, and eSign your documents swiftly without any hold-ups. Handle Ca Form 100 Instructions on any platform using airSlate SignNow Android or iOS applications and simplify any document-related procedure today.

The simplest way to modify and eSign Ca Form 100 Instructions without hassle

- Locate Ca Form 100 Instructions and then click Get Form to begin.

- Utilize the tools we offer to fill out your form.

- Emphasize important sections of the documents or redact sensitive information using tools that airSlate SignNow provides specifically for that purpose.

- Generate your signature with the Sign tool, which takes mere seconds and holds the same legal validity as a traditional wet ink signature.

- Review all the information and then click on the Done button to save your modifications.

- Choose how you wish to send your form, via email, text message (SMS), invitation link, or download it to your computer.

Say goodbye to lost or misplaced files, cumbersome form searching, or errors that necessitate reprinting new document copies. airSlate SignNow addresses your document management needs in just a few clicks from any device of your choice. Alter and eSign Ca Form 100 Instructions to ensure exceptional communication at any point in your form preparation journey with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the ca form 100 instructions

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

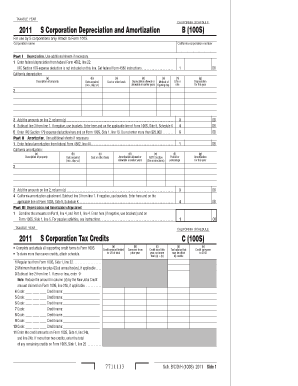

What are the CA Form 100S instructions?

The CA Form 100S instructions provide guidelines for filing the California S Corporation Franchise Tax Board form. These instructions are crucial for ensuring compliance with state regulations and understanding tax obligations for S Corporations in California.

-

How can airSlate SignNow assist with CA Form 100S instructions?

airSlate SignNow simplifies the eSigning and document management process, making it easy to complete and submit CA Form 100S instructions securely. Our platform streamlines workflows, enabling you to focus on filling out the necessary documentation accurately.

-

What features does airSlate SignNow offer for CA Form 100S users?

airSlate SignNow offers a range of features such as customizable templates, in-app document editing, and secure eSigning, all of which can support the completion of CA Form 100S instructions. These features enhance efficiency, reduce errors, and ensure a seamless filing experience.

-

Is there a cost associated with using airSlate SignNow for CA Form 100S instructions?

Yes, airSlate SignNow offers various pricing plans to cater to different business needs, starting with a free trial. The plans include essential features to help manage CA Form 100S instructions efficiently and affordably.

-

Can I integrate airSlate SignNow with other tools for CA Form 100S instructions?

Absolutely! airSlate SignNow provides integration with various software applications, enabling you to enhance your workflow related to CA Form 100S instructions. This allows for seamless data transfer and improved productivity across different platforms.

-

What are the benefits of using airSlate SignNow for CA Form 100S instructions?

Using airSlate SignNow for CA Form 100S instructions offers numerous benefits, including increased speed in document processing, improved accuracy through rich editing tools, and enhanced security for sensitive information. Additionally, the platform simplifies collaboration among team members.

-

Are there any customer support options for using airSlate SignNow with CA Form 100S instructions?

Yes, airSlate SignNow provides robust customer support options including FAQs, live chat, and email assistance to help you with CA Form 100S instructions. Our dedicated support teams are available to answer your questions and provide guidance whenever needed.

Get more for Ca Form 100 Instructions

- Confidentiality agreements noncompetition in employment form

- Restricted endowment to religious institution form

- Agreement between owner and construction manager for services in overseeing a construction project form

- Advertising opportunity sample letter form

- Request production documents form

- Appointment resolution 497328650 form

- Company confidentiality form

- Nondisclosure agreement in connection with discussion of business plan form

Find out other Ca Form 100 Instructions

- How To Sign Wyoming Non-Profit Business Plan Template

- How To Sign Wyoming Non-Profit Credit Memo

- Sign Wisconsin Non-Profit Rental Lease Agreement Simple

- Sign Wisconsin Non-Profit Lease Agreement Template Safe

- Sign South Dakota Life Sciences Limited Power Of Attorney Mobile

- Sign Alaska Plumbing Moving Checklist Later

- Sign Arkansas Plumbing Business Plan Template Secure

- Sign Arizona Plumbing RFP Mobile

- Sign Arizona Plumbing Rental Application Secure

- Sign Colorado Plumbing Emergency Contact Form Now

- Sign Colorado Plumbing Emergency Contact Form Free

- How Can I Sign Connecticut Plumbing LLC Operating Agreement

- Sign Illinois Plumbing Business Plan Template Fast

- Sign Plumbing PPT Idaho Free

- How Do I Sign Wyoming Life Sciences Confidentiality Agreement

- Sign Iowa Plumbing Contract Safe

- Sign Iowa Plumbing Quitclaim Deed Computer

- Sign Maine Plumbing LLC Operating Agreement Secure

- How To Sign Maine Plumbing POA

- Sign Maryland Plumbing Letter Of Intent Myself