Restricted Endowment to Religious Institution Form

What is the Restricted Endowment To Religious Institution

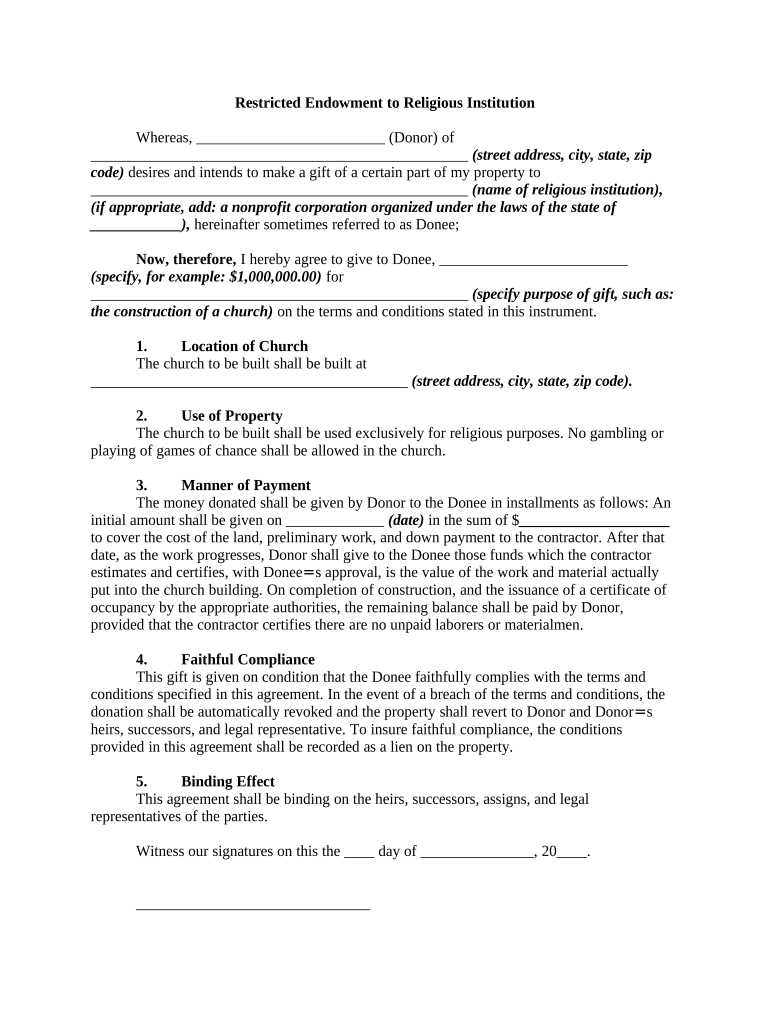

The Restricted Endowment To Religious Institution is a financial arrangement designed to support a specific religious organization or cause. This endowment typically involves donations that are earmarked for particular purposes, ensuring that the funds are used in accordance with the donor's wishes. The restrictions placed on the endowment can vary, often specifying how the funds should be utilized, such as for educational programs, community outreach, or maintenance of facilities. Understanding the nature of this endowment is crucial for both donors and religious institutions to ensure compliance with legal and financial guidelines.

Steps to complete the Restricted Endowment To Religious Institution

Completing the Restricted Endowment To Religious Institution form involves several key steps. First, gather all necessary information, including the details of the religious institution, the purpose of the endowment, and the amount being donated. Next, accurately fill out the form, ensuring that all fields are completed as required. It is important to clearly outline any restrictions associated with the endowment to avoid future misunderstandings. Once the form is filled out, review it for accuracy and completeness before submitting it to the appropriate authority within the religious institution.

Legal use of the Restricted Endowment To Religious Institution

The legal use of the Restricted Endowment To Religious Institution is governed by both state and federal laws. These laws ensure that the funds are used in accordance with the donor's intentions and that the religious institution adheres to any applicable regulations. It is essential for institutions to maintain transparency in their financial dealings and to comply with guidelines set forth by the Internal Revenue Service (IRS) regarding charitable contributions. Failure to comply with these legal requirements can lead to penalties and loss of tax-exempt status.

Key elements of the Restricted Endowment To Religious Institution

Several key elements define the Restricted Endowment To Religious Institution. These include the purpose of the endowment, the specific restrictions imposed by the donor, and the governance structure of the religious institution managing the funds. Additionally, proper documentation is essential to outline the terms of the endowment, including any reporting requirements and the duration of the restrictions. Understanding these elements helps ensure that both donors and institutions fulfill their obligations and maintain compliance with legal standards.

Who Issues the Form

The Restricted Endowment To Religious Institution form is typically issued by the religious institution itself or by a governing body associated with the institution. This form may also be developed in accordance with local or state regulations that govern charitable donations and endowments. It is important for institutions to provide clear guidelines on how to obtain and complete the form to facilitate the donation process for potential donors.

Examples of using the Restricted Endowment To Religious Institution

Examples of using the Restricted Endowment To Religious Institution include funding specific projects, such as building a new community center, supporting educational programs, or providing scholarships for students attending religious schools. Donors may also choose to restrict funds for maintenance of historical sites or to support outreach initiatives in the community. These examples illustrate how targeted endowments can significantly impact the mission and activities of a religious institution.

Quick guide on how to complete restricted endowment to religious institution

Prepare Restricted Endowment To Religious Institution effortlessly on any device

Online document management has gained traction among businesses and individuals. It offers an ideal environmentally friendly alternative to conventional printed and signed documents, as you can easily locate the needed form and securely store it online. airSlate SignNow equips you with all the tools necessary to create, edit, and eSign your documents swiftly without delays. Manage Restricted Endowment To Religious Institution on any platform using the airSlate SignNow Android or iOS applications and enhance any document-based process today.

How to edit and eSign Restricted Endowment To Religious Institution without hassle

- Obtain Restricted Endowment To Religious Institution and then click Get Form to begin.

- Utilize the tools we provide to complete your form.

- Emphasize important sections of the documents or obscure sensitive information with tools that airSlate SignNow offers specifically for this purpose.

- Create your signature using the Sign tool, which takes moments and carries the same legal standing as a conventional wet ink signature.

- Review all the information and then click on the Done button to save your modifications.

- Choose how you prefer to share your form, whether by email, SMS, or invite link, or download it to your computer.

Eliminate concerns about lost or misplaced documents, tedious form searching, or errors that require printing new copies. airSlate SignNow caters to your document management needs in just a few clicks from any chosen device. Edit and eSign Restricted Endowment To Religious Institution and ensure excellent communication at every stage of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

People also ask

-

What is a Restricted Endowment To Religious Institution?

A Restricted Endowment To Religious Institution refers to funds that are designated for specific purposes within a religious organization. These endowments are crucial as they ensure financial stability while supporting specific missions or projects within the institution.

-

What are the benefits of creating a Restricted Endowment To Religious Institution?

Creating a Restricted Endowment To Religious Institution provides long-term financial support dedicated to specific areas of ministry or outsignNow. This type of endowment helps facilitate planned giving, ensuring that contributions are used according to the donor's wishes and enhancing the sustainability of the ministry.

-

How can airSlate SignNow assist with managing Restricted Endowment To Religious Institution documentation?

airSlate SignNow simplifies the process of managing Restricted Endowment To Religious Institution documentation by allowing organizations to easily send, sign, and store essential documents digitally. This ensures that all documents are securely managed and accessible whenever needed.

-

Is there a pricing model for using airSlate SignNow related to Restricted Endowment To Religious Institution?

Yes, airSlate SignNow offers flexible pricing plans that can accommodate the needs of any organization handling a Restricted Endowment To Religious Institution. The cost-effective solutions ensure that both large and small institutions can benefit from our eSigning services without breaking the budget.

-

What features does airSlate SignNow offer for managing Restricted Endowment To Religious Institution agreements?

airSlate SignNow includes features like customizable templates, secure cloud storage, and tracking tools that facilitate the management of Restricted Endowment To Religious Institution agreements. These tools make it easy for organizations to keep their records organized and compliant.

-

Can airSlate SignNow integrate with other management systems used for Restricted Endowment To Religious Institution?

Absolutely! airSlate SignNow offers various integrations with popular management systems, which can streamline the administration of a Restricted Endowment To Religious Institution. This ensures seamless operations and data flow across platforms, enhancing overall efficiency.

-

How does airSlate SignNow enhance collaboration for Restricted Endowment To Religious Institution?

With airSlate SignNow, collaboration on documents related to a Restricted Endowment To Religious Institution becomes effortless. Users can invite team members to review, comment, and sign documents in real-time, improving communication and reducing turnaround time.

Get more for Restricted Endowment To Religious Institution

Find out other Restricted Endowment To Religious Institution

- Can I eSign Hawaii Reference Checking Form

- Help Me With eSign Hawaii Acknowledgement Letter

- eSign Rhode Island Deed of Indemnity Template Secure

- eSign Illinois Car Lease Agreement Template Fast

- eSign Delaware Retainer Agreement Template Later

- eSign Arkansas Attorney Approval Simple

- eSign Maine Car Lease Agreement Template Later

- eSign Oregon Limited Power of Attorney Secure

- How Can I eSign Arizona Assignment of Shares

- How To eSign Hawaii Unlimited Power of Attorney

- How To eSign Louisiana Unlimited Power of Attorney

- eSign Oklahoma Unlimited Power of Attorney Now

- How To eSign Oregon Unlimited Power of Attorney

- eSign Hawaii Retainer for Attorney Easy

- How To eSign Texas Retainer for Attorney

- eSign Hawaii Standstill Agreement Computer

- How Can I eSign Texas Standstill Agreement

- How To eSign Hawaii Lease Renewal

- How Can I eSign Florida Lease Amendment

- eSign Georgia Lease Amendment Free