Irs Form 3903

What is the IRS Form 3903

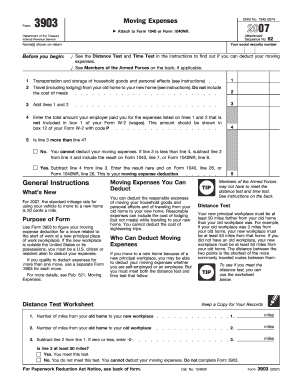

The IRS Form 3903 is a tax form used by individuals to claim deductions for moving expenses related to a job change. This form is particularly relevant for taxpayers who have relocated for work and meet specific criteria set by the IRS. The purpose of Form 3903 is to provide a structured way for taxpayers to report their moving expenses and seek reimbursement for eligible costs incurred during the relocation process.

How to Use the IRS Form 3903

Using the IRS Form 3903 involves several steps to ensure accurate reporting of moving expenses. Taxpayers must first determine if they qualify for the deduction based on their employment status and the distance of their move. Once eligibility is confirmed, individuals can fill out the form by detailing their moving expenses, including transportation, storage, and travel costs. It is essential to keep receipts and documentation to support the claims made on the form.

Steps to Complete the IRS Form 3903

Completing the IRS Form 3903 requires careful attention to detail. Follow these steps:

- Gather all relevant documents, including receipts for moving expenses.

- Fill out your personal information in the designated sections.

- List all eligible moving expenses, ensuring each cost is clearly itemized.

- Calculate the total amount of your moving expenses and enter it on the form.

- Review the completed form for accuracy before submission.

Legal Use of the IRS Form 3903

The legal use of IRS Form 3903 is governed by IRS regulations, which stipulate that only eligible moving expenses can be claimed. Taxpayers must adhere to the guidelines provided by the IRS to ensure compliance. Failure to follow these regulations may result in penalties or disallowance of the claimed deductions. It is crucial to understand the legal implications of the information provided on this form.

Filing Deadlines / Important Dates

Filing deadlines for the IRS Form 3903 align with the general tax filing deadlines set by the IRS. Typically, individual tax returns are due on April 15 of each year. However, if this date falls on a weekend or holiday, the deadline may be extended. Taxpayers should be aware of any changes to deadlines and ensure that Form 3903 is submitted in a timely manner to avoid penalties.

Required Documents

To complete the IRS Form 3903, taxpayers must provide several key documents, including:

- Receipts for moving expenses, such as transportation and storage.

- Proof of employment, confirming the job change that necessitated the move.

- Any additional documentation that supports the claim for moving expenses.

Eligibility Criteria

Eligibility for claiming deductions on IRS Form 3903 is based on specific criteria established by the IRS. Taxpayers must have moved due to a job change, and the new job must be at least fifty miles farther from their old home than their previous job. Additionally, the move must occur within one year of starting the new job. Meeting these criteria is essential for successfully claiming moving expense deductions.

Quick guide on how to complete irs form 3903 1655414

Manage Irs Form 3903 effortlessly on any device

Digital document management has become increasingly popular among businesses and individuals. It offers an ideal eco-friendly alternative to conventional printed and signed documents, as you can obtain the necessary form and securely store it online. airSlate SignNow provides you with all the tools required to create, modify, and eSign your documents quickly without any holdups. Handle Irs Form 3903 on any device using airSlate SignNow Android or iOS applications and enhance any document-related task today.

The easiest way to modify and eSign Irs Form 3903 with ease

- Find Irs Form 3903 and click on Get Form to begin.

- Use the tools we offer to complete your document.

- Highlight important sections of the documents or redact sensitive information with tools that airSlate SignNow provides specifically for this purpose.

- Create your eSignature using the Sign tool, which takes moments and has the same legal validity as a traditional handwritten signature.

- Review the details and click on the Done button to save your changes.

- Choose how you would like to share your form, via email, text message (SMS), or invitation link, or download it to your computer.

Say goodbye to lost or misplaced documents, tedious form searching, or mistakes that require printing new copies. airSlate SignNow caters to all your document management needs in just a few clicks from any device of your choice. Edit and eSign Irs Form 3903 and ensure excellent communication throughout your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the irs form 3903 1655414

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is IRS Form 3903 and how does it relate to airSlate SignNow?

IRS Form 3903 is used to claim your moving expenses deduction when you relocate for a job. By utilizing airSlate SignNow, you can easily eSign and securely share your IRS Form 3903 with tax professionals or employers, enhancing your workflow efficiency.

-

How can I electronically sign IRS Form 3903 with airSlate SignNow?

With airSlate SignNow, you can upload your IRS Form 3903, add eSignature fields, and send it for signature. The platform ensures your document is legally binding and meets all compliance requirements, so you can submit your tax claim confidently.

-

Are there costs associated with using airSlate SignNow for IRS Form 3903?

airSlate SignNow offers various pricing plans to fit your business needs, ranging from basic to enterprise solutions. All plans provide the necessary tools to manage files like IRS Form 3903 while keeping expenses low and transparency high.

-

What features does airSlate SignNow offer for IRS Form 3903 management?

airSlate SignNow includes features like document templates, automated workflows, and secure cloud storage, which simplify the management of IRS Form 3903. These tools help streamline your tax preparation process and minimize errors.

-

Can I store my IRS Form 3903 securely in airSlate SignNow?

Absolutely! airSlate SignNow provides secure cloud storage for your IRS Form 3903 and other documents. Your files are protected with bank-level encryption, ensuring that your personal and financial information remains confidential.

-

Does airSlate SignNow integrate with other applications for handling IRS Form 3903?

Yes, airSlate SignNow seamlessly integrates with various applications such as Google Drive, Dropbox, and other document management systems. This enables users to manage and share their IRS Form 3903 more effectively across different platforms.

-

How can airSlate SignNow improve the process of submitting IRS Form 3903?

By using airSlate SignNow, the process of completing and submitting IRS Form 3903 becomes more straightforward. The platform allows for quick editing, eSigning, and tracking, ensuring that you meet all deadlines without unnecessary delays.

Get more for Irs Form 3903

- Legal last will and testament form for single person with adult and minor children kentucky

- Legal last will and testament form for single person with adult children kentucky

- Legal last will and testament for married person with minor children from prior marriage kentucky form

- Legal last will and testament form for married person with adult children from prior marriage kentucky

- Legal last will and testament form for divorced person not remarried with adult children kentucky

- Legal last will and testament form for divorced person not remarried with no children kentucky

- Legal last will and testament form for divorced person not remarried with minor children kentucky

- Legal last will and testament form for divorced person not remarried with adult and minor children kentucky

Find out other Irs Form 3903

- Electronic signature Arizona Real Estate Business Plan Template Free

- Electronic signature Washington Legal Contract Safe

- How To Electronic signature Arkansas Real Estate Contract

- Electronic signature Idaho Plumbing Claim Myself

- Electronic signature Kansas Plumbing Business Plan Template Secure

- Electronic signature Louisiana Plumbing Purchase Order Template Simple

- Can I Electronic signature Wyoming Legal Limited Power Of Attorney

- How Do I Electronic signature Wyoming Legal POA

- How To Electronic signature Florida Real Estate Contract

- Electronic signature Florida Real Estate NDA Secure

- Can I Electronic signature Florida Real Estate Cease And Desist Letter

- How Can I Electronic signature Hawaii Real Estate LLC Operating Agreement

- Electronic signature Georgia Real Estate Letter Of Intent Myself

- Can I Electronic signature Nevada Plumbing Agreement

- Electronic signature Illinois Real Estate Affidavit Of Heirship Easy

- How To Electronic signature Indiana Real Estate Quitclaim Deed

- Electronic signature North Carolina Plumbing Business Letter Template Easy

- Electronic signature Kansas Real Estate Residential Lease Agreement Simple

- How Can I Electronic signature North Carolina Plumbing Promissory Note Template

- Electronic signature North Dakota Plumbing Emergency Contact Form Mobile