Form 1139

What is the Form 1139

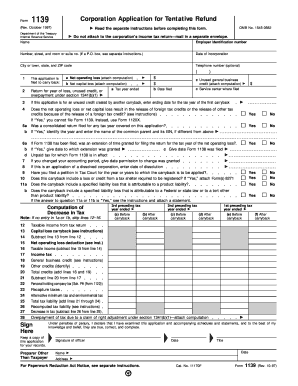

The Form 1139, also known as the Application for Tentative Refund, is a tax form used by corporations to claim a refund for overpayments of estimated tax or to apply for a refund due to a carryback of certain tax attributes. This form is particularly relevant for corporations that have experienced losses in the current year that can be carried back to offset taxes paid in prior years. It is essential for businesses to understand the purpose of this form to ensure they maximize their tax benefits.

Steps to complete the Form 1139

Completing the Form 1139 involves several key steps to ensure accuracy and compliance with IRS requirements. Start by gathering all necessary financial documents, including prior year tax returns and any relevant schedules. Follow these steps:

- Fill in the corporation's name, address, and Employer Identification Number (EIN) at the top of the form.

- Indicate the tax year for which you are applying for a refund.

- Complete the sections detailing the tax attributes being carried back, including any net operating losses or capital losses.

- Calculate the tentative refund amount based on the carryback provisions applicable to your situation.

- Sign and date the form, ensuring that it is filed by the deadline to avoid penalties.

Legal use of the Form 1139

The legal use of Form 1139 is governed by IRS regulations, which stipulate that the form must be filed within a specific timeframe to be valid. Corporations must adhere to the guidelines set forth by the IRS to ensure that the application for a tentative refund is legally binding. This includes proper documentation of losses and adherence to the carryback rules as outlined in the Internal Revenue Code. Failure to comply with these regulations can result in denial of the refund request.

Required Documents

When filing Form 1139, certain documents are required to support your claim for a tentative refund. These documents typically include:

- Prior year tax returns that reflect the overpayment or losses.

- Financial statements that detail the corporation's income and expenses for the current year.

- Schedules or forms that substantiate any carryback claims, such as Form 1120 or Schedule C.

- Any correspondence with the IRS related to previous tax filings that may impact the refund claim.

Filing Deadlines / Important Dates

Understanding the filing deadlines for Form 1139 is crucial for corporations seeking a tentative refund. Generally, Form 1139 must be filed within twelve months of the end of the tax year in which the loss occurred. For example, if a corporation incurs a loss in the tax year ending December 31, it must file Form 1139 by December 31 of the following year. It is important to keep track of these dates to ensure timely submission and avoid potential penalties.

Examples of using the Form 1139

Form 1139 can be utilized in various scenarios where corporations seek to recover taxes due to losses. For instance, a corporation that incurred a significant net operating loss in the current tax year may use Form 1139 to carry back that loss to offset taxable income from the previous two years. This can result in a substantial refund of taxes previously paid. Additionally, businesses that experience capital losses can also apply for refunds using this form, illustrating its versatility in tax planning and recovery.

Quick guide on how to complete form 1139

Prepare Form 1139 effortlessly on any device

Digital document management has gained traction among organizations and individuals. It offers an excellent environmentally friendly substitute for conventional printed and signed paperwork, allowing you to find the suitable form and securely keep it online. airSlate SignNow provides you with all the tools necessary to create, modify, and eSign your documents swiftly without delays. Manage Form 1139 on any device using airSlate SignNow Android or iOS applications and enhance any document-centric task today.

The easiest way to modify and eSign Form 1139 with ease

- Find Form 1139 and click Get Form to initiate the process.

- Make use of the tools we provide to complete your form.

- Emphasize pertinent sections of the documents or obscure sensitive information with tools that airSlate SignNow specifically offers for that purpose.

- Craft your signature using the Sign tool, which takes seconds and holds the same legal validity as a traditional wet ink signature.

- Verify the details and click on the Done button to save your changes.

- Choose how you want to send your form, via email, text message (SMS), or invitation link, or download it to your computer.

Forget about lost or misplaced files, tedious form searching, or errors that necessitate printing new document copies. airSlate SignNow meets all your document management needs in a few clicks from a device of your choice. Edit and eSign Form 1139 and ensure excellent communication at any stage of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the form 1139

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is a form 1139 example and how is it used?

A form 1139 example represents a template or instance of the IRS Form 1139, which is used by corporations to apply for a tentative carryback adjustment. This form enables companies to adjust their taxes based on a net operating loss. By reviewing a form 1139 example, businesses can better understand the information required to effectively file their claims.

-

How can airSlate SignNow help with completing a form 1139 example?

airSlate SignNow simplifies the process of completing a form 1139 example by providing an intuitive platform for document editing and electronic signatures. Users can easily fill out the necessary fields, add attachments, and send the form for signature securely. This streamlines the paperwork process, making it faster and more efficient.

-

Is there a cost associated with using airSlate SignNow for form 1139 example processing?

Yes, airSlate SignNow offers various pricing plans tailored to different business needs. You can choose a plan that suits your budget and access features specifically designed to optimize the completion of forms, such as the form 1139 example. The cost is competitive, providing good value for an effective e-signing solution.

-

What features does airSlate SignNow offer for handling form 1139 examples?

airSlate SignNow offers features like customizable templates, secure e-signatures, and collaboration tools for handling form 1139 examples. These features enhance document management by allowing multiple users to collaborate in real-time, thereby reducing errors and ensuring compliance. Additionally, automated reminders help keep the process on track.

-

Can I integrate airSlate SignNow with other applications while working on a form 1139 example?

Absolutely! airSlate SignNow integrates seamlessly with various applications, including cloud storage and productivity tools. This integration allows users to access their documents easily and work on a form 1139 example without switching platforms. It enhances productivity by consolidating workflows in one place.

-

What are the benefits of using airSlate SignNow for a form 1139 example?

Using airSlate SignNow for a form 1139 example offers numerous benefits, including time savings and improved accuracy. The platform ensures that all necessary fields are completed correctly and provides easy access to signed documents. Additionally, the document tracking feature allows users to monitor the status of their forms in real time.

-

Is my data secure when using airSlate SignNow for form 1139 example?

Yes, data security is a top priority for airSlate SignNow. The platform uses industry-standard encryption to protect sensitive information, ensuring that your form 1139 example and related documents remain secure. Regular security audits and compliance with privacy regulations further enhance user confidence in data protection.

Get more for Form 1139

- Algebra 1 unit 1 practice test name building blocks of form

- Personal training sheet form

- Ijca word template form

- Clawr orientation hours form

- Ue4 compendium form

- Space maintainer order form pdf denovo

- Witness amp exhibit list yavapai county courts website form

- Application for registration lpg form 16b railroad commission

Find out other Form 1139

- How To Sign South Carolina Time Off Policy

- How To Sign Iowa Christmas Bonus Letter

- How To Sign Nevada Christmas Bonus Letter

- Sign New Jersey Promotion Announcement Simple

- Sign Louisiana Company Bonus Letter Safe

- How To Sign Delaware Letter of Appreciation to Employee

- How To Sign Florida Letter of Appreciation to Employee

- How Do I Sign New Jersey Letter of Appreciation to Employee

- How Do I Sign Delaware Direct Deposit Enrollment Form

- How To Sign Alabama Employee Emergency Notification Form

- How To Sign Oklahoma Direct Deposit Enrollment Form

- Sign Wyoming Direct Deposit Enrollment Form Online

- Sign Nebraska Employee Suggestion Form Now

- How Can I Sign New Jersey Employee Suggestion Form

- Can I Sign New York Employee Suggestion Form

- Sign Michigan Overtime Authorization Form Mobile

- How To Sign Alabama Payroll Deduction Authorization

- How To Sign California Payroll Deduction Authorization

- How To Sign Utah Employee Emergency Notification Form

- Sign Maine Payroll Deduction Authorization Simple