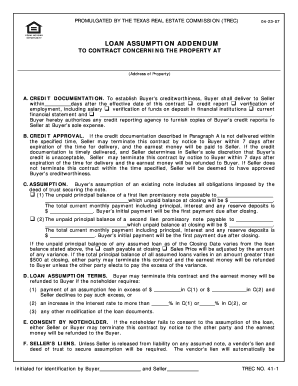

Loan Assumption Addendum Form

What is the Loan Assumption Addendum

The loan assumption addendum is a legal document that allows a buyer to take over the seller's existing mortgage under specific terms. This addendum is typically used in real estate transactions when the buyer is assuming the seller's loan, which can be beneficial in situations where the existing mortgage has a lower interest rate than current market rates. By using this addendum, both parties can outline the responsibilities and obligations associated with the loan transfer, ensuring clarity and legal compliance.

How to Use the Loan Assumption Addendum

To effectively use the loan assumption addendum, both the buyer and seller should review the terms of the existing mortgage and understand the implications of the assumption. The addendum must be filled out accurately, detailing the loan's specifics, including the loan amount, interest rate, and any other pertinent details. Both parties should sign the document to validate the agreement. It is advisable to consult with a legal professional to ensure that all aspects of the addendum comply with relevant laws and regulations.

Steps to Complete the Loan Assumption Addendum

Completing the loan assumption addendum involves several key steps:

- Review the existing mortgage agreement to understand the terms of the loan.

- Gather necessary information about the buyer, including financial qualifications.

- Fill out the addendum, ensuring all details are accurate and complete.

- Both the buyer and seller should sign the document, along with any required witnesses.

- Submit the signed addendum to the lender for approval.

Key Elements of the Loan Assumption Addendum

Several important elements must be included in the loan assumption addendum to ensure its effectiveness and legality:

- Loan Details: Include the loan amount, interest rate, and payment terms.

- Parties Involved: Clearly identify the buyer and seller, including their legal names and contact information.

- Assumption Terms: Outline the conditions under which the loan is being assumed.

- Signatures: Ensure that both parties sign the document to validate the agreement.

Legal Use of the Loan Assumption Addendum

The legal use of the loan assumption addendum is governed by state laws and the terms of the original mortgage. It is essential for both parties to understand their rights and obligations under the assumption. The addendum must comply with federal and state regulations regarding mortgage assumptions, including any necessary disclosures. Consulting with a real estate attorney can help ensure that the addendum meets all legal requirements.

Eligibility Criteria

Eligibility to use the loan assumption addendum typically depends on the lender's policies and the terms of the existing mortgage. Generally, the buyer must demonstrate financial capability to assume the loan, which may include a credit check and proof of income. Additionally, the original loan must allow for assumption; some loans may have restrictions or require the lender's approval before an assumption can take place.

Quick guide on how to complete loan assumption addendum 16915289

Easily Prepare Loan Assumption Addendum on Any Device

The management of online documents has become increasingly popular among businesses and individuals. It offers an ideal environmentally friendly alternative to traditional printed and signed documents, allowing you to access the correct form and safely store it online. airSlate SignNow provides you with all the necessary tools to create, modify, and eSign your documents swiftly without any delays. Manage Loan Assumption Addendum on any device using the airSlate SignNow Android or iOS applications and enhance any document-driven process today.

Effortlessly Modify and eSign Loan Assumption Addendum

- Locate Loan Assumption Addendum and click on Get Form to begin.

- Utilize the tools we provide to complete your document.

- Emphasize important sections of your documents or obscure sensitive information with tools that airSlate SignNow specifically offers for this purpose.

- Create your eSignature using the Sign tool, which only takes a few seconds and carries the same legal validity as a conventional wet ink signature.

- Review all the details and then click on the Done button to save your modifications.

- Choose your preferred method to send your form, whether by email, SMS, invite link, or download it to your PC.

Eliminate concerns about lost or misplaced documents, tedious form navigation, or mistakes that necessitate printing new document copies. airSlate SignNow fulfills all your document management needs in just a few clicks from any device you choose. Edit and eSign Loan Assumption Addendum to ensure excellent communication at every stage of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the loan assumption addendum 16915289

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is a loan assumption addendum?

A loan assumption addendum is a legal document that outlines the terms under which a buyer can take over an existing loan from the seller. This addendum is crucial for defining the responsibilities and obligations of both parties involved in the loan assumption process. Understanding this document can help facilitate a smoother transition during property transactions.

-

How does airSlate SignNow facilitate the creation of a loan assumption addendum?

airSlate SignNow provides an easy-to-use platform that allows users to create, send, and eSign a loan assumption addendum effortlessly. Our templates and document management tools streamline the drafting process, ensuring that all necessary clauses are included. With our solution, you can quickly customize the addendum to fit your specific needs and requirements.

-

Is there a cost associated with using airSlate SignNow for a loan assumption addendum?

Yes, airSlate SignNow offers flexible pricing plans that cater to businesses of all sizes. These plans provide access to features needed to create and manage a loan assumption addendum effectively. By choosing a cost-effective subscription, you can benefit from additional functionalities that enhance your overall document management experience.

-

What are the main benefits of using a loan assumption addendum?

Utilizing a loan assumption addendum can simplify the transfer of mortgage obligations, potentially saving you time and money. It allows the buyer to take over the existing loan terms, which may offer more favorable conditions compared to securing a new loan. Furthermore, it helps ensure that all parties are clear on their obligations in the transaction.

-

Can airSlate SignNow integrate with other software tools for managing loan documents?

Yes, airSlate SignNow is designed to seamlessly integrate with various software tools that help manage financial documents and transactions. This feature allows users to automate workflows and streamline the process of creating a loan assumption addendum alongside other relevant documents. Integration enhances efficiency and helps maintain a cohesive document management system.

-

How can I ensure the loan assumption addendum is legally binding?

To ensure your loan assumption addendum is legally binding, it must be properly signed and dated by all parties involved in the agreement. Utilizing airSlate SignNow’s eSignature feature ensures that your document meets legal standards. Additionally, it is advisable to consult with a legal professional to ensure the addendum complies with applicable laws.

-

What types of loans can be included in a loan assumption addendum?

Typically, a loan assumption addendum can be used for various types of loans, including conventional mortgages, FHA loans, and VA loans. Each loan type may have specific requirements regarding assumptions, so it's essential to review the terms of the existing loan agreement. With airSlate SignNow, you can customize your addendum to reflect these specific loan details accurately.

Get more for Loan Assumption Addendum

- Consent change name form

- Change name person form

- Maryland name change order form

- Name change minor maryland form

- Md change file form

- Md service process form

- No fault uncontested agreed divorce package for dissolution of marriage with adult children and with or without property and 497310053 form

- Bill of sale of automobile and odometer statement maryland form

Find out other Loan Assumption Addendum

- eSignature Washington Landlord tenant lease agreement Free

- eSignature Wisconsin Landlord tenant lease agreement Online

- eSignature Wyoming Landlord tenant lease agreement Online

- How Can I eSignature Oregon lease agreement

- eSignature Washington Lease agreement form Easy

- eSignature Alaska Lease agreement template Online

- eSignature Alaska Lease agreement template Later

- eSignature Massachusetts Lease agreement template Myself

- Can I eSignature Arizona Loan agreement

- eSignature Florida Loan agreement Online

- eSignature Florida Month to month lease agreement Later

- Can I eSignature Nevada Non-disclosure agreement PDF

- eSignature New Mexico Non-disclosure agreement PDF Online

- Can I eSignature Utah Non-disclosure agreement PDF

- eSignature Rhode Island Rental agreement lease Easy

- eSignature New Hampshire Rental lease agreement Simple

- eSignature Nebraska Rental lease agreement forms Fast

- eSignature Delaware Rental lease agreement template Fast

- eSignature West Virginia Rental lease agreement forms Myself

- eSignature Michigan Rental property lease agreement Online