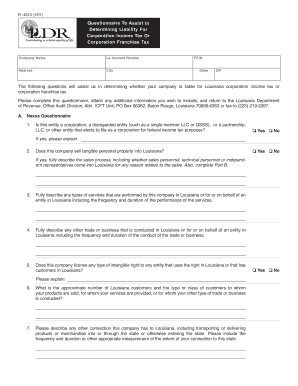

R 4310 Louisiana Department of Revenue Revenue Louisiana Form

What is the R-4310 Louisiana Department of Revenue Revenue Louisiana?

The R-4310 form is a specific document used by the Louisiana Department of Revenue for various tax-related purposes. This form is essential for individuals and businesses to report income, claim deductions, or fulfill other tax obligations. Understanding the purpose of the R-4310 is crucial for ensuring compliance with state tax laws. It is designed to streamline the process of tax reporting and facilitate communication between taxpayers and the Louisiana Department of Revenue.

Steps to complete the R-4310 Louisiana Department of Revenue Revenue Louisiana

Completing the R-4310 form requires careful attention to detail to ensure accuracy and compliance. Here are the general steps to follow:

- Gather necessary information, including personal identification details and financial records.

- Fill out the form accurately, ensuring all sections are completed as required.

- Review the completed form for any errors or omissions.

- Sign and date the form to certify its accuracy.

- Submit the form through the appropriate channels, whether online, by mail, or in person.

How to use the R-4310 Louisiana Department of Revenue Revenue Louisiana

The R-4310 form can be utilized in various scenarios, primarily for tax reporting and compliance. Taxpayers should use this form to report their income, claim applicable deductions, or fulfill other tax obligations as mandated by the Louisiana Department of Revenue. It is important to ensure that the form is filled out correctly to avoid delays or penalties. Utilizing digital tools, such as eSignature solutions, can enhance the efficiency of submitting this form.

Legal use of the R-4310 Louisiana Department of Revenue Revenue Louisiana

The R-4310 form is legally binding when completed and submitted according to the guidelines set forth by the Louisiana Department of Revenue. To ensure its legal validity, it must be signed by the appropriate parties, and all information must be accurate and truthful. Compliance with state regulations regarding eSignatures and digital submissions is essential for maintaining the legal integrity of the document.

Filing Deadlines / Important Dates

It is important to be aware of the filing deadlines associated with the R-4310 form to avoid penalties. Typically, tax forms must be submitted by specific dates each year, which may vary based on individual circumstances or changes in legislation. Keeping track of these deadlines ensures timely compliance and helps taxpayers avoid unnecessary fees.

Required Documents

When preparing to complete the R-4310 form, certain documents are typically required. These may include:

- Personal identification information, such as Social Security numbers.

- Financial records, including income statements and expense receipts.

- Any previous tax returns that may be relevant to the current filing.

Having these documents ready will facilitate a smoother completion process.

Who Issues the Form

The R-4310 form is issued by the Louisiana Department of Revenue, which is responsible for administering state tax laws and ensuring compliance. This department provides the necessary resources and guidance for taxpayers to correctly complete and submit the form, making it a vital entity in the tax reporting process.

Quick guide on how to complete r 4310 louisiana department of revenue revenue louisiana

Prepare R 4310 Louisiana Department Of Revenue Revenue Louisiana effortlessly on any device

Digital document management has gained traction among businesses and individuals. It offers an ideal environmentally friendly alternative to traditional printed and signed documents, allowing you to locate the necessary form and securely save it online. airSlate SignNow provides you with all the tools required to create, edit, and electronically sign your documents swiftly and without delays. Handle R 4310 Louisiana Department Of Revenue Revenue Louisiana on any device using airSlate SignNow's Android or iOS applications and simplify any document-related task today.

The easiest way to modify and electronically sign R 4310 Louisiana Department Of Revenue Revenue Louisiana seamlessly

- Obtain R 4310 Louisiana Department Of Revenue Revenue Louisiana and select Get Form to begin.

- Utilize the tools we provide to complete your form.

- Emphasize important sections of the documents or obscure sensitive data with the tools that airSlate SignNow provides specifically for that purpose.

- Generate your eSignature using the Sign feature, which only takes seconds and holds the same legal validity as a conventional wet ink signature.

- Review the details and click the Done button to save your changes.

- Select your preferred method to send your form, via email, SMS, or invite link, or download it to your computer.

Eliminate concerns about lost or misplaced files, tedious form searches, or errors that necessitate printing new document copies. airSlate SignNow addresses all your document management needs in just a few clicks from any device you choose. Modify and electronically sign R 4310 Louisiana Department Of Revenue Revenue Louisiana and ensure excellent communication at any stage of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the r 4310 louisiana department of revenue revenue louisiana

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is the R 4310 form for the Louisiana Department of Revenue?

The R 4310 form is utilized by the Louisiana Department of Revenue to streamline various reporting requirements for businesses. It is essential for ensuring compliance with state tax regulations and must be completed accurately to avoid penalties. Using airSlate SignNow can simplify the eSigning process of the R 4310 Louisiana Department of Revenue, making it efficient and hassle-free.

-

How can airSlate SignNow help with submitting the R 4310 form?

airSlate SignNow offers an intuitive platform that allows businesses to electronically sign and send the R 4310 Louisiana Department of Revenue form securely. With our eSigning solution, you can easily manage your documents and ensure timely submission, alleviating concerns about paperwork delays. This convenience leads to a smoother compliance process.

-

What are the pricing options for using airSlate SignNow to handle the R 4310 form?

airSlate SignNow provides flexible pricing plans tailored to suit various business needs, whether you're a small enterprise or a large corporation. Our services include features that are perfect for managing the R 4310 Louisiana Department of Revenue form efficiently. You can explore our plans on our website to find the one that best fits your requirements.

-

What features does airSlate SignNow offer for managing the R 4310 form?

airSlate SignNow includes numerous features designed to simplify the process of managing the R 4310 Louisiana Department of Revenue form. These features include customizable templates, audit trails, and seamless document sharing, ensuring you have everything you need for efficient document management. This comprehensive functionality enhances your workflow and compliance efforts.

-

Can I integrate airSlate SignNow with other applications for the R 4310 form process?

Absolutely! airSlate SignNow supports integration with various applications, such as CRM systems and cloud storage services, which can help streamline your workflow when handling the R 4310 Louisiana Department of Revenue form. This connectivity facilitates easy access to your documents, enhancing collaboration within your team. You can boost productivity by integrating your existing tools.

-

Is airSlate SignNow secure for submitting the R 4310 form?

Yes, airSlate SignNow prioritizes security, using advanced encryption and stringent security protocols to protect your documents, including the R 4310 Louisiana Department of Revenue form. You can have peace of mind knowing that sensitive information is safeguarded throughout the eSigning process. Our platform ensures that your data remains confidential and compliant.

-

How does airSlate SignNow benefit businesses dealing with the R 4310 Louisiana Department of Revenue?

Using airSlate SignNow enables businesses to reduce the time and effort involved in managing the R 4310 Louisiana Department of Revenue form. Our user-friendly interface makes it easy to complete and sign documents electronically, promoting efficiency and accuracy. This not only saves you time but also helps maintain compliance with state regulations.

Get more for R 4310 Louisiana Department Of Revenue Revenue Louisiana

- Sample letter for promotional letter finance company form

- Letter promissory template form

- Cohabitation and nonmarital agreement between parties living together but remaining unmarried with joint purchase of real estate form

- Letter thank you 497332936 form

- Sample summons complaint form

- Agreement terminate form

- Sample letter financing form

- Sample complaint form 497332940

Find out other R 4310 Louisiana Department Of Revenue Revenue Louisiana

- Electronic signature Michigan Real Estate LLC Operating Agreement Easy

- Electronic signature West Virginia Plumbing Memorandum Of Understanding Simple

- Electronic signature Sports PDF Alaska Fast

- Electronic signature Mississippi Real Estate Contract Online

- Can I Electronic signature Missouri Real Estate Quitclaim Deed

- Electronic signature Arkansas Sports LLC Operating Agreement Myself

- How Do I Electronic signature Nevada Real Estate Quitclaim Deed

- How Can I Electronic signature New Jersey Real Estate Stock Certificate

- Electronic signature Colorado Sports RFP Safe

- Can I Electronic signature Connecticut Sports LLC Operating Agreement

- How Can I Electronic signature New York Real Estate Warranty Deed

- How To Electronic signature Idaho Police Last Will And Testament

- How Do I Electronic signature North Dakota Real Estate Quitclaim Deed

- Can I Electronic signature Ohio Real Estate Agreement

- Electronic signature Ohio Real Estate Quitclaim Deed Later

- How To Electronic signature Oklahoma Real Estate Business Plan Template

- How Can I Electronic signature Georgia Sports Medical History

- Electronic signature Oregon Real Estate Quitclaim Deed Free

- Electronic signature Kansas Police Arbitration Agreement Now

- Electronic signature Hawaii Sports LLC Operating Agreement Free