CITY of EVANS SALES and USE TAX RETURN Form

What is the CITY OF EVANS SALES AND USE TAX RETURN

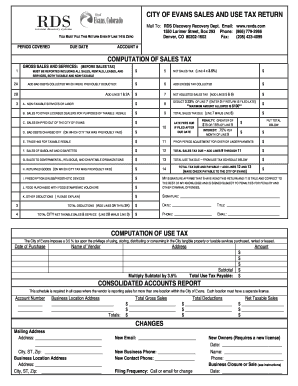

The CITY OF EVANS SALES AND USE TAX RETURN is a tax form used by businesses operating within the city of Evans, Colorado, to report sales and use tax liabilities. This form is essential for ensuring compliance with local tax regulations. Sales tax is collected on retail sales of tangible personal property and certain services, while use tax applies to items purchased out of state but used within Evans. Completing this return accurately is crucial for businesses to avoid penalties and maintain good standing with local tax authorities.

Steps to complete the CITY OF EVANS SALES AND USE TAX RETURN

Filling out the CITY OF EVANS SALES AND USE TAX RETURN involves several key steps:

- Gather necessary information: Collect all relevant sales data, including gross sales, exempt sales, and any purchases subject to use tax.

- Calculate tax owed: Use the current sales tax rate to determine the total sales tax due based on your gross sales.

- Complete the form: Input the gathered information into the appropriate sections of the return, ensuring all figures are accurate.

- Review for accuracy: Double-check all entries to prevent errors that could lead to penalties.

- Submit the form: Choose your preferred submission method, whether online, by mail, or in person, and ensure it is sent by the filing deadline.

How to obtain the CITY OF EVANS SALES AND USE TAX RETURN

The CITY OF EVANS SALES AND USE TAX RETURN can be obtained through several channels. Businesses can access the form online via the official city website, where it is often available for download in PDF format. Additionally, physical copies may be available at the city’s finance department or local government offices. It is advisable to ensure that you are using the most current version of the form to avoid compliance issues.

Legal use of the CITY OF EVANS SALES AND USE TAX RETURN

To ensure the legal validity of the CITY OF EVANS SALES AND USE TAX RETURN, it is crucial to adhere to specific guidelines. The form must be completed accurately and submitted by the established deadlines. Failure to comply with local tax laws can result in penalties, including fines or interest on unpaid taxes. Furthermore, digital submissions must meet eSignature laws to be considered legally binding, which includes using a trusted platform that provides secure digital signatures.

Form Submission Methods (Online / Mail / In-Person)

The CITY OF EVANS SALES AND USE TAX RETURN can be submitted through various methods, providing flexibility for businesses. Online submission is often the quickest and most efficient method, allowing for immediate processing. Alternatively, businesses can mail the completed form to the designated tax office address. In-person submissions are also accepted at local government offices, where assistance may be available if needed. It is important to choose the method that best suits your needs while ensuring timely submission.

Filing Deadlines / Important Dates

Understanding the filing deadlines for the CITY OF EVANS SALES AND USE TAX RETURN is essential for compliance. Typically, returns are due on a monthly or quarterly basis, depending on the business's sales volume. It is important to check the specific deadlines for your filing period to avoid late fees. Additionally, businesses should be aware of any changes in deadlines due to holidays or other factors that may affect tax filing schedules.

Quick guide on how to complete city of evans sales and use tax return

Complete CITY OF EVANS SALES AND USE TAX RETURN effortlessly on any device

Digital document management has become widely embraced by both organizations and individuals. It offers an ideal environmentally friendly substitute for conventional printed and signed documents, allowing you to access the correct form and securely store it online. airSlate SignNow provides you with all the tools required to create, edit, and electronically sign your documents quickly and without interruptions. Manage CITY OF EVANS SALES AND USE TAX RETURN on any platform with airSlate SignNow's Android or iOS applications and enhance any document-related process today.

How to modify and electronically sign CITY OF EVANS SALES AND USE TAX RETURN with ease

- Find CITY OF EVANS SALES AND USE TAX RETURN and click on Get Form to begin.

- Use the tools we provide to fill out your form.

- Emphasize pertinent sections of your documents or redact sensitive information using tools that airSlate SignNow specifically offers for that purpose.

- Generate your signature using the Sign tool, which takes mere seconds and holds the same legal validity as a conventional wet ink signature.

- Review all the details and click on the Done button to save your updates.

- Choose how you wish to send your form, whether by email, text message (SMS), invitation link, or download it to your computer.

Say goodbye to lost or misplaced documents, tedious form searching, or errors that require printing new document copies. airSlate SignNow addresses all your document management needs in just a few clicks from any device you prefer. Edit and electronically sign CITY OF EVANS SALES AND USE TAX RETURN to ensure outstanding communication at every stage of your form preparation with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the city of evans sales and use tax return

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is the CITY OF EVANS SALES AND USE TAX RETURN process?

The CITY OF EVANS SALES AND USE TAX RETURN process involves reporting the sales and use tax collected by businesses operating within Evans. This form must be filed regularly, and airSlate SignNow makes it easy to prepare, sign, and submit your returns efficiently.

-

How can airSlate SignNow help with the CITY OF EVANS SALES AND USE TAX RETURN?

airSlate SignNow streamlines the process of managing documents related to the CITY OF EVANS SALES AND USE TAX RETURN. With its user-friendly interface, businesses can quickly create, send, and eSign tax returns, ensuring that all submissions are accurate and timely.

-

What are the costs associated with using airSlate SignNow for the CITY OF EVANS SALES AND USE TAX RETURN?

airSlate SignNow offers a cost-effective solution for handling the CITY OF EVANS SALES AND USE TAX RETURN while ensuring you stay compliant. Pricing plans vary based on features and team size, providing flexibility to match your business needs without breaking your budget.

-

Are there key features in airSlate SignNow that cater to the CITY OF EVANS SALES AND USE TAX RETURN?

Yes, airSlate SignNow includes features such as customizable templates for the CITY OF EVANS SALES AND USE TAX RETURN, automated reminders, and secure cloud storage. These features help ensure that you never miss a filing deadline and that all your documents are safely archived.

-

Can I integrate airSlate SignNow with other accounting software for the CITY OF EVANS SALES AND USE TAX RETURN?

Absolutely! airSlate SignNow seamlessly integrates with popular accounting software, enabling you to manage the CITY OF EVANS SALES AND USE TAX RETURN alongside your financial records. This integration simplifies data entry and helps maintain overall accuracy in your tax filings.

-

What benefits does airSlate SignNow provide for handling the CITY OF EVANS SALES AND USE TAX RETURN?

Using airSlate SignNow for the CITY OF EVANS SALES AND USE TAX RETURN offers numerous benefits, including enhanced efficiency, reduced errors, and secure document management. You'll save time and resources while ensuring compliance with municipal tax regulations.

-

Is airSlate SignNow user-friendly for filing the CITY OF EVANS SALES AND USE TAX RETURN?

Yes, airSlate SignNow is designed with user experience in mind, making it simple for businesses to file the CITY OF EVANS SALES AND USE TAX RETURN. Whether you're tech-savvy or a novice, the intuitive interface guides you through each step of the process effortlessly.

Get more for CITY OF EVANS SALES AND USE TAX RETURN

- Jury instruction fraud 497334266 form

- Jury instruction mail fraud depriving another of intangible right of honest services form

- Jury instruction fraud 497334268 form

- Jury instruction fraud 497334269 form

- Instruction sale 497334272 form

- Ds 600 form

- Assignment of deed of trust first american form

- Form 18a 41196795

Find out other CITY OF EVANS SALES AND USE TAX RETURN

- Can I Sign North Carolina Orthodontists Presentation

- How Do I Sign Rhode Island Real Estate Form

- Can I Sign Vermont Real Estate Document

- How To Sign Wyoming Orthodontists Document

- Help Me With Sign Alabama Courts Form

- Help Me With Sign Virginia Police PPT

- How To Sign Colorado Courts Document

- Can I eSign Alabama Banking PPT

- How Can I eSign California Banking PDF

- How To eSign Hawaii Banking PDF

- How Can I eSign Hawaii Banking Document

- How Do I eSign Hawaii Banking Document

- How Do I eSign Hawaii Banking Document

- Help Me With eSign Hawaii Banking Document

- How To eSign Hawaii Banking Document

- Can I eSign Hawaii Banking Presentation

- Can I Sign Iowa Courts Form

- Help Me With eSign Montana Banking Form

- Can I Sign Kentucky Courts Document

- How To eSign New York Banking Word