FORM 1099 MISC REMINDERS for STATE & LOCAL in

What is the FORM 1099 MISC REMINDERS FOR STATE & LOCAL In

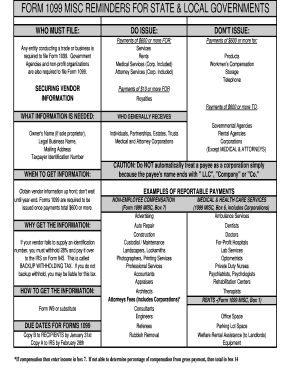

The FORM 1099 MISC REMINDERS FOR STATE & LOCAL In is a tax document used in the United States to report various types of income other than wages, salaries, and tips. This form is primarily utilized by businesses to report payments made to independent contractors, freelancers, and other non-employees. It is essential for ensuring that both the payer and the recipient accurately report income to the Internal Revenue Service (IRS) and respective state tax authorities. Understanding the purpose and requirements of this form is crucial for compliance with tax regulations.

Steps to complete the FORM 1099 MISC REMINDERS FOR STATE & LOCAL In

Completing the FORM 1099 MISC REMINDERS FOR STATE & LOCAL In involves several key steps:

- Gather necessary information about the recipient, including their name, address, and taxpayer identification number (TIN).

- Determine the total amount paid to the recipient during the tax year, ensuring it meets the reporting threshold.

- Fill out the form accurately, entering the recipient's information and the payment amounts in the appropriate boxes.

- Review the completed form for accuracy, ensuring all details are correct before submission.

- Submit the form to the IRS and provide a copy to the recipient by the required deadlines.

Legal use of the FORM 1099 MISC REMINDERS FOR STATE & LOCAL In

The FORM 1099 MISC REMINDERS FOR STATE & LOCAL In is legally binding when filled out correctly and submitted in compliance with IRS regulations. It serves as an official record of income paid to non-employees, which is essential for both tax reporting and auditing purposes. To ensure its legal validity, it is important to use a reliable electronic signature platform that complies with the ESIGN Act and other relevant regulations. This guarantees that the document is recognized as legitimate in legal contexts.

Filing Deadlines / Important Dates

Filing deadlines for the FORM 1099 MISC REMINDERS FOR STATE & LOCAL In are critical for compliance. Generally, the form must be submitted to the IRS by January thirty-first of the year following the tax year in which payments were made. If filing electronically, the deadline may extend to March second. Recipients should also receive their copies by January thirty-first. Missing these deadlines can result in penalties, making it essential to stay informed and organized.

State-specific rules for the FORM 1099 MISC REMINDERS FOR STATE & LOCAL In

Each state may have specific rules and requirements regarding the FORM 1099 MISC REMINDERS FOR STATE & LOCAL In. Some states require additional forms or have different thresholds for reporting. It is important to check with state tax authorities to ensure compliance with local regulations. Understanding these nuances can help avoid potential issues and ensure accurate reporting for both state and federal tax purposes.

Penalties for Non-Compliance

Failing to file the FORM 1099 MISC REMINDERS FOR STATE & LOCAL In on time or providing incorrect information can lead to significant penalties. The IRS imposes fines based on how late the form is filed, which can range from fifty dollars to over five hundred dollars per form, depending on the delay. Additionally, state penalties may apply, further emphasizing the importance of timely and accurate filings to avoid unnecessary financial burdens.

Quick guide on how to complete form 1099 misc reminders for state amp local in

Complete FORM 1099 MISC REMINDERS FOR STATE & LOCAL In effortlessly on any device

Online document management has become increasingly popular among businesses and individuals. It offers an excellent eco-friendly substitute for conventional printed and signed paperwork, as you can access the correct form and safely store it online. airSlate SignNow equips you with all the necessary tools to create, modify, and eSign your documents promptly without delays. Manage FORM 1099 MISC REMINDERS FOR STATE & LOCAL In on any device using airSlate SignNow's Android or iOS applications and enhance any document-based process today.

The simplest way to modify and eSign FORM 1099 MISC REMINDERS FOR STATE & LOCAL In with ease

- Find FORM 1099 MISC REMINDERS FOR STATE & LOCAL In and click on Get Form to begin.

- Utilize the tools we offer to complete your form.

- Emphasize important sections of the documents or hide sensitive information with the tools airSlate SignNow provides specifically for that purpose.

- Create your eSignature using the Sign tool, which takes moments and carries the same legal validity as a conventional wet ink signature.

- Review the information and then click on the Done button to preserve your changes.

- Choose how you wish to share your form, via email, SMS, or invitation link, or download it to your computer.

Eliminate concerns about lost or misplaced files, tedious form searching, or errors that require new document copies to be printed. airSlate SignNow meets all your document management needs in just a few clicks from any device you prefer. Modify and eSign FORM 1099 MISC REMINDERS FOR STATE & LOCAL In and ensure exceptional communication at any stage of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the form 1099 misc reminders for state amp local in

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What are the key features of airSlate SignNow regarding FORM 1099 MISC REMINDERS FOR STATE & LOCAL In?

airSlate SignNow offers essential features like customizable templates and automatic reminders that help you manage your FORM 1099 MISC REMINDERS FOR STATE & LOCAL In efficiently. With its user-friendly interface, you can easily set up reminders for document submissions, ensuring compliance with local regulations. This helps streamline your tax processes and saves valuable time.

-

How does airSlate SignNow assist with compliance for FORM 1099 MISC REMINDERS FOR STATE & LOCAL In?

With airSlate SignNow, you can rest assured that your FORM 1099 MISC REMINDERS FOR STATE & LOCAL In are compliant with the latest state and local requirements. The platform provides up-to-date templates and guidance to ensure your documents meet all necessary regulations. This helps businesses avoid penalties and maintain a good standing.

-

What is the pricing structure for airSlate SignNow related to FORM 1099 MISC REMINDERS FOR STATE & LOCAL In?

airSlate SignNow offers flexible pricing plans to accommodate various business sizes and needs, particularly for those dealing with FORM 1099 MISC REMINDERS FOR STATE & LOCAL In. Plans typically include features such as unlimited eSigning and document storage, making it a cost-effective option for managing your tax documents. Always check the website for the most current pricing details.

-

Can I integrate airSlate SignNow with my current accounting software for FORM 1099 MISC REMINDERS FOR STATE & LOCAL In?

Yes, airSlate SignNow integrates seamlessly with many popular accounting software solutions, facilitating easy management of your FORM 1099 MISC REMINDERS FOR STATE & LOCAL In. These integrations help keep your documents organized and ensure that data flows smoothly between systems, enhancing your overall productivity. You can connect with various tools to automate specific tasks.

-

How does airSlate SignNow enhance the eSigning experience for FORM 1099 MISC REMINDERS FOR STATE & LOCAL In?

airSlate SignNow enhances the eSigning experience by offering a secure and intuitive platform for signing FORM 1099 MISC REMINDERS FOR STATE & LOCAL In. Users can sign from any device, and the platform ensures that each signed document is legally binding and securely stored. This convenience helps speed up the signing process and improves the overall efficiency.

-

What types of documents can be managed with airSlate SignNow regarding FORM 1099 MISC REMINDERS FOR STATE & LOCAL In?

airSlate SignNow allows you to manage a variety of documents related to FORM 1099 MISC REMINDERS FOR STATE & LOCAL In, including invoices, contracts, and tax forms. The platform provides customizable templates, making it easy to create and send documents for signature. This versatility allows businesses to streamline multiple processes within a single solution.

-

How does airSlate SignNow prioritize security for FORM 1099 MISC REMINDERS FOR STATE & LOCAL In?

Security is a top priority at airSlate SignNow, especially for sensitive documents like FORM 1099 MISC REMINDERS FOR STATE & LOCAL In. The platform employs advanced encryption methods and robust user authentication to protect your data. Regular compliance audits and strict security protocols ensure that your information remains secure at all times.

Get more for FORM 1099 MISC REMINDERS FOR STATE & LOCAL In

Find out other FORM 1099 MISC REMINDERS FOR STATE & LOCAL In

- eSignature Minnesota Email Cover Letter Template Fast

- How To eSignature New York Job Applicant Rejection Letter

- How Do I eSignature Kentucky Executive Summary Template

- eSignature Hawaii CV Form Template Mobile

- eSignature Nevada CV Form Template Online

- eSignature Delaware Software Development Proposal Template Now

- eSignature Kentucky Product Development Agreement Simple

- eSignature Georgia Mobile App Design Proposal Template Myself

- eSignature Indiana Mobile App Design Proposal Template Now

- eSignature Utah Mobile App Design Proposal Template Now

- eSignature Kentucky Intellectual Property Sale Agreement Online

- How Do I eSignature Arkansas IT Consulting Agreement

- eSignature Arkansas IT Consulting Agreement Safe

- eSignature Delaware IT Consulting Agreement Online

- eSignature New Jersey IT Consulting Agreement Online

- How Can I eSignature Nevada Software Distribution Agreement

- eSignature Hawaii Web Hosting Agreement Online

- How Do I eSignature Hawaii Web Hosting Agreement

- eSignature Massachusetts Web Hosting Agreement Secure

- eSignature Montana Web Hosting Agreement Myself