Form 14764

What is the Form 14764

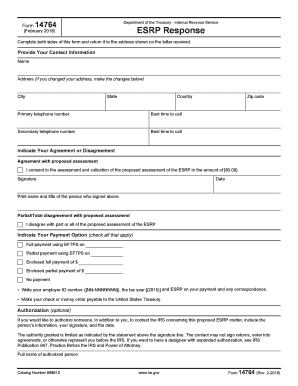

The Form 14764, also known as the ESRP response form, is a document used by employers to respond to the IRS regarding the Employer Shared Responsibility Payment (ESRP). This form is essential for employers who may be subject to penalties under the Affordable Care Act (ACA) for not providing adequate health coverage to their employees. The form allows employers to explain their circumstances and provide necessary documentation to the IRS to avoid or reduce potential penalties.

How to use the Form 14764

Using the Form 14764 involves a few straightforward steps. First, ensure you have the correct version of the form, which can be obtained from the IRS website or through authorized tax professionals. Next, fill out the form accurately, providing all required information, including your employer identification number (EIN) and details about your health coverage offerings. Once completed, submit the form to the IRS as instructed, either electronically or via mail, depending on your preference and the specific requirements set forth by the IRS.

Steps to complete the Form 14764

Completing the Form 14764 requires careful attention to detail. Here are the steps to follow:

- Gather necessary information, including your EIN, employee details, and health coverage information.

- Download the Form 14764 from the IRS website.

- Fill out the form, ensuring all fields are completed accurately.

- Review the form for any errors or omissions.

- Submit the form to the IRS by the designated deadline, either electronically or by mail.

Legal use of the Form 14764

The legal use of the Form 14764 is crucial for compliance with IRS regulations. When properly filled out and submitted, the form serves as a formal response to any penalties assessed under the ACA. It is important to ensure that all information provided is truthful and accurate, as any discrepancies may lead to further penalties or legal issues. Utilizing a reliable eSignature solution, such as signNow, can enhance the legal validity of your submission by ensuring secure and compliant electronic signatures.

Key elements of the Form 14764

Understanding the key elements of the Form 14764 is essential for accurate completion. The form typically includes:

- Employer identification number (EIN)

- Contact information for the employer

- Details of the health coverage offered to employees

- Explanations for any discrepancies in coverage

- Signature of the authorized representative

IRS Guidelines

The IRS provides specific guidelines for completing and submitting the Form 14764. These guidelines outline the necessary information required, deadlines for submission, and acceptable methods for filing. It is important to review these guidelines carefully to ensure compliance and avoid any potential penalties. Employers should stay updated on any changes to IRS regulations that may affect the use of this form.

Quick guide on how to complete form 14764

Complete Form 14764 effortlessly on any device

Digital document management has gained traction among businesses and individuals. It serves as a great environmentally friendly alternative to traditional printed and signed documents, allowing you to easily access the necessary form and securely store it online. airSlate SignNow equips you with all the resources needed to create, modify, and eSign your documents quickly without any delays. Manage Form 14764 on any platform using airSlate SignNow's Android or iOS applications and streamline any document-related task today.

How to modify and eSign Form 14764 with ease

- Locate Form 14764 and then click Get Form to begin.

- Utilize the tools we offer to finalize your form.

- Emphasize important sections of the documents or conceal sensitive information with tools that airSlate SignNow specifically provides for that purpose.

- Generate your eSignature using the Sign tool, which takes just seconds and holds the same legal validity as a traditional wet ink signature.

- Review all the details and then click on the Done button to save your changes.

- Choose your preferred method of sending your form, whether by email, text message (SMS), or invitation link, or download it to your computer.

Eliminate concerns about lost or misplaced documents, tedious form searching, or errors that require printing new document copies. airSlate SignNow meets all your document management needs in just a few clicks from your device of choice. Adjust and eSign Form 14764 and ensure effective communication at every stage of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the form 14764

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is form 14764 and how is it used?

Form 14764 is a document used by taxpayers to request an extension to file their tax returns. Utilizing airSlate SignNow, users can easily create, edit, and eSign form 14764, making the submission process more efficient and secure.

-

How much does it cost to use airSlate SignNow for form 14764?

airSlate SignNow offers a range of pricing plans tailored to fit different business needs. The cost to eSign and manage form 14764 depends on the plan you choose, with options available for individuals and teams looking for a cost-effective solution.

-

What features does airSlate SignNow offer for form 14764?

airSlate SignNow provides features such as template creation, cloud storage, and the ability to eSign documents, including form 14764. Users can also track the status of their documents in real-time, ensuring a smooth workflow.

-

Can I integrate airSlate SignNow with other tools for form 14764 processing?

Yes, airSlate SignNow seamlessly integrates with various applications, allowing users to enhance their workflow. This means you can easily incorporate form 14764 into your existing systems, boosting productivity.

-

What are the benefits of using airSlate SignNow for form 14764?

Using airSlate SignNow for form 14764 simplifies the signing process, reduces paper usage, and saves time. The platform’s user-friendly interface enables quick eSigning, making it easier for businesses to maintain compliance with tax requirements.

-

Is it secure to eSign form 14764 with airSlate SignNow?

Absolutely! airSlate SignNow prioritizes security, ensuring that all eSignatures on form 14764 are legally binding and compliant with regulations. The platform implements high-level encryption to protect your data during transmission.

-

How can I get started with airSlate SignNow for form 14764?

Getting started with airSlate SignNow for form 14764 is simple. You can sign up for a free trial, explore the platform's features, and begin creating and eSigning your documents right away, without any technical expertise required.

Get more for Form 14764

Find out other Form 14764

- How Do I eSign Arkansas Charity LLC Operating Agreement

- eSign Colorado Charity LLC Operating Agreement Fast

- eSign Connecticut Charity Living Will Later

- How Can I Sign West Virginia Courts Quitclaim Deed

- Sign Courts Form Wisconsin Easy

- Sign Wyoming Courts LLC Operating Agreement Online

- How To Sign Wyoming Courts Quitclaim Deed

- eSign Vermont Business Operations Executive Summary Template Mobile

- eSign Vermont Business Operations Executive Summary Template Now

- eSign Virginia Business Operations Affidavit Of Heirship Mobile

- eSign Nebraska Charity LLC Operating Agreement Secure

- How Do I eSign Nevada Charity Lease Termination Letter

- eSign New Jersey Charity Resignation Letter Now

- eSign Alaska Construction Business Plan Template Mobile

- eSign Charity PPT North Carolina Now

- eSign New Mexico Charity Lease Agreement Form Secure

- eSign Charity PPT North Carolina Free

- eSign North Dakota Charity Rental Lease Agreement Now

- eSign Arkansas Construction Permission Slip Easy

- eSign Rhode Island Charity Rental Lease Agreement Secure