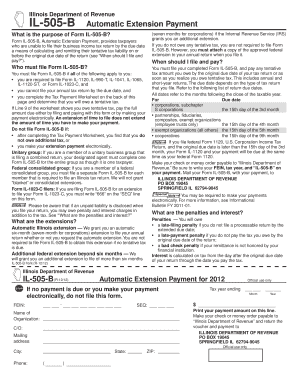

Form Il 505 B

What is the Form IL 505 B

The 2018 Form IL 505 B is a state-specific document used in Illinois for tax purposes. It is primarily utilized for individuals who are filing their income tax returns. This form is essential for reporting income, deductions, and credits, ensuring that taxpayers comply with state tax laws. Understanding the purpose of this form is crucial for accurate tax filing and to avoid potential penalties.

How to Use the Form IL 505 B

Using the 2018 Form IL 505 B involves several steps to ensure proper completion. Taxpayers should begin by gathering all necessary financial documents, including W-2s, 1099s, and any relevant receipts for deductions. The form requires personal information, such as your name, address, and Social Security number. Once the form is filled out, it can be submitted either electronically or via mail, depending on the taxpayer's preference.

Steps to Complete the Form IL 505 B

Completing the 2018 Form IL 505 B involves a systematic approach:

- Gather all required documents, including income statements and deduction records.

- Fill out your personal information accurately at the top of the form.

- Report your total income in the designated section.

- List any deductions or credits you are eligible for.

- Calculate your total tax liability and any payments made.

- Sign and date the form before submission.

Legal Use of the Form IL 505 B

The 2018 Form IL 505 B is legally binding when completed accurately and submitted according to Illinois state tax regulations. It must be signed by the taxpayer to validate the information provided. Compliance with state laws regarding the use of this form is essential to avoid legal repercussions, including fines or audits.

Filing Deadlines / Important Dates

Taxpayers must be aware of the filing deadlines associated with the 2018 Form IL 505 B. Generally, the form must be submitted by April 15 of the year following the tax year. If this date falls on a weekend or holiday, the deadline may be extended. It is advisable to check for any updates or changes to the deadlines each tax season.

Form Submission Methods

The 2018 Form IL 505 B can be submitted through various methods, providing flexibility for taxpayers. Options include:

- Online submission through the Illinois Department of Revenue's e-filing system.

- Mailing a printed copy of the form to the appropriate state address.

- In-person submission at designated tax offices.

Key Elements of the Form IL 505 B

Several key elements must be included on the 2018 Form IL 505 B to ensure its validity:

- Personal identification details, including name and Social Security number.

- Accurate reporting of income from various sources.

- Documented deductions and credits that apply to the taxpayer.

- Signature and date to confirm the accuracy of the information provided.

Quick guide on how to complete form il 505 b

Easily Prepare Form Il 505 B on Any Device

Digital document management has become increasingly favored by companies and individuals alike. It offers an ideal environmentally friendly substitute to conventional printed and signed documents, as you can locate the appropriate form and securely store it online. airSlate SignNow equips you with all the necessary tools to create, edit, and electronically sign your documents swiftly without any holdups. Manage Form Il 505 B on any device using airSlate SignNow's Android or iOS applications and enhance any document-related process today.

The simplest way to edit and electronically sign Form Il 505 B with ease

- Find Form Il 505 B and click Get Form to begin.

- Utilize the tools available to fill out your document.

- Emphasize important sections of the documents or redact sensitive information using tools provided by airSlate SignNow specifically for that purpose.

- Create your electronic signature with the Sign feature, which takes mere seconds and holds the same legal validity as a conventional wet ink signature.

- Review all information and click the Done button to save your changes.

- Choose your preferred method for delivering your form, whether by email, text message (SMS), or invitation link, or download it to your computer.

Eliminate concerns regarding lost or misfiled documents, tedious form searching, or errors that necessitate printing new copies. airSlate SignNow meets all your document management needs in just a few clicks from any device you prefer. Edit and electronically sign Form Il 505 B and guarantee effective communication at every step of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the form il 505 b

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is the 2018 form il 505 b and why is it important?

The 2018 form il 505 b is a crucial document for Illinois taxpayers, providing important tax information. It helps in ensuring that the correct amount of state taxes is reported and paid. Understanding this form is essential for compliance and avoiding penalties.

-

How can airSlate SignNow assist with filling out the 2018 form il 505 b?

With airSlate SignNow, you can easily fill out the 2018 form il 505 b electronically. Our platform allows users to complete and eSign documents quickly, streamlining the tax filing process. This efficiency ensures that you don’t waste time and can submit your form with confidence.

-

Is there a cost associated with using airSlate SignNow to file the 2018 form il 505 b?

Yes, while airSlate SignNow offers various pricing plans, using our service to file the 2018 form il 505 b may incur a fee. However, the value comes from the convenience and efficiency our platform provides, often saving users time and reducing the stress of document management.

-

What integrations does airSlate SignNow offer for handling the 2018 form il 505 b?

airSlate SignNow integrates seamlessly with numerous applications to help manage the 2018 form il 505 b and other documents. Whether you're using accounting software or cloud storage solutions, our platform supports various integrations for enhanced workflow. This makes it easier to keep all relevant information in one place.

-

Can I track the status of my 2018 form il 505 b once it’s been submitted?

Absolutely! airSlate SignNow provides tracking features that allow you to monitor the status of your submitted 2018 form il 505 b. You'll receive notifications when your document is viewed and signed, giving you peace of mind throughout the process.

-

Is airSlate SignNow secure for submitting the 2018 form il 505 b?

Yes, airSlate SignNow prioritizes security. Our platform uses advanced encryption methods to protect your personal and financial information when submitting the 2018 form il 505 b. You can trust that your data is safe with us.

-

What benefits does airSlate SignNow offer for using the 2018 form il 505 b?

Using airSlate SignNow for the 2018 form il 505 b comes with several benefits, including reduced paperwork, faster processing times, and enhanced organization. Our platform simplifies tax filing, allowing you to focus on other important aspects of your business or personal finances.

Get more for Form Il 505 B

- Quitclaim deed from husband and wife to llc wisconsin form

- Warranty deed from husband and wife to llc wisconsin form

- Wisconsin satisfaction judgment form

- Wisconsin partial form

- A fax cover for workers compensation wisconsin form

- Full satisfaction of claim for lien by individual wisconsin form

- Landlord tenant notice 497430578 form

- Landlord tenant remove 497430579 form

Find out other Form Il 505 B

- How To eSign Hawaii Construction Word

- How Can I eSign Hawaii Construction Word

- How Can I eSign Hawaii Construction Word

- How Do I eSign Hawaii Construction Form

- How Can I eSign Hawaii Construction Form

- How To eSign Hawaii Construction Document

- Can I eSign Hawaii Construction Document

- How Do I eSign Hawaii Construction Form

- How To eSign Hawaii Construction Form

- How Do I eSign Hawaii Construction Form

- How To eSign Florida Doctors Form

- Help Me With eSign Hawaii Doctors Word

- How Can I eSign Hawaii Doctors Word

- Help Me With eSign New York Doctors PPT

- Can I eSign Hawaii Education PDF

- How To eSign Hawaii Education Document

- Can I eSign Hawaii Education Document

- How Can I eSign South Carolina Doctors PPT

- How Can I eSign Kansas Education Word

- How To eSign Kansas Education Document