RPD 41378 Application for Type 11 or 12 Nontaxable Transaction Certificates Form

What is the RPD 41378 Application For Type 11 Or 12 Nontaxable Transaction Certificates

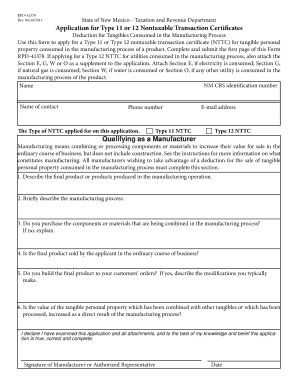

The RPD 41378 Application For Type 11 Or 12 Nontaxable Transaction Certificates is a form utilized in the United States for claiming nontaxable transactions. This application is essential for businesses and individuals who wish to purchase items without incurring sales tax, provided they meet specific criteria. The type 11 certificate is generally for purchases by exempt organizations, while the type 12 certificate is for certain government entities. Understanding the distinctions between these types is crucial for accurate completion and compliance with state tax laws.

How to use the RPD 41378 Application For Type 11 Or 12 Nontaxable Transaction Certificates

Using the RPD 41378 Application involves several straightforward steps. First, ensure you identify which type of certificate applies to your situation—Type 11 or Type 12. Next, gather the necessary information, including your organization’s name, address, and tax identification number. Complete the application accurately, ensuring all required fields are filled. Once completed, submit the application to the appropriate state tax authority. It is advisable to keep a copy of the application for your records, as it may be required for future transactions.

Steps to complete the RPD 41378 Application For Type 11 Or 12 Nontaxable Transaction Certificates

Completing the RPD 41378 Application involves the following steps:

- Identify the correct type of certificate needed based on your eligibility.

- Gather all required information, including your organization’s details.

- Fill out the application form, ensuring accuracy in every section.

- Review the completed application for any errors or omissions.

- Submit the application to the relevant state tax authority via the chosen submission method.

Legal use of the RPD 41378 Application For Type 11 Or 12 Nontaxable Transaction Certificates

The legal use of the RPD 41378 Application is governed by state tax laws. It is important to ensure that the application is used only for eligible purchases to avoid penalties. Misuse of the certificate can lead to legal repercussions, including fines or back taxes owed. Organizations must maintain proper documentation to substantiate their claims for nontaxable transactions. This includes keeping copies of the application and any supporting documents related to the purchases made under the certificate.

Eligibility Criteria

Eligibility for the RPD 41378 Application varies based on the type of certificate being applied for. Generally, Type 11 is available for nonprofit organizations, while Type 12 is designated for government entities. Applicants must provide proof of their status, such as a tax-exempt letter or government identification. It is essential to review the specific eligibility requirements set forth by the state tax authority to ensure compliance and avoid any issues during the application process.

Form Submission Methods

The RPD 41378 Application can typically be submitted through various methods, including:

- Online submission via the state tax authority's website.

- Mailing a physical copy of the application to the designated address.

- In-person submission at local tax offices, if available.

Choosing the appropriate submission method depends on your preferences and the specific requirements of your state.

Quick guide on how to complete rpd 41378 application for type 11 or 12 nontaxable transaction certificates

Complete RPD 41378 Application For Type 11 Or 12 Nontaxable Transaction Certificates effortlessly on any device

Managing documents online has gained traction among businesses and individuals. It offers a viable eco-friendly substitute for traditional printed and signed files, as you can locate the necessary template and securely store it online. airSlate SignNow equips you with all the tools necessary to create, modify, and eSign your documents swiftly without delays. Handle RPD 41378 Application For Type 11 Or 12 Nontaxable Transaction Certificates on any platform with airSlate SignNow's Android or iOS applications and enhance any document-driven process today.

The easiest way to alter and eSign RPD 41378 Application For Type 11 Or 12 Nontaxable Transaction Certificates with ease

- Obtain RPD 41378 Application For Type 11 Or 12 Nontaxable Transaction Certificates and click on Get Form to begin.

- Use the tools we offer to complete your form.

- Highlight pertinent sections of your documents or obscure sensitive data with features provided by airSlate SignNow specifically for that purpose.

- Create your eSignature using the Sign tool, which takes mere seconds and carries the same legal validity as a conventional handwritten signature.

- Review all the details and click on the Done button to save your modifications.

- Choose how you want to submit your form, whether by email, text message (SMS), invitation link, or download it to your computer.

Say goodbye to lost or misplaced documents, tedious form searching, or mistakes that necessitate printing new document copies. airSlate SignNow fulfills all your requirements in document management with just a few clicks from any device you prefer. Modify and eSign RPD 41378 Application For Type 11 Or 12 Nontaxable Transaction Certificates and ensure excellent communication at any stage of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the rpd 41378 application for type 11 or 12 nontaxable transaction certificates

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is the RPD 41378 Application For Type 11 Or 12 Nontaxable Transaction Certificates?

The RPD 41378 Application For Type 11 Or 12 Nontaxable Transaction Certificates is a form used to claim exemption from gross receipts tax for specific types of transactions. Businesses can fill out this application to ensure they are compliant with the local tax regulations while minimizing their tax liabilities.

-

How can airSlate SignNow help with the RPD 41378 Application?

airSlate SignNow offers a user-friendly platform that simplifies the process of completing and signing the RPD 41378 Application For Type 11 Or 12 Nontaxable Transaction Certificates. With eSigning features, you can quickly collaborate on documents, ensuring that all necessary parties can sign and submit the application efficiently.

-

Is there a cost associated with using airSlate SignNow for the RPD 41378 Application?

Yes, airSlate SignNow operates on a subscription-based pricing model that offers various plans to fit different business needs. While there is a cost associated with using airSlate SignNow, the ease and efficiency it provides in managing the RPD 41378 Application For Type 11 Or 12 Nontaxable Transaction Certificates can lead to signNow time and cost savings.

-

What features does airSlate SignNow offer for the RPD 41378 Application?

airSlate SignNow includes features such as customizable templates, eSignature capabilities, and secure document storage to streamline the RPD 41378 Application For Type 11 Or 12 Nontaxable Transaction Certificates. These functionalities enhance workflow efficiency and ensure that documents are handled safely and professionally.

-

Can I use airSlate SignNow on mobile devices for the RPD 41378 Application?

Absolutely! airSlate SignNow supports mobile functionality, allowing you to access and manage the RPD 41378 Application For Type 11 Or 12 Nontaxable Transaction Certificates from your smartphone or tablet. This flexibility ensures that you can sign and send documents on the go, enhancing productivity.

-

How does airSlate SignNow ensure the security of my RPD 41378 Application?

Security is a top priority at airSlate SignNow. The platform utilizes industry-standard encryption and authentication protocols to protect your RPD 41378 Application For Type 11 Or 12 Nontaxable Transaction Certificates and any other documents you handle, ensuring that your sensitive information remains confidential.

-

Are there any integrations available with airSlate SignNow for the RPD 41378 Application?

Yes, airSlate SignNow seamlessly integrates with various software and applications, enabling you to streamline your workflow while working on the RPD 41378 Application For Type 11 Or 12 Nontaxable Transaction Certificates. These integrations enhance productivity by allowing you to connect with tools you already use.

Get more for RPD 41378 Application For Type 11 Or 12 Nontaxable Transaction Certificates

- Legal last will form for a widow or widower with no children wyoming

- Legal last will and testament form for a widow or widower with adult and minor children wyoming

- Legal last will and testament form for divorced and remarried person with mine yours and ours children wyoming

- Legal last will and testament form with all property to trust called a pour over will wyoming

- Written revocation of will wyoming form

- Last will and testament for other persons wyoming form

- Notice to beneficiaries of being named in will wyoming form

- Estate planning questionnaire and worksheets wyoming form

Find out other RPD 41378 Application For Type 11 Or 12 Nontaxable Transaction Certificates

- Electronic signature Wisconsin Business Operations LLC Operating Agreement Myself

- Electronic signature Colorado Doctors Emergency Contact Form Secure

- How Do I Electronic signature Georgia Doctors Purchase Order Template

- Electronic signature Doctors PDF Louisiana Now

- How To Electronic signature Massachusetts Doctors Quitclaim Deed

- Electronic signature Minnesota Doctors Last Will And Testament Later

- How To Electronic signature Michigan Doctors LLC Operating Agreement

- How Do I Electronic signature Oregon Construction Business Plan Template

- How Do I Electronic signature Oregon Construction Living Will

- How Can I Electronic signature Oregon Construction LLC Operating Agreement

- How To Electronic signature Oregon Construction Limited Power Of Attorney

- Electronic signature Montana Doctors Last Will And Testament Safe

- Electronic signature New York Doctors Permission Slip Free

- Electronic signature South Dakota Construction Quitclaim Deed Easy

- Electronic signature Texas Construction Claim Safe

- Electronic signature Texas Construction Promissory Note Template Online

- How To Electronic signature Oregon Doctors Stock Certificate

- How To Electronic signature Pennsylvania Doctors Quitclaim Deed

- Electronic signature Utah Construction LLC Operating Agreement Computer

- Electronic signature Doctors Word South Dakota Safe