Alliance CashVantage Personal Financing I Application Form

What is the Alliance CashVantage Personal Financing i Application Form

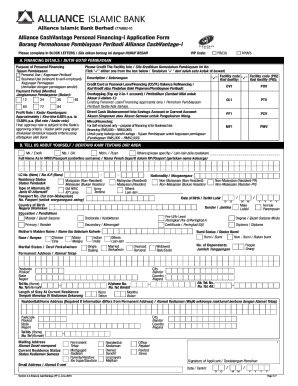

The Alliance CashVantage Personal Financing i Application Form is a crucial document for individuals seeking personal financing options. This form serves as the official request for financial assistance, allowing applicants to provide essential information about their financial status, employment, and personal details. It is designed to streamline the application process for loans, ensuring that all necessary information is collected efficiently. By completing this form, applicants can initiate the evaluation process for their financing needs, making it a vital step in obtaining personal loans.

Steps to complete the Alliance CashVantage Personal Financing i Application Form

Completing the Alliance CashVantage Personal Financing i Application Form involves several key steps that ensure accuracy and completeness. First, gather all necessary documents, including proof of income, identification, and any other relevant financial information. Next, fill out the form with accurate personal details, including your name, address, and social security number. It is essential to provide truthful information regarding your financial situation, as this will impact the approval process. After completing the form, review it carefully for any errors or omissions before submitting it to ensure a smooth application experience.

Legal use of the Alliance CashVantage Personal Financing i Application Form

The legal use of the Alliance CashVantage Personal Financing i Application Form is governed by several regulations that ensure the integrity of the application process. When filled out electronically, the form must comply with the ESIGN Act and UETA, which establish the legality of electronic signatures and documents. This compliance ensures that the submitted application is legally binding and can be used in financial agreements. It is important for applicants to understand these legal frameworks, as they protect both the lender and the borrower during the financing process.

Key elements of the Alliance CashVantage Personal Financing i Application Form

Several key elements are essential for the Alliance CashVantage Personal Financing i Application Form to be effective. These include personal identification details, financial information, and loan specifics. Applicants must provide their full name, contact information, and social security number. Additionally, the form requires details about income sources, monthly expenses, and any existing debts. Understanding these elements is crucial, as they help lenders assess the applicant's financial health and determine eligibility for financing options.

Eligibility Criteria

Eligibility criteria for the Alliance CashVantage Personal Financing i Application Form typically include factors such as age, income level, and credit history. Applicants must be at least eighteen years old and possess a valid social security number. Lenders often evaluate the applicant's credit score and financial history to determine their ability to repay the loan. Meeting these criteria is essential for a successful application, as they help lenders assess risk and make informed lending decisions.

Application Process & Approval Time

The application process for the Alliance CashVantage Personal Financing i Application Form involves several stages, starting with the submission of the completed form. After submission, lenders review the application, which may take anywhere from a few hours to several days, depending on the lender's policies and the complexity of the application. Once the review is complete, applicants will receive notification regarding the approval status. Understanding this timeline can help applicants manage their expectations and plan accordingly for their financing needs.

Quick guide on how to complete alliance cashvantage personal financing i application form

Effortlessly Prepare Alliance CashVantage Personal Financing i Application Form on Any Device

Digital document management has gained popularity among businesses and individuals alike. It presents an ideal eco-friendly substitute for conventional printed and signed papers, allowing you to obtain the necessary form and securely store it online. airSlate SignNow equips you with all the features needed to create, edit, and eSign your documents promptly without delays. Handle Alliance CashVantage Personal Financing i Application Form on any platform using the airSlate SignNow apps for Android or iOS and streamline any document-related process today.

The Easiest Way to Edit and eSign Alliance CashVantage Personal Financing i Application Form with Ease

- Find Alliance CashVantage Personal Financing i Application Form and click on Get Form to begin.

- Utilize the tools available to complete your form.

- Mark important sections of your documents or redact sensitive information using tools specifically provided by airSlate SignNow.

- Generate your eSignature with the Sign feature, which takes just seconds and holds the same legal validity as a conventional handwritten signature.

- Review all the details and click on the Done button to save your modifications.

- Choose your preferred method of sending the form, whether by email, SMS, or invitation link, or download it to your computer.

Eliminate concerns about lost or misplaced documents, cumbersome form searching, or errors that necessitate printing additional copies. airSlate SignNow meets your document management needs in just a few clicks from any device you prefer. Edit and eSign Alliance CashVantage Personal Financing i Application Form and ensure seamless communication at every stage of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the alliance cashvantage personal financing i application form

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is cashvantage personal financing i?

Cashvantage personal financing i is a financial solution designed to help individuals manage their personal financing needs effectively. It provides flexible borrowing options that can be tailored to meet specific financial situations, ensuring you have access to funds when necessary.

-

How much does cashvantage personal financing i cost?

The pricing for cashvantage personal financing i varies depending on the loan amount and term chosen. Generally, the service offers competitive interest rates and transparent fees, ensuring that you understand the total cost of borrowing before committing.

-

What are the key features of cashvantage personal financing i?

Cashvantage personal financing i offers features such as quick online applications, personalized loan options, and easy repayment terms. Additionally, it includes a user-friendly interface and 24/7 customer support to assist you throughout the process.

-

What are the benefits of using cashvantage personal financing i?

Using cashvantage personal financing i enables you to access funds quickly and conveniently, making it ideal for emergencies or unexpected expenses. The ability to customize loan terms helps you manage repayment comfortably according to your financial situation.

-

Can I manage my cashvantage personal financing i account online?

Yes, cashvantage personal financing i provides an easy-to-use online portal for managing your account. You can check your balance, make payments, and view transaction history anytime, giving you full control over your financing.

-

Does cashvantage personal financing i integrate with other financial tools?

Cashvantage personal financing i is designed to seamlessly integrate with various financial management tools and platforms. This ensures that you can maintain a holistic view of your financial health while benefiting from personalized financing options.

-

Who is eligible for cashvantage personal financing i?

Eligibility for cashvantage personal financing i typically includes individuals who meet certain credit and income requirements. It's advisable to check the specific criteria and documentation needed during the application process to ensure a smooth experience.

Get more for Alliance CashVantage Personal Financing i Application Form

- Ohio revocation 497322562 form

- Newly divorced individuals package ohio form

- Contractors forms package ohio

- Power of attorney for sale of motor vehicle ohio form

- Wedding planning or consultant package ohio form

- Oh power attorney form

- Hunting forms package ohio

- Identity theft recovery package ohio form

Find out other Alliance CashVantage Personal Financing i Application Form

- Sign Wyoming Courts LLC Operating Agreement Online

- How To Sign Wyoming Courts Quitclaim Deed

- eSign Vermont Business Operations Executive Summary Template Mobile

- eSign Vermont Business Operations Executive Summary Template Now

- eSign Virginia Business Operations Affidavit Of Heirship Mobile

- eSign Nebraska Charity LLC Operating Agreement Secure

- How Do I eSign Nevada Charity Lease Termination Letter

- eSign New Jersey Charity Resignation Letter Now

- eSign Alaska Construction Business Plan Template Mobile

- eSign Charity PPT North Carolina Now

- eSign New Mexico Charity Lease Agreement Form Secure

- eSign Charity PPT North Carolina Free

- eSign North Dakota Charity Rental Lease Agreement Now

- eSign Arkansas Construction Permission Slip Easy

- eSign Rhode Island Charity Rental Lease Agreement Secure

- eSign California Construction Promissory Note Template Easy

- eSign Colorado Construction LLC Operating Agreement Simple

- Can I eSign Washington Charity LLC Operating Agreement

- eSign Wyoming Charity Living Will Simple

- eSign Florida Construction Memorandum Of Understanding Easy