Form 89 350 10 2

What is the Form 89 350 10 2

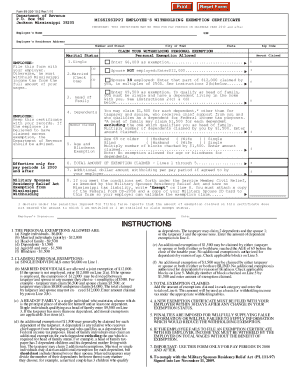

The Form 89 350 10 2 is a specific document used for withholding tax purposes in Mississippi. This form is essential for employers to report and remit state income taxes withheld from employee wages. Understanding its purpose ensures compliance with state tax regulations and helps avoid potential penalties. It is crucial for both employers and employees to be familiar with the details of this form to ensure accurate reporting and withholding.

How to use the Form 89 350 10 2

Using the Form 89 350 10 2 involves several steps to ensure proper completion and submission. Employers must accurately fill out the required fields, including the employee's information, the amount of wages paid, and the corresponding tax withheld. Once completed, the form must be submitted to the Mississippi Department of Revenue by the designated deadline. Utilizing electronic tools can streamline this process, making it easier to manage and submit the form efficiently.

Steps to complete the Form 89 350 10 2

Completing the Form 89 350 10 2 requires careful attention to detail. Here are the key steps:

- Gather necessary employee information, including name, address, and Social Security number.

- Calculate the total wages paid to the employee during the reporting period.

- Determine the amount of state income tax to withhold based on the applicable tax rates.

- Fill out the form accurately, ensuring all fields are completed.

- Review the form for any errors before submission.

- Submit the completed form to the Mississippi Department of Revenue by the due date.

Legal use of the Form 89 350 10 2

The legal use of the Form 89 350 10 2 is governed by Mississippi state tax laws. Employers must ensure that they are compliant with these regulations to avoid legal repercussions. The form serves as an official record of the state income tax withheld from employees, and proper usage is crucial for maintaining transparency and accountability in payroll practices. Non-compliance can lead to penalties, making it essential to understand the legal implications of this form.

Key elements of the Form 89 350 10 2

Several key elements must be included when completing the Form 89 350 10 2. These include:

- Employer's name and identification number.

- Employee's name, address, and Social Security number.

- Total wages paid during the reporting period.

- Amount of state income tax withheld.

- Signature of the employer or authorized representative.

Form Submission Methods (Online / Mail / In-Person)

The Form 89 350 10 2 can be submitted through various methods, depending on the preferences of the employer. Options include:

- Online submission via the Mississippi Department of Revenue's website, which allows for faster processing.

- Mailing the completed form to the appropriate state office, ensuring it is postmarked by the due date.

- In-person submission at designated state offices for those who prefer direct interaction.

Quick guide on how to complete form 89 350 10 2

Effortlessly Prepare Form 89 350 10 2 on Any Device

Web-based document management has become increasingly favored by businesses and individuals. It offers an ideal environmentally friendly substitute to traditional printed and signed documents, allowing you to locate the correct form and securely store it online. airSlate SignNow provides you with all the resources required to create, modify, and electronically sign your documents rapidly without delays. Manage Form 89 350 10 2 on any platform with the airSlate SignNow Android or iOS applications and enhance any document-related process today.

How to Edit and Electronically Sign Form 89 350 10 2 with Ease

- Locate Form 89 350 10 2 and click on Get Form to begin.

- Utilize the tools we provide to complete your document.

- Select important sections of the documents or conceal sensitive details with tools specifically designed for that purpose by airSlate SignNow.

- Generate your electronic signature using the Sign tool, which takes only seconds and carries the same legal validity as a traditional wet ink signature.

- Verify all the details and then click the Done button to save your modifications.

- Select how you wish to share your form, via email, SMS, or invitation link, or download it to your computer.

No more concerns about lost or misplaced documents, tiresome form searches, or mistakes that require new document copies to be printed. airSlate SignNow addresses all your document management needs in just a few clicks from any device you prefer. Edit and electronically sign Form 89 350 10 2 and guarantee excellent communication at every stage of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the form 89 350 10 2

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is the pricing structure for airSlate SignNow with the 89 350 feature?

The pricing for airSlate SignNow using the 89 350 feature is designed to be affordable and transparent. We offer various plans tailored for businesses of all sizes, ensuring that you can find a solution that fits your budget. Don't forget to check for any ongoing promotions or discounts that can help you save even more.

-

What key features does the airSlate SignNow platform provide?

The airSlate SignNow platform offers a range of features with the 89 350 functionality, including document tracking, customizable templates, and advanced security options. These features ensure that your documents are processed efficiently and securely. With a user-friendly interface, managing documents has never been easier.

-

How can the 89 350 solution benefit my business?

Implementing the 89 350 solution through airSlate SignNow can signNowly streamline your document workflows. This leads to reduced turnaround times and improved client satisfaction. Furthermore, by embracing such solutions, businesses often see increased productivity across their teams.

-

Can I integrate airSlate SignNow with other tools I use?

Absolutely! The 89 350 offering from airSlate SignNow is designed to integrate seamlessly with various popular tools and platforms. Whether you're using CRM systems, project management tools, or cloud storage services, our integrations will help you maintain a smooth workflow.

-

Is there a free trial available for airSlate SignNow with the 89 350 feature?

Yes, we offer a free trial for potential customers to explore the capabilities of airSlate SignNow, including the 89 350 feature. This allows you to test all functionalities without any commitment. Sign up today to experience the ease of eSigning and document management.

-

How secure is the airSlate SignNow platform with the 89 350 features?

Security is a top priority at airSlate SignNow, particularly for the 89 350 functionalities. We implement industry-standard encryption and security protocols to ensure that your documents remain protected throughout the signing process. You can trust that your sensitive information is safe with us.

-

What types of documents can I send for eSigning with airSlate SignNow?

With airSlate SignNow’s 89 350 features, you can send a wide variety of documents for eSigning, including contracts, agreements, and forms. The platform supports various file types, making it easy to manage all your documentation in one place. Custom templates can also streamline repetitive tasks.

Get more for Form 89 350 10 2

- Cancel license plates illinois online form

- Public policylegacy community health form

- Product id 481 revision id 2283 date published 23 june 2021 date effective 23 june 2021 form

- Cosmetology department of statedepartment of statecosmetology department of statedepartment of statecosmetology department of form

- Oh residential property disclosure form the basics

- Fa 4170v form

- 28 day multi dose vial calendar 2021calendar template 2022 form

- Sctxca form

Find out other Form 89 350 10 2

- How To eSignature Oklahoma Finance & Tax Accounting PPT

- Help Me With eSignature Connecticut High Tech Presentation

- How To eSignature Georgia High Tech Document

- How Can I eSignature Rhode Island Finance & Tax Accounting Word

- How Can I eSignature Colorado Insurance Presentation

- Help Me With eSignature Georgia Insurance Form

- How Do I eSignature Kansas Insurance Word

- How Do I eSignature Washington Insurance Form

- How Do I eSignature Alaska Life Sciences Presentation

- Help Me With eSignature Iowa Life Sciences Presentation

- How Can I eSignature Michigan Life Sciences Word

- Can I eSignature New Jersey Life Sciences Presentation

- How Can I eSignature Louisiana Non-Profit PDF

- Can I eSignature Alaska Orthodontists PDF

- How Do I eSignature New York Non-Profit Form

- How To eSignature Iowa Orthodontists Presentation

- Can I eSignature South Dakota Lawers Document

- Can I eSignature Oklahoma Orthodontists Document

- Can I eSignature Oklahoma Orthodontists Word

- How Can I eSignature Wisconsin Orthodontists Word