Form 540EZ California Franchise Tax Board Ftb Ca

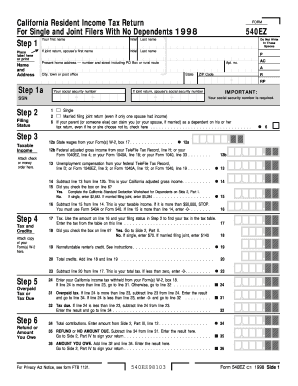

What is the Form 540EZ?

The Form 540EZ is a simplified tax return form used by residents of California to report their income and calculate their state tax liability. It is designed for individuals with straightforward tax situations, such as single filers or married couples filing jointly, who do not have dependents and earn below a specified income threshold. This form streamlines the filing process, allowing eligible taxpayers to complete their returns quickly and efficiently.

Steps to Complete the Form 540EZ

Completing the Form 540EZ involves several key steps:

- Gather necessary documents, including W-2 forms, 1099s, and any other income statements.

- Fill out personal information, such as your name, address, and Social Security number.

- Report your income by entering amounts from your income statements.

- Calculate your adjustments and deductions, if applicable, to determine your taxable income.

- Complete the tax calculation section to find out your total tax owed or refund due.

- Sign and date the form before submitting it.

Legal Use of the Form 540EZ

The Form 540EZ is legally recognized by the California Franchise Tax Board (FTB) for filing state income taxes. To ensure its legal validity, taxpayers must complete the form accurately and comply with all applicable tax laws. Using a reliable electronic signature solution, like signNow, can enhance the security and legality of your submission, ensuring that your eSignature meets the requirements set forth by the ESIGN Act and UETA.

Eligibility Criteria for the Form 540EZ

To qualify for using the Form 540EZ, taxpayers must meet specific eligibility criteria:

- Filing status must be single or married filing jointly.

- Adjusted gross income must be below a specified limit, which varies each tax year.

- No dependents can be claimed on the tax return.

- Taxpayers must not have income from sources such as business, rental properties, or other complex financial situations.

How to Obtain the Form 540EZ

The Form 540EZ can be obtained through various channels:

- Visit the California Franchise Tax Board website to download the form directly.

- Request a paper form to be mailed to you by contacting the FTB.

- Access the form through tax preparation software that supports California state tax filings.

Form Submission Methods

Taxpayers have several options for submitting the Form 540EZ:

- Online submission through the California Franchise Tax Board's e-file system.

- Mailing a completed paper form to the designated FTB address.

- In-person submission at local FTB offices, if available.

Quick guide on how to complete form 540ez california franchise tax board ftb ca 5926783

Complete Form 540EZ California Franchise Tax Board Ftb Ca effortlessly on any device

Managing documents online has gained traction among businesses and individuals. It offers an ideal environmentally friendly substitute for conventional printed and signed documents, as you can obtain the appropriate form and securely store it online. airSlate SignNow equips you with all the resources you need to create, edit, and eSign your documents promptly without delays. Manage Form 540EZ California Franchise Tax Board Ftb Ca on any device using airSlate SignNow's Android or iOS applications and enhance any document-centric workflow today.

How to modify and eSign Form 540EZ California Franchise Tax Board Ftb Ca with ease

- Find Form 540EZ California Franchise Tax Board Ftb Ca and click Get Form to begin.

- Utilize the tools we offer to finalize your document.

- Highlight pertinent sections of your documents or redact sensitive information using the tools provided by airSlate SignNow specifically for that purpose.

- Create your signature with the Sign tool, which takes mere seconds and carries the same legal authority as a conventional wet ink signature.

- Review the details and click the Done button to save your changes.

- Select your preferred method to share your form, whether by email, text message (SMS), invitation link, or download it to your computer.

Put an end to the worry of lost or misplaced documents, tedious form searches, or errors that necessitate printing new document copies. airSlate SignNow addresses your document management requirements in a few clicks from your chosen device. Edit and eSign Form 540EZ California Franchise Tax Board Ftb Ca and guarantee effective communication at every stage of your form preparation journey with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the form 540ez california franchise tax board ftb ca 5926783

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is the Form 540EZ for the California Franchise Tax Board, Ftb Ca?

The Form 540EZ is a simplified income tax return specifically designed for California residents with straightforward tax situations. This form allows taxpayers to report their income, claim standard deductions, and receive potential refunds efficiently. By using the Form 540EZ from the California Franchise Tax Board, Ftb Ca, individuals can streamline their tax filing process.

-

How can airSlate SignNow assist with submitting the Form 540EZ to the California Franchise Tax Board, Ftb Ca?

airSlate SignNow provides businesses and individuals with a seamless e-signature solution for submitting important documents like the Form 540EZ to the California Franchise Tax Board, Ftb Ca. This platform enables users to sign, send, and manage their tax documents securely and efficiently, ensuring compliance with state filing requirements.

-

What are the key features of airSlate SignNow related to the Form 540EZ California Franchise Tax Board, Ftb Ca?

Key features include customizable templates, secure electronic signatures, and real-time tracking for your Form 540EZ submissions to the California Franchise Tax Board, Ftb Ca. These features enhance document management, reduce processing times, and minimize errors, making tax filing a hassle-free experience.

-

Is there a cost associated with using airSlate SignNow to manage my Form 540EZ California Franchise Tax Board, Ftb Ca submissions?

Yes, airSlate SignNow offers various pricing plans that cater to different needs, whether for individuals or businesses. The cost is designed to be cost-effective, providing users with a reliable solution for managing their Form 540EZ submissions to the California Franchise Tax Board, Ftb Ca without breaking the bank.

-

What benefits does airSlate SignNow provide for Form 540EZ electronic submissions?

Using airSlate SignNow for your Form 540EZ electronic submissions ensures speeding up the tax filing process and enhances the security of your sensitive information. Additionally, the platform's user-friendly interface and robust features make it easy to navigate, helping users meet their obligations to the California Franchise Tax Board, Ftb Ca with confidence.

-

Can I integrate airSlate SignNow with other applications for Form 540EZ processing?

Absolutely! airSlate SignNow offers integrations with several popular applications, enhancing your workflow for processing Form 540EZ documents. This compatibility allows users to connect with accounting software and cloud storage solutions, making it easier to manage submissions to the California Franchise Tax Board, Ftb Ca.

-

How does airSlate SignNow ensure compliance with the California Franchise Tax Board, Ftb Ca when submitting Form 540EZ?

airSlate SignNow is built to comply with state and federal regulations, ensuring that your Form 540EZ submissions to the California Franchise Tax Board, Ftb Ca meet all necessary legal requirements. The platform employs cutting-edge security measures and provides a clear audit trail for each document, reinforcing its commitment to compliance.

Get more for Form 540EZ California Franchise Tax Board Ftb Ca

- Wwwnewbridgerugbycomwp contentuploadsirish rugby football union youthadult player registration form

- Sports massage consultation form template uk

- Wwwctqgouvqcca fileadmin documentstransport of persons by bus and leasing of buses quebecca form

- Microsoft word registration form regular

- Hospice referral form

- Client referral form final seniors services

- Wwwpdffillercom438120198 ellice swamp hunting ellice swamp hunting fill online printable fillable form

- Declaration and client consent form hawthorn clinic

Find out other Form 540EZ California Franchise Tax Board Ftb Ca

- How Can I Sign West Virginia Courts Quitclaim Deed

- Sign Courts Form Wisconsin Easy

- Sign Wyoming Courts LLC Operating Agreement Online

- How To Sign Wyoming Courts Quitclaim Deed

- eSign Vermont Business Operations Executive Summary Template Mobile

- eSign Vermont Business Operations Executive Summary Template Now

- eSign Virginia Business Operations Affidavit Of Heirship Mobile

- eSign Nebraska Charity LLC Operating Agreement Secure

- How Do I eSign Nevada Charity Lease Termination Letter

- eSign New Jersey Charity Resignation Letter Now

- eSign Alaska Construction Business Plan Template Mobile

- eSign Charity PPT North Carolina Now

- eSign New Mexico Charity Lease Agreement Form Secure

- eSign Charity PPT North Carolina Free

- eSign North Dakota Charity Rental Lease Agreement Now

- eSign Arkansas Construction Permission Slip Easy

- eSign Rhode Island Charity Rental Lease Agreement Secure

- eSign California Construction Promissory Note Template Easy

- eSign Colorado Construction LLC Operating Agreement Simple

- Can I eSign Washington Charity LLC Operating Agreement