Birt Schedule Sc 00 00 00 00 00 00 00 00 00 00 00 00 Form

What is the Birt Schedule Sc 00 00 00 00 00 00 00 00 00 00 00 00

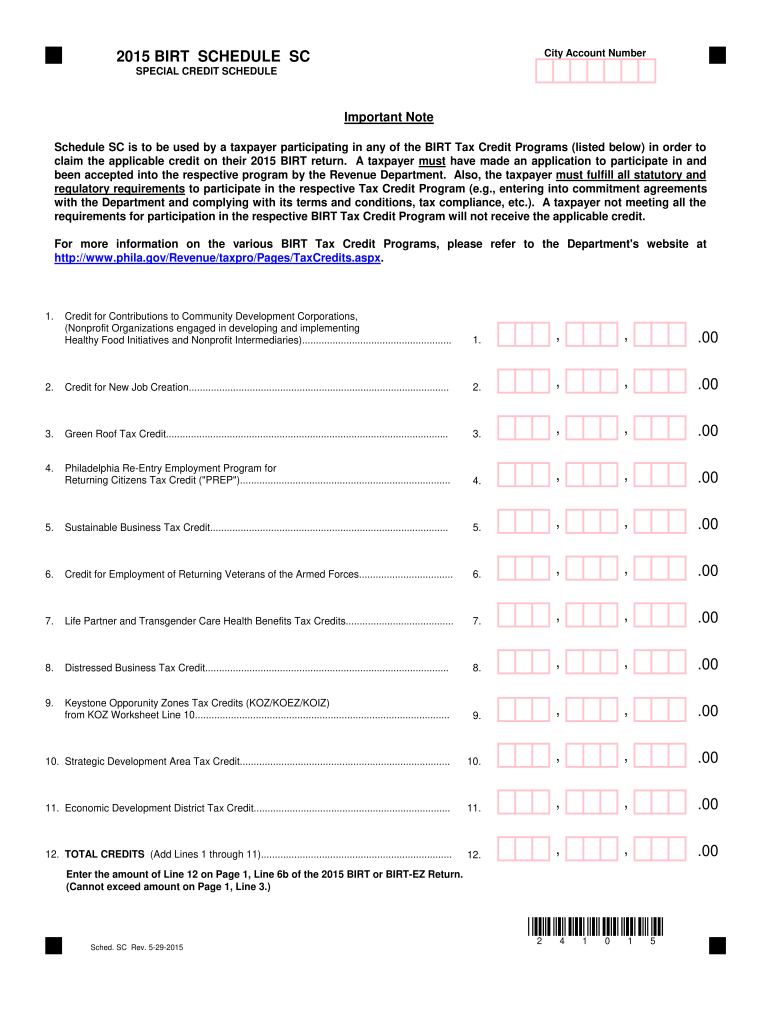

The Birt Schedule Sc 00 00 00 00 00 00 00 00 00 00 00 00 is a specific tax form used in the United States for reporting certain tax-related information. It is typically utilized by businesses and individuals to provide details about their income, expenses, and other financial activities. This form is essential for ensuring compliance with federal and state tax regulations, allowing taxpayers to accurately report their earnings and claim any applicable deductions.

How to use the Birt Schedule Sc 00 00 00 00 00 00 00 00 00 00 00 00

Using the Birt Schedule Sc 00 00 00 00 00 00 00 00 00 00 00 00 involves several steps. First, gather all necessary financial documents, including income statements and expense records. Next, fill out the form accurately, ensuring that all figures are correct and correspond to your financial data. After completing the form, review it for any errors before submission. It is advisable to keep a copy for your records and submit the form according to the designated filing methods.

Steps to complete the Birt Schedule Sc 00 00 00 00 00 00 00 00 00 00 00 00

Completing the Birt Schedule Sc 00 00 00 00 00 00 00 00 00 00 00 00 involves the following steps:

- Gather all relevant financial documents.

- Accurately fill in your income details on the form.

- Document any allowable deductions or credits.

- Double-check all entries for accuracy.

- Submit the completed form via the appropriate method.

Legal use of the Birt Schedule Sc 00 00 00 00 00 00 00 00 00 00 00 00

The Birt Schedule Sc 00 00 00 00 00 00 00 00 00 00 00 00 must be used in compliance with applicable tax laws. This means that all information reported must be truthful and accurate. Failing to comply with legal requirements can result in penalties or audits. It is essential to understand the legal implications of submitting this form, including the potential consequences of inaccuracies or omissions.

Filing Deadlines / Important Dates

Filing deadlines for the Birt Schedule Sc 00 00 00 00 00 00 00 00 00 00 00 00 are crucial to avoid penalties. Typically, the form must be submitted by the tax filing deadline, which is usually April fifteenth for individual taxpayers. Businesses may have different deadlines based on their fiscal year. It is important to stay informed about any changes in tax law that may affect these dates.

Required Documents

To complete the Birt Schedule Sc 00 00 00 00 00 00 00 00 00 00 00 00, you will need several documents, including:

- Income statements (W-2s, 1099s).

- Receipts for deductible expenses.

- Previous tax returns for reference.

- Any relevant financial statements.

Quick guide on how to complete 2015 birt schedule sc 00 00 00 00 00 00 00 00 00 00 00 00

Complete Birt Schedule Sc 00 00 00 00 00 00 00 00 00 00 00 00 effortlessly on any device

Digital document management has become increasingly popular among businesses and individuals. It offers an excellent eco-friendly alternative to conventional printed and signed paperwork, allowing you to access the necessary form and securely store it online. airSlate SignNow equips you with all the tools required to create, modify, and eSign your documents swiftly without delays. Manage Birt Schedule Sc 00 00 00 00 00 00 00 00 00 00 00 00 on any device with airSlate SignNow's Android or iOS applications and streamline any document-related process today.

How to alter and eSign Birt Schedule Sc 00 00 00 00 00 00 00 00 00 00 00 00 with ease

- Locate Birt Schedule Sc 00 00 00 00 00 00 00 00 00 00 00 00 and click on Get Form to begin.

- Utilize the tools we provide to fill out your form.

- Highlight important sections of the documents or redact sensitive information using tools specifically designed for that purpose by airSlate SignNow.

- Generate your eSignature using the Sign tool, which takes only seconds and carries the same legal validity as a conventional wet ink signature.

- Verify the details and click on the Done button to save your modifications.

- Choose how you wish to send your form: via email, text message (SMS), invitation link, or download it to your computer.

Leave behind the worries of lost or misplaced documents, tedious form navigation, or mistakes that necessitate printing new document copies. airSlate SignNow fulfills your document management needs in just a few clicks from any device you prefer. Alter and eSign Birt Schedule Sc 00 00 00 00 00 00 00 00 00 00 00 00 to ensure effective communication at every step of your form preparation journey with airSlate SignNow.

Create this form in 5 minutes or less

FAQs

-

Why is 3 am considered the “witching hour” or the "devil's hour"?

Before I begin theology time I want to start with story time. When I was 16 I had a dream that black, clawlike hands were messing with my alarm clock and giggling. As soon as the dream ended my alarm clock went off at 3AM! That experience was more frightening than any horror movie you could ever watch and it took quite a while before I had a good nights sleep after that experience. I assure the reader that my alarm was always set for 6AM and that I have no idea how it could have been changed. I questioned anyone who could have been in my room and everyone swore they did nothing to my alarm clock. Only conclusion I have ever come to is spiritual warfare.Now it’s theology time. There is nothing in the Bible that says 3 AM is the Devil’s hour. Some people believe that Jesus rose from the dead at 3 PM and the Devil likes to work at the opposite hour. The Bible only says Jesus rose from the dead on the third day it does not say what time he rose. As far as we know Jesus rose from the dead at 3 AM! The reason people say Jesus rose from the dead at 3 PM is because it is picturesque. It’s the brightest time of day so it represents the truimph of good over evil. But there is nothing in the scripture that requires we believe Jesus rose at 3PM.So we can't associate Satan with a certain time but can we associate him with darkness? Absolutely.Ephesians 6:12 “ For we do not wrestle against flesh and blood, but against the rulers, against the authorities, against the cosmic powers over this present darkness, against the spiritual forces of evil in the heavenly places.”It is fair to say that Satan is the leader of these evil cosmic forces of darkness. However, there is no reason to believe that “darkness” refers to literal light and dark. Instead, darkness refers to lack of good, lack of wisdom, lack of truth, and lack of beauty. I think reading that Satan is mostly active at night is stretching the scripture. Satan wants to tempt us. How can he do this when we are asleep?I do think that Satan does use night to his advantage. Satan works through fear. People are more easy to scare when it's dark and if you want to harass someone you mess with their sleep. I don't think the Devil owns 3AM but I do think he uses it when he can. It’s even better for him if people believe he owns the night; makes him more scary.Truth is Satan has nothing; not even 3AM. He is Lord of the Flies not Lord of the Night. As Christians we need to pray more so that we will experience victory over the Devil. “Some things can only come out with prayer and fasting”. As Christians we can take the night back too. Don't let the Devil have 3AM.

-

When you work from 8:00 a.m. to 6:00 p.m., how do you grow as a person?

I was there and I am thankful for my fate to endure such long hours.My life completely changed when I was forced to work in an environment with long hours and long commute. I realized, I have to do something about it. (I was sleeping earlier but it woke me up.)When you have a 10-11 hours long workday, how do you grow as a person? Spiritually, intellectually, emotionally and financially. This is a fair question and an important one.I used to asked this question to myself and my colleagues. Sometimes this question used to scream at me at night. My job was very technical (debugging code and sql stored procedures) and I was learning and growing as far as my technical skills were concerned. But, the focused screen time was taking a toll on my eyes and after my job, I did not want to look at any screen which emits light. I was done for the day.That said, it was also true that I am not a kind of person cut out for a 9-5 or 8-6 job! I am a person cut out for 7-7 (irony?) but as an entrepreneur.How much do I make an hour? About $200. Will spending one hour to write this answer on Quora help me make my hourly rate? Nope, not even a single dime... but here I am. (Because I like doing this and therefore do not mind the hours.)It's not about hours, it's about passion and growthWhy do I do what I do and make my day 7-7? Because, I am passionate about my mission in life and I have the freedom to work on whatever project I want, whenever I want. It's Monday, 10:30 am. No problem. I am going to spend an hour writing an answer on Quora.My heart is into answering questions on quora, writing blogs, writing books, running an IT company, running an offshore VA company and investing, I am learning everyday. I am growing every single day. On all fronts. Spiritually, emotionally, intellectually and financially.I try and tend to accomplish atleast 20 hours of productivity each day (during my 7-7). I structure my time to do this. I have a routine (even though I work from home). And, I read a lot.What can you do in your situation?The 5 Point Solution1. First celebrate yourselfCelebrate the fact that you have a 8-6. A lot of people do not have a job or they have an underpaying job for their skills. You may not realize this but you are in an advantageous situation over many other (reading this answer right now).May be you are commuting 2 hours daily for your job. Listen to podcasts and audiobooks. That is your 2 hours of daily reading. Powerful.2 hours daily x 5 days a week = 10 hours of reading/weeki.e. 40 hours of reading/month i.e. 3-4 books each months + dozens of self-development, business, entrepreneurship podcastsImagine, after 6 months of doing this how powerful your mind will become! How much knowledge you will have!2. Meditate, Visualize and AffirmationsWhen you wake up in morning, spend 10 minutes (not too much to ask for) to meditate (if that's your thing). If not read a spiritual book (again depending on how you define spirituality and what is spiritual for you).If nothing comes to mind and meditation is not your thing, just practice deep visualization of how you would want to shape your life. Visualize clearly that everything that you desire have come to the fruition. Visualize them as vividly as possible. Feel the emotions.You can also read aloud your self-affirmations. An example would be:"I am a positive person who is happy for my long commute so that I can listen to uplifting audiobooks and podcasts.""I am a happy person who likes to learn as much as I can on my work. I am happy for my job because it provides for my family."And so on..3. Meal and life planningSince you have time consuming job, I would assume it is also stress inducing. You should cook on Sunday evening for your next three days of lunch. On Wednesday evening, you should cook lunch for Thursday and Friday.If your team eats out on Friday, join them. Make connections. Build relationships.Stick to your lunch box on the rest of the days. Try to eat on your own (if possible). Or, with other folks. It's up to you.Take a small walk. Let new ideas come to your brain whenever you take a break from your work. Be it small tea or coffee breaks or be it a small walk.Spend these moments alone. Atleast try to. That is when your inner fire will transform your passion into great ideas.Besides, the above benefits, you are also saving money on lunch dollars if you are currently eating out. This small saving will pay off in big ways in terms of self-discipline, routine, structuring your life and allowing yourself the luxury of having the free time during lunch hours to think hard and come up with ideas that will make your life better.4. Exercise and evening ritualIf you are in a relationship and have kids, spend time with your family. If you have to drop your kids for classes or gymnastics, you should participate with them as well. Swimming? How about you and your partner swim as well with your kids. Music lessons? How about you train yourself in music too. Pick up an instrument that you always wanted to learn.Gymnastics or dance? How about you start training your body just as you are training your mind.If you are single, you are lucky. Eat light dinner. Go straight to the gym and workout. Give your best. Lift heavy weights. Challenge your body to its maximum limits. Run as if you are preparing for a coming zombie apocalypse. This is how you grow your physical self. This is how you become mentally tough. This is how you show to yourself, you are serious. That you are committed to transforming your lifestyle. 5. Weekends are yours to keepWeekends are sacred. Use those 48 hours as if your life depends on it because it does.Let's say you are single. (People with family will have a somewhat different structure on weekends. I can cover them in an another quora question.)Talk to your friends who are equally motivated and positive as you are. Cut off from people who are negative and time-money-and-blood suckers. By now, you probably know who they are in you life. Limit your Facebook and social media time to 30 minutes each day on weekends. Take a trip to somewhere new or go for a hike. When you walk, your brain thinks smarter and faster. When you are moving, your brain gets stronger. During afternoon or in the morning, (depending on your schedule), sit down and come up with ideas on how you can make some passive income.Think: How can you save more money? How can you cut your overhead cost by 10% and invest that money? How you can earn more money?Spend some time learning about money, investing and the world economy.Think about all the hard questions about your life and try to come up with answers. If you do not have the answers, it's okay. Ask questions to others and find the answer. Your goal is to just explore possibilities at this time. I can promise that if you do this for just 6 months, you will be transformed into a new soul in a more youthful and stronger body. Now that you are smarter, get a new jobNow, you are ready to look for a new job and start a business on the side. If you are not a risk taker, then you would come up with ideas on smart money management and smart investment techniques and strategies. Business is not for everyone and it's okay to accept that.In such case, you would simply want to improve a skill that you have. Assuming, you are already happy with the money. Or perhaps, you would just like to relax and take things as they come. Whatever you wish or want, you have the mental and spiritual toughness to face it with grace and gratitude.Don't forget to cook your meals on Sunday night. Respect money and it will serve you. Learn discipline and it will take you to the next level.Have fun in the process. Life is too short to spend figuring out everything when all the beauty of this creation is right in front of you. Take it easy and enjoy the process.Good luck!Related:What are some real life stories of young entrepreneurs becoming millionaire before the age of 30? Is that goal even possible for most people?How do I think positive in life?What are some ways you would recommend about handling internal battles when you're on your 20s?How do I turn motivation and inspiration into an effort for something I want to achieve so badly?How do you live day by day and not think about the big picture of life?The author also wrote about My Top posts on Metalearning. Read more from the author… Salil Jha, an authorpreneur, best-selling author, podcast host and angel investor. He writes on meta-learning, learning techniques, poetry, entrepreneurship and self-growth in his personal blog at Naked Soul Blog | The Blog of Salil Jha.

-

How do I reduce my belly fat?

Belly fat is basically “starvation insurance”. Our body is designed to preserve fat in case there is no food for an extended period of time.On average our body needs about 1200 calories (female) and 2000 calories (male) per day to maintain homeostasis (that’s just a fancy word for “keeping us alive and all organs functioning properly”). So yes, even if we are just sitting on a couch and watching Netflix, our body still needs energy because we are alive - we are breathing, our heart is beating, every single cell inside of us is alive and that needs energy!That’s the good news, the bad news is that our bodies are incredibly efficient in terms of energy use. For example lets compare how much energy our body uses vs a Honda Civic (which is considered to be a fuel efficient car).The 2019 Honda Civic will do about 32 miles per gallon. Not bad you’d think. But wait a minute! How many calories is that?Aha! So a Honda Civic needs close to 29 million calories to go 32 miles. How much does a human use to go 32 miles?We use about 100 calories per mile so that is only about 3200 calories for us vs 29 million calories for the Honda Civic! Humans win in terms of energy efficiency, hands down!While this energy efficiency allowed our ancestors to survive in times of starvation, in our modern society, it is more of a curse than a blessing because we now have food available 24/7. Not just regular food but foods that have been engineered to appeal to our taste-buds (high calorie, fatty, sugary, salty) because they sell better and we live in a capitalistic world.The second bad news is that fat is a “slow” source of energy for our body, meaning fat only gets broken down and burned when our body has depleted other “faster” sources of energy.Take a look at the following table, left column:The fastest energy source is ATP/CP (on the very top) which our body uses up first. The second fastest is carbohydrates, then its fat and lastly - when there is no fat available its protein (that’s basically when our body is breaking down itself to survive and “consuming” its own muscle tissue!).Contrary to popular belief, we do not lose more fat the harder we work out. Yes, we do lose ENERGY in form of calories, but calories can come from a number of sources as mentioned above, not just fat.THIS IS WHY SO MANY FAIL IN THE GYM - THEY EXERCISE HARD (HIGH INTENSITY) AND WONDER WHY THEY HAVEN’T LOST ANY FAT, WHEN IN REALITY ALL THE CALORIES THEY LOST CAME FROM CARBS, NOT FAT!To summarize what do we need to do to reduce/lose fat?Establish a daily “calorie baseline”. This is based off of the 1200/2000 calorie recommendation for average sized female/male adults. Your baseline will be different depending on whether you are smaller or bigger than the average.Track the calories you consume daily by reading food labels and/or getting a smartphone app.Reduce your daily caloric intake. The more you reduce your intake, the faster you will see results.Get a heart-rate monitor, they are used to measure how hard or “how intense” you are exercising.When exercising, keep your heart-rate at or below the “fat-burn” zone, if you speed up (increase your pace) beyond the fat burn zone, you no longer burn fat, but carbs!6. For most people “fast walking” will be at or below the fat-burn zone, even jogging will get you outside of the fat-burn zone, so slow down!7. Try replacing high calorie foods with lower calorie alternatives that are still filling (satiate you adequately). For example tofu soaks up the flavor of anything it comes in contact with like a sponge and can be a great healthy replacement for meats.8. When you are going for meat, skip red-meats and go for fish/seafood instead.9. Eat healthy snacks like fruit instead of high-calorie, highly processed ones.10. Use spices to enhance the flavor of healthy foods like vegetables.Stay frosty =)

-

Is it better to sleep 7 hours from 22:00 to 05:00 than to sleep from 00:00 to 09:00?

Physiologically, it makes more sense to sleep from 22:00 to 5:00 because it aligns more with your body’s internal clock aka the circadian clock.Our internal circadian biological clocks regulate the timing of periods of sleepiness and wakefulness throughout the day. The circadian rhythm dips and rises at different times of the day.When the circadian rhythm is disrupted by irregular sleep schedule like from 0:00–9:00, it puts us in conflict with our natural sleep pattern. The shift in time and light cues on the brain forces the body to alter its normal pattern to adjust.This is why people sometimes don’t feel alert or have low energy to perform. You probably feel more tired when you sleep from 22:00 to 5:00 because you’re not used to it, and 5:00 is typically before the sun rises, which is a natural trigger for your body to get up.As much as I think it’d be better to sleep from 22:00 to 5:00, it’s more important for you to keep a regular sleep schedule. The schedule means less compared to the quality of the sleep. Just to stick to a schedule that helps you perform at your best.If you’d like to learn more about sleep, how to get better sleep, and creating a sleeping habit:Check out my blogIf you’re trying to change your habits like sleep, you should check out my latest ebook about the 10 most common mistakes people make when they try to make positive changes in their lives.Get your copy here

-

When does a new day start? 00:00:00 hrs or 00:00:01 hrs?

It’s a fine line. The day ends at one side of the line at 24:00:00 and the new day begins at 00:00:00 - two sides of the same moments but, the definition is in the context. When you you look back to the start it is at 00:00:01. When you look forward to a new start it is 00:00:00. Or if you look at the same moment as the end of the day it is 24:00:00One is no more correct than another, just a different perspective.

-

Why was WhatsApp not working on 23rd Feb, 2014 00:00:00?

This is why it was disrupted.

-

Why isn't the trading day for stocks 24 hours? What then is the significance of the 9:30am-4pm "trading day", and why do stock price charts only cover those hours?

Because traders are human and people want to go home every now and then. We get 24/7 trading by "passing the baton" to other markets so that people aren't tied to their machines.Trading is like driving a car. While the markets are open, you do not take your eyes off the computer screen, and you are completely focused on the markets. Eight hours is about the limit that you can focus on something without blanking out.In addition, there is daily "bookkeeping" that needs to be done, so moving the markets off line lets you do it. For example, one of the first thing that gets done when the markets close is that people do trade reconcilation. You print out the list of all of the trades that the system thinks that you did, and you compare then with the ones that you think you actually did. If there is a difference then you call people up and resolve it. For example, you call someone up and you tell them to sell 500 shares, and you look at the report that they sold 600. At that point you get on the phone and resolve that issue. You know when you look at your credit card statement, and there is this charge that you don't know about. That happens to banks too, and people can't really resolve these sorts of things while the markets are online.Once you've done trade reconciliations, then you start running the computers and they generate daily P&L reports and then do risk analysis to calculate the trade limits for the next day. A lot of these reports need to run overnight, and that's why the markets need to go offline. Also after the days close, the traders will look at the days events and start planning strategy for the next day.The other thing is that a lot of money transfers happen overnight, so it helps bookkeepping a lot if you move money while the markets are closed, so that you start out the day with a known amount of cash and you end the day with a known amount of cash, and then any bank transfers happen overnight while there is no trading.Also tying everything to the clock gives you some predictability. For example, mutual funds and hedge funds have cutoff times for orders, and then start executing the orders at 2 p.m. Once the markets close they have a few hours to publish their daily returns and so those go out about 6 p.m.There's a lot of periodic events that happen in the markets and if you are in the front office you can feel the earth turning as markets go online and offline. Because there are all of these periodic events, we still have open and close hours so that we can synchronize a lot of the events.

-

For the past week, I have been going to sleep at 6:00 AM and waking up at 4:00 PM. How do I fix a severely messed up sleeping schedule?

Thanks for getting me to answer. Well, I don't know your daily schedule for study or work etc., you may have a reason to go to bed in the morning and wake up in the noon. Is it because of your work or study? But hey, if your schedule allowed, go to bed at night and wake up the next morning, do this: 1) Get Your Sleep time RightYour current sleep time is 10 hours, come on, that is too long.Reduce to 7-9 hours.Say, now you fix it as 8 hours. 2) Get Your Rise Time RightAsk yourself honestly, what time do you need to wake up - to make full use of the day? Wait, you can't simply give a timing... 8 a.m... 9 a.m...nope. In order to determine the best rise time, you have to plan your day. I had emphasize the importance of this because you can't skip this step. It is the driving force to fix you mess-up schedule. If you don't know what you are going to do the next day, you will not know how to plan your rise time. If you already have the plan or will plan for it, whatever, you will be able to fix your rise time. Say, now you decided to fix it as 7 a.m. 3) Get Your Bedtime Right Counting backwards from 7 a.m. (your sleep time 8 hours) so you will have to go to bed no later than 11 p.m. Recap, your bedtime 11 p.m., rise time 7 a.m. 4) Get your Daily Activities RightYou have to stick to this schedule (example only) every night to achieve a restful sleep.Based on this sleep schedule, plan your daily activities (work, study, social etc.,). It is better to list down the time table for a day. So you can plan to manage your time more efficiently. Plan more exciting activities in the 1st half of the day, do some relaxing activities after evening, to get your body tired and avoid too tense that can leads to sleeping problem at night. If you can't go with above schedule because of work or study:That means you have to go to bed based on your current schedule, you still have to make some adjustment: 1) You still have to stick to your sleep time as stated above (e.g., 8 hours) In this way, you are shortening your current sleep time (which is too long) to the healthy standard. 2) You still have to determine the best productive rise time (say, 1 p.m. instead of current 4p.m.) For example, you may have waste 3 hours if you wake up at 4 p.m. Look at the time you have wasted.. the things you cao in this time slot..write them down, so you will see the consequences. Time is money, come on, the more you waste, the poorer you get. But it is not easy to adjust rise time as we are used to it. It is a habit. You can do it step by step. For example, If you think that waking up at 1 p.m. is the best, but you can't make it. Okay, wake up at 3 p.m then. The day after tomorrow, wake up at 2 p.m. Move forward slowly, adjust 1 hour every day, if you still have problem, adjust 30 minutes every day. 3) You still have to determine your best bed time (say, 5 a.m. instead of current 6 a.m.) Don't be too worried, it is good that you realised your sleep schedule is mess up, do something about it today. Hope that my suggestion helps you.

-

Is midnight 12 o'clock AM or PM?

I asked a military person about this and they told me in the 24 hour clock that midnight was 00:00:00 AM and NOT PM. PM ended at 23:59:59 PM.Just so you know, Noon is considered 12:00:00 PM. The last time for AM is 11:59:59 AM.If this sounds confusing, it really isn’t. Just think of the day as having 24 hours instead of 12 twice. Or add 12 to 1 pm 2 pm, etc.Have fun learning!

Create this form in 5 minutes!

How to create an eSignature for the 2015 birt schedule sc 00 00 00 00 00 00 00 00 00 00 00 00

How to make an electronic signature for your 2015 Birt Schedule Sc 00 00 00 00 00 00 00 00 00 00 00 00 in the online mode

How to make an eSignature for the 2015 Birt Schedule Sc 00 00 00 00 00 00 00 00 00 00 00 00 in Chrome

How to generate an eSignature for signing the 2015 Birt Schedule Sc 00 00 00 00 00 00 00 00 00 00 00 00 in Gmail

How to create an electronic signature for the 2015 Birt Schedule Sc 00 00 00 00 00 00 00 00 00 00 00 00 from your mobile device

How to generate an eSignature for the 2015 Birt Schedule Sc 00 00 00 00 00 00 00 00 00 00 00 00 on iOS devices

How to generate an eSignature for the 2015 Birt Schedule Sc 00 00 00 00 00 00 00 00 00 00 00 00 on Android devices

People also ask

-

What is the Birt Schedule Sc 00 00 00 00 00 00 00 00 00 00 00 00 feature in airSlate SignNow?

The Birt Schedule Sc 00 00 00 00 00 00 00 00 00 00 00 00 feature in airSlate SignNow allows users to automate document generation and scheduling. This functionality ensures that your documents are created and sent at designated times, enhancing efficiency. It's particularly useful for businesses that handle regular reporting or need timely document execution.

-

How does airSlate SignNow improve the document signing process using Birt Schedule Sc 00 00 00 00 00 00 00 00 00 00 00 00?

airSlate SignNow enhances the document signing process with the Birt Schedule Sc 00 00 00 00 00 00 00 00 00 00 00 00 feature by streamlining workflows. This tool not only speeds up the sending and signing process but also ensures that documents are signed when needed without manual intervention. It signNowly reduces delays and increases productivity.

-

Is there a cost associated with the Birt Schedule Sc 00 00 00 00 00 00 00 00 00 00 00 00 functionality?

While airSlate SignNow offers various pricing tiers, the Birt Schedule Sc 00 00 00 00 00 00 00 00 00 00 00 00 feature is included in most plans. This ensures that businesses of all sizes can benefit from automated document scheduling at an economical price. It's highly recommended to check the pricing details for specific features that best suit your operational needs.

-

Can I integrate Birt Schedule Sc 00 00 00 00 00 00 00 00 00 00 00 00 with other tools I use?

Yes, airSlate SignNow allows integration of the Birt Schedule Sc 00 00 00 00 00 00 00 00 00 00 00 00 feature with various third-party tools such as CRMs and project management software. This seamless integration ensures that your document workflows are connected across different platforms, enhancing collaboration and efficiency in your business processes.

-

What are the primary benefits of using Birt Schedule Sc 00 00 00 00 00 00 00 00 00 00 00 00 with airSlate SignNow?

One of the primary benefits of using Birt Schedule Sc 00 00 00 00 00 00 00 00 00 00 00 00 with airSlate SignNow is the automation of routine document tasks. This not only saves time but also minimizes the risk of human error in document management. Moreover, it enhances compliance by ensuring that documents are sent and signed on schedule.

-

What types of documents can I automate using the Birt Schedule Sc 00 00 00 00 00 00 00 00 00 00 00 00 feature?

You can automate various types of documents using the Birt Schedule Sc 00 00 00 00 00 00 00 00 00 00 00 00 feature in airSlate SignNow, including contracts, invoices, and reports. This flexibility allows businesses to customize their document workflows based on their specific needs. Automating these documents helps streamline operations and ensures timely processing.

-

Does Birt Schedule Sc 00 00 00 00 00 00 00 00 00 00 00 00 work with mobile devices?

Yes, airSlate SignNow and the Birt Schedule Sc 00 00 00 00 00 00 00 00 00 00 00 00 feature are fully optimized for mobile devices. This mobile compatibility enables users to send and sign documents on-the-go, providing greater flexibility and accessibility. It’s beneficial for teams that require on-the-spot document handling in various environments.

Get more for Birt Schedule Sc 00 00 00 00 00 00 00 00 00 00 00 00

Find out other Birt Schedule Sc 00 00 00 00 00 00 00 00 00 00 00 00

- Help Me With Sign New Hampshire Non-Profit Presentation

- How To Sign Alaska Orthodontists Presentation

- Can I Sign South Dakota Non-Profit Word

- Can I Sign South Dakota Non-Profit Form

- How To Sign Delaware Orthodontists PPT

- How Can I Sign Massachusetts Plumbing Document

- How To Sign New Hampshire Plumbing PPT

- Can I Sign New Mexico Plumbing PDF

- How To Sign New Mexico Plumbing Document

- How To Sign New Mexico Plumbing Form

- Can I Sign New Mexico Plumbing Presentation

- How To Sign Wyoming Plumbing Form

- Help Me With Sign Idaho Real Estate PDF

- Help Me With Sign Idaho Real Estate PDF

- Can I Sign Idaho Real Estate PDF

- How To Sign Idaho Real Estate PDF

- How Do I Sign Hawaii Sports Presentation

- How Do I Sign Kentucky Sports Presentation

- Can I Sign North Carolina Orthodontists Presentation

- How Do I Sign Rhode Island Real Estate Form