Local Business Tax Application Revision 3 15 16 2016

What is the Local Business Tax Application Revision 3 15 16

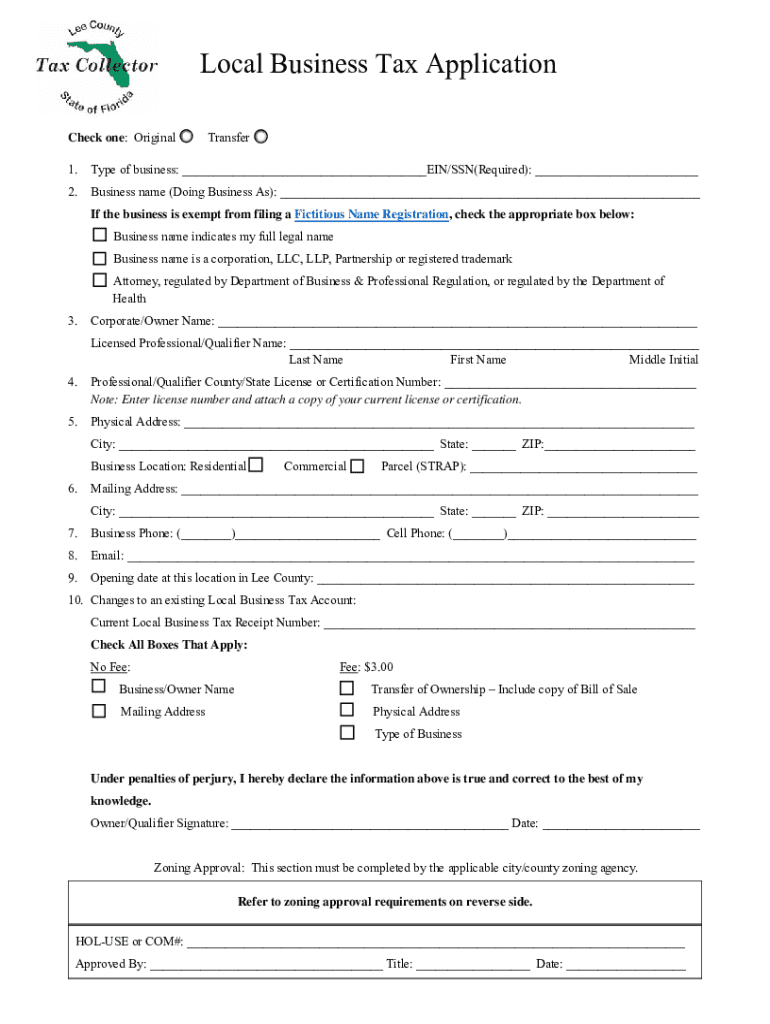

The Local Business Tax Application Revision 3 15 16 is a form used by businesses to apply for local tax registration. This document is essential for businesses operating within a specific jurisdiction to comply with local tax laws. The application collects important information about the business, including its name, address, type of business entity, and ownership details. Completing this form accurately ensures that the business is properly registered and can fulfill its tax obligations.

Steps to complete the Local Business Tax Application Revision 3 15 16

Completing the Local Business Tax Application Revision 3 15 16 involves several key steps:

- Gather necessary information about your business, including the legal name, address, and type of entity.

- Fill out the application form accurately, ensuring all sections are completed as required.

- Review the form for any errors or omissions before submission.

- Submit the application according to the specified method, whether online, by mail, or in person.

Required Documents

When submitting the Local Business Tax Application Revision 3 15 16, certain documents may be required to support your application. These may include:

- Proof of business registration, such as articles of incorporation or a partnership agreement.

- Identification documents for the business owner or authorized signatory.

- Any applicable licenses or permits related to your business operations.

Legal use of the Local Business Tax Application Revision 3 15 16

The Local Business Tax Application Revision 3 15 16 is legally binding once submitted. It serves as a formal declaration of your business's intent to operate within the local jurisdiction. Failing to submit this application or providing false information can result in penalties, including fines or legal action. It is crucial to ensure that all information provided is accurate and up to date to maintain compliance with local tax regulations.

Filing Deadlines / Important Dates

Filing deadlines for the Local Business Tax Application Revision 3 15 16 can vary by jurisdiction. It is important to check with local tax authorities to determine specific deadlines for submission. Missing the deadline may result in late fees or penalties. Keeping track of important dates related to your local business tax obligations helps ensure compliance and avoids unnecessary financial burdens.

Who Issues the Form

The Local Business Tax Application Revision 3 15 16 is typically issued by local government tax authorities. This may include city or county offices responsible for business licensing and taxation. It is advisable to visit your local tax authority's website or contact them directly for the most accurate and updated information regarding the application process and requirements.

Quick guide on how to complete local business tax application revision 3 15 16

Set Up Local Business Tax Application Revision 3 15 16 effortlessly on any device

Digital document management has gained traction among businesses and individuals alike. It offers an excellent environmentally friendly substitute for traditional printed and signed paperwork, allowing you to access the correct form and securely store it online. airSlate SignNow equips you with all the necessary tools to create, modify, and eSign your documents swiftly without delays. Manage Local Business Tax Application Revision 3 15 16 on any device using the airSlate SignNow Android or iOS applications and enhance any document-driven process today.

How to edit and eSign Local Business Tax Application Revision 3 15 16 with ease

- Obtain Local Business Tax Application Revision 3 15 16 and click on Get Form to begin.

- Utilize the tools we provide to complete your document.

- Highlight important sections of your documents or redact confidential information with the tools that airSlate SignNow offers specifically for this purpose.

- Generate your signature using the Sign feature, which takes mere seconds and holds the same legal validity as a conventional wet ink signature.

- Verify the information and click on the Done button to save your changes.

- Choose how you wish to deliver your form, via email, text message (SMS), invite link, or download it to your computer.

Avoid the hassle of lost or misplaced files, tedious document searches, or errors that necessitate printing new copies. airSlate SignNow meets your document management needs in a few clicks from any device you prefer. Edit and eSign Local Business Tax Application Revision 3 15 16 and ensure exceptional communication at any stage of your document preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct local business tax application revision 3 15 16

Create this form in 5 minutes!

How to create an eSignature for the local business tax application revision 3 15 16

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is the Local Business Tax Application Revision 3 15 16?

The Local Business Tax Application Revision 3 15 16 is a specific form required for businesses to apply for local tax licenses. This application ensures compliance with local tax regulations and helps businesses operate legally within their jurisdictions.

-

How can airSlate SignNow assist with the Local Business Tax Application Revision 3 15 16?

airSlate SignNow streamlines the process of completing and submitting the Local Business Tax Application Revision 3 15 16 by providing an easy-to-use platform for eSigning and document management. This allows businesses to efficiently handle their tax applications without the hassle of traditional paperwork.

-

What are the pricing options for using airSlate SignNow for the Local Business Tax Application Revision 3 15 16?

airSlate SignNow offers various pricing plans to accommodate different business needs, including options for small businesses and larger enterprises. Each plan provides access to features that simplify the Local Business Tax Application Revision 3 15 16 process, ensuring you find a solution that fits your budget.

-

What features does airSlate SignNow provide for the Local Business Tax Application Revision 3 15 16?

Key features of airSlate SignNow include customizable templates, secure eSigning, and automated workflows. These tools enhance the efficiency of completing the Local Business Tax Application Revision 3 15 16, making it easier for businesses to manage their tax documentation.

-

Are there any benefits to using airSlate SignNow for the Local Business Tax Application Revision 3 15 16?

Using airSlate SignNow for the Local Business Tax Application Revision 3 15 16 offers numerous benefits, including time savings, reduced paperwork, and improved compliance. The platform's user-friendly interface ensures that businesses can focus on their core operations while managing their tax applications seamlessly.

-

Can airSlate SignNow integrate with other software for the Local Business Tax Application Revision 3 15 16?

Yes, airSlate SignNow integrates with various software applications, enhancing its functionality for the Local Business Tax Application Revision 3 15 16. This allows businesses to connect their existing tools and streamline their workflows, making the tax application process even more efficient.

-

Is airSlate SignNow secure for handling the Local Business Tax Application Revision 3 15 16?

Absolutely, airSlate SignNow prioritizes security and compliance, ensuring that all documents, including the Local Business Tax Application Revision 3 15 16, are protected. The platform employs advanced encryption and security measures to safeguard sensitive information throughout the signing process.

Get more for Local Business Tax Application Revision 3 15 16

- Test form 3a

- Ds 11 fillable form

- Form a3 for renewal of arms licence

- Odometer disclosure statement form

- Do not hospitalize order form pdf 378044925

- Fs fuel form 1 docx ai state wy

- Social workers and marriage and family therapists georgia form

- Pa 010 def motion dissolve mod amnd temp rev 08 21 09 form

Find out other Local Business Tax Application Revision 3 15 16

- Sign South Carolina Pregnancy Leave Policy Safe

- How To Sign South Carolina Time Off Policy

- How To Sign Iowa Christmas Bonus Letter

- How To Sign Nevada Christmas Bonus Letter

- Sign New Jersey Promotion Announcement Simple

- Sign Louisiana Company Bonus Letter Safe

- How To Sign Delaware Letter of Appreciation to Employee

- How To Sign Florida Letter of Appreciation to Employee

- How Do I Sign New Jersey Letter of Appreciation to Employee

- How Do I Sign Delaware Direct Deposit Enrollment Form

- How To Sign Alabama Employee Emergency Notification Form

- How To Sign Oklahoma Direct Deposit Enrollment Form

- Sign Wyoming Direct Deposit Enrollment Form Online

- Sign Nebraska Employee Suggestion Form Now

- How Can I Sign New Jersey Employee Suggestion Form

- Can I Sign New York Employee Suggestion Form

- Sign Michigan Overtime Authorization Form Mobile

- How To Sign Alabama Payroll Deduction Authorization

- How To Sign California Payroll Deduction Authorization

- How To Sign Utah Employee Emergency Notification Form