Louisiana Form Cift 620

What is the Louisiana Form Cift 620

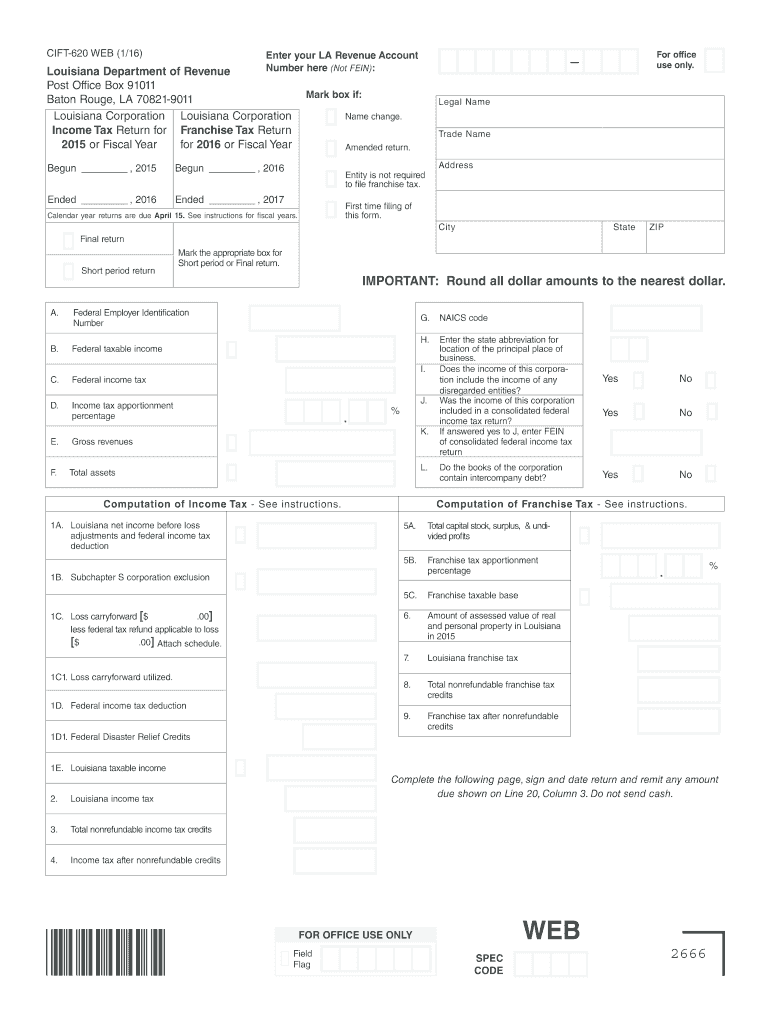

The Louisiana Form Cift 620 is a tax form used by corporations to report their income, deductions, and tax liability to the state of Louisiana. This form is specifically designed for corporations that are subject to the Louisiana franchise tax. It is essential for businesses operating in Louisiana to accurately complete this form to comply with state tax regulations.

The Cift 620 form collects various financial information, including gross receipts, taxable income, and any applicable credits. Understanding the purpose and requirements of this form is crucial for ensuring compliance and avoiding potential penalties.

Steps to complete the Louisiana Form Cift 620

Completing the Louisiana Form Cift 620 involves several key steps that ensure accurate reporting of financial information. Begin by gathering all necessary financial documents, including income statements and balance sheets. This information will be essential for filling out the form correctly.

Next, follow these steps:

- Enter the corporation's name, address, and federal employer identification number (EIN).

- Report total gross receipts for the taxable year.

- Calculate and enter the deductions that apply to your corporation.

- Determine the taxable income by subtracting deductions from gross receipts.

- Calculate the franchise tax owed based on the taxable income.

- Review the form for accuracy and completeness before submission.

Once completed, ensure that the form is signed and dated by an authorized representative of the corporation.

Legal use of the Louisiana Form Cift 620

The Louisiana Form Cift 620 is legally binding when completed and submitted in accordance with state regulations. It is crucial for corporations to understand that any inaccuracies or omissions may lead to penalties or audits from the Louisiana Department of Revenue.

To ensure legal compliance, corporations should adhere to the following guidelines:

- Complete the form honestly and accurately, reflecting true financial conditions.

- File the form by the specified deadlines to avoid late fees.

- Retain copies of the submitted form and supporting documents for record-keeping purposes.

Fulfilling these requirements helps maintain the corporation's good standing with state authorities.

Filing Deadlines / Important Dates

Filing deadlines for the Louisiana Form Cift 620 are critical for compliance. Generally, the form is due on the fifteenth day of the fourth month following the close of the corporation's fiscal year. For corporations operating on a calendar year, this means the form must be filed by April 15.

It is important to stay informed about any changes to deadlines or extensions that may be granted by the Louisiana Department of Revenue. Missing the deadline can result in penalties and interest on any unpaid taxes.

Form Submission Methods (Online / Mail / In-Person)

The Louisiana Form Cift 620 can be submitted through various methods, providing flexibility for corporations. The available submission methods include:

- Online: Corporations can file the form electronically through the Louisiana Department of Revenue's online portal.

- Mail: The completed form can be printed and mailed to the appropriate address provided by the Louisiana Department of Revenue.

- In-Person: Corporations may also choose to deliver the form in person to a local office of the Department of Revenue.

Choosing the right submission method can help ensure timely processing and compliance with state regulations.

Key elements of the Louisiana Form Cift 620

Understanding the key elements of the Louisiana Form Cift 620 is essential for accurate completion. The form includes several sections that require specific information:

- Identification Information: This section captures the corporation's name, address, and EIN.

- Income Reporting: Corporations must report total gross receipts and any relevant deductions.

- Tax Calculation: This section outlines how to determine the franchise tax owed based on taxable income.

- Signature: An authorized representative must sign the form to validate the information provided.

Each of these elements plays a crucial role in ensuring that the form is completed correctly and complies with state regulations.

Quick guide on how to complete cift 620 2015 corporation income and 2016 franchise tax return revenue louisiana

Prepare Louisiana Form Cift 620 effortlessly on any device

Online document management has become increasingly popular among organizations and individuals. It offers an ideal eco-friendly substitute to traditional printed and signed papers, as you can easily access the necessary form and securely store it online. airSlate SignNow equips you with all the tools required to create, modify, and electronically sign your documents quickly without delays. Handle Louisiana Form Cift 620 on any device using airSlate SignNow's Android or iOS applications and streamline any document-related process today.

The easiest way to edit and electronically sign Louisiana Form Cift 620 without hassle

- Obtain Louisiana Form Cift 620 and then click Get Form to begin.

- Use the tools we offer to fill out your document.

- Emphasize relevant sections of the documents or redact sensitive information with tools specifically provided by airSlate SignNow for that purpose.

- Create your signature with the Sign tool, which takes seconds and carries the same legal validity as a conventional wet ink signature.

- Review all the information and then click the Done button to save your modifications.

- Choose how you wish to send your form, via email, SMS, or invitation link, or download it to your computer.

Say goodbye to lost or misplaced documents, tedious form searching, or mistakes that necessitate printing new copies. airSlate SignNow meets your document management needs in just a few clicks from any device of your preference. Modify and electronically sign Louisiana Form Cift 620 and ensure excellent communication at every stage of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the cift 620 2015 corporation income and 2016 franchise tax return revenue louisiana

How to generate an electronic signature for your Cift 620 2015 Corporation Income And 2016 Franchise Tax Return Revenue Louisiana online

How to make an eSignature for your Cift 620 2015 Corporation Income And 2016 Franchise Tax Return Revenue Louisiana in Chrome

How to create an electronic signature for signing the Cift 620 2015 Corporation Income And 2016 Franchise Tax Return Revenue Louisiana in Gmail

How to generate an eSignature for the Cift 620 2015 Corporation Income And 2016 Franchise Tax Return Revenue Louisiana right from your smart phone

How to generate an electronic signature for the Cift 620 2015 Corporation Income And 2016 Franchise Tax Return Revenue Louisiana on iOS devices

How to make an eSignature for the Cift 620 2015 Corporation Income And 2016 Franchise Tax Return Revenue Louisiana on Android

People also ask

-

What are the la cift 620 instructions for using airSlate SignNow?

The la cift 620 instructions guide you through the process of integrating and using airSlate SignNow for eSigning documents. These instructions provide step-by-step details to ensure a seamless setup and efficient usage of our platform, helping businesses streamline their document workflows.

-

How does airSlate SignNow compare in pricing for the la cift 620 instructions feature?

When considering the la cift 620 instructions feature, airSlate SignNow offers competitive pricing tailored to fit various business needs. Our cost-effective solution includes comprehensive tools that maximize your document management efficiency without breaking the bank.

-

What are the key benefits of following the la cift 620 instructions?

Following the la cift 620 instructions ensures you can utilize airSlate SignNow effectively, unlocking the full potential of its features. Key benefits include improved document turnaround times, enhanced compliance, and a more straightforward eSigning experience for your team and clients.

-

Can I integrate airSlate SignNow with existing systems using la cift 620 instructions?

Yes, the la cift 620 instructions include information on how to easily integrate airSlate SignNow with your existing systems. This functionality allows for seamless document sharing and signing, ensuring that all your tools work together smoothly for enhanced productivity.

-

Are there any tutorials available for the la cift 620 instructions?

Yes, we provide comprehensive tutorials that complement the la cift 620 instructions. These tutorials offer practical guidance on how to navigate airSlate SignNow, ensuring that users can learn at their own pace and maximize the tool's features.

-

What types of documents can be managed with the la cift 620 instructions?

The la cift 620 instructions cover a variety of document types, enabling you to manage contracts, agreements, and important forms all in one place. This versatility makes airSlate SignNow an ideal solution for businesses looking to streamline their document workflows.

-

Is support available for issues related to la cift 620 instructions?

Absolutely! Our support team is available to assist with any issues related to the la cift 620 instructions. Whether you're facing technical difficulties or need further clarification, we're here to help ensure your experience with airSlate SignNow is seamless.

Get more for Louisiana Form Cift 620

- Request for assistance form 138311

- Counselor professional disclosure statement example form

- Mod 209 modulo 1 form

- Lincoln sa 200 service manual form

- Brief respiratory questionnaire brq hudson valley asthma hudsonvalleyasthmacoalition form

- Formulaire demande de visa schengen

- Vehicle reservation form

- Form 12 900g

Find out other Louisiana Form Cift 620

- eSignature Construction PPT New Jersey Later

- How Do I eSignature North Carolina Construction LLC Operating Agreement

- eSignature Arkansas Doctors LLC Operating Agreement Later

- eSignature Tennessee Construction Contract Safe

- eSignature West Virginia Construction Lease Agreement Myself

- How To eSignature Alabama Education POA

- How To eSignature California Education Separation Agreement

- eSignature Arizona Education POA Simple

- eSignature Idaho Education Lease Termination Letter Secure

- eSignature Colorado Doctors Business Letter Template Now

- eSignature Iowa Education Last Will And Testament Computer

- How To eSignature Iowa Doctors Business Letter Template

- Help Me With eSignature Indiana Doctors Notice To Quit

- eSignature Ohio Education Purchase Order Template Easy

- eSignature South Dakota Education Confidentiality Agreement Later

- eSignature South Carolina Education Executive Summary Template Easy

- eSignature Michigan Doctors Living Will Simple

- How Do I eSignature Michigan Doctors LLC Operating Agreement

- How To eSignature Vermont Education Residential Lease Agreement

- eSignature Alabama Finance & Tax Accounting Quitclaim Deed Easy