Georgia Tire Fee Report 2013-2026

What is the Georgia Tire Fee Report

The Georgia Tire Fee Report is a document that tracks the collection and remittance of tire fees in the state of Georgia. This report is essential for businesses that sell tires, as it ensures compliance with state regulations regarding tire disposal and environmental protection. The fee collected contributes to the proper management of used tires, helping to mitigate environmental hazards associated with tire waste.

Steps to complete the Georgia Tire Fee Report

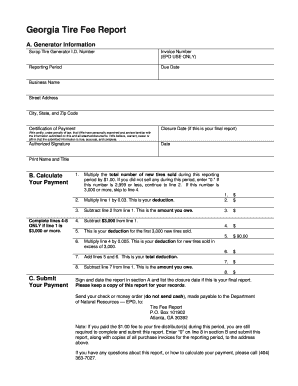

Completing the Georgia Tire Fee Report involves several key steps to ensure accuracy and compliance. First, gather all necessary sales data related to tire transactions within the reporting period. Next, calculate the total tire fees collected based on the number of tires sold. After that, fill in the report with the required information, including your business details, total tire sales, and the amount of fees collected. Finally, review the report for accuracy before submission to avoid any potential penalties.

How to obtain the Georgia Tire Fee Report

The Georgia Tire Fee Report can be obtained through the Georgia Department of Revenue's website or by contacting their office directly. It is typically available as a downloadable form that can be filled out electronically or printed for manual completion. Ensure you have the latest version of the report to comply with current regulations.

Legal use of the Georgia Tire Fee Report

Using the Georgia Tire Fee Report legally requires adherence to state regulations regarding tire sales and environmental practices. Businesses must accurately report the tire fees collected and remit them to the appropriate state agency. Failure to comply with these legal requirements can result in penalties and fines, making it crucial for businesses to understand their obligations under Georgia law.

Key elements of the Georgia Tire Fee Report

Key elements of the Georgia Tire Fee Report include the business name, address, and identification number, as well as the total number of tires sold and the corresponding fees collected. Additionally, the report may require signatures from authorized personnel to validate the information provided. Accurate completion of these elements is vital for compliance and to avoid discrepancies during audits.

Form Submission Methods

The Georgia Tire Fee Report can be submitted through various methods, including online submission via the Georgia Department of Revenue's e-filing system, mailing a completed paper form, or delivering it in person to a designated office. Each method has its own processing times and requirements, so businesses should choose the option that best fits their needs.

Quick guide on how to complete georgia tire fee report

Effortlessly Prepare Georgia Tire Fee Report on Any Device

Digital document management has become increasingly popular among businesses and individuals alike. It offers an ideal eco-friendly alternative to traditional printed and signed paperwork, as you can access the necessary form and securely store it online. airSlate SignNow provides you with all the resources required to create, modify, and electronically sign your documents rapidly without delays. Manage Georgia Tire Fee Report across any platform with airSlate SignNow's Android or iOS applications and enhance any document-related process today.

The easiest way to modify and electronically sign Georgia Tire Fee Report without hassle

- Find Georgia Tire Fee Report and click on Get Form to begin.

- Utilize the tools we provide to fill out your form.

- Emphasize important sections of the documents or obscure sensitive information using tools that airSlate SignNow offers specifically for that purpose.

- Create your electronic signature with the Sign tool, which takes mere seconds and holds the same legal validity as a conventional wet ink signature.

- Review the details and click on the Done button to save your modifications.

- Choose your preferred method for sending your form, via email, text message (SMS), or invite link, or download it to your computer.

Eliminate the worry of lost or misplaced files, the hassle of searching for forms, or mistakes that require printing new document copies. airSlate SignNow meets your document management needs in just a few clicks from any device you prefer. Edit and electronically sign Georgia Tire Fee Report and ensure excellent communication at every step of your form preparation journey with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the georgia tire fee report

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is a Georgia tire fee report?

The Georgia tire fee report is a documentation requirement for businesses involved in the sale or distribution of tires in Georgia. This report helps ensure compliance with environmental regulations related to tire disposal and recycling. Submitting accurate tire fee reports is essential for avoiding penalties and supporting eco-friendly practices.

-

How can airSlate SignNow help with Georgia tire fee report management?

airSlate SignNow simplifies the management of Georgia tire fee reports by allowing businesses to easily send, sign, and store documents electronically. Our platform provides a secure environment, ensuring compliance and ease of collaboration. With intuitive features, you can streamline the report process, saving time and reducing errors.

-

What are the pricing options for using airSlate SignNow for Georgia tire fee reports?

airSlate SignNow offers several pricing plans tailored to meet the needs of businesses handling Georgia tire fee reports. Whether you’re a small business or a larger organization, our pricing is designed to be cost-effective and scalable. You can select a plan that aligns with your volume of document management and reporting needs.

-

Are there any features specifically beneficial for managing Georgia tire fee reports?

Yes, airSlate SignNow includes features such as customizable templates, secure eSignature capabilities, and tracking options that are especially beneficial for managing Georgia tire fee reports. These features help ensure that your reports are completed accurately and submitted on time, while also providing an easy method to keep all stakeholders informed.

-

Can I integrate airSlate SignNow with other applications for Georgia tire fee reports?

Absolutely! airSlate SignNow offers integration capabilities with various applications to streamline the process of managing Georgia tire fee reports. You can connect with tools like CRM systems, document storage solutions, and accounting software, enhancing your workflow efficiency and data accuracy.

-

What benefits does using airSlate SignNow provide for Georgia tire fee report submissions?

Using airSlate SignNow for Georgia tire fee report submissions provides multiple benefits, including instant access to documents, reduced paperwork, and enhanced compliance tracking. Our electronic signature feature accelerates the submission process, ensuring your reports are filed promptly. With every document securely stored, you can easily reference past reports when needed.

-

Is training available for businesses new to airSlate SignNow and Georgia tire fee reporting?

Yes, airSlate SignNow provides comprehensive training resources for businesses new to the platform, specifically for Georgia tire fee reporting. Our user-friendly guides, tutorials, and customer support ensure that you can quickly learn how to utilize our tools effectively. We’re here to support your transition towards efficient document management.

Get more for Georgia Tire Fee Report

- Petitionforincompletedoc extension berkeley form

- Application workshop the california state university form

- Must be at least 13 years old form

- How to file a charge of employment discriminationus form

- Appealplan form

- Upromise helps you save for college form

- Cpr amp first aid certification class 1495 online cprcpr amp first aid certification class 1495 online cprcpr amp first aid form

- Medical office administration program form

Find out other Georgia Tire Fee Report

- eSignature Maine Lawers Last Will And Testament Free

- eSignature Alabama Non-Profit Living Will Free

- eSignature Wyoming Legal Executive Summary Template Myself

- eSignature Alabama Non-Profit Lease Agreement Template Computer

- eSignature Arkansas Life Sciences LLC Operating Agreement Mobile

- eSignature California Life Sciences Contract Safe

- eSignature California Non-Profit LLC Operating Agreement Fast

- eSignature Delaware Life Sciences Quitclaim Deed Online

- eSignature Non-Profit Form Colorado Free

- eSignature Mississippi Lawers Residential Lease Agreement Later

- How To eSignature Mississippi Lawers Residential Lease Agreement

- Can I eSignature Indiana Life Sciences Rental Application

- eSignature Indiana Life Sciences LLC Operating Agreement Fast

- eSignature Kentucky Life Sciences Quitclaim Deed Fast

- Help Me With eSignature Georgia Non-Profit NDA

- How Can I eSignature Idaho Non-Profit Business Plan Template

- eSignature Mississippi Life Sciences Lease Agreement Myself

- How Can I eSignature Mississippi Life Sciences Last Will And Testament

- How To eSignature Illinois Non-Profit Contract

- eSignature Louisiana Non-Profit Business Plan Template Now