Medicare Savings Program Application Dphhsmtgov Form

What is the Medicare Savings Program Application Dphhsmtgov Form

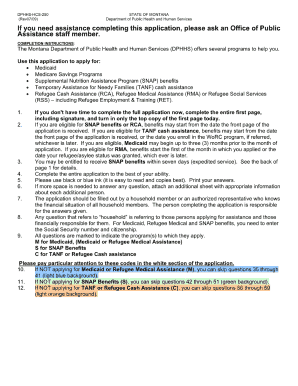

The Medicare Savings Program Application Dphhsmtgov Form is a crucial document for individuals seeking assistance with Medicare costs. This application enables eligible individuals to apply for programs that help pay for premiums, deductibles, and copayments associated with Medicare. By completing this form, applicants can access financial support that reduces their out-of-pocket expenses, making healthcare more affordable. Understanding the purpose and benefits of this form is essential for those who qualify, ensuring they receive the necessary assistance to maintain their health and wellbeing.

How to use the Medicare Savings Program Application Dphhsmtgov Form

Using the Medicare Savings Program Application Dphhsmtgov Form involves several straightforward steps. First, ensure you have the most current version of the form, as updates may occur. Next, gather all required information, including personal identification details, income statements, and Medicare information. Carefully fill out each section of the form, ensuring accuracy to avoid delays in processing. Once completed, review the application for any errors before submitting it through the designated method, whether online, by mail, or in person. Proper use of this form is vital for a smooth application process.

Steps to complete the Medicare Savings Program Application Dphhsmtgov Form

Completing the Medicare Savings Program Application Dphhsmtgov Form involves a series of organized steps:

- Obtain the form from the appropriate source, ensuring it is the latest version.

- Read the instructions carefully to understand the requirements and eligibility criteria.

- Gather necessary documents, such as proof of income and Medicare details.

- Fill out the application thoroughly, providing accurate information in all fields.

- Double-check the form for any errors or missing information.

- Submit the completed form through the specified method, keeping a copy for your records.

Eligibility Criteria

Eligibility for the Medicare Savings Program varies by state but generally includes specific criteria that applicants must meet. Typically, individuals must be enrolled in Medicare Part A and have limited income and resources. Many states set income limits based on the Federal Poverty Level, and applicants may need to provide documentation to verify their financial situation. Understanding these eligibility requirements is essential for those looking to benefit from the Medicare Savings Program, as it determines whether they can receive assistance with their Medicare costs.

Form Submission Methods

The Medicare Savings Program Application Dphhsmtgov Form can be submitted through various methods, allowing applicants flexibility based on their preferences. Common submission methods include:

- Online: Many states offer an online platform for submitting the application, providing a quick and efficient option.

- By Mail: Applicants can print the completed form and send it to the designated address via postal service.

- In-Person: Some individuals may choose to submit their application in person at local government offices or designated agencies.

Legal use of the Medicare Savings Program Application Dphhsmtgov Form

The Medicare Savings Program Application Dphhsmtgov Form holds legal significance as it is used to determine eligibility for financial assistance. When completed accurately, the information provided is considered a formal request for support. Compliance with state and federal regulations is essential, as any inaccuracies or omissions could lead to delays or denial of benefits. Understanding the legal implications of this form ensures that applicants are aware of their rights and responsibilities throughout the application process.

Quick guide on how to complete medicare savings program application dphhsmtgov form

Prepare Medicare Savings Program Application Dphhsmtgov Form with ease on any device

The online management of documents has gained popularity among organizations and individuals alike. It serves as a perfect eco-friendly alternative to conventional printed and signed papers, allowing you to locate the appropriate form and securely store it online. airSlate SignNow equips you with all the tools required to create, modify, and eSign your documents swiftly without unnecessary delays. Manage Medicare Savings Program Application Dphhsmtgov Form on any device utilizing the airSlate SignNow Android or iOS applications and streamline any document-related task today.

The easiest way to modify and eSign Medicare Savings Program Application Dphhsmtgov Form effortlessly

- Obtain Medicare Savings Program Application Dphhsmtgov Form and then click Get Form to begin.

- Utilize the tools we provide to complete your form.

- Emphasize relevant sections of your documents or redact sensitive information using tools specifically designed by airSlate SignNow for this purpose.

- Generate your signature with the Sign tool, which only takes seconds and holds the same legal validity as a handwritten signature.

- Review all the details and then click on the Done button to save your changes.

- Choose how you wish to send your form, via email, text message (SMS), or invitation link, or download it to your computer.

Eliminate the worry of lost or misplaced files, tedious form searches, or errors that necessitate reprinting new document copies. airSlate SignNow addresses your document management requirements in just a few clicks from any device you prefer. Modify and eSign Medicare Savings Program Application Dphhsmtgov Form and ensure effective communication at every stage of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the medicare savings program application dphhsmtgov form

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is the Medicare Savings Program Application Dphhsmtgov Form?

The Medicare Savings Program Application Dphhsmtgov Form is a specific application designed to help eligible individuals apply for financial assistance with their Medicare costs. This form simplifies the process of determining eligibility for various savings programs, making healthcare more affordable for seniors and individuals with disabilities.

-

How can I complete the Medicare Savings Program Application Dphhsmtgov Form?

Completing the Medicare Savings Program Application Dphhsmtgov Form is straightforward. You can fill it out online through designated state websites or download the form to complete it manually. Ensure all required information is accurate to avoid delays in processing your application.

-

Is there a fee associated with the Medicare Savings Program Application Dphhsmtgov Form?

No, there is no fee to submit the Medicare Savings Program Application Dphhsmtgov Form. This program aims to reduce the financial burden on eligible individuals, ensuring they receive the necessary support to cover their Medicare costs without any associated fees.

-

What are the benefits of the Medicare Savings Program Application Dphhsmtgov Form?

The benefits of the Medicare Savings Program Application Dphhsmtgov Form include potential reductions in monthly premiums and out-of-pocket costs for Medicare services. By applying, eligible individuals can gain access to vital healthcare services without incurring substantial expenses, leading to better health outcomes.

-

Who is eligible to apply for the Medicare Savings Program through the Dphhsmtgov Form?

Eligibility for the Medicare Savings Program Application Dphhsmtgov Form primarily includes individuals aged 65 or older, as well as certain younger individuals with disabilities. Requirements vary by state, so it's essential to check specific criteria related to income and resource limits on your state’s health department website.

-

Can I track the status of my Medicare Savings Program Application Dphhsmtgov Form?

Yes, many states provide a method to track the status of your Medicare Savings Program Application Dphhsmtgov Form online. After submitting your application, you will typically receive information on how to check your status, ensuring you can stay informed throughout the process.

-

Are there integrations available for managing the Medicare Savings Program Application Dphhsmtgov Form?

While the Medicare Savings Program Application Dphhsmtgov Form itself is a state-specific document, many electronic document management tools, like airSlate SignNow, can facilitate eSigning and managing such forms. Integrating these tools can streamline your application process, making it automated and less error-prone.

Get more for Medicare Savings Program Application Dphhsmtgov Form

Find out other Medicare Savings Program Application Dphhsmtgov Form

- Sign Indiana Finance & Tax Accounting Confidentiality Agreement Later

- Sign Iowa Finance & Tax Accounting Last Will And Testament Mobile

- Sign Maine Finance & Tax Accounting Living Will Computer

- Sign Montana Finance & Tax Accounting LLC Operating Agreement Computer

- How Can I Sign Montana Finance & Tax Accounting Residential Lease Agreement

- Sign Montana Finance & Tax Accounting Residential Lease Agreement Safe

- How To Sign Nebraska Finance & Tax Accounting Letter Of Intent

- Help Me With Sign Nebraska Finance & Tax Accounting Letter Of Intent

- Sign Nebraska Finance & Tax Accounting Business Letter Template Online

- Sign Rhode Island Finance & Tax Accounting Cease And Desist Letter Computer

- Sign Vermont Finance & Tax Accounting RFP Later

- Can I Sign Wyoming Finance & Tax Accounting Cease And Desist Letter

- Sign California Government Job Offer Now

- How Do I Sign Colorado Government Cease And Desist Letter

- How To Sign Connecticut Government LLC Operating Agreement

- How Can I Sign Delaware Government Residential Lease Agreement

- Sign Florida Government Cease And Desist Letter Online

- Sign Georgia Government Separation Agreement Simple

- Sign Kansas Government LLC Operating Agreement Secure

- How Can I Sign Indiana Government POA