3rd Quarter Payroll Tax Booklet the City of Newark, New Ci Newark Nj Form

What is the 3rd Quarter Payroll Tax Booklet The City Of Newark, New Ci Newark Nj

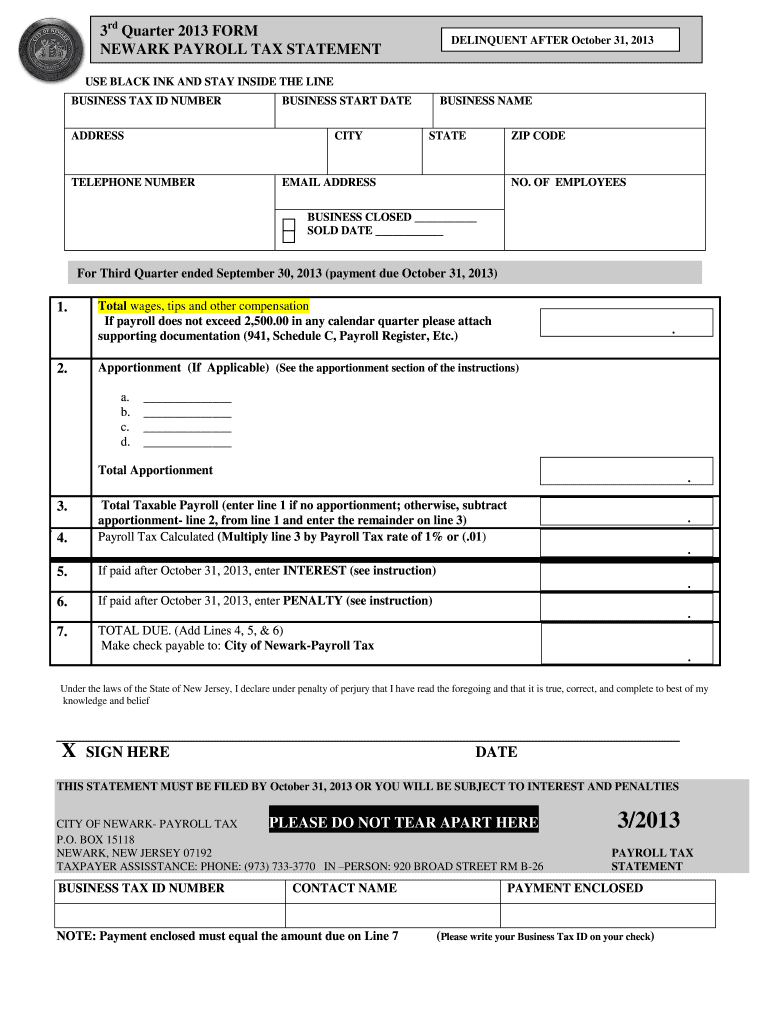

The 3rd Quarter Payroll Tax Booklet for the City of Newark is an essential document for employers operating within the city. This booklet outlines the necessary tax obligations for the third quarter of the fiscal year, including payroll taxes that must be withheld and reported. It serves as a guide for businesses to ensure compliance with local tax laws and regulations, helping to avoid potential penalties. The booklet contains detailed instructions on calculating payroll taxes, deadlines for submission, and any specific forms that need to be completed.

How to use the 3rd Quarter Payroll Tax Booklet The City Of Newark, New Ci Newark Nj

Utilizing the 3rd Quarter Payroll Tax Booklet effectively requires understanding its structure and content. Employers should begin by reviewing the booklet to familiarize themselves with the required tax rates and calculations. The booklet typically includes sections on how to report employee wages, calculate the appropriate payroll taxes, and submit the necessary forms. It is important to follow the instructions carefully to ensure accurate reporting and compliance with local tax laws.

Steps to complete the 3rd Quarter Payroll Tax Booklet The City Of Newark, New Ci Newark Nj

Completing the 3rd Quarter Payroll Tax Booklet involves several key steps:

- Gather all relevant payroll information, including employee wages and hours worked during the quarter.

- Calculate the total payroll tax owed based on the guidelines provided in the booklet.

- Fill out the required forms accurately, ensuring all information is complete and correct.

- Review the completed forms for accuracy before submission.

- Submit the forms by the specified deadline, either online or by mail, as indicated in the booklet.

Legal use of the 3rd Quarter Payroll Tax Booklet The City Of Newark, New Ci Newark Nj

The legal use of the 3rd Quarter Payroll Tax Booklet is crucial for maintaining compliance with local tax regulations. Employers must ensure that they adhere to the guidelines outlined in the booklet to avoid legal repercussions. This includes accurate reporting of payroll taxes and timely submission of all required forms. Electronic signatures can be used to validate the completion of forms, provided they meet the legal standards set forth by the ESIGN and UETA acts.

Filing Deadlines / Important Dates

Filing deadlines for the 3rd Quarter Payroll Tax Booklet are critical for ensuring compliance. Employers should note the specific dates for submitting payroll tax reports and payments to avoid penalties. Typically, these deadlines are set according to the end of the quarter, and it is advisable to mark these dates on a calendar to ensure timely filing. Late submissions can result in fines and interest charges, making adherence to these deadlines essential for all businesses.

Penalties for Non-Compliance

Failure to comply with the requirements set forth in the 3rd Quarter Payroll Tax Booklet can lead to significant penalties for employers. Common consequences include fines, interest on unpaid taxes, and potential legal action. It is important for businesses to understand these risks and ensure that all payroll tax obligations are met in a timely and accurate manner. Regular audits and reviews of payroll practices can help mitigate the risk of non-compliance.

Quick guide on how to complete 3rd quarter payroll tax booklet the city of newark new ci newark nj

Complete 3rd Quarter Payroll Tax Booklet The City Of Newark, New Ci Newark Nj seamlessly on any device

Online document management has become widely adopted by enterprises and individuals alike. It serves as an excellent eco-conscious alternative to traditional printed and signed papers, allowing you to find the correct form and securely store it online. airSlate SignNow equips you with all the tools necessary to create, modify, and eSign your documents quickly without delays. Manage 3rd Quarter Payroll Tax Booklet The City Of Newark, New Ci Newark Nj on any device with airSlate SignNow applications for Android or iOS and enhance any document-centric workflow today.

How to edit and eSign 3rd Quarter Payroll Tax Booklet The City Of Newark, New Ci Newark Nj effortlessly

- Find 3rd Quarter Payroll Tax Booklet The City Of Newark, New Ci Newark Nj and click Get Form to start.

- Utilize the tools we provide to complete your form.

- Highlight important sections of the documents or obscure sensitive information using tools that airSlate SignNow offers specifically for that purpose.

- Generate your eSignature with the Sign tool, which takes moments and holds the same legal validity as a conventional handwritten signature.

- Review the information and click on the Done button to save your changes.

- Select your preferred method of delivering your form, whether by email, SMS, invitation link, or download it to your computer.

Eliminate concerns about lost or misplaced documents, tedious form searches, or errors that require new document copies. airSlate SignNow meets all your document management needs in just a few clicks from your chosen device. Edit and eSign 3rd Quarter Payroll Tax Booklet The City Of Newark, New Ci Newark Nj and ensure exceptional communication at every stage of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the 3rd quarter payroll tax booklet the city of newark new ci newark nj

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is the 3rd Quarter Payroll Tax Booklet The City Of Newark, New Ci Newark Nj?

The 3rd Quarter Payroll Tax Booklet The City Of Newark, New Ci Newark Nj is a vital resource for businesses to comply with local tax regulations. It provides comprehensive guidelines and instructions to ensure accurate payroll reporting. Utilizing this booklet can help prevent costly mistakes and keep your business in good standing with local authorities.

-

How can I obtain the 3rd Quarter Payroll Tax Booklet The City Of Newark, New Ci Newark Nj?

You can easily obtain the 3rd Quarter Payroll Tax Booklet The City Of Newark, New Ci Newark Nj through the official City of Newark website or local tax offices. Additionally, our platform simplifies accessing these documents digitally, ensuring you have the latest version at your fingertips for your payroll needs.

-

What are the benefits of using the 3rd Quarter Payroll Tax Booklet The City Of Newark, New Ci Newark Nj?

Using the 3rd Quarter Payroll Tax Booklet The City Of Newark, New Ci Newark Nj helps ensure compliance with local tax regulations. It also streamlines payroll processes, saving your business time and reducing errors. By leveraging this booklet, you can focus more on your core operations, knowing that your payroll taxes are correctly handled.

-

Are there any costs associated with the 3rd Quarter Payroll Tax Booklet The City Of Newark, New Ci Newark Nj?

Typically, the 3rd Quarter Payroll Tax Booklet The City Of Newark, New Ci Newark Nj is provided free of charge by the city. However, if you opt to use premium services or software solutions to help manage your payroll and tax submissions, there may be associated costs. It's advised to compare your options to find the best balance of cost and convenience.

-

Does airSlate SignNow integrate with payroll systems for the 3rd Quarter Payroll Tax Booklet The City Of Newark, New Ci Newark Nj?

Yes, airSlate SignNow integrates seamlessly with various payroll and accounting systems to facilitate easy handling of the 3rd Quarter Payroll Tax Booklet The City Of Newark, New Ci Newark Nj. This integration allows for automatic updates and ensures that your tax documents remain accurate and current. Streamlining this process improves efficiency and reduces the risk of mistakes.

-

What features does airSlate SignNow offer for managing the 3rd Quarter Payroll Tax Booklet The City Of Newark, New Ci Newark Nj?

airSlate SignNow offers features that include electronic signatures, document sharing, and tracking for the 3rd Quarter Payroll Tax Booklet The City Of Newark, New Ci Newark Nj. These features enhance collaboration and ensure all stakeholders stay informed. Furthermore, the user-friendly interface simplifies the document management process for your business.

-

How does using airSlate SignNow enhance the handling of the 3rd Quarter Payroll Tax Booklet The City Of Newark, New Ci Newark Nj?

Using airSlate SignNow to manage the 3rd Quarter Payroll Tax Booklet The City Of Newark, New Ci Newark Nj enhances operational efficiency. It allows for quick access to necessary documents, reduces paper usage, and accelerates the signing process. These benefits not only save time but also contribute to a more sustainable business model.

Get more for 3rd Quarter Payroll Tax Booklet The City Of Newark, New Ci Newark Nj

- Trip sheet 101188842 form

- Backpack literature 6th edition pdf form

- Smithville meat locker form

- Prehospital emergency care 11th edition pdf form

- Pokemon evolutions checklist form

- Pipeline pressure test record test information azcc

- Nasa certificate form

- Activities in llandudno primary leap worksheets year 5 geography a contrasting locality primary resource exercise form

Find out other 3rd Quarter Payroll Tax Booklet The City Of Newark, New Ci Newark Nj

- Sign Delaware High Tech Rental Lease Agreement Online

- Sign Connecticut High Tech Lease Template Easy

- How Can I Sign Louisiana High Tech LLC Operating Agreement

- Sign Louisiana High Tech Month To Month Lease Myself

- How To Sign Alaska Insurance Promissory Note Template

- Sign Arizona Insurance Moving Checklist Secure

- Sign New Mexico High Tech Limited Power Of Attorney Simple

- Sign Oregon High Tech POA Free

- Sign South Carolina High Tech Moving Checklist Now

- Sign South Carolina High Tech Limited Power Of Attorney Free

- Sign West Virginia High Tech Quitclaim Deed Myself

- Sign Delaware Insurance Claim Online

- Sign Delaware Insurance Contract Later

- Sign Hawaii Insurance NDA Safe

- Sign Georgia Insurance POA Later

- How Can I Sign Alabama Lawers Lease Agreement

- How Can I Sign California Lawers Lease Agreement

- Sign Colorado Lawers Operating Agreement Later

- Sign Connecticut Lawers Limited Power Of Attorney Online

- Sign Hawaii Lawers Cease And Desist Letter Easy