Arizona Form 140PY Arizona Department of Revenue

What is the Arizona Form 140PY Arizona Department Of Revenue

The Arizona Form 140PY is a tax return form specifically designed for part-year residents of Arizona. It allows individuals who have moved into or out of the state during the tax year to report their income accurately. This form is essential for ensuring that taxpayers only pay taxes on income earned while residing in Arizona, in compliance with state tax laws.

How to use the Arizona Form 140PY Arizona Department Of Revenue

Using the Arizona Form 140PY involves several steps. First, gather all necessary financial documents, including W-2s, 1099s, and any other income statements. Next, determine your residency status and the portion of your income that is taxable in Arizona. Fill out the form by entering your personal information, income, deductions, and credits. Finally, review your entries for accuracy before submitting the form to the Arizona Department of Revenue.

Steps to complete the Arizona Form 140PY Arizona Department Of Revenue

Completing the Arizona Form 140PY requires careful attention to detail. Follow these steps:

- Gather all relevant financial documents, including income statements and records of deductions.

- Identify your residency status for the tax year.

- Fill in your personal information, including your name, address, and Social Security number.

- Report your income earned while a resident of Arizona.

- Calculate any deductions and credits applicable to your situation.

- Review the completed form for accuracy and completeness.

- Submit the form by the designated deadline, either electronically or via mail.

Required Documents

To complete the Arizona Form 140PY, certain documents are necessary. These include:

- W-2 forms from employers for income earned.

- 1099 forms for any freelance or contract work.

- Records of any other income sources, such as rental income or dividends.

- Documentation for deductions, such as mortgage interest statements or property tax receipts.

Form Submission Methods (Online / Mail / In-Person)

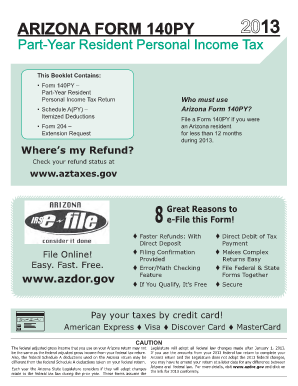

The Arizona Form 140PY can be submitted through various methods. Taxpayers may choose to file online using the Arizona Department of Revenue's e-file system, which is convenient and efficient. Alternatively, the form can be mailed to the appropriate address provided by the department. In-person submissions may also be possible at designated tax offices, although this option may vary based on location and current health guidelines.

Penalties for Non-Compliance

Filing the Arizona Form 140PY late or failing to file can result in penalties. The Arizona Department of Revenue imposes fines for late submissions, which can accumulate over time. Additionally, if taxes owed are not paid, interest will accrue on the unpaid balance. It is crucial for taxpayers to adhere to filing deadlines to avoid these penalties and ensure compliance with state tax laws.

Quick guide on how to complete arizona form 140py arizona department of revenue 100295243

Effortlessly Prepare [SKS] on Any Device

Managing documents online has become increasingly favored by companies and individuals. It offers an ideal environmentally friendly substitute for traditional printed and signed documents, allowing you to find the correct form and securely store it online. airSlate SignNow equips you with all the resources necessary to create, alter, and eSign your documents quickly and efficiently. Manage [SKS] on any device using the airSlate SignNow apps for Android or iOS, and enhance any document-driven workflow today.

The simplest way to alter and eSign [SKS] effortlessly

- Find [SKS] and click on Get Form to begin.

- Utilize the tools we provide to complete your form.

- Emphasize pertinent sections of the documents or obscure sensitive information with tools that airSlate SignNow specifically offers for this purpose.

- Create your signature using the Sign feature, which only takes seconds and carries the same legal validity as a conventional ink signature.

- Review the details and then click on the Done button to save your changes.

- Select how you wish to send your form, whether by email, SMS, or invitation link, or download it to your computer.

Say goodbye to lost or mislaid documents, tedious form searches, or errors that necessitate printing new document copies. airSlate SignNow meets your document management needs in just a few clicks from any device of your choosing. Modify and eSign [SKS] and ensure effective communication throughout your document preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Related searches to Arizona Form 140PY Arizona Department Of Revenue

Create this form in 5 minutes!

How to create an eSignature for the arizona form 140py arizona department of revenue 100295243

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is Arizona Form 140PY and why is it important?

Arizona Form 140PY is a tax return used by part-year residents to report their income to the Arizona Department of Revenue. It is crucial for accurately calculating tax obligations based on the income earned during the time spent in Arizona. Filing this form ensures compliance with state tax laws.

-

How can airSlate SignNow help me with Arizona Form 140PY?

airSlate SignNow offers an intuitive platform to eSign Arizona Form 140PY and other documents quickly and securely. Our solution eliminates the hassle of printing and mailing by allowing you to manage your signing process online, making it efficient and user-friendly.

-

Is there a cost associated with using airSlate SignNow for Arizona Form 140PY?

Yes, airSlate SignNow offers various pricing plans tailored to suit different business needs, including plans for individuals needing to eSign Arizona Form 140PY. We provide a cost-effective solution with flexible subscription options that ensure you are only paying for what you use.

-

What features does airSlate SignNow offer for signing tax documents like Arizona Form 140PY?

airSlate SignNow provides features such as document templates, in-person signing, payment integrations, and cloud storage, all designed to make the eSigning process seamless. You can easily manage and store your Arizona Form 140PY securely in the cloud.

-

Can I integrate airSlate SignNow with other software I use for my taxes?

Absolutely! airSlate SignNow supports numerous integrations with popular tax software and business applications, enhancing your workflow when preparing Arizona Form 140PY. This means you can streamline your processes without having to switch between different platforms.

-

Is airSlate SignNow secure for signing sensitive tax documents like Arizona Form 140PY?

Yes, airSlate SignNow prioritizes document security and data privacy. We use encryption and compliance with industry standards to ensure that your Arizona Form 140PY and other sensitive documents are stored and transmitted safely.

-

How quickly can I complete Arizona Form 140PY using airSlate SignNow?

With airSlate SignNow, you can complete and eSign your Arizona Form 140PY in just minutes. Our user-friendly interface allows for quick navigation, making it easy to fill in your information and send it for signatures swiftly.

Get more for Arizona Form 140PY Arizona Department Of Revenue

Find out other Arizona Form 140PY Arizona Department Of Revenue

- Help Me With Sign Wyoming High Tech Presentation

- How Do I Sign Florida Insurance PPT

- How To Sign Indiana Insurance Document

- Can I Sign Illinois Lawers Form

- How To Sign Indiana Lawers Document

- How To Sign Michigan Lawers Document

- How To Sign New Jersey Lawers PPT

- How Do I Sign Arkansas Legal Document

- How Can I Sign Connecticut Legal Document

- How Can I Sign Indiana Legal Form

- Can I Sign Iowa Legal Document

- How Can I Sign Nebraska Legal Document

- How To Sign Nevada Legal Document

- Can I Sign Nevada Legal Form

- How Do I Sign New Jersey Legal Word

- Help Me With Sign New York Legal Document

- How Do I Sign Texas Insurance Document

- How Do I Sign Oregon Legal PDF

- How To Sign Pennsylvania Legal Word

- How Do I Sign Wisconsin Legal Form