Form 12s

What is the Form 12s

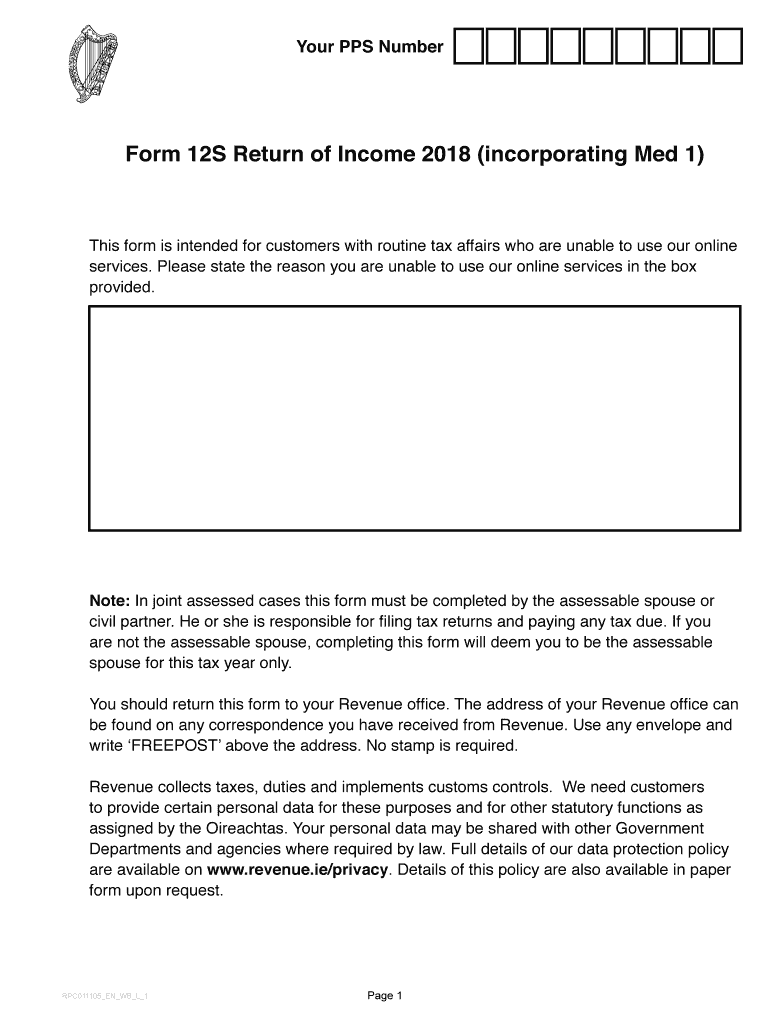

The Form 12s is a specific document used primarily for tax purposes in the United States. It serves as a means for individuals and businesses to report certain financial information to the Internal Revenue Service (IRS). This form is essential for ensuring compliance with federal tax regulations and is often required for various tax filings. Understanding the purpose and requirements of the Form 12s is crucial for accurate tax reporting.

How to use the Form 12s

Using the Form 12s involves several straightforward steps. First, gather all necessary financial documents and information relevant to the form. This may include income statements, deductions, and credits applicable to your tax situation. Next, carefully fill out the form, ensuring that all entries are accurate and complete. Once completed, the form can be submitted electronically or via traditional mail, depending on your preference and the specific instructions provided by the IRS.

Steps to complete the Form 12s

Completing the Form 12s requires attention to detail. Follow these steps for a smooth process:

- Review the form instructions thoroughly to understand the requirements.

- Gather all necessary documents, including W-2s, 1099s, and receipts for deductions.

- Fill out the form accurately, ensuring all information is current and correct.

- Double-check entries for any errors or omissions.

- Submit the completed form according to the IRS guidelines, either electronically or by mail.

Legal use of the Form 12s

The legal use of the Form 12s hinges on its compliance with IRS regulations. To ensure that the form is legally binding, it must be filled out accurately and submitted by the appropriate deadlines. Additionally, any signatures required must be provided in accordance with the guidelines set forth by the IRS. Utilizing a reliable eSignature solution can enhance the legal validity of the form, ensuring that it meets all necessary requirements.

Filing Deadlines / Important Dates

Filing deadlines for the Form 12s are crucial to avoid penalties. Typically, the form must be submitted by April fifteenth of the tax year following the reporting period. However, extensions may be available under certain circumstances. It is essential to stay informed about any changes to deadlines, especially during tax season, to ensure timely submission and compliance with IRS regulations.

Examples of using the Form 12s

There are various scenarios in which the Form 12s may be utilized. For instance, self-employed individuals may use the form to report income and expenses related to their business activities. Similarly, individuals claiming specific tax credits or deductions may need to complete the form to substantiate their claims. Understanding these practical applications can help taxpayers navigate their filing obligations more effectively.

Quick guide on how to complete form 12s

Effortlessly Prepare Form 12s on Any Device

Digital document management has gained traction among businesses and individuals alike. It serves as an ideal environmentally friendly substitute for conventional printed and signed documentation, enabling you to obtain the correct form and securely maintain it online. airSlate SignNow provides you with all the tools necessary to create, edit, and eSign your documents swiftly without any holdups. Handle Form 12s on any device with airSlate SignNow's Android or iOS applications and enhance document-centric processes today.

How to Edit and eSign Form 12s Effortlessly

- Locate Form 12s and then click Get Form to begin.

- Utilize the tools we offer to complete your form.

- Emphasize critical sections of the documents or redact sensitive information using tools specifically designed for that purpose by airSlate SignNow.

- Generate your eSignature with the Sign feature, which only takes seconds and carries the same legal validity as a conventional wet ink signature.

- Review all details and click the Done button to save your modifications.

- Choose your preferred method to submit your form, whether by email, text message (SMS), invitation link, or download it to your computer.

Eliminate concerns about lost or misfiled documents, cumbersome form navigation, or mistakes that necessitate reprinting. airSlate SignNow meets all your document management needs in just a few clicks from any device you choose. Edit and eSign Form 12s and ensure outstanding communication at any stage of your form processing with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the form 12s

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is a form 12s and how can airSlate SignNow help?

A form 12s is a type of document often used for specific business transactions. airSlate SignNow simplifies the process of creating, sending, and electronically signing these forms, ensuring compliance and efficiency. With our platform, you can manage your form 12s seamlessly and maintain a reliable audit trail.

-

What features does airSlate SignNow offer for form 12s?

airSlate SignNow provides several features tailored for handling form 12s, including customizable templates, real-time collaboration, and automated reminders. Our user-friendly interface allows for quick edits and adjustments, ensuring your forms meet all necessary requirements without delay. You can also track the status of your form 12s easily.

-

Is there a free trial available for airSlate SignNow focused on form 12s?

Yes, airSlate SignNow offers a free trial that allows potential users to explore our features for form 12s without any commitment. This trial period gives you the opportunity to test the platform's capabilities, including signing documents and creating templates, so you can see firsthand how it can benefit your business.

-

How does airSlate SignNow integrate with other applications for managing form 12s?

airSlate SignNow easily integrates with various third-party applications, enhancing your workflow for managing form 12s. Whether you're using CRM systems, cloud storage services, or project management tools, our seamless integrations help you keep track of your documents and streamline the signing process. This interconnectedness maximizes efficiency in your operations.

-

What are the pricing plans for airSlate SignNow if I primarily use form 12s?

airSlate SignNow offers flexible pricing plans to cater to different business needs, particularly for users managing form 12s. Our plans include options for small teams and larger organizations, allowing you to choose the level of service that best fits your budget and requirements. Additionally, there are no hidden fees, ensuring transparency in your investment.

-

Can I customize my form 12s using airSlate SignNow?

Absolutely! airSlate SignNow allows you to customize your form 12s according to your specific needs. You can add your branding, logos, and tailored fields, ensuring that each form reflects your company's identity. This creativity not only enhances professionalism but also meets unique business requirements.

-

What benefits can I expect when using airSlate SignNow for form 12s?

Using airSlate SignNow for your form 12s comes with numerous benefits, including improved workflow efficiency, enhanced security, and reduced turnaround times. By digitizing your signing process, you'll save time and resources while ensuring that all documents are legally compliant. This efficiency translates to better service for your clients and stakeholders.

Get more for Form 12s

Find out other Form 12s

- Sign Arizona Banking Permission Slip Easy

- Can I Sign California Banking Lease Agreement Template

- How Do I Sign Colorado Banking Credit Memo

- Help Me With Sign Colorado Banking Credit Memo

- How Can I Sign Colorado Banking Credit Memo

- Sign Georgia Banking Affidavit Of Heirship Myself

- Sign Hawaii Banking NDA Now

- Sign Hawaii Banking Bill Of Lading Now

- Sign Illinois Banking Confidentiality Agreement Computer

- Sign Idaho Banking Rental Lease Agreement Online

- How Do I Sign Idaho Banking Limited Power Of Attorney

- Sign Iowa Banking Quitclaim Deed Safe

- How Do I Sign Iowa Banking Rental Lease Agreement

- Sign Iowa Banking Residential Lease Agreement Myself

- Sign Kansas Banking Living Will Now

- Sign Kansas Banking Last Will And Testament Mobile

- Sign Kentucky Banking Quitclaim Deed Online

- Sign Kentucky Banking Quitclaim Deed Later

- How Do I Sign Maine Banking Resignation Letter

- Sign Maine Banking Resignation Letter Free