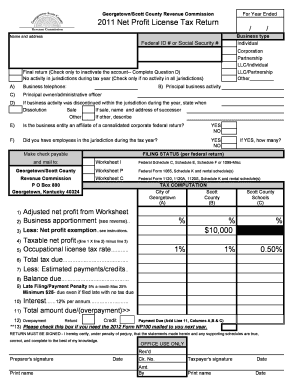

Georgetown Net Profit License Tax Return Form

What is the Georgetown Net Profit License Tax Return

The Georgetown net profit license tax return is a form that businesses operating within Georgetown, Scott County, Kentucky, must submit to report their net profits for taxation purposes. This return is essential for local revenue collection and ensures that businesses contribute fairly to the community. It typically includes information about the business's income, expenses, and any applicable deductions to determine the net profit subject to taxation.

Steps to complete the Georgetown Net Profit License Tax Return

Completing the Georgetown net profit license tax return involves several key steps:

- Gather financial records, including income statements and expense reports.

- Calculate total revenue and allowable deductions to determine net profit.

- Fill out the return form accurately, ensuring all figures are correct.

- Review the completed form for any errors or omissions.

- Submit the form by the specified deadline, ensuring compliance with local regulations.

Legal use of the Georgetown Net Profit License Tax Return

The Georgetown net profit license tax return is legally binding when submitted correctly. It must be signed by an authorized representative of the business, affirming that the information provided is accurate and complete. Compliance with local tax laws is crucial, as inaccuracies or failures to file can lead to penalties or legal repercussions.

Filing Deadlines / Important Dates

Filing deadlines for the Georgetown net profit license tax return are typically set by the local revenue commission. Businesses should be aware of these dates to avoid late fees or penalties. Generally, returns are due annually, and it is advisable to check for any specific deadlines that may apply to the current tax year.

Required Documents

To complete the Georgetown net profit license tax return, businesses must prepare several documents, including:

- Financial statements showing income and expenses.

- Previous year’s tax return for reference.

- Any supporting documentation for deductions claimed.

Who Issues the Form

The Georgetown net profit license tax return is issued by the Georgetown Scott County Revenue Commission. This local authority is responsible for tax collection and ensuring compliance with local tax laws. Businesses can obtain the form directly from their office or through official channels, such as local government websites.

Quick guide on how to complete georgetown net profit license tax return

Complete Georgetown Net Profit License Tax Return effortlessly on any device

Digital document management has gained traction among companies and individuals. It serves as a perfect eco-friendly alternative to traditional printed and signed documents, allowing you to find the appropriate form and securely store it online. airSlate SignNow provides you with all the tools necessary to create, modify, and eSign your documents quickly and without delays. Manage Georgetown Net Profit License Tax Return across any platform using airSlate SignNow Android or iOS applications and enhance any document-based process today.

How to change and eSign Georgetown Net Profit License Tax Return effortlessly

- Find Georgetown Net Profit License Tax Return and then click Get Form to begin.

- Utilize the tools we provide to fill out your form.

- Highlight important sections of your documents or redact sensitive information using tools that airSlate SignNow offers specifically for that purpose.

- Create your eSignature with the Sign feature, which takes seconds and holds the same legal validity as a conventional wet ink signature.

- Review all the details and then click on the Done button to save your changes.

- Choose how you would like to send your form, via email, SMS, or invitation link, or download it to your computer.

Eliminate concerns about lost or misplaced documents, frustrating form searches, or errors that necessitate the printing of additional document copies. airSlate SignNow fulfills all your document management needs in just a few clicks from any device you prefer. Modify and eSign Georgetown Net Profit License Tax Return and ensure excellent clarity at every stage of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the georgetown net profit license tax return

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is the process for filing a Georgetown Scott County net profit license tax return?

Filing a Georgetown Scott County net profit license tax return involves gathering your financial documents, completing the return forms provided by the county, and submitting them by the deadline. It's essential to ensure that all income and expenses are accurately reported to comply with local regulations. For ease, many businesses use online tools like airSlate SignNow to streamline the eSigning process.

-

How does airSlate SignNow assist with Georgetown Scott County net profit license tax return filings?

airSlate SignNow simplifies the process of preparing and signing your Georgetown Scott County net profit license tax return. Our platform allows you to securely create, edit, and eSign necessary tax documents online. This ensures that your filings are submitted quickly and efficiently, reducing the likelihood of errors that could lead to fines.

-

What are the costs associated with using airSlate SignNow for Georgetown Scott County net profit license tax return?

airSlate SignNow offers a range of pricing plans to fit various business needs when preparing a Georgetown Scott County net profit license tax return. Costs depend on the features you choose, such as document storage and eSignature capabilities. Overall, our services provide a cost-effective solution compared to other traditional filing methods.

-

Are there any discounts available for frequent users of airSlate SignNow?

Yes, airSlate SignNow provides discounts and offers for businesses that frequently use our services for tasks like filing the Georgetown Scott County net profit license tax return. Signing up for an annual plan may also yield further savings. Check our website for current promotions that can help reduce your overall costs.

-

Can airSlate SignNow integrate with accounting software for Georgetown Scott County net profit license tax returns?

Absolutely! airSlate SignNow offers seamless integrations with various accounting software platforms. This integration allows you to easily import your financial data, making it convenient to prepare your Georgetown Scott County net profit license tax return without missing crucial details.

-

What are the benefits of using airSlate SignNow for business tax return preparations?

Using airSlate SignNow for your Georgetown Scott County net profit license tax return offers multiple benefits, including a user-friendly interface, automated reminders for deadlines, and secure document storage. Moreover, our eSigning features save time and eliminate the hassle of printing and scanning documents.

-

What types of documents can I manage when preparing my Georgetown Scott County net profit license tax return?

When preparing your Georgetown Scott County net profit license tax return, you can manage various types of documents, including income statements, expense reports, and previous tax returns. airSlate SignNow allows you to upload, edit, and electronically sign these documents, ensuring a smooth filing process.

Get more for Georgetown Net Profit License Tax Return

Find out other Georgetown Net Profit License Tax Return

- Electronic signature Utah Outsourcing Services Contract Online

- How To Electronic signature Wisconsin Debit Memo

- Electronic signature Delaware Junior Employment Offer Letter Later

- Electronic signature Texas Time Off Policy Later

- Electronic signature Texas Time Off Policy Free

- eSignature Delaware Time Off Policy Online

- Help Me With Electronic signature Indiana Direct Deposit Enrollment Form

- Electronic signature Iowa Overtime Authorization Form Online

- Electronic signature Illinois Employee Appraisal Form Simple

- Electronic signature West Virginia Business Ethics and Conduct Disclosure Statement Free

- Electronic signature Alabama Disclosure Notice Simple

- Electronic signature Massachusetts Disclosure Notice Free

- Electronic signature Delaware Drug Testing Consent Agreement Easy

- Electronic signature North Dakota Disclosure Notice Simple

- Electronic signature California Car Lease Agreement Template Free

- How Can I Electronic signature Florida Car Lease Agreement Template

- Electronic signature Kentucky Car Lease Agreement Template Myself

- Electronic signature Texas Car Lease Agreement Template Easy

- Electronic signature New Mexico Articles of Incorporation Template Free

- Electronic signature New Mexico Articles of Incorporation Template Easy