Form MT 44909 Schedule C Out of State Sales, MT44 Tax Ny

What is the Form MT 44909 Schedule C Out of State Sales, MT44 Tax NY

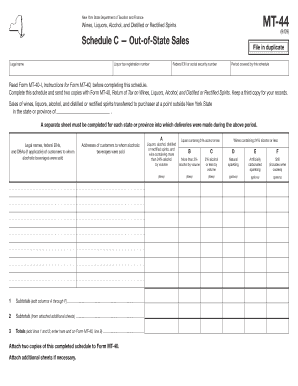

The Form MT 44909 Schedule C is a tax document used by businesses in New York to report out-of-state sales. This form is essential for ensuring compliance with state tax regulations when sales are made outside of New York. It helps businesses accurately calculate their tax obligations related to these sales, ensuring that they meet both state and federal requirements. Understanding this form is crucial for any business involved in interstate commerce.

How to use the Form MT 44909 Schedule C Out of State Sales, MT44 Tax NY

Using the Form MT 44909 Schedule C involves several steps that ensure proper completion and submission. First, gather all necessary sales data, including the total amount of out-of-state sales. Next, accurately fill out the form, ensuring that all required fields are completed. Once the form is filled, review it for accuracy before submission. This process not only helps in maintaining compliance but also aids in avoiding potential penalties associated with incorrect filings.

Steps to complete the Form MT 44909 Schedule C Out of State Sales, MT44 Tax NY

Completing the Form MT 44909 Schedule C requires careful attention to detail. Begin by entering your business information at the top of the form. Then, list all out-of-state sales, categorizing them as necessary. Calculate the total sales amount and any applicable tax credits. Ensure that you sign and date the form before submission. Double-checking each section can prevent errors that might lead to delays or rejections from tax authorities.

Key elements of the Form MT 44909 Schedule C Out of State Sales, MT44 Tax NY

Key elements of the Form MT 44909 Schedule C include the business identification section, a detailed breakdown of out-of-state sales, and a summary of tax calculations. Each section is designed to capture specific information critical to the tax assessment process. Understanding these elements helps ensure that all necessary data is provided, which can facilitate smoother processing by tax authorities.

Filing Deadlines / Important Dates

Filing deadlines for the Form MT 44909 Schedule C are crucial for compliance. Typically, this form must be submitted by the same deadline as your annual tax return. It is important to keep track of these dates to avoid late fees or penalties. Marking these deadlines on your calendar can help ensure timely submissions and maintain good standing with tax authorities.

Penalties for Non-Compliance

Non-compliance with the requirements of the Form MT 44909 Schedule C can result in significant penalties. These may include fines, interest on unpaid taxes, and potential audits. It is essential for businesses to understand the implications of failing to file or inaccurately completing the form. Staying informed about compliance requirements can help mitigate these risks.

Quick guide on how to complete form mt 44909 schedule c out of state sales mt44 tax ny

Effortlessly Prepare Form MT 44909 Schedule C Out of State Sales, MT44 Tax Ny on Any Device

Managing documents online has gained traction among businesses and individuals alike. It offers an ideal environmentally friendly alternative to traditional printed and signed paperwork, as you can access the necessary form and securely store it online. airSlate SignNow equips you with all the resources required to create, modify, and electronically sign your documents promptly without delays. Manage Form MT 44909 Schedule C Out of State Sales, MT44 Tax Ny on any device using the airSlate SignNow Android or iOS applications and simplify any document-related procedure today.

The simplest method to edit and electronically sign Form MT 44909 Schedule C Out of State Sales, MT44 Tax Ny effortlessly

- Obtain Form MT 44909 Schedule C Out of State Sales, MT44 Tax Ny and click Get Form to begin.

- Utilize the tools we provide to fill out your form.

- Select the pertinent sections of your documents or redact sensitive information with tools that airSlate SignNow specifically offers for that purpose.

- Create your electronic signature with the Sign tool, which takes mere seconds and holds the same legal validity as a traditional ink signature.

- Review all the details, then click the Done button to finalize your changes.

- Decide how you wish to send your form, whether by email, SMS, or invitation link, or download it to your computer.

Put an end to lost or misfiled documents, tedious form searches, or errors that necessitate printing new copies. airSlate SignNow addresses all your document management needs in just a few clicks from any device you prefer. Modify and electronically sign Form MT 44909 Schedule C Out of State Sales, MT44 Tax Ny and ensure excellent communication at every stage of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the form mt 44909 schedule c out of state sales mt44 tax ny

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is Form MT 44909 Schedule C for Out of State Sales?

Form MT 44909 Schedule C is used by businesses in Montana to report income from out-of-state sales. Understanding this form is crucial for ensuring compliance with tax regulations. Properly completing the Form MT 44909 Schedule C can streamline your tax filing process and help you avoid potential penalties.

-

How does airSlate SignNow support the completion of Form MT 44909 Schedule C?

airSlate SignNow provides an intuitive platform for electronically signing and managing documents, including Form MT 44909 Schedule C. With its eSigning feature, businesses can quickly gather signatures and finalize documents without the hassle of printing or scanning. This saves time and ensures that your tax paperwork is handled efficiently.

-

What are the pricing plans for using airSlate SignNow for tax documents?

airSlate SignNow offers various pricing plans tailored to meet the needs of businesses handling documents such as Form MT 44909 Schedule C. Each plan includes essential features, such as eSigning, document management, and integration capabilities. For detailed pricing information, it's best to visit the airSlate SignNow website to find the plan that suits your business requirements.

-

How can I integrate airSlate SignNow with other software for tax form management?

airSlate SignNow offers seamless integrations with various software solutions such as cloud storage services and accounting tools. By integrating airSlate SignNow with your preferred applications, you can streamline your workflow, especially when dealing with forms like Form MT 44909 Schedule C. This ensures that all your documents are synchronized and organized efficiently.

-

What are the benefits of using airSlate SignNow for eSigning Form MT 44909 Schedule C?

Using airSlate SignNow for eSigning Form MT 44909 Schedule C provides a secure and legally binding method of obtaining signatures. The platform enhances efficiency by allowing multiple parties to sign documents remotely, which is ideal for busy business owners. Additionally, it offers a user-friendly interface that simplifies the signing process.

-

Is it safe to use airSlate SignNow for sensitive tax documents?

Yes, airSlate SignNow prioritizes the security of your documents, including sensitive ones like Form MT 44909 Schedule C. The platform employs advanced encryption and security protocols to protect your data. You can confidently eSign and store your tax documents knowing that they are safeguarded against unauthorized access.

-

Can I track the status of my Form MT 44909 Schedule C submissions with airSlate SignNow?

Absolutely! airSlate SignNow provides tracking features that allow you to monitor the status of your Form MT 44909 Schedule C submissions. You will receive notifications when your documents are viewed and signed, ensuring that you’re always up-to-date on your tax paperwork. This feature enhances transparency and efficiency throughout the signing process.

Get more for Form MT 44909 Schedule C Out of State Sales, MT44 Tax Ny

Find out other Form MT 44909 Schedule C Out of State Sales, MT44 Tax Ny

- How To Electronic signature Virginia Healthcare / Medical Operating Agreement

- Electronic signature Wisconsin Healthcare / Medical Business Letter Template Mobile

- Can I Electronic signature Wisconsin Healthcare / Medical Operating Agreement

- Electronic signature Alabama High Tech Stock Certificate Fast

- Electronic signature Insurance Document California Computer

- Electronic signature Texas Education Separation Agreement Fast

- Electronic signature Idaho Insurance Letter Of Intent Free

- How To Electronic signature Idaho Insurance POA

- Can I Electronic signature Illinois Insurance Last Will And Testament

- Electronic signature High Tech PPT Connecticut Computer

- Electronic signature Indiana Insurance LLC Operating Agreement Computer

- Electronic signature Iowa Insurance LLC Operating Agreement Secure

- Help Me With Electronic signature Kansas Insurance Living Will

- Electronic signature Insurance Document Kentucky Myself

- Electronic signature Delaware High Tech Quitclaim Deed Online

- Electronic signature Maine Insurance Quitclaim Deed Later

- Electronic signature Louisiana Insurance LLC Operating Agreement Easy

- Electronic signature West Virginia Education Contract Safe

- Help Me With Electronic signature West Virginia Education Business Letter Template

- Electronic signature West Virginia Education Cease And Desist Letter Easy